Highlights

- Delaware Basin and STACK drive U.S. oil

production beat

- Light-oil production growth on track to

expand 16 percent in 2018

- EnLink ownership interests monetized at

12 times cash flow

- Industry-leading share-repurchase

program increased to $4 billion

- Field-level cash margins expand by 31

percent year over year

- Corporate cost structure to improve by

$475 million annually

Devon Energy Corp. (NYSE: DVN) today reported operational and

financial results for the second quarter of 2018. Also included

within the release is the company’s guidance outlook for the third

quarter and full-year 2018.

“Devon is executing at a very high level on our 2020 Vision,”

said Dave Hager, president and CEO. “Operationally, our

second-quarter performance was headlined by strong well

productivity in the Delaware Basin and STACK, which drove light-oil

production above the high end of our guidance expectations.

Importantly, we converted this volume growth into higher profits

with our access to premium pricing in advantaged markets and

through our success in driving both field-level and corporate costs

lower.

“With the strong well productivity we’ve achieved year to date

in the U.S., light-oil production growth is on track to advance 16

percent in 2018, which is 200 basis points above our original

budget expectations,” said Hager. “We expect to deliver this

improved outlook without any increase to our planned activity, and

this disciplined investment program positions us to generate

substantial amounts of free cash flow at today’s market prices.

“In addition to our strong operating results, we took a

significant step forward in achieving our 2020 Vision by further

simplifying our asset portfolio through our monetization of

EnLink,” said Hager. “This highly accretive transaction provides a

strategic exit from EnLink at a value of 12 times cash flow, and

we’re returning the sales proceeds to our shareholders through our

industry-leading $4 billion share-repurchase program.”

Delaware Basin and STACK Drive U.S. Oil Production

Beat

Production results in the quarter were highlighted by oil growth

from Devon’s U.S. resource plays, which are attaining the highest

margins and returns in Devon’s portfolio. In the quarter, light-oil

production in the U.S. averaged 136,000 barrels per day, a 12

percent increase compared to the first quarter of 2018. This result

exceeded the top end of guidance by 2,000 barrels per day.

The strongest asset-level performance during the second quarter

was from the company’s Delaware Basin assets. Light-oil production

increased 54 percent year over year in the quarter, driving total

volumes in the Delaware to 79,000 oil-equivalent barrels (Boe) per

day. Growth in the Delaware was driven by prolific well

productivity, where the top 10 wells in the quarter averaged

initial 30-day rates of approximately 3,000 Boe per day.

Devon’s STACK assets also delivered strong results during the

quarter. Total production in the STACK advanced 26 percent compared

to the second quarter of 2017. Driven by several strong wells

across the play, oil production delivered the highest growth rate,

increasing 41 percent year over year.

In Canada, net oil production averaged 109,000 barrels per day

in the second quarter. Scheduled maintenance at the company’s

Jackfish facility curtailed production by approximately 15,000

barrels per day. Also contributing to lower production was a 2

percentage point increase in royalty rates because of higher

commodity prices and improved profitability.

Overall, total companywide production averaged 541,000 Boe per

day in the second quarter. Oil accounted for the largest component

of the product mix at 45 percent of total volumes. For additional

details on Devon’s E&P operations in the quarter, please refer

to the company’s second-quarter 2018 operations report at

www.devonenergy.com.

Light-Oil Production Growth on Track to Increase 16 Percent

in 2018

With the strong well productivity Devon has achieved year to

date in the U.S., light-oil production growth is on track to

advance 16 percent in 2018. This growth rate is trending at

approximately 200 basis points above the company’s original budget

expectations.

The incremental oil growth in the U.S. is expected to be

delivered without an increase to Devon’s capital activity. This

disciplined investment program positions the company to generate

free cash flow in the second half of 2018 at today’s market

prices.

EnLink Ownership Interests Monetized at 12 Times Cash

Flow

In mid-July, Devon completed the sale of its ownership interests

in EnLink Midstream Partners, LP (NYSE: ENLK) and EnLink Midstream,

LLC (NYSE: ENLC) for $3.125 billion. The company’s interests in

EnLink generated $265 million of cash distributions over the past

year, valuing the investment at approximately 12 times cash flow.

Devon expects no incremental corporate cash taxes resulting from

this sale.

With the closing of the EnLink transaction, combined with other

minor asset sales achieved to date, total proceeds from Devon’s

divestiture program have now reached $4.2 billion. The company

expects to monetize an additional $1 billion of minor, non-core

assets across the United States by year-end. These divestiture

packages include undeveloped leasehold in the southern Delaware

Basin, enhanced oil recovery projects in the Rockies and Midland

Basin along with Wise County acreage in the Barnett Shale. Data

rooms are open for the majority of these packages and bids are

expected throughout the second half of 2018.

Industry-Leading Share-Repurchase Program Increased to $4

Billion

In conjunction with closing the EnLink transaction, Devon’s

board of directors authorized an increase in the company’s

share-repurchase program to $4 billion. This authorization

represents the largest share-repurchase program in the upstream

industry when measured as a percentage of market capitalization. At

the end of July, Devon had repurchased 24 million shares, or nearly

5 percent of outstanding shares, at a total cost of approximately

$1 billion.

For the remaining share-repurchase authorization, the company

plans to utilize a series of accelerated stock repurchase programs

(ASR) that are expected to commence in early August. With these ASR

programs, Devon expects to complete its $4 billion share-repurchase

program during the first half of 2019. Detailed forward-looking

guidance on share count is provided later in this release.

Financial Reporting Impact of EnLink Monetization

With the closing of the EnLink transaction, the financial

results of EnLink Midstream will no longer be consolidated with

Devon’s upstream business, and historical results related to EnLink

will be presented as discontinued operations in the company’s

consolidated financial statements.

To assist with this financial reporting transition, Devon has

provided pro forma financial statements for its upstream business

in a Form 8-K filing in July. Additionally, updated detailed

forward-looking guidance for financial statement line items

impacted by this transaction in 2018 is provided later in this

release.

Upstream Revenue Benefits from Premium Gulf Coast

Pricing

Devon’s upstream revenue, excluding commodity derivatives,

totaled $1.6 billion in the second quarter, a 15 percent

improvement compared to the previous quarter. The strong growth in

revenue was driven by growth in higher-margin, light-oil production

coupled with improved price realizations across the company’s asset

portfolio.

Also contributing to the improving price realizations in the

quarter were Devon’s firm transport and marketing agreements that

provide the majority of U.S. oil production direct access to

premium Gulf Coast markets. Combined with the price protection

provided by regional basis swaps, second-quarter oil realizations

in the U.S. averaged approximately 98 percent of the West Texas

Intermediate benchmark. Importantly, the company is positioned to

maintain these strong U.S. oil price realizations through the end

of the decade.

In Canada, Devon continues to benefit from Western Canadian

Select (WCS) basis swaps on approximately 50 percent of its

estimated oil production in 2018. These attractive WCS basis swaps

are locked in at $15 off the WTI benchmark price and have generated

cash settlements of $109 million year to date.

U.S. Operating Costs Improve and Field-Level Margins

Expand

Devon continued to effectively manage operating costs during the

second quarter. Production expense, which represents field-level

operating costs, totaled $572 million in the second quarter. The

largest components of production expense are lease operating

expense and transportation, which totaled $493 million in the

quarter. Taxes also contributed $79 million to production expense

during the second quarter.

The company’s U.S. resource plays delivered the strongest cost

performance, where lease operating expense and transportation costs

declined 3 percent on a per-unit basis compared to the first

quarter. In Canada, production expense in the quarter was impacted

by $21 million of non-recurring costs associated with maintenance

work at the Jackfish complex.

Overall, the benefits of higher-margin oil production, improved

price realizations and a lower cost structure resulted in expanded

margins for Devon. Field-level cash margin reached $20.19 per Boe

in the second quarter, a 31 percent increase compared to the

year-ago period. Field-level cash margin is computed as upstream

revenues, excluding commodity derivatives, less production expenses

with the result divided by oil equivalent production volumes.

Corporate Cost Structure to Improve by $475 Million

Annually

Further expanding Devon’s profitability is its improving general

and administrative (G&A) cost structure. Upstream-related

G&A expenses totaled $153 million, a 22 percent improvement

compared to the first quarter. The significantly lower overhead

costs were driven by reduced personnel expenses.

The company has also reduced financing costs. With the early

retirement of $807 million of debt early in the year, the company

expects to reduce net financing costs by approximately $64 million

on an annual basis.

The aforementioned cost savings, combined with the financial

benefits related to the sale of EnLink Midstream, position Devon’s

go-forward G&A and interest expense to improve by approximately

$475 million annually.

Investment-Grade Financial Position Continues to

Strengthen

Devon’s financial position remains exceptionally strong, with

investment-grade credit ratings and excellent liquidity. The

company exited the second quarter with $1.5 billion of cash on

hand. Adjusted for the sale of EnLink Midstream in July, pro forma

cash balances reached $4.6 billion and the company’s consolidated

debt declined by 40 percent to $6.1 billion.

Second-Quarter Earnings and Cash-Flow Results

The company reported a net loss attributable to Devon of $425

million or $0.83 per diluted share in the second quarter. Excluding

the impact of noncontrolling interests, the company reported a net

loss of $335 million. Devon’s results were impacted by certain

items securities analysts typically exclude from their published

estimates. After excluding adjusting items, the company’s core

earnings totaled $177 million or $0.34 per diluted share. Adjusted

earnings before interest, taxes, depreciation and amortization

(EBITDA) reached $1.0 billion in the quarter.

Devon’s operating cash flow from continuing operations totaled

$269 million in the second quarter. Operating cash flow in the

quarter was impacted by several non-recurring or unusual items,

including a non-cash foreign exchange loss, restructuring charges,

EnLink’s reclassification to discontinued operations and working

capital changes. The most significant item was related to a

non-cash, foreign exchange loss. This impact was driven by foreign

currency denominated intercompany loan activity resulting in a

realized loss of $244 million as a result of the strengthening of

the U.S. dollar in relation to the Canadian dollar. For more

understanding of the company’s cash flow performance during the

quarter please refer to the explanations and reconciliations

provided later in this release.

Pursuant to regulatory disclosure requirements, Devon is

required to reconcile non-GAAP (generally accepted accounting

principles) financial measures to the related GAAP information.

Reconciliations of these non-GAAP measures are provided within the

tables of this release.

Conference Call Webcast and Supplemental Earnings

Materials

Also provided with today’s release is the company’s detailed

operations report that is available on the company’s website at

www.devonenergy.com. The company’s second-quarter conference call

will be held at 10 a.m. Central (11 a.m. Eastern) on Wednesday,

Aug. 1, 2018, and will serve primarily as a forum for analyst and

investor questions and answers.

Forward-Looking Statements

This release includes "forward-looking statements" as defined by

the Securities and Exchange Commission (SEC). Such statements

include those concerning strategic plans, expectations and

objectives for future operations, and are often identified by use

of the words “expects,” “believes,” “will,” “would,” “could,”

“forecasts,” “projections,” “estimates,” “plans,” “expectations,”

“targets,” “opportunities,” “potential,” “anticipates,” “outlook”

and other similar terminology. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the company. Statements regarding our

business and operations are subject to all of the risks and

uncertainties normally incident to the exploration for and

development and production of oil and gas. These risks include, but

are not limited to: the volatility of oil, gas and NGL prices;

uncertainties inherent in estimating oil, gas and NGL reserves; the

extent to which we are successful in acquiring and discovering

additional reserves; the uncertainties, costs and risks involved in

oil and gas operations; regulatory restrictions, compliance costs

and other risks relating to governmental regulation, including with

respect to environmental matters; risks related to our hedging

activities; counterparty credit risks; risks relating to our

indebtedness; cyberattack risks; our limited control over third

parties who operate our oil and gas properties; midstream capacity

constraints and potential interruptions in production; the extent

to which insurance covers any losses we may experience; competition

for leases, materials, people and capital; our ability to

successfully complete mergers, acquisitions and divestitures; and

any of the other risks and uncertainties identified in our Form

10-K and our other filings with the SEC. Investors are cautioned

that any such statements are not guarantees of future performance

and that actual results or developments may differ materially from

those projected in the forward-looking statements. The

forward-looking statements in this release are made as of the date

of this release, even if subsequently made available by Devon on

its website or otherwise. Devon does not undertake any obligation

to update the forward-looking statements as a result of new

information, future events or otherwise. The SEC permits oil and

gas companies, in their filings with the SEC, to disclose only

proved, probable and possible reserves that meet the SEC's

definitions for such terms, and price and cost sensitivities for

such reserves, and prohibits disclosure of resources that do not

constitute such reserves. This release may contain certain

terms, such as resource potential, potential locations, risked and

unrisked locations, estimated ultimate recovery (or EUR),

exploration target size and other similar terms. These

estimates are by their nature more speculative than estimates of

proved, probable and possible reserves and accordingly are subject

to substantially greater risk of being actually realized. The SEC

guidelines strictly prohibit us from including these estimates in

filings with the SEC. Investors are urged to consider closely the

disclosure in our Form 10-K, available at www.devonenergy.com. You

can also obtain this form from the SEC by calling 1-800-SEC-0330 or

from the SEC’s website at www.sec.gov.

About Devon Energy

Devon Energy is a leading independent energy company engaged in

finding and producing oil and natural gas. Based in Oklahoma City

and included in the S&P 500, Devon operates in several of the

most prolific oil and natural gas plays in the U.S. and Canada with

an emphasis on achieving strong returns and capital-efficient cash

flow growth. For more information, please visit

www.devonenergy.com.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

PRODUCTION NET OF ROYALTIES Quarter Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017 Oil and bitumen

(MBbls/d) U. S. - Core 136 113 129 117 Heavy Oil 109

122 119 130 Retained assets 245 235 248 247

Divested assets — 3 — 2 Total

245 238 248 249

Natural gas liquids

(MBbls/d) U. S. - Core 105 90 98 89 Divested assets 4

7 5 8 Total 109 97 103

97

Gas (MMcf/d) U. S. - Core 1,013 1,010 1,007 1,012

Heavy Oil 12 14 12 18 Retained assets

1,025 1,024 1,019 1,030 Divested assets 103 184

133 188 Total 1,128 1,208 1,152

1,218

Total oil equivalent (MBoe/d) U. S. - Core 409

371 395 375 Heavy Oil 111 124 121 133

Retained assets 520 495 516 508 Divested assets 21 41

27 42 Total 541 536 543

550

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

PRODUCTION TREND 2017 2018 Quarter

2 Quarter 3 Quarter 4 Quarter 1 Quarter

2 Oil and bitumen (MBbls/d) STACK 25 27 30 35 35

Delaware Basin 30 31 32 36 46 Rockies Oil 13 12 15 18 16 Heavy Oil

122 121 132 129 109 Eagle Ford 34 28 27 23 28 Barnett Shale 1 1 1 1

1 Other 10 11 9 9 10 Retained

assets 235 231 246 251 245 Divested assets 3 2

— — — Total 238 233 246

251 245

Natural gas liquids (MBbls/d) STACK 31 32 34

37 38 Delaware Basin 10 11 13 11 16 Rockies Oil 1 1 1 2 2 Eagle

Ford 10 12 13 8 13 Barnett Shale 35 29 36 31 34 Other 3

2 3 2 2 Retained assets 90 87 100 91

105 Divested assets 7 7 6 6 4

Total 97 94 106 97 109

Gas

(MMcf/d) STACK 298 313 316 344 352 Delaware Basin 94 90 89 97

100 Rockies Oil 17 13 14 18 18 Heavy Oil 14 16 15 12 12 Eagle Ford

92 86 87 63 74 Barnett Shale 496 498 466 470 460 Other 13

10 13 10 9 Retained assets 1,024 1,026

1,000 1,014 1,025 Divested assets 184 175 175

163 103 Total 1,208 1,201 1,175

1,177 1,128

Total oil equivalent (MBoe/d)

STACK 105 111 117 129 132 Delaware Basin 55 57 60 64 79 Rockies Oil

17 16 19 23 21 Heavy Oil 124 124 134 131 111 Eagle Ford 60 54 55 41

54 Barnett Shale 118 113 114 110 111 Other 16 14

13 13 12 Retained assets 495 489 512 511 520

Divested assets 41 38 36 33 21

Total 536 527 548 544 541

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

BENCHMARK PRICES (average prices)

Quarter 2

June YTD 2018 2017 2018 2017 Oil

($/Bbl) - West Texas Intermediate (Cushing) $ 67.83 $ 48.32 $ 65.38

$ 50.16 Natural Gas ($/Mcf) - Henry Hub $ 2.80 $ 3.19 $ 2.90 $ 3.25

REALIZED PRICES Quarter Ended June 30, 2018

Oil /Bitumen NGL Gas Total (Per

Bbl) (Per Bbl) (Per Mcf) (Per Boe) United

States $ 65.41 $ 24.10 $ 2.01 $ 31.97 Canada $ 31.70 N/M

N/M $ 31.17 Realized price without hedges $ 50.43 $

24.10 $ 2.01 $ 31.81 Cash settlements $ (5.80 ) $ (1.66 ) $ 0.13 $

(2.68 ) Realized price, including cash settlements $ 44.63 $

22.44 $ 2.14 $ 29.13

Quarter Ended June 30,

2017 Oil /Bitumen NGL Gas Total

(Per Bbl) (Per Bbl) (Per Mcf) (Per Boe)

United States $ 46.65 $ 13.26 $ 2.50 $ 23.58 Canada $ 29.05

N/M N/M $ 28.50 Realized price without hedges $ 37.63

$ 13.26 $ 2.50 $ 24.72 Cash settlements $ 0.29 $ (0.03

)

$ 0.04 $ 0.22 Realized price, including cash settlements $

37.92 $ 13.23 $ 2.54 $ 24.94

Six

Months Ended June 30, 2018 Oil /Bitumen NGL

Gas Total (Per Bbl) (Per Bbl) (Per

Mcf) (Per Boe) United States $ 63.71 $ 23.38 $ 2.21 $

31.20 Canada $ 25.24 N/M N/M $ 24.84 Realized

price without hedges $ 45.25 $ 23.38 $ 2.21 $ 29.79 Cash

settlements $ (2.93 ) $ (1.13 ) $ 0.16 $ (1.23 ) Realized price,

including cash settlements $ 42.32 $ 22.25 $ 2.37 $

28.56

Six Months Ended June 30, 2017 Oil

/Bitumen NGL Gas Total (Per Bbl)

(Per Bbl) (Per Mcf) (Per Boe) United States $

48.18 $ 14.36 $ 2.59 $ 24.72 Canada $ 27.60 N/M N/M $

27.03 Realized price without hedges $ 37.48 $ 14.36 $ 2.59 $

25.28 Cash settlements $ 0.39 $ (0.02 ) $ — $ 0.19

Realized price, including cash settlements $ 37.87 $ 14.34

$ 2.59 $ 25.47

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

CONSOLIDATED STATEMENTS OF EARNINGS (in millions,

except per share amounts)

Quarter Ended Six Months

Ended June 30, June 30, 2018 2017

2018 2017 Upstream revenues $ 1,069 $ 1,332 $ 2,388 $

2,873 Marketing revenues 1,180 833

2,059 1,692 Total revenues 2,249

2,165 4,447 4,565

Production expenses 572 455 1,115 912 Exploration expenses 68 57

101 152 Marketing expenses 1,160 849 2,033 1,728 Depreciation,

depletion and amortization 420 369 819 769 Asset impairments 154 —

154 — Asset dispositions 23 (22 ) 11 (30 ) General and

administrative expenses 153 181 352 376 Financing costs, net 62 77

449 160 Restructuring and transaction costs 94 — 94 — Other

expenses 24 (8 ) 45 (22 )

Total expenses 2,730 1,958 5,173

4,045 Earnings (loss) from continuing

operations before income taxes (481 ) 207 (726 ) 520 Income tax

benefit (7 ) (5 ) (41 ) — Net

earnings (loss) from continuing operations (474 ) 212 (685 ) 520

Net earnings from discontinued operations, net of income tax

expense 139 33 197

42 Net earnings (loss) (335 ) 245 (488 ) 562 Net earnings

attributable to noncontrolling interests 90 26

134 40 Net earnings (loss)

attributable to Devon $ (425 ) $ 219 $ (622 ) $ 522

Basic net earnings (loss) per share: Basic earnings (loss)

from continuing operations per share $ (0.92 ) $ 0.40 $ (1.33 ) $

0.99 Basic earnings from discontinued operations per share

0.09 0.01 0.13 —

Basic net earnings (loss) per share $ (0.83 ) $ 0.41 $ (1.20

) $ 0.99 Diluted net earnings (loss) per share: Diluted

earnings (loss) from continuing operations per share $ (0.92 ) $

0.40 $ (1.33 ) $ 0.99 Diluted earnings from discontinued operations

per share 0.09 0.01 0.13

— Diluted net earnings (loss) per share $ (0.83 ) $

0.41 $ (1.20 ) $ 0.99 Weighted average common shares

outstanding: Basic 521 526 524 525 Diluted 524 529 527 528

UPSTREAM REVENUES (in millions)

Quarter Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017 Oil, gas and NGL sales $ 1,566

$ 1,206 $ 2,926 $ 2,515 Derivative cash settlements (131 ) 11 (120

) 19 Derivative valuation changes (366 ) 115

(418 ) 339 Upstream revenues $ 1,069 $

1,332 $ 2,388 $ 2,873

PRODUCTION EXPENSES (in millions)

Quarter Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017 Lease operating expense $ 269 $

239 $ 510 $ 462 Gathering, processing & transportation 224 160

452 323 Production taxes 67 41 126 96 Property taxes 12

15 27 31

Production expense $ 572 $ 455 $ 1,115 $ 912

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions)

Quarter Ended Six Months Ended June 30,

June 30, 2018 2017 2018 2017

Cash flows from operating activities: Net earnings (loss) $ (335 )

$ 245 $ (488 ) $ 562 Adjustments to reconcile net earnings to net

cash

from operating activities:

Earnings from discontinued operations, net of tax (139 ) (33 ) (197

) (42 ) Depreciation, depletion and amortization 420 369 819 769

Asset impairments 154 — 154 — Leasehold impairments 53 22 61 64

Accretion on discounted liabilities 15 15 31 32 Total (gains)

losses on commodity derivatives 497 (126 ) 538 (358 ) Cash

settlements on commodity derivatives (131 ) 11 (120 ) 19 (Gains)

and losses on asset dispositions 23 (22 ) 11 (30 ) Deferred income

tax expense (benefit) 20 (17 ) (18 ) (32 ) Share-based compensation

58 45 96 81 Early retirement of debt — — 312 — Total (gains) losses

on foreign exchange 31 (49 ) 81 (64 ) Settlements of intercompany

foreign denominated assets/liabilities (244 ) 1 (243 ) 10 Other (20

) 23 (50 ) 11 Changes in assets and liabilities, net (133 )

102 (108 ) 133 Net cash from

operating activities - continuing operations 269

586 879 1,155 Cash flows

from investing activities: Capital expenditures (602 ) (434 )

(1,253 ) (831 ) Acquisitions of property and equipment (10 ) (13 )

(16 ) (33 ) Divestitures of property and equipment 560

75 607 107 Net

cash from investing activities - continuing operations (52 )

(372 ) (662 ) (757 ) Cash flows from financing

activities: Repayments of long-term debt principal — — (807 ) —

Early retirement of debt — — (304 ) — Repurchases of common stock

(428 ) — (499 ) — Dividends paid on common stock (42 ) (33 ) (74 )

(65 ) Shares exchanged for tax withholdings (6 ) (3 ) (44 ) (56 )

Net cash from financing activities - continuing operations (476 )

(36 ) (1,728 ) (121 ) Effect of exchange rate changes on cash:

Settlements of intercompany foreign denominated assets/liabilities

244 (1 ) 243 (10 ) Other (17 ) 9 (31 ) 10 Total

effect of exchange rate changes on cash – continuing operations 227

8 212 — Net change in cash, cash

equivalents and restricted cash of

continuing operations

(32 ) 186 (1,299 ) 277 Cash flows from discontinued

operations: Operating activities 236 151 430 328 Investing

activities (222 ) (215 ) (402 ) (284 ) Financing activities

73 128 112 89 Net

change in cash, cash equivalents and restricted cash of

discontinued operations

87 64 140 133

Net change in cash, cash equivalents and restricted cash 55

250 (1,159 ) 410 Cash, cash equivalents and restricted cash at

beginning of period 1,470 2,119

2,684 1,959 Cash, cash equivalents and

restricted cash at end of period $ 1,525 $ 2,369 $

1,525 $ 2,369 Reconciliation of cash, cash

equivalents and restricted cash: Cash and cash equivalents $ 1,460

$ 2,358 $ 1,460 $ 2,358 Restricted cash included in other current

assets 28 — 28 — Cash and cash equivalents included in current

assets held for sale 37 11 37

11 Total cash, cash equivalents and restricted

cash $ 1,525 $ 2,369 $ 1,525 $ 2,369

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

CONSOLIDATED BALANCE SHEETS (in millions)

June

30, December 31, 2018 2017 Current assets:

Cash and cash equivalents $ 1,460 $ 2,642 Accounts receivable 1,141

989 Current assets held for sale 10,764 760 Other current assets

455 400 Total current assets 13,820 4,791 Oil and gas

property and equipment, based on successful efforts accounting, net

12,957 13,318 Other property and equipment, net 1,164

1,266 Total property and equipment, net 14,121 14,584 Goodwill 841

841 Other long-term assets 377 296 Long-term assets held for sale

— 9,729 Total assets $ 29,159 $ 30,241 Current

liabilities: Accounts payable $ 771 $ 633 Revenues and royalties

payable 959 748 Short-term debt 277 115 Current liabilities held

for sale 5,291 991 Other current liabilities 1,079

828 Total current liabilities 8,377 3,315 Long-term

debt 5,790 6,749 Asset retirement obligations 1,088 1,099 Other

long-term liabilities 624 549 Long-term liabilities held for sale —

3,936 Deferred income taxes 432 489 Equity: Common stock 51 53

Additional paid-in capital 6,888 7,333 Retained earnings 6 702

Accumulated other comprehensive earnings 1,091 1,166 Treasury

stock, at cost, 0.5 million shares in 2018 (22) —

Total stockholders’ equity attributable to Devon 8,014 9,254

Noncontrolling interests 4,834 4,850 Total equity

12,848 14,104 Total liabilities and equity $ 29,159 $

30,241 Common shares outstanding 515 525

CAPITAL EXPENDITURES (in millions)

Quarter Ended

Six Months Ended June 30, 2018 June 30, 2018

Upstream capital $ 607 $ 1,271 Land and other acquisitions

12 18 Exploration and production (E&P) capital 619 1,289

Capitalized interest 17 35 Other 9 22 Devon capital

expenditures $ 645 $ 1,346

DEVON ENERGY CORPORATIONFINANCIAL AND

OPERATIONAL INFORMATION

NON-GAAP FINANCIAL MEASURES

This press release includes non-GAAP financial measures. These

non-GAAP measures are not alternatives to GAAP measures, and you

should not consider these non-GAAP measures in isolation or as a

substitute for analysis of our results as reported under GAAP.

Below is additional disclosure regarding each of the non-GAAP

measures used in this press release, including reconciliations to

their most directly comparable GAAP measure.

CORE EARNINGS

Devon’s reported net earnings include items of income and

expense that are typically excluded by securities analysts in their

published estimates of the company’s financial results.

Accordingly, the company also uses the measures of core earnings

and core earnings per share attributable to Devon. Devon believes

these non-GAAP measures facilitate comparisons of its performance

to earnings estimates published by securities analysts. Devon also

believes these non-GAAP measures can facilitate comparisons of its

performance between periods and to the performance of its peers.

The following table summarizes the effects of these items on

second-quarter 2018 earnings.

(in millions, except per share amounts)

Quarter Ended June 30, 2018 Before-tax

After-tax

AfterNoncontrollingInterests

Per DilutedShare

Continuing Operations Loss attributable to Devon (GAAP) $

(481 ) $ (474 ) $ (474 ) $ (0.92 ) Adjustments: Asset dispositions

23 18 18 0.03 Asset and exploration impairments 207 159 159 0.31

Deferred tax asset valuation allowance — 73 73 0.14 Fair value

changes in financial instruments and foreign currency 376 291 291

0.56 Restructuring and transaction costs 94 72

72 0.14 Core earnings

attributable to Devon (Non-GAAP) $ 219 $ 139 $ 139

$ 0.26

Discontinued Operations Earnings

attributable to Devon (GAAP) $ 149 $ 139 $ 49 $ 0.09 Adjustments:

Fair value changes and minimum volume commitment settlement

(36 ) (30 ) (11 ) (0.01 ) Core earnings

attributable to Devon (Non-GAAP) $ 113 $ 109 $ 38

$ 0.08

Total Loss attributable to Devon

(GAAP) $ (332 ) $ (335 ) $ (425 ) $ (0.83 ) Adjustments: Continuing

Operations 700 613 613 1.18 Discontinued Operations (36 )

(30 ) (11 ) (0.01 ) Core earnings attributable

to Devon (Non-GAAP) $ 332 $ 248 $ 177 $ 0.34

NET DEBT

Devon defines net debt as debt less cash and cash equivalents.

Devon believes that netting these sources of cash against debt

provides a clearer picture of the future demands on cash from Devon

to repay debt.

(in millions)

June 30, 2018 Total debt

(GAAP)(1) $ 6,067 Less cash and cash equivalents (1,460) Net

debt (Non-GAAP) $ 4,607 (1) Excludes EnLink since its

debt-related amounts are included in liabilities held for sale.

DEVON ENERGY CORPORATIONFINANCIAL AND

OPERATIONAL INFORMATION

ADJUSTED EBITDA

We define Adjusted EBITDA, a non-GAAP financial measure, as

EBITDA adjusted for certain items presented in the accompanying

reconciliation. We believe that EBITDA is widely used by investors

to measure a company’s performance without regard to items such as

interest expense, taxes, depreciation and amortization, which can

vary substantially from company to company depending upon

accounting methods and book value of assets, capital structure and

the method by which assets were acquired. In addition, Adjusted

EBITDA generally excludes certain other items that management

believes affect the comparability of operating results or are not

related to Devon’s ongoing operations. Management uses Adjusted

EBITDA to evaluate the company’s operational trends and performance

relative to other oil and gas companies.

ADJUSTED EBITDA (in millions)

Quarter Ended June 30,

2018 Continuing Discontinued Operations

Operations Total Net earnings (loss) $ (474) $ 139 $

(335) Financing costs, net 62 45 107 Income tax expense (benefit)

(7) 10 3 Depreciation, depletion and amortization 420 106 526

Accretion of discounted liabilities 15 — 15

EBITDA $ 16 $ 300 $ 316 Non-cash stock compensation 32 10 42

Asset and leasehold impairments 207 — 207 Asset disposition losses

23 — 23 Restructuring and transaction costs 94 — 94 Derivative and

financial instrument valuation changes 376 12 388 EnLink minimum

volume commitment settlement — (48) (48)

Adjusted EBITDA $ 748 $ 274 $ 1,022

PRO FORMA CASH & CASH EQUIVALENTS

Devon defines pro forma cash and cash equivalents as cash and

cash equivalents plus proceeds from the recently closed EnLink

Midstream sale. Devon believes adjusting for this item provides a

clearer picture of Devon’s financial position.

(in millions)

June 30, 2018 Cash

and cash equivalents (GAAP) $ 1,460 Proceeds from EnLink Midstream

monetization that closed in mid-July 3,125 Pro forma cash

and cash equivalents (Non-GAAP) $ 4,585

DEVON ENERGY CORPORATIONFORWARD

LOOKING GUIDANCE

PRODUCTION GUIDANCE

Quarter 3 Full Year Low

High Low High Oil and bitumen (MBbls/d)

U.S. – retained assets 132 137 130 135 Heavy Oil 115

120 120 125 Total – retained assets 247

257 250 260

Natural gas liquids (MBbls/d)

Total – retained assets 100 105 100 104

Gas (MMcf/d) U.S. –

retained assets 1,010 1,060 1,000 1,050 Heavy Oil 11

13 11 13 Total – retained assets 1,021

1,073 1,011 1,063

Total oil equivalent

(MBoe/d) U.S. – retained assets 400 419 397 414 Heavy Oil

117 122 122 127 Total – retained assets

517 541 519 541

PRICE REALIZATIONS GUIDANCE

Quarter 3 Full Year Low High Low

High Oil and bitumen - % of WTI U.S.(1) 88 %(1) 93 %(1) 92

%(1) 97 %(1) Canada(1) 40 %(1) 50 %(1) 37 %(1) 42 %(1) NGL -

realized price $ 23 $ 28 $ 22 $ 27 Natural gas - % of Henry Hub 70

% 80 % 70 % 80 % (1) Does not include benefits from basis

swaps and firm transportation agreements.

OTHER GUIDANCE

ITEMS

Quarter 3 Full Year ($

millions, except Boe and %)

Low High Low

High Marketing & midstream operating profit $ 5 $ 15 $

40 $ 50 LOE & GP&T per BOE $ 9.50 $ 9.75 $ 9.40 $ 9.90

Production & Property Tax (% of upstream sales) 5.20 % 5.40 %

5.20 % 5.40 % Exploration expenses $ 20 $ 30 $ 90 $ 100

Depreciation, depletion and amortization $ 420 $ 470 $ 1,700 $

1,800 General & administrative expenses $ 150 $ 170 $ 650 $ 700

Financing costs, net(2) $

70

(2)

$

80

(2)

$

285

(2)

$

295

(2)

Other expenses $ 15 $ 20 $ 60 $ 80 Current income tax rate 0 % 5 %

0 % 5 % Deferred income tax rate 20 % 25 % 20

% 25 % Total income tax rate 20 % 30 %

20 % 30 %

Average basic share count outstanding

(MM)

493 496 500 505 (2) On a go-forward basis interest expense

that had been historically capitalized will now be included in

financing costs, net.

CAPITAL EXPENDITURES

GUIDANCE Quarter 3 Full Year (in millions)

Low High Low High Upstream capital $

550 $ 600 $ 2,200 $ 2,400 Capitalized interest and other(2)

20 30 100 150

Total $ 570 $ 630 $ 2,300 $ 2,550

DEVON ENERGY CORPORATIONFORWARD

LOOKING GUIDANCE

Oil Commodity Hedges

Price Swaps Price Collars Period Volume

(Bbls/d)

WeightedAverage Price($/Bbl)

Volume (Bbls/d)

WeightedAverage FloorPrice ($/Bbl)

Weighted AverageCeiling Price($/Bbl)

Q3-Q4 2018 91,300 $ 58.15 100,700 $ 52.27 $ 62.87 Q1-Q4 2019 54,225

$ 59.34 65,875 $ 52.76 $ 62.76

Oil Basis Swaps Oil

Basis Swaps Oil Basis Collars Period Index

Volume (Bbls/d)

WeightedAverageDifferential toWTI

($/Bbl)

Volume (Bbls/d)

WeightedAverage FloorDifferential toWTI

($/Bbl)

WeightedAverageCeilingDifferential toWTI

($/Bbl)

Q3-Q4 2018 Midland Sweet 23,000 $ (1.02 ) — $ — $ — Q3-Q4 2018

Argus LLS 12,000 $ 3.95 — $ — $ — Q3-Q4 2018 Argus MEH 15,832 $

2.82 — $ — $ — Q3-Q4 2018 NYMEX Roll 21,315 $ 0.63 — $ — $ — Q3-Q4

2018 Western Canadian Select 78,000 $ (14.91 ) 2,000 $ (15.50 ) $

(13.93 ) Q1-Q4 2019 Midland Sweet 28,000 $ (0.46 ) — $ — $ — Q1-Q4

2019 Argus LLS 1,000 $ 4.60 — $ — $ — Q1-Q4 2019 Argus MEH 16,000 $

2.84 — $ — $ — Q1-Q4 2019 NYMEX Roll 24,000 $ 0.51 — $ — $ — Q1-Q4

2020 NYMEX Roll 24,000 $ 0.31 — $ — $ —

Natural Gas Commodity Hedges - Henry Hub

Price Swaps Price Collars Period

Volume (MMBtu/d)

WeightedAverage Price($/MMBtu)

Volume (MMBtu/d)

WeightedAverage FloorPrice ($/MMBtu)

Weighted AverageCeiling Price($/MMBtu)

Q3-Q4 2018 278,750 $ 2.91 246,500 $ 2.76 $ 3.09 Q1-Q4 2019 194,000

$ 2.81 155,750 $ 2.64 $ 3.03

Natural Gas Basis Swaps Period

Index

Volume (MMBtu/d)

Weighted AverageDifferential toHenry

Hub($/MMBtu)

Q3-Q4 2018 Panhandle Eastern Pipe Line 120,000 $ (0.51 ) Q3-Q4 2018

El Paso Natural Gas 100,000 $ (1.25 ) Q3-Q4 2018 Houston Ship

Channel 115,000 $ 0.01 Q3-Q4 2018 Transco Zone 4 15,000 $ (0.03 )

Q1-Q4 2019 Panhandle Eastern Pipe Line 62,500 $ (0.77 ) Q1-Q4 2019

El Paso Natural Gas 120,000 $ (1.48 ) Q1-Q4 2019 Houston Ship

Channel 100,000 $ (0.01 ) Q1-Q4 2019 Transco Zone 4 7,500 $ (0.03 )

Devon’s oil derivatives settle against the average of the prompt

month NYMEX West Texas Intermediate futures price. Devon’s natural

gas derivatives settle against the Inside FERC first of the month

Henry Hub index. Commodity hedge positions are shown as of July 27,

2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180731005843/en/

Devon Energy CorporationInvestor ContactsScott

Coody, 405-552-4735Chris Carr, 405-228-2496Media ContactJohn

Porretto, 405-228-7506

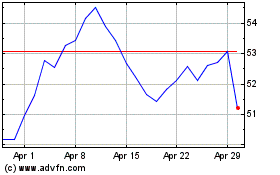

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

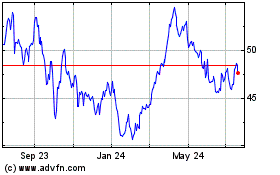

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024