By Akane Otani

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 30, 2018).

The broad U.S. stock market is within 2% of a new high despite

big drops by some of the technology giants that have powered recent

gains, reassuring investors that the nine-year rally remains on

firm footing to continue its run.

For months, analysts and investors have been debating whether a

stock market whose gains have largely been driven by a handful of

technology companies may be subject to a sudden reversal. They have

already witnessed several big selloffs in recent days: Facebook

Inc. wiped out more than $100 billion in market capitalization

Thursday after warning its growth was slowing, while Netflix Inc.

tumbled earlier this month after missing its own forecasts for user

growth by more than a million subscribers. Twitter Inc. and Intel

Corp. slid Friday after posting disappointing earnings.

Yet through much of those shock waves, the broader stock market

has remained resilient. As Facebook suffered its biggest slide as a

public company, dragging other technology stocks down with it, the

S&P 500 slipped just 0.3%. The broad index lost some ground

Friday but eked out a gain for the week and hovered 1.9% away from

its all-time high.

One reason why: While corporate-earnings results have been

uneven for some technology firms, others have continued posting

robust results, with both Alphabet Inc. and Amazon.com Inc. defying

analysts' expectations for yet another quarter. Earnings across the

rest of the stock market have been strong, buoyed by corporate tax

cuts, consumer spending and an economy growing at its fastest pace

in years.

The next big test for the tech sector comes Tuesday, when Apple

Inc. is projected to report double-digit growth in quarterly

earnings and revenue.

Even after adding hundreds of billions of dollars to their

market capitalizations, the five biggest companies in the S&P

500) -- Apple, Amazon, Alphabet, Microsoft Corp. and Facebook --

remain a smaller share of the index than the five biggest during

the lead-up to the 1980s oil glut, the 2000 dot-com bust and the

2008 financial crisis, according to Ned Davis Research.

Taken together, many investors are betting that the stock

market's dependence on a small number of technology giants isn't as

precarious as it seems and that the bull market has the breadth to

continue.

"I would never not want to own some of these names because I

can't imagine what an Amazon or Google are going to come up with

next," said Tom Stringfellow, chief investment officer at Frost

Investment Advisors, which owns a number of the so-called FAANG

stocks: Facebook, Amazon, Apple, Netflix and Google-parent

Alphabet.

To be sure, there are plenty of naysayers who would disagree

with Mr. Stringfellow.

Brendan Erne, director of portfolio implementation at Personal

Capital, has been advising clients to pare back their technology

holdings and raise their exposure to areas of the market that he

considers neglected.

"The fact that investors continue to double down on this crowded

trade is a sign of greed," Mr. Erne said, adding that many seem to

have bought into the idea that "these companies are

infallible."

History has also shown the stock market dropping precipitously

in periods when the weight of the top five stocks in the S&P

500 significantly diverged from the weight of the bottom half of

the index. Before the peak of the dot-com era in March 2000, the

top five S&P 500 stocks made up 18% of the index, more than

double the weight of the bottom half of the index, according to Ned

Davis Research.

Yet the stock market is far less lopsided today, with the top

five S&P 500 stocks making up 14% of the market -- about the

same as the bottom half of the index.

Stock indexes that either exclude or de-emphasize the FAANG

names have also managed to perform well, evidence that areas of the

market that haven't been dominated by technology have still managed

to draw in investors. The Russell 2000 index of

small-capitalization stocks has outpaced the S&P 500's 2018

advance, while the S&P 500 equal-weighted index, which gives

the smallest companies in the index the same weight as the largest

ones, has trailed the S&P 500 by less than 2%.

"There is broader strength outside of just tech," said Jim

Paulsen, chief investment strategist at Leuthold Group.

Much of that has to do with the strength of the economy. Data on

Friday showed the U.S. economy grew in the second quarter at the

fastest pace in nearly four years. The labor market has added jobs

for a record 93 months, while corporate earnings have also shined,

showing companies ranging from industrial conglomerates to oil

producers to department-store owners growing profits with the help

of a potent mix of tax cuts and economic growth.

All that has helped lift stocks across the market and even

revive trades that many investors had left for dead as technology

giants such as Amazon waded further into industries ranging from

health care to retail.

Rising consumer spending, cost-cutting and rewards from shifting

more toward e-commerce have helped stocks such as Macy's Inc. soar

57% this year, outpacing Amazon's 55% gain, while Under Armour Inc.

has jumped 43%, Advance Auto Parts Inc. has added 40% and Kohl's

Corp. has risen 34%. Ten of the 11 sectors in the S&P 500 are

posting gains over the past three months.

"We're in a period of historically low interest rates, a strong

labor market and favorable tech backdrop," said Mr. Erne. Despite

his misgivings about the lofty expectations around large tech

firms, he said those factors are helping him remain cautiously

optimistic.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

July 30, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

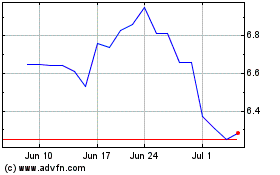

Under Armour (NYSE:UA)

Historical Stock Chart

From Mar 2024 to Apr 2024

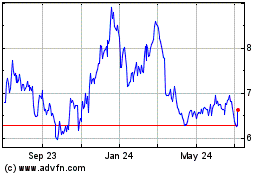

Under Armour (NYSE:UA)

Historical Stock Chart

From Apr 2023 to Apr 2024