Nokia Corporation Half Year Financial Report July 26, 2018

at 08:00 (CET +1)

Nokia Corporation Financial Report for Q2 and Half Year

2018

First half 2018 as expected; improvement expected in Nokia's

Networks business in second half 2018

- Full year 2018 Nokia-level guidance reiterated

This is a summary of the Nokia Corporation financial report for

Q2 and half year 2018 published today. The complete financial

report for Q2 and half year 2018 with tables is available at

www.nokia.com/financials. Investors should not rely on summaries of

our financial reports only, but should review the complete

financial reports with tables.

FINANCIAL HIGHLIGHTS

- Net sales in Q2 2018 were EUR 5.3bn, compared to EUR 5.6bn in

Q2 2017. On a constant currency basis, net sales would have been

down 1%.

- Non-IFRS diluted EPS in Q2 2018 was EUR 0.03, compared to EUR

0.08 in Q2 2017. Reported diluted EPS in Q2 2018 was negative EUR

0.05, compared to negative EUR 0.07 in Q2 2017.

- In the second quarter, net cash and current financial

investments decreased by approximately EUR 2.0 billion, primarily

due to two expected items: the payment of the dividend of

approximately EUR 940 million; and the payment of employee

incentives related to Nokia's business performance in 2017, which

was the primary driver of the decrease in liabilities within net

working capital of approximately EUR 600 million.

Nokia's Networks business net sales were EUR 4.7bn, with

operating profit of EUR 69mn

- Our backlog was strong at the end of Q2, and we continue to

expect commercial 5G network deployments to begin near the end of

2018.

- Continued progress was made in Q2 with our strategy to

diversify and grow by targeting attractive adjacent markets.

Strong momentum continued with large enterprise vertical and

webscale customers, with double-digit year-on-year growth in net

sales.

- Momentum in our end-to-end strategy continued, with

approximately 40% of our sales pipeline now comprised of solutions,

products and services from multiple business groups.

Nokia Technologies net sales were EUR 361mn, with operating

profit of EUR 292mn

- Strong track record maintained, with 23% year-on-year growth in

recurring licensing net sales and 27% year-on-year operating profit

increase in Q2, primarily related to license agreements entered

into in 2017.

- Nokia Technologies continued to make good progress on new

licensing agreements; no major agreements were announced in

Q2.

Outlook

- Nokia reiterates full year 2018 Nokia-level guidance and

remains on target to deliver EUR 1.2 billion of recurring annual

cost savings in full year 2018.

- In its Networks business, Nokia expects improving market

conditions in the second half of 2018, with particular acceleration

in the fourth quarter in North America. Results in 2018 and over

the longer term are expected to be influenced by: a) our ability to

scale our supply chain operations to meet increasing demand; b)

recovery actions to address increased price pressure; and c) the

timing of completions and acceptances of certain projects,

particularly related to 5G.

- Nokia continues to see opportunities to build on its track

record in Nokia Licensing within Nokia Technologies and drive a

compound annual growth rate of approximately 10% for recurring net

sales over the 3-year period ending 2020.

- Please refer to the full details and other targets in the

Outlook section of this press release.

| Second quarter and January-June 2018 non-IFRS

results. Refer to note 1, "Basis of Preparation" and note 15,

"Performance measures", in the "Financial statement information"

section for further details1 |

| EUR

million (except for EPS in EUR) |

Q2'18 |

Q2'17 |

YoY change |

Constant currency YoY change |

Q1-Q2'18 |

Q1-Q2'17 |

YoY change |

Constant currency YoY change |

| Net sales

(non-IFRS) |

5

318 |

5

629 |

(6)% |

(1)% |

10

246 |

11

017 |

(7)% |

0% |

|

Nokia's Networks business |

4

693 |

4

971 |

(6)% |

0% |

9

018 |

9

873 |

(9)% |

(1)% |

|

Nokia Technologies |

361 |

369 |

(2)% |

(2)% |

726 |

616 |

18% |

19% |

|

Group Common and Other |

278 |

307 |

(9)% |

(4)% |

530 |

562 |

(6)% |

(1)% |

| Gross profit

(non-IFRS) |

2

038 |

2

350 |

(13)% |

|

3

979 |

4

546 |

(12)% |

|

| Gross margin %

(non-IFRS) |

38.3% |

41.7% |

(340)bps |

|

38.8% |

41.3% |

(250)bps |

|

| Operating profit

(non-IFRS) |

334 |

574 |

(42)% |

|

573 |

915 |

(37)% |

|

|

Nokia's Networks business |

69 |

406 |

(83)% |

|

112 |

730 |

(85)% |

|

|

Nokia Technologies |

292 |

230 |

27% |

|

565 |

346 |

63% |

|

|

Group Common and Other |

(27) |

(62) |

(56)% |

|

(105) |

(161) |

(35)% |

|

| Operating margin %

(non-IFRS) |

6.3% |

10.2% |

(390)bps |

|

5.6% |

8.3% |

(270)bps |

|

| Financial income and

expenses (non-IFRS) |

(84) |

(63) |

33% |

|

(200) |

(144) |

39% |

|

| Income taxes

(non-IFRS) |

(106) |

(74) |

43% |

|

(143) |

(122) |

17% |

|

| Profit for the period

(non-IFRS) |

139 |

441 |

(68)% |

|

223 |

644 |

(65)% |

|

|

Profit attributable to the equity holders of the parent

(non-IFRS) |

144 |

449 |

(68)% |

|

230 |

646 |

(64)% |

|

|

Non-controlling interests (non-IFRS) |

(4) |

(9) |

|

|

(7) |

(2) |

|

|

| EPS, EUR

diluted (non-IFRS) |

0.03 |

0.08 |

(63)% |

|

0.04 |

0.11 |

(64)% |

|

| |

|

|

|

|

|

|

|

|

| Second quarter and January-June 2018 reported

results. Refer to note 1, "Basis of Preparation" and note 15,

"Performance measures", in the "Financial statement information"

section for further details1 |

| EUR

million (except for EPS in EUR) |

Q2'18 |

Q2'17 |

YoY change |

Constant currency YoY change |

Q1-Q2'18 |

Q1-Q2'17 |

YoY change |

Constant currency YoY change |

| Net sales |

5

313 |

5

619 |

(5)% |

(1)% |

10

237 |

10

996 |

(7)% |

0% |

|

Nokia's Networks business |

4

693 |

4

971 |

(6)% |

0% |

9

018 |

9

873 |

(9)% |

(1)% |

|

Nokia Technologies |

361 |

369 |

(2)% |

(2)% |

726 |

616 |

18% |

19% |

|

Group Common and Other |

278 |

307 |

(9)% |

(4)% |

530 |

562 |

(6)% |

(1)% |

|

Non-IFRS exclusions |

(5) |

(11) |

(55)% |

|

(9) |

(21) |

(57)% |

|

| Gross profit |

1

860 |

2

236 |

(17)% |

|

3

666 |

4

361 |

(16)% |

|

| Gross margin % |

35.0% |

39.8% |

(480)bps |

|

35.8% |

39.7% |

(390)bps |

|

| Operating loss |

(221) |

(45) |

391% |

|

(557) |

(173) |

222% |

|

|

Nokia's Networks business |

69 |

406 |

(83)% |

|

112 |

730 |

(85)% |

|

|

Nokia Technologies |

292 |

230 |

27% |

|

565 |

346 |

63% |

|

|

Group Common and Other |

(27) |

(62) |

(56)% |

|

(105) |

(161) |

(35)% |

|

|

Non-IFRS exclusions |

(555) |

(620) |

(10)% |

|

(1

129) |

(1

088) |

4% |

|

| Operating margin % |

(4.2)% |

(0.8)% |

(340)bps |

|

(5.4)% |

(1.6)% |

(380)bps |

|

| Financial income and

expenses |

(56) |

(287) |

(80)% |

|

(164) |

(433) |

(62)% |

|

| Income taxes |

10 |

(103) |

|

|

104 |

(256) |

|

|

| Loss for the

period |

(271) |

(433) |

(37)% |

|

(625) |

(868) |

(28)% |

|

|

Loss attributable to the equity holders of the parent |

(267) |

(423) |

(37)% |

|

(618) |

(896) |

(31)% |

|

|

Non-controlling interests |

(4) |

(9) |

|

|

(7) |

28 |

|

|

| EPS, EUR diluted |

(0.05) |

(0.07) |

(29)% |

|

(0.11) |

(0.16) |

(31)% |

|

| Net cash

and current financial investments |

2 144 |

3 964 |

(46)% |

|

2 144 |

3 964 |

(46)% |

|

| 1Results

are as reported unless otherwise specified. The financial

information in this report is unaudited. Non-IFRS results exclude

costs related to the acquisition of Alcatel-Lucent and related

integration, goodwill impairment charges, intangible asset

amortization and other purchase price fair value adjustments,

restructuring and associated charges and certain other items that

may not be indicative of Nokia's underlying business performance.

For details, please refer to the non-IFRS exclusions section

included in discussions of both the quarterly and year to date

performance and note 2, "Non-IFRS to reported reconciliation", in

the notes to the Financial statement information in this report.

Change in net sales at constant currency excludes the effect of

changes in exchange rates in comparison to euro, our reporting

currency. For more information on currency exposures, please refer

to note 1, "Basis of Preparation", in the "Financial statement

information" section in this report. |

CEO STATEMENT

Nokia's Q2 2018 results were consistent with our view that the

first half of the year would be weak followed by an increasingly

robust second half. Pleasingly, I am able to confirm that we expect

to deliver 2018 results within the ranges of our annual

guidance.

Our topline started to recover in the second quarter, with sales

in constant currency approximately flat at both Group and Networks

levels; year-on-year constant currency sales growth in three of

five of our Networks business groups and in three out of our six

regions.

Our entry into the enterprise market continued to proceed well

in Q2. Year-on-year sales in constant currency increased

approximately 30%, with strength in both vertical markets and

webscale companies. Nokia Technologies had a very good second

quarter, with recurring licensing revenues up very strongly and

operating profit up at excellent levels compared to Q2 last

year.

Our view about the acceleration of 5G has not changed and we

continue to believe that Nokia is well-positioned for the coming

technology cycle given the strength of our end-to-end portfolio.

Our deal win rate is very good, with significant recent successes

in the key early 5G markets of the United States and China.

The installed base of our superb high-capacity AirScale product,

which enables customers to quickly upgrade to 5G without a hardware

swap, is growing fast. And, the strength of our end-to-end

portfolio remains a differentiator. When you look at our sales

pipeline, 40% of it is now comprised of end-to-end deals. That is

the highest level we have seen to-date.

Business and regional mix continued to have some impact on gross

margin, as did near-term actions of a small number of large

customers funding their 5G entry within their existing budget

plans.

We expect market conditions to improve further in the second

half, particularly in Q4, Nokia's seasonally strongest quarter, and

as 5G accelerates significantly.

Rajeev Suri President and CEO

OUTLOOK

|

|

Metric |

Guidance |

Commentary |

| Nokia |

Non-IFRS operating margin |

9-11% for full year 2018 and 12-16% for full year 2020 |

Nokia 's guidance for significant improvement between

full year 2018 and full year 2020 is primarily due to expectations

for: Improved results in Nokia's Networks business, which are

detailed below; Improved results in Nokia Technologies, which are

detailed below; and Lower Nokia support function costs within

Nokia's Networks business and Group Common and Other. |

|

Non-IFRS diluted earnings per share |

EUR 0.23 - 0.27 in full year 2018 and EUR 0.37 - 0.42 in full year

2020 |

| |

Dividend |

Approximately 40% to 70% of non-IFRS EPS on a long-term basis |

Nokia's Board of Directors is committed to proposing a growing

dividend, including for 2018. |

| |

Recurring free cash flow |

Slightly positive in full year 2018 and clearly positive in full

year 2020 |

Recurring free cash flow is expected to improve over the

longer-term, due to lower cash outflows related to restructuring

and network equipment swaps1 and improved operational results over

time. |

| |

Recurring annual cost savings for Nokia, excluding Nokia

Technologies |

Approximately EUR 1.2 billion of recurring annual cost savings in

full year 2018, of which approximately EUR 800 million are expected

from operating expenses1 |

The reference period is full year 2015, in which the combined

operating expenses of Nokia and Alcatel-Lucent, excluding Nokia

Technologies, were approximately EUR 7.3 billion.As a result of

active efforts to drive 5G adoption, and in the interest of our

long-term strategy given the acceleration of 5G, in 2018 we expect

to incur approximately EUR 100 to 200 million of temporary

incremental expenses related to 5G customer trials that will

partially reduce the positive impact from the recurring annual cost

savings. |

| |

Network equipment swaps |

Approximately EUR 1.4 billion of charges and cash outflows in

total1 |

The charges related to network equipment swaps are being recorded

as non-IFRS exclusions, and therefore do not affect Nokia's

non-IFRS operating profit. |

| |

Non-IFRS financial income and expenses |

Expense of approximately EUR 350 million in full year 2018 and

approximately EUR 300 million over the longer-term (This is an

update to earlier guidance of approximately EUR 300 million for

full year 2018) |

Nokia's outlook for non-IFRS financial income and expenses in full

year 2018 and over the longer-term is expected to be influenced by

factors including: Net interest expenses related to

interest-bearing liabilities and defined benefit pension and other

post-employment benefit plans; Foreign exchange fluctuations and

hedging costs; and Expenses related to the sale of

receivables. |

| |

Non-IFRS tax rate |

Approximately 30% for full year 2018 and 25% over the

longer-term |

Nokia's outlook for non-IFRS tax rate for full year 2018 and over

the longer-term is expected to be influenced by factors including

the absolute level of profits, regional profit mix and any further

changes to our operating model.Nokia expects cash outflows related

to taxes to be approximately EUR 400 million in full year 2018 and

approximately EUR 450 million over the longer-term until Nokia's US

or Finnish deferred tax assets are fully utilized.(This is an

update to earlier commentary for cash outflows related to taxes to

be approximately EUR 450 million in full year 2018.) |

|

|

Capital expenditures |

Approximately EUR 700 million in full year 2018 and approximately

EUR 600 million over the longer-term |

Primarily attributable to Nokia's Networks business, and consistent

with the depreciation of property, plant and equipment over the

longer-term. |

| Nokia's Networks business |

Net sales |

Outperform its primary addressable market in 2018 and over the

longer-term |

For Nokia's Networks business, Nokia expects net sales

to outperform its primary addressable market and operating margin

to expand between full year 2018 and full year 2020.Nokia's outlook

for net sales and operating margin for Nokia's Networks business in

2018 and 2020 is expected to be influenced by factors including: An

approximately 1 to 3 percent decline in the primary addressable

market for Nokia's Networks business in full year 2018, compared to

2017, on a constant currency basis; Customer demand for 5G, with

commercial 5G network deployments expected to begin near the end of

2018; Improving market conditions in the second half of 2018, with

particular acceleration in the fourth quarter in North America,

following weakness in the first half of 2018 (This is an update to

earlier commentary for improved market conditions in the second

half of 2018, particularly in North America.); Growth in the

primary addressable market for Nokia's Networks business in 2019

and 2020, on a constant currency basis; Our ability to scale our

supply chain operations to meet increasing demand; Recovery actions

to address increased price pressure, including the ability to

offset price erosion through cost reductions (new commentary); The

timing of completions and acceptances of certain projects,

particularly related to 5G (new commentary); Focus on targeted

growth opportunities in attractive adjacent markets; Building a

strong standalone software business; Improved R&D productivity

resulting from new ways of working and the reduction of legacy

platforms over time; Lower support function costs, including IT and

site costs; Uncertainty related to potential mergers or

acquisitions by our customers; Product and regional mix; and

Competitive and other industry dynamics. |

|

Operating margin |

6-9% for full year 2018 and 9-12% for full year 2020 |

| Nokia Licensing within

Nokia Technologies |

Recurring net sales |

Grow at a compound annual growth rate (CAGR) of approximately 10%

over the 3-year period ending 2020 |

Due to risks and uncertainties in determining the

timing and value of significant patent, brand and technology

licensing agreements, Nokia believes it is not appropriate to

provide annual outlook ranges for Nokia Licensing within Nokia

Technologies. Although annual results are difficult to forecast,

Nokia expects net sales growth and operating margin expansion over

the 3-year period ending 2020.In full year 2017, licensing net

sales were approximately EUR 1.6 billion, of which approximately

EUR 300 million were non-recurring in nature and related to

catch-up net sales for prior years.Nokia's outlook for net sales

and operating margin for Nokia Licensing within Nokia Technologies

is expected to be influenced by factors including: The timing and

value of new patent licensing agreements with smartphone vendors,

automotive companies and consumer electronics companies;

Renegotiation of expiring patent licensing agreements; Increases or

decreases in net sales related to existing patent licensees;

Results in brand and technology licensing; Costs to protect and

enforce our intellectual property rights; and The regulatory

landscape. |

|

|

Operating margin |

Expand to approximately 85% for full year 2020 |

1 For further details related to the cost savings and network

equipment swaps guidance, please refer to the "Cost savings

program" on page 8.

NOKIA IN Q2 2018 - NON-IFRS

FINANCIAL DISCUSSION

The financial discussion included in this financial report of

Nokia's results comprises the results of Nokia's businesses -

Nokia's Networks business and Nokia Technologies, as well as Group

Common and Other. For more information on our reportable segments,

please refer to note 3, "Segment information", in the "Financial

statement information" section in this report.

Year-on-year changes in non-IFRS net sales and non-IFRS

operating profit

Nokia non-IFRS net sales decreased 6% year-on-year. On a

constant currency basis, Nokia non-IFRS net sales would have

decreased 1% year-on-year.

| EUR

million, non-IFRS |

Net sales |

% change |

Gross profit |

(R&D) |

(SG&A) |

Other income and (expenses) |

Operating profit |

Change in operating margin % |

| Networks business |

(278) |

(6)% |

(313) |

5 |

31 |

(60) |

(337) |

(670)bps |

| Nokia Technologies |

(8) |

(2)% |

2 |

24 |

25 |

11 |

62 |

1

860bps |

| Group Common and

Other |

(29) |

(9)% |

(1) |

(3) |

4 |

35 |

35 |

1

050bps |

| Eliminations |

3 |

|

0 |

0 |

0 |

0 |

0 |

|

|

Nokia |

(311) |

(6)% |

(312) |

25 |

60 |

(14) |

(240) |

(390)bps |

On a year-on-year basis, foreign exchange fluctuations had a

negative impact on non-IFRS gross profit, a positive impact on

non-IFRS operating expenses and an approximately neutral net impact

on non-IFRS operating profit in the second quarter 2018.

Year-on-year changes in non-IFRS profit attributable to the

equity holders of the parent

| EUR

million, non-IFRS |

Operating profit |

Financial income and expenses |

Income taxes |

Profit |

Non-controlling interests |

Profit attributable to the equity holders of the parent |

|

Nokia |

(240) |

(21) |

(32) |

(302) |

(5) |

(305) |

Non-IFRS financial income and expenses

The net negative fluctuation in non-IFRS financial income and

expenses was primarily due to the absence of venture fund

distributions. Interest expenses associated with the inclusion of

new items such as costs related to the sale of receivables and

financing elements from customer and other contracts as a result of

the adoption of new IFRS standards in the first quarter 2018 were

offset by lower interest expenses from financing activities.

Non-IFRS income taxes

Increase in non-IFRS tax rate to 43% in the second quarter 2018

was primarily due to regional profit mix. In the second quarter

2017 regional profit mix resulted in an unusually low non-IFRS tax

rate of 14% and in addition, in the second quarter 2018 the

combination of lower absolute level of profit and certain prior

year tax charges increased the non-IFRS tax

rate.

NOKIA IN Q2 2018 - REPORTED

FINANCIAL DISCUSSION

Year-on year changes in net sales and operating

profit

Nokia net sales decreased 5% year-on-year. On a constant

currency basis, Nokia net sales would have decreased 1%

year-on-year.

| EUR

million |

Net Sales |

% change |

Gross profit |

(R&D) |

(SG&A) |

Other income and (expenses) |

Operating profit |

Change in operating margin % |

| Networks business |

(278) |

(6)% |

(313) |

5 |

31 |

(60) |

(337) |

(670)bps |

| Nokia Technologies |

(8) |

(2)% |

2 |

24 |

25 |

11 |

62 |

1

860bps |

| Group Common and

Other |

(29) |

(9)% |

(1) |

(3) |

4 |

35 |

35 |

1

050bps |

| Eliminations |

3 |

|

0 |

0 |

0 |

0 |

0 |

|

| Non-IFRS

exclusions |

6 |

(55)% |

(64) |

23 |

34 |

72 |

65 |

|

|

Nokia |

(306) |

(5)% |

(376) |

49 |

93 |

59 |

(176) |

(340)bps |

Year-on year changes in profit attributable to the equity

holders of the parent

| EUR

million |

Operating profit |

Financial income and expenses |

Income taxes |

Profit |

Non-controlling interests |

Profit attributable to the equity holders of the parent |

|

Nokia |

(176) |

231 |

113 |

162 |

(5) |

156 |

Financial income and expenses

The net positive fluctuation in financial income and expenses

was primarily due to the absence of non-IFRS exclusions related to

Nokia's tender offer to purchase the 6.50% notes due January 15,

2028, the 6.45% notes due March 15, 2029 and the 5.375% notes due

May 15, 2019 and the absence of non-recurring interest expense

resulting from the uncertain tax position related to disposal of

former Alcatel-Lucent railway signaling business to Thales as well

as the release of cumulative exchange differences related to

abandonment of foreign operations and the change in financial

liability to acquire NSB non-controlling interest.

Income taxes

The change in taxes from an expense in the second quarter 2017

to a slight benefit in the second quarter 2018 was primarily due to

absence of non-recurring tax expenses related to the disposal of

the former Alcatel Lucent railway signaling business to Thales and

deferred tax valuation allowance both of which had negative impact

on the second quarter 2017 tax expense.

Non-IFRS exclusions in Q2 2018

Non-IFRS exclusions consist of costs related to the acquisition

of Alcatel-Lucent and related integration, goodwill impairment

charges, intangible asset amortization and purchase price related

items, restructuring and associated charges and certain other items

that may not be indicative of Nokia's underlying business

performance. For additional details, please refer to note 2,

"Non-IFRS to reported reconciliation", in the "Financial statement

information" section in this report.

Cost savings program

The following table summarizes the financial information related

to our cost savings program, as of the end of the second quarter

2018. Balances related to previous Nokia and Alcatel-Lucent

restructuring and cost savings programs have been included as part

of this overall cost savings program as of the second quarter

2016.

| In

EUR million, approximately |

Q2'18 |

| Opening balance of

restructuring and associated liabilities |

830 |

| + Charges in the

quarter |

30 |

| - Cash outflows

in the quarter |

110 |

| = Ending balance

of restructuring and associated liabilities |

750 |

| of which

restructuring provisions |

680 |

| of which other

associated liabilities |

70 |

| |

|

| Total expected

restructuring and associated charges |

1 900 |

| - Cumulative

recorded |

1 490 |

| = Charges

remaining to be recorded |

410 |

| |

|

| Total expected

restructuring and associated cash outflows |

2 250 |

| - Cumulative

recorded |

1 190 |

| = Cash outflows

remaining to be recorded |

1 060 |

The following table summarizes our full year 2016 and 2017

results and future expectations related to our cost savings program

and network equipment swaps.

|

|

Actual |

Actual |

Actual |

Expected amounts for |

|

In EUR million, approximately rounded to the nearest EUR 50

million |

2016 |

2017 |

Cumulative through the end of 2017 |

FY 2018 as of the end of |

FY 2019 and beyond as of the end of |

Total as of the end of |

|

|

|

|

Q1'18 |

Q2'18 |

Q1'18 |

Q2'18 |

Q1'18 |

Q2'18 |

|

Recurring annual cost savings |

550 |

250 |

800 |

400 |

400 |

0 |

0 |

1

200 |

1

200 |

|

- operating expenses |

350 |

150 |

500 |

300 |

300 |

0 |

0 |

800 |

800 |

|

- cost of sales |

200 |

100 |

300 |

100 |

100 |

0 |

0 |

400 |

400 |

|

Restructuring and associated charges |

750 |

550 |

1 300 |

600 |

600 |

0 |

0 |

1

900 |

1

900 |

|

Restructuring and associated cash outflows |

400 |

550 |

950 |

650 |

650 |

650 |

650 |

2

250 |

2

250 |

|

Charges related to network equipment swaps |

150 |

450 |

600 |

650 |

650 |

150 |

150 |

1

400 |

1

400 |

|

Cash outflows related to network equipment swaps |

150 |

450 |

600 |

650 |

650 |

150 |

150 |

1 400 |

1 400 |

On a cumulative basis, Nokia continues to be on track to achieve

the targeted EUR 1.2 billion of recurring annual cost savings in

full year 2018.

RISKS AND FORWARD-LOOKING STATEMENTS

It should be noted that Nokia and its businesses are exposed to

various risks and uncertainties and certain statements herein that

are not historical facts are forward-looking statements, including,

without limitation, those regarding: A) our ability to integrate

acquired businesses into our operations and achieve the targeted

business plans and benefits, including targeted benefits,

synergies, cost savings and efficiencies; B) expectations, plans or

benefits related to our strategies and growth management; C)

expectations, plans or benefits related to future performance of

our businesses; D) expectations, plans or benefits related to

changes in organizational and operational structure; E)

expectations regarding market developments, general economic

conditions and structural changes; F) expectations and targets

regarding financial performance, results, operating expenses,

taxes, currency exchange rates, hedging, cost savings and

competitiveness, as well as results of operations including

targeted synergies and those related to market share, prices, net

sales, income and margins; G) expectations, plans or benefits

related to any future collaboration or to business collaboration

agreements or patent license agreements or arbitration awards,

including income to be received under any collaboration or

partnership, agreement or award; H) timing of the deliveries of our

products and services; I) expectations and targets regarding

collaboration and partnering arrangements, joint ventures or the

creation of joint ventures, and the related administrative, legal,

regulatory and other conditions, as well as our expected customer

reach; J) outcome of pending and threatened litigation,

arbitration, disputes, regulatory proceedings or investigations by

authorities; K) expectations regarding restructurings, investments,

capital structure optimization efforts, uses of proceeds from

transactions, acquisitions and divestments and our ability to

achieve the financial and operational targets set in connection

with any such restructurings, investments, capital structure

optimization efforts, divestments and acquisitions; and L)

statements preceded by or including "believe", "expect",

"anticipate", "foresee", "sees", "target", "estimate", "designed",

"aim", "plans", "intends", "focus", "continue", "project",

"should", "is to", "will" or similar expressions. These statements

are based on management's best assumptions and beliefs in light of

the information currently available to it. Because they involve

risks and uncertainties, actual results may differ materially from

the results that we currently expect. Factors, including risks and

uncertainties that could cause these differences include, but are

not limited to: 1) our strategy is subject to various risks and

uncertainties and we may be unable to successfully implement our

strategic plans, sustain or improve the operational and financial

performance of our business groups, correctly identify or

successfully pursue business opportunities or otherwise grow our

business; 2) general economic and market conditions and other

developments in the economies where we operate; 3) competition and

our ability to effectively and profitably invest in new competitive

high-quality products, services, upgrades and technologies and

bring them to market in a timely manner; 4) our dependence on the

development of the industries in which we operate, including the

cyclicality and variability of the information technology and

telecommunications industries; 5) our dependence on a limited

number of customers and large multi-year agreements; 6) our ability

to maintain our existing sources of intellectual property-related

revenue, establish new sources of revenue and protect our

intellectual property from infringement; 7) our global business and

exposure to regulatory, political or other developments in various

countries or regions, including emerging markets and the associated

risks in relation to tax matters and exchange controls, among

others; 8) our ability to achieve the anticipated benefits,

synergies, cost savings and efficiencies of acquisitions, including

the acquisition of Alcatel Lucent, and our ability to implement

changes to our organizational and operational structure

efficiently; 9) our ability to manage and improve our financial and

operating performance, cost savings, competitiveness and synergies

generally and after the acquisition of Alcatel Lucent; 10) exchange

rate fluctuations, as well as hedging activities; 11) our ability

to successfully realize the expectations, plans or benefits related

to any future collaboration or business collaboration agreements

and patent license agreements or arbitration awards, including

income to be received under any collaboration, partnership,

agreement or arbitration award; 12) Nokia Technologies' ability to

protect its IPR and to maintain and establish new sources of

patent, brand and technology licensing income and IPR-related

revenues, particularly in the smartphone market, which may not

materialize as planned, 13) our dependence on IPR technologies,

including those that we have developed and those that are licensed

to us, and the risk of associated IPR-related legal claims,

licensing costs and restrictions on use; 14) our exposure to direct

and indirect regulation, including economic or trade policies, and

the reliability of our governance, internal controls and compliance

processes to prevent regulatory penalties in our business or in our

joint ventures; 15) our reliance on third-party solutions for data

storage and service distribution, which expose us to risks relating

to security, regulation and cybersecurity breaches; 16)

inefficiencies, breaches, malfunctions or disruptions of

information technology systems; 17) our exposure to various legal

frameworks regulating corruption, fraud, trade policies, and other

risk areas, and the possibility of proceedings or investigations

that result in fines, penalties or sanctions; 18) adverse

developments with respect to customer financing or extended payment

terms we provide to customers; 19) the potential complex tax

issues, tax disputes and tax obligations we may face in various

jurisdictions, including the risk of obligations to pay additional

taxes; 20) our actual or anticipated performance, among other

factors, which could reduce our ability to utilize deferred tax

assets; 21) our ability to retain, motivate, develop and recruit

appropriately skilled employees; 22) disruptions to our

manufacturing, service creation, delivery, logistics and supply

chain processes, and the risks related to our

geographically-concentrated production sites; 23) the impact of

litigation, arbitration, agreement-related disputes or product

liability allegations associated with our business; 24) our ability

to re-establish investment grade rating or maintain our credit

ratings; 25) our ability to achieve targeted benefits from, or

successfully implement planned transactions, as well as the

liabilities related thereto; 26) our involvement in joint ventures

and jointly-managed companies; 27) the carrying amount of our

goodwill may not be recoverable; 28) uncertainty related to the

amount of dividends and equity return we are able to distribute to

shareholders for each financial period; 29) pension costs, employee

fund-related costs, and healthcare costs; and 30) risks related to

undersea infrastructure, as well as the risk factors specified on

pages 71 to 89 of our 2017 annual report on Form 20-F published on

March 22, 2018 under "Operating and financial review and

prospects-Risk factors" and in our other filings or documents

furnished with the U.S. Securities and Exchange Commission. Other

unknown or unpredictable factors or underlying assumptions

subsequently proven to be incorrect could cause actual results to

differ materially from those in the forward-looking statements. We

do not undertake any obligation to publicly update or revise

forward-looking statements, whether as a result of new information,

future events or otherwise, except to the extent legally

required.

The financial report was authorized for issue by management on

July 25, 2018.

- Nokia plans to publish its third quarter and January-September

2018 results on October 25, 2018.

Media Enquiries: Nokia Communications Tel. +358 (0) 10

448 4900 Email: press.services@nokia.com Jon Peet, Vice President,

Corporate Communications

Investor Enquiries:Nokia Investor RelationsTel. +358 4080

3 4080Email: investor.relations@nokia.com About Nokia We

create the technology to connect the world. Powered by the research

and innovation of Nokia Bell Labs, we serve communications service

providers, governments, large enterprises and consumers, with the

industry's most complete, end-to-end portfolio of products,

services and licensing.

We adhere to the highest ethical business standards as we create

technology with social purpose, quality and integrity. Nokia is

enabling the infrastructure for 5G and the Internet of Things to

transform the human experience www.nokia.com

- Nokia Corporation report for Q2 2018.pdf

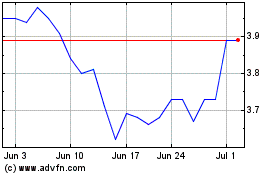

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024