The Score: The Business Week in 7 Stocks

July 20 2018 - 5:38PM

Dow Jones News

By Laine Higgins and Caitlin Ostroff

Goldman Sachs Group Inc. - DOWN 0.2% (Tuesday)

Goldman Sachs headlined the bank earnings show this past week,

notching a 51% increase in quarterly profit and announcing that

veteran investment banker David Solomon would succeed Lloyd

Blankfein as chief executive on Oct. 1. Its shares, among the

worst-performing among big U.S. banks this year, edged down 0.2% on

Tuesday. Meanwhile, JPMorgan Chase & Co., Citigroup Inc., Bank

of America Corp. and Morgan Stanley all beat earnings expectations;

Wells Fargo & Co. did not.

Arconic Inc. - UP 8.1% (Monday)

In the first trading session after The Wall Street Journal

reported that the aerospace-parts maker was the subject of takeover

interest from several private-equity firms, shares soared 10%

Monday. The New York company, which was part of Alcoa Corp. before

the aluminum maker broke itself up, also on Monday unveiled its

largest-ever supply deal with Boeing Co. and announced a new

partnership with Lockheed Martin Corp. Monday's stock move was a

record one-day gain for the company and boosted Arconic's market

value by almost $1 billion.

Amazon.com Inc. - UP 1.2% (Tuesday)

Website outages on your company's self-declared midsummer

shopping holiday? No problem for Amazon. Prime Day, a 36-hour

promotional period, kicked off on midday Monday with outages on the

tech giant's mobile app and website that delivered error messages

to many customers' screens. The good news: The error messages had

pictures of dogs, which caused a minor internet sensation. Oh, and

customers ordered more than 100 million products in 36 hours.

Shares rose 1.2% Tuesday, making Amazon the second U.S. company

ever to top $900 billion in market cap.

Netflix Inc. - DOWN 5.2% (Tuesday)

Investors were in no mood to binge on Netflix after the

video-streaming site reported quarterly results after Monday's

closing bell. Although Netflix's second-quarter profit surged to

$384.3 million, it missed its expected subscriber growth by over a

million users. Netflix blamed the underwhelming numbers on faulty

internal forecasting and not on business reasons such as price

increases. Investors interpreted the miss as a sign that the

fast-growing company, whose stock has roughly doubled this year,

may be slowing down. Shares fell 5.2% Tuesday.

Alphabet Inc. - UNCH. (Wednesday)

The European Union's antitrust regulator found Wednesday that

Alphabet's Google had abused the dominance of its Android operating

system in smartphones, leveling a record $5 billion fine and

ordering changes to business practices. The EU said Google must

stop requiring that phone makers and telecom operators preload its

search engine and Chrome web browser on smartphones that use the

Android system, a potentially far-reaching and costly order that

Google plans to appeal. Shares of the parent company fell 1% in

early trading Wednesday but recovered to end the day unchanged.

Berkshire Hathaway Inc. - UP 5.3% (Wednesday)

Berkshire Hathaway's shares will soon be fair game for Chairman

Warren Buffett as he looks to spend a cash pile topping $100

billion. The conglomerate's board late Tuesday changed a policy

that had restricted share buybacks to prices below 120% of the

stock's book value, a benchmark not seen since 2012. Now, after the

company reports earnings Aug. 3, the Oracle of Omaha will be free

to repurchase shares if he feels the price is right. It's the

latest sign that Mr. Buffett is struggling to smartly spend

Berkshire's massive cash hoard. Class B shares leapt 5.3% on

Wednesday.

State Street Corp. - DOWN 7.4% (Friday)

The custody bank said it plans to buy financial-data firm

Charles River Systems for $2.6 billion, nearly nine times its

revenue. To pay for the deal, State Street canceled plans to buy

back about $950 million in stock this year. State Street's shares

fell 7.4% Friday as investors worried the company overpaid.

Separately Friday, in reporting earnings that missed some analysts'

expectations, State Street said its exchange-traded-fund business

saw no net inflows in the second quarter, the latest sign of a

slowdown in the ETF arena.

(END) Dow Jones Newswires

July 20, 2018 17:23 ET (21:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

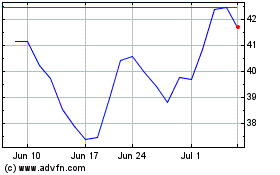

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

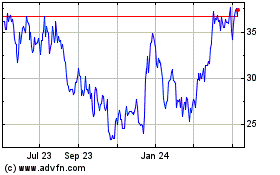

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024