CMA Raises Concerns over Experian's ClearScore Buy; Seeks Remedy By July 27

July 20 2018 - 3:03AM

Dow Jones News

By Ian Walker

The U.K. Competition and Markets Authority said Friday that

Experian PLC's (EXPN.LN) 275 million pound ($358.1 million)

acquisition of ClearScore Ltd. may reduce competition for people

who want to check their credit score, and is seeking a remedy from

the companies to address its concerns.

The regulator said Experian and ClearScore have until July 27 to

offer a solution or it will refer the merger for a further

investigation.

"As Experian and ClearScore are the market leaders in this

field, and each other's main competitor, the Competition and

Markets Authority is concerned that the merged company would be

less likely to innovate to help people better understand their

finances, potentially leading to people paying more for credit

cards and loans," the regulator said.

Experian announced in March that it was buying ClearScore and

said at the time that it hoped to complete the deal later this

year. It said that the deal was subject to regulatory approval by

both the CMA and the U.K. Financial Conduct Authority.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

July 20, 2018 02:48 ET (06:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

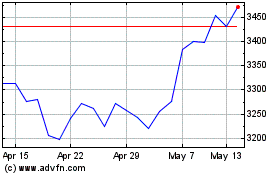

Experian (LSE:EXPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Apr 2023 to Apr 2024