J&J's Pharma Business Fuels Sales Growth -- WSJ

July 18 2018 - 3:02AM

Dow Jones News

By Peter Loftus and Allison Prang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 18, 2018).

Strong sales of Johnson & Johnson's cancer drugs and other

medicines helped boost the company's revenue and earnings for the

latest quarter, but the health-products giant's U.S. consumer

business continued to struggle.

Sales in the pharmaceuticals unit rose 19.9% globally, the

largest increase among J&J segments. Cancer-drug sales rose

42.2%, helped by big gains for the Zytiga prostate-cancer drug and

Darzalex, a blood-cancer treatment.

J&J's pharmaceutical sales topped analysts' expectations

despite what executives said was a continued decline in average net

U.S. pricing after discounts and rebates. Chief Financial Officer

Joe Wolk said on a conference call with analysts that average U.S.

net pricing could decline 4% to 6% this year, after a 4.6% drop

last year.

J&J shares surged 4% to $128.65 in midday trading after the

earnings report, though the stock is still down 7.9% year to date

on investors' concerns about slower growth in other parts of

J&J's diversified business, including consumer products.

Global sales in J&J's consumer unit inched up 0.7% to $3.5

billion. U.S. consumer sales fell 0.7%.

Within the consumer unit, the baby-care division, which sells

well-known brands such as Johnson's baby shampoo, saw global sales

drop 7.7% for the quarter. J&J is in the process of introducing

new versions of its baby-care products, and inventory moves hurt

sales for the quarter.

J&J Chief Executive Alex Gorsky called the consumer-segment

results disappointing. "We need to perform better here," he told

analysts on a conference call.

J&J's medical-device sales rose 3.7% to $6.97 billion for

the quarter. Sales of surgery and vision products increased, while

orthopedics dropped.

Overall, J&J said its sales rose 11% from a year earlier to

$20.83 billion for the second quarter.

The New Jersey-based company said it now expects sales to be

between $80.5 billion and $81.3 billion for the year, compared with

its prior estimates of between $81 billion and $81.8 billion.

J&J said Tuesday that its sales will receive a

smaller-than-expected benefit from currency fluctuations.

J&J's profit rose 3.3% to $3.95 billion, or $1.45 a

share.

The company narrowed its full-year profit target to between

$8.07 a share and $8.17 a share on an adjusted basis, compared with

its previous estimates of between $8 a share and $8.20 a share.

J&J also reported $57 million in restructuring costs in the

second quarter, up from $11 million a year earlier.

By 2022, J&J aims to cut between $600 million and $800

million in supply-chain costs a year, which the company expects

will result in as much $2.3 billion in charges over the next few

years.

A jury in St. Louis last week awarded $4.69 billion to women and

their families who alleged that the firm's talcum powder caused

ovarian cancer, the biggest award so far in powder litigation that

involves more than 6,000 cases. The company plans to appeal last

week's verdict.

Mr. Gorsky defended the baby powder on Tuesday, saying, "We

remain confident that our products do not contain asbestos and do

not cause ovarian cancer."

The company announced about a month ago that it accepted a

roughly $2.1 billion offer to sell its blood-glucose monitoring

equipment business, LifeScan, to private-equity firm Platinum

Equity.

J&J also recently got an offer from Fortive Corp. to buy

Advanced Sterilization Products for $2.7 billion. J&J said at

the time it had four months to decide to take the

industrial-equipment maker up on its offer.

Write to Peter Loftus at peter.loftus@wsj.com and Allison Prang

at allison.prang@wsj.com

(END) Dow Jones Newswires

July 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

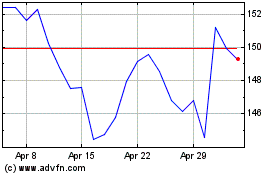

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

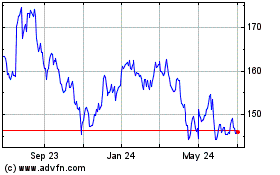

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024