America Movil Registers Small Second-Quarter Net Loss -- Update

July 17 2018 - 8:06PM

Dow Jones News

By Anthony Harrup

MEXICO CITY -- Latin America's largest telecommunications

company, América Móvil SAB, had a small net loss in the second

quarter as foreign-exchange losses from a weaker Mexican peso

offset increases in revenue and operating profits.

The company controlled by billionaire Carlos Slim on Tuesday

reported a net loss of 236 million Mexican pesos ($12.5 million),

compared with a net profit of 14.3 billion pesos a year

earlier.

Revenue in the April-June quarter rose 3.2% to 257.3 billion

pesos, with service revenue in local currencies up 2%. Earnings

before interest, taxes, depreciation and amortization -- a measure

of operating cash flow -- rose 3% to 72 billion pesos. Operating

profit was up 4.8% at 32.6 billion pesos.

The Mexican peso weakened against the U.S. dollar during the

second quarter as a result of rising U.S. interest rates, investor

caution over the future of talks to renegotiate the North American

Free Trade Agreement with the U.S. and Canada, and Mexico's July 1

presidential election.

The resulting exchange losses led the company's financial costs

to more than double, to 32.2 billion pesos, contributing to the

negative net result.

Revenue beat the median expectations of 254.3 billion pesos

among analysts polled by The Wall Street Journal, who also expected

a net profit of 12.2 billion pesos and Ebitda of 71.9 billion

pesos.

América Móvil, which operates in Latin America, the U.S.,

Austria and parts of Eastern Europe, ended the quarter with 279

million wireless lines and 83.4 million subscriptions to fixed-line

services including telephones, pay TV and broadband internet.

The number of wireless customers was little changed from a year

earlier, although the company continued to gain contract

subscribers while disconnecting prepaid lines as people use more

mobile data and make fewer calls.

"Service revenue growth in the mobile space was remarkable both

in Brazil and Mexico, 11.9% and 8.7% respectively," América Móvil

said.

Ebitda in Mexico grew 14.9%, its biggest increase in nearly 11

years, and in Brazil it rose 9.9%, the sharpest gain in almost

three years.

In Mexico, where mobile unit Telcel competes with AT&T Inc.

and Spain's Telefónica SA, the company has been recovering margins

that were squeezed by regulatory measures against América Móvil as

the dominant wireless and fixed-line carrier.

Telcel pays more to connect its customers to rival networks than

it charges for receiving incoming calls, and fixed-line unit Telmex

has been ordered to separate wholesale and retail services.

"Following our recent meeting with the company, we emerged

encouraged that incremental regulatory pressures over the near term

are unlikely," Barclays analysts said in a recent note. "With the

competitive environment largely stable, focus will likely continue

to center on prospects for margin expansion in Mexico."

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

July 17, 2018 19:51 ET (23:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

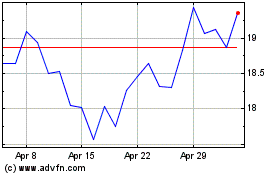

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

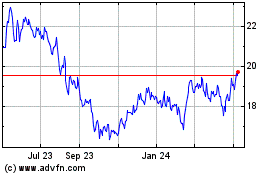

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Apr 2023 to Apr 2024