ConocoPhillips to Increase 2018 Buyback by 50% to $3 Billion

July 12 2018 - 9:49AM

Dow Jones News

By Waverly Colville

ConocoPhillips (COP) is boosting its 2018 buyback program by 50%

to $3 billion in cash, the company announced Thursday.

The board increased the buyback authorization by $9 billion,

bringing the total authorization to $15 billion. The initial $6

billion limit is set to be maxed out, given the buyback expansion

and $3 billion of repurchased in 2016 and 2017.

The company estimates that the $15 billion authorization

represents about 20% of the shares outstanding as of Sept. 30,

2016, based shares already bought back and future buybacks based on

the current stock price.

The Houston-based energy company started repurchasing shares in

late 2016. Chairman and Chief Executive Ryan Lance said in prepared

remarks that the expanded buyback program is a signal the company

sees upside potential in its shares.

ConocoPhillips also said it has paid off $2.1 billion of debt

during the second quarter, reaching its goal of $15 billion in debt

much earlier than its late 2019 forecast.

Shares were up 1.4% during pretrading Thursday.

Write to Waverly Colville at waverly.colville@wsj.com

(END) Dow Jones Newswires

July 12, 2018 09:34 ET (13:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

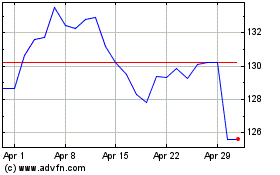

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

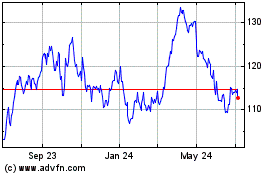

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024