Europa Oil & Gas (Holdings) Plc New Irish Prospect Inventory and Farmout Launch

July 12 2018 - 2:00AM

UK Regulatory

TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

12 July 2018

Europa Oil & Gas (Holdings) plc ('Europa' or 'the Company')

New Prospect Inventory for Atlantic Ireland Licences and Launch of Farmout

Europa Oil & Gas (Holdings) plc, the UK and Ireland focused exploration,

development and production company, is pleased to report that is has completed

an updated prospect inventory for its 100% owned Frontier Exploration Licences

('FEL') 1/17 and 2/13 in the South Porcupine Basin, Atlantic Ireland. In

addition, the Company has today launched a farmout process for three of its

licences in the South Porcupine Basin FELs 1/17, 2/13 and 3/13, which together

are estimated to hold gross mean un-risked prospective resources of 4.3 billion

barrels of oil equivalent (boe).

Highlights

* Marked improvement in seismic quality and a substantial de-risking of the

prospect inventory for FELs 1/17 and FEL 2/13 following pre-stack depth

migration ('PSDM') reprocessing of proprietary 3D seismic data originally

acquired in 2013

* FEL 1/17: gross mean un-risked prospective resources of 584 million barrels

of oil equivalent ("mmboe") comprised of two pre-rift prospects Edgeworth

and Ervine and one new syn-rift target, Egerton

* Egerton is interpreted to be analogous to the Bay du Nord discovery on the

conjugate margin, offshore Newfoundland

* FEL 2/13: gross mean un-risked resources of 817 mmboe comprised of two

pre-rift prospects Kiely East and Kiely West and one Cretaceous target,

Kilroy

* Together with previously announced gross mean un-risked prospective

resources of 2.9 billion boe on FEL 3/13 (see RNS of 5 June 2018), total

gross mean un-risked prospective resources across FELs 1/17, 2/13, and 3/13

now stand at 4.3 billion boe

* Firm drilling targets identified in FEL 1/17, 3/13 and 2/13 - respectively

prospects Edgeworth, Wilde and Kiely East

* The farmout data room to secure partner(s) and fund exploration drilling

activity opened today (12 July 2018)

Hugh Mackay CEO said: "The PSDM reprocessing of our proprietary 3D seismic data

sets over our South Porcupine licences has transformed the prospect inventory.

Prospect volumes have changed, but more importantly the accuracy of our maps

and our confidence in them, has substantially increased. Our prospects are

tightened up and de-risked. We now have firm drilling targets with clearly

positive economics on each licence. We promised half a dozen drillable

prospects by the end of 2018, now we have four, three here in the Porcupine and

one in the Slyne. Subject to regulatory approval we will be able to proceed to

FEL Phase 2 on each licence with confidence, and we now believe we have the

data to convince substantive farminees of the compelling case to take these

four licences forward towards drilling with the first well targeted for

mid-2019 on the Inishkea prospects in the Slyne licence LO 16/20, subject to

funding."

Further Information

Europa has recently completed pre-stack depth migration (PSDM) reprocessing of

3D seismic data originally acquired in 2013 over the FEL 1/17, FEL 2/13 and FEL

3/13 licences in South Porcupine Basin, Atlantic Ireland. Europa has 100%

interest in, and is operator of, all three licences. A location map can be

found on Europa's website https://bit.ly/2IA1mMR.

The new prospect inventory for FEL 3/13 was reported to shareholders on 5 June

2018 https://bit.ly/2sxeQTV.

Detailed interpretation of the new reprocessed data has been completed over FEL

1/17 on the east flank and FEL 2/13 on the west flank of the South Porcupine

Basin, resulting in a marked improvement in seismic quality and a substantial

de-risking of the prospect inventory. This announcement concerns the new

prospect inventory for FEL 1/17 and FEL 2/13. The results are summarised below,

and further information can be found in a report on Europa's website using the

following link: http://www.europaoil.com/reportsandpresentations.aspx

FEL 1/17 contains the Edgeworth and Ervine pre-rift tilted fault blocks. As a

result of the newly reprocessed seismic data, Europa's estimates of gross mean

un-risked prospective resources in these structures has been reduced to 225 and

192 mmboe respectively. This is largely due to a reduction in the upside, and

hence a narrowing of the range of the Company's predictions - associated with

increased prediction confidence. In addition to pre-rift targets, Europa has

now been able to firm-up a syn-rift target, analogous to discoveries such as

Bay du Nord on the conjugate margin offshore Newfoundland. The new Egerton

prospect has mean un-risked prospective resources of 167 mmboe.

Numerous play concepts have been suggested for FEL 2/13, however Europa is now

focused on the two most likely to support a commitment well. These are the

Kiely East and Kiely West tilted fault blocks (now significantly increased in

volume with gross mean un-risked prospective resources on block of 505 mmboe),

and lowermost Cretaceous slope apron deposits characterised by Kilroy (gross

mean un-risked prospective resources of 312 mmboe).

The new prospect inventory arising from interpretation of the new 3D PSDM

reprocessed seismic data across Europa's three 100% operated South Porcupine is

tabulated below.

Licence Prospect Play Gross Prospective Resources mmboe*

Un-risked

Low Best High Mean

FEL 1/17 Ervine Pre-rift 63 159 363 192

FEL 1/17 Edgeworth Pre-rift 49 156 476 225

FEL 1/17 Egerton Syn-rift 59 148 301 167

FEL 3/13 Beckett mid-Cretaceous Fan 111 758 4229 1719

FEL 3/13 Shaw+ mid-Cretaceous Fan 20 196 1726 747

FEL 3/13 Wilde Early Cretaceous Fan 45 241 1082 462

FEL 2/13 Kiely East + Pre-rift 52 187 612 280

FEL 2/13 Kiely West + Pre-rift 23 123 534 225

FEL 2/13 Kilroy+ Cret. Slope Apron 37 177 734 312

Total 4329

*million barrels of oil equivalent. The hydrocarbon system is considered an oil

play and mmboe is used to take account of associated gas. However, due to the

significant uncertainties in the available geological information, there is a

possibility of gas charge.

+prospect extends outside licence, volumes are

on-licence

The firm drilling targets in FEL 1/17, 3/13 and 2/13 are respectively prospects

Edgeworth, Wilde and Kiely East. The key next step across all three licences is

to secure a farmin partner or partners to fund exploration drilling activity.

The farmout data room opened on 12 July 2018. Europa believes that the new PSDM

seismic data has transformed the prospectivity on the licences and will be

working hard to secure partners.

Further information regarding Europa's complete Atlantic Ireland prospect

inventory can be found on its website (https://bit.ly/2u9c9so).

Europa follows Society of Petroleum Engineers (SPE) guidelines for petroleum

reserves and resources classification. Further information can be found on the

SPE website https://bit.ly/2LtLVIa.

The information communicated in this announcement contains inside information

for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

* * ENDS * *

For further information please visit www.europaoil.com or contact:

Hugh Mackay Europa + 44 (0) 20 7224

3770

Phil Greenhalgh Europa + 44 (0) 20 7224

3770

Matt Goode finnCap Ltd + 44 (0) 20 7220

0500

Simon Hicks finnCap Ltd + 44 (0) 20 7220

0500

Emily Morris finnCap Ltd + 44 (0) 20 7220

0500

Frank Buhagiar St Brides Partners Ltd + 44 (0) 20 7236

1177

Susie Geliher St Brides Partners Ltd + 44 (0) 20 7236

1177

Notes

Europa Oil & Gas (Holdings) plc has a diversified portfolio of multi-stage

hydrocarbon assets that includes production, exploration and development

interests, in countries that are politically stable, have transparent licensing

processes, and offer attractive terms.

In 2017 Europa produced 113 boepd. Its highly prospective exploration projects

include the Wressle development in the UK (targeting production start-up in

2019 at 500 bopd gross) and six licences offshore Ireland with the potential to

host gross mean un-risked prospective resources of 6.4 billion barrels oil

equivalent and 2.5 tcf undiscovered GIIP across all six licences.

END

(END) Dow Jones Newswires

July 12, 2018 02:00 ET (06:00 GMT)

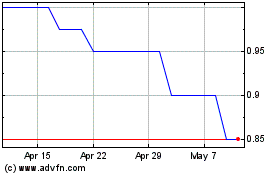

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024