By Michael Wursthorn

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 9, 2018).

U.S. companies are buying back record amounts of stock this

year, but their shares aren't getting the boost they bargained

for.

S&P 500 companies are on track to repurchase as much as $800

billion in stock this year, a record that would eclipse 2007's

buyback bonanza. Among the biggest buyers are companies like Oracle

Corp., Bank of America Corp. and JPMorgan Chase & Co.

But 57% of the more than 350 companies in the S&P 500 that

bought back shares so far this year are trailing the index's 3.2%

increase. That is the highest percentage of companies to fall short

of the benchmark's gain since the onset of the financial crisis in

2008, according to a Wall Street Journal analysis of share buyback

and performance data from FactSet.

And the historic spending spree on share buybacks has some

analysts worried companies are buying their shares at excessive

valuations during the peak of the economic cycle and at a time when

the market rally is nine years old. Others warn the billions of

dollars spent to buy back shares could have gone toward capital

improvements like new factories or technology that could lead to

stronger long-term growth.

"There has been less of a reward for companies engaging in new

buybacks over the last 18 months," said Kate Moore, chief equity

strategist and a managing director at asset-management firm

BlackRock Inc. "It's fair for investors to ask whether companies

are buying at the right point."

The S&P 500 Buyback index, which tracks the share

performance of the 100 biggest stock repurchasers, has gained just

1.3% this year, well underperforming the S&P 500.

Share buybacks have become corporate America's go-to strategy

for boosting stock prices and earnings over the past 30 years. The

point of buybacks is to try to make a company's stock more

valuable. By mopping up shares, a company shrinks the stock pie,

which boosts earnings per share. That, in turn, should push the

share price higher.

The potential problem: Executives directing buybacks are

essentially timing the market, and often they end up buying

high.

Buyback activity reached a frenzy in the early 2000s; the

previous record for share repurchases was $589.1 billion in 2007.

But that was just a year before the stock market tumbled into the

worst financial crisis since the Great Depression. The result:

companies like Exxon Mobil Corp., Microsoft Corp. and International

Business Machine Corp. each paid more than $18 billion to

repurchase stock at a peak, only to see their share prices slump a

year later.

Stock buybacks appear just as ill-timed now, some analysts and

investors say, especially as companies ramp up spending after last

year's $1.5 trillion tax overhaul put extra cash in their

coffers.

Oracle has been one of the biggest buyers of its own stock in

recent years and spent $11.8 billion on stock repurchases last

year, when shares gained nearly 23%. But that gamble hasn't looked

smart this year as the networking-device maker has struggled

alongside the broader market, pulling its shares down 6%.

Still, Oracle's board approved a fresh round of share buybacks

totaling $12 billion in February, and executives appear to have

spent nearly half that sum already. A representative from Oracle

declined to comment on its share buyback program, but the company

said in a recent Securities and Exchange Commission filing that it

"cannot guarantee" its share repurchase "will enhance long-term

stockholder value."

Others like McDonald's Corp., Bank of America and JPMorgan Chase

have spent billions on share repurchases this year, but haven't

seen a short-term bounce in share prices. McDonald's bought back

$1.6 billion of shares in the first quarter, but the fast-food

chain's stock is down 7.4% this year. Bank of America and JPMorgan

Chase have both spent more than $4.5 billion to buy back their

shares, which are down 5% and 2.7%, respectively.

All three companies also spent multibillion-dollar sums on

buybacks in 2017 as the stock market hit repeated highs.

Companies in the S&P 500 that have repurchased shares are

expected to see a return on investment of about 6.4% this year, a

percentage that falls below the past six rolling five-year periods

as measured by Fortuna Advisors, a financial consulting firm that

has examined buyback trends going back to 2007.

Returns on investment for buybacks peaked in 2013, according to

Fortuna's analysis, as companies used share repurchases to boost

earnings and dig themselves out of the depths of the financial

crisis. With stock prices relatively low at the time and economic

activity tepid, share buybacks were one of companies' key sources

of earnings growth.

But even as the stock market steadied in the subsequent years

and economic growth around the world picked up to help boost

profits, corporate executives continued to spend wildly on share

repurchases -- often at the expense of other types of spending,

including dividends and capital improvements. Spending on capital

expenditures rose to $166 billion in the first quarter, up 24% from

a year earlier, according to Credit Suisse, but still well below

the $189 billion spent on buybacks.

"The majority of capital deployed is going right back to

shareholders and not reinvestment in businesses," said Gregory

Milano, chief executive at Fortuna. "If that's the only thing

you're relying on, it's going to end badly."

Some share buybacks do pay off, but that tends to be among

companies that show a high level of sales and earnings growth on

their own, analysts say. Apple Inc., for example, has bought back

$22.8 billion worth of stock so far this year. Its shares have

risen 11%, with much of the boost coming after it reported strong

gains in second-fiscal-quarter revenue and profit -- as well as a

record $100 billion plan to buy back more stock.

"Corporate America has such an obsession with bottom-line

growth," said Jay Bowen, president of Bowen Hanes & Co.,

manager of the $2 billion Tampa Firefighters and Police Officers

Pension Fund. "Long term, I don't like it."

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

July 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

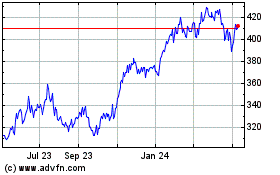

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

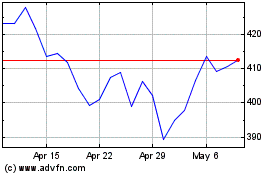

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024