Facebook to Accept Cryptocurrency Ads Again

June 26 2018 - 6:48PM

Dow Jones News

By Gabriel T. Rubin

Cryptocurrency peddlers are being let back into valuable

social-media advertising space, after Facebook Inc. eased an

outright ban on ads from the industry.

The tech company put a blanket ban on such ads in January, after

a spike in the price of bitcoin and other cryptocurrencies led to a

proliferation of new cryptocurrency products -- some legitimate,

others scams. Companies including Alphabet Inc.'s Google, Twitter

Inc. and Snap Inc.'s Snapchat soon followed with their own

bans.

Facebook will maintain its ban on advertising initial coin

offerings, which have soared in popularity recently. In an ICO, a

company creates a new virtual coin or token and offers it for

public sale.

Which cryptocurrency firms will get to advertise on the platform

will be up to Facebook's discretion. The company didn't detail the

criteria it plans to use.

"Eligibility may be subject to such conditions and restrictions

as Facebook may decide," the company says on its cryptocurrency

product onboarding request form.

Facebook said its initial ban on cryptocurrency ads was

"intentionally broad" as it worked to "detect deceptive and

misleading advertising practices." The company promised to revisit

the policy once it had conducted a sweep of existing ads that

violated its prohibition on financial products associated with

scams.

Promotional efforts for cryptocurrencies have come under fire

from federal and state regulators in recent months. In November,

the Securities and Exchange Commission warned investors about the

risks of celebrity-backed ICOs, and encouraged investors to

"research potential investments rather than rely on paid

endorsements from artists, sports figures, or other icons."

Before the crackdown, celebrities including Paris Hilton and the

retired boxer Floyd Mayweather Jr. had appeared in ads touting

crypto products.

Some fraudulent ICOs shut down by regulators don't even bother

to pay celebrity endorsers, or even refer to them by their names or

titles when using their photos.

Texas securities regulators shut down a coin offering last month

that included "client testimonials" along with photos of Prince

Charles and Jennifer Aniston. Another scheme shut down by Texas

regulators featured a photo of Supreme Court Justice Ruth Bader

Ginsburg and former U.S. solicitors general as the ICO's purported

legal team. None of these celebrities or government officials were

involved in the ICOs.

An analysis by The Wall Street Journal last month found that one

in five digital coin offerings shows hallmarks of fraud.

As part of its investor education efforts, the SEC even created

its own fraudulent ICO website -- dubbed HoweyCoin, a

tongue-in-cheek reference to a famous securities law case -- to

demonstrate how easy it is to separate unwitting investors from

their money with the help of urgent-sounding language and a sleek

website.

People who click on the "Buy Coins Now!" link are taken to an

SEC webpage that says: "If you responded to an investment offer

like this, you could have been scammed -- HoweyCoins are completely

fake!"

Write to Gabriel T. Rubin at gabriel.rubin@wsj.com

(END) Dow Jones Newswires

June 26, 2018 18:33 ET (22:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

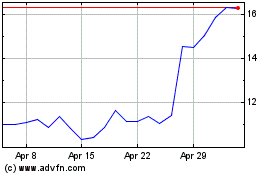

Snap (NYSE:SNAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Snap (NYSE:SNAP)

Historical Stock Chart

From Apr 2023 to Apr 2024