GE Nears Deal to Sell Industrial-Engines Unit to Private-Equity Firm Advent -- Sources

June 24 2018 - 6:57PM

Dow Jones News

By Ben Dummett and Dana Mattioli

General Electric Co. is nearing a deal to sell a unit that makes

large industrial engines to private-equity firm Advent

International for $3 billion or more, people familiar with the

matter said, a move that would bring in needed cash for the

struggling conglomerate.

A deal, if completed, could be announced on Monday, the people

said. Advent appears to have beaten out Cummins Inc. in an auction

for the businesses, according to the people.

The sale is another step in Chief Executive John Flannery's push

to simplify the beleaguered company after years of

underperformance, by selling $20 billion worth of assets by the end

of next year. GE last month agreed to sell its railroad division in

a complex deal worth $11 billion.

But investors are waiting for a major portfolio update expected

to come soon. Mr. Flannery continues to preach that "everything is

on the table, " including a breakup of the 126-year-old

company.

GE just learned in recent days that it will be removed from the

Dow Jones Industrial Average after more than a century in the

blue-chip index. The company's shares closed Friday at $13.05, down

by more than half in the past year.

The assets being sold are GE's so-called distributed-power

business, which makes Jenbacher and Waukesha gas engines. These

truck-sized machines, often painted bright orange or green, are

used to generate electricity in remote areas, along with other

industrial operations requiring a mechanical drive.

The deal unwinds two acquisitions by former CEO Jeff Immelt, who

left last summer after 16 years at the helm. Mr. Immelt exited amid

investor pressure to improve profits and revive the stock price,

and following his departure GE slashed its dividend and financial

targets.

GE acquired Jenbacher, based in Austria, in 2003. Waukesha,

which dates back to 1906, came as a part of GE's purchase of

oil-and-gas equipment maker Dresser Inc. for $3 billion in

2010.

GE caused a fracas in 2015 when it said it would stop making

engines in Waukesha, Wis., and instead move 350 jobs to a new

factory in Canada to use that country's export-financing regime to

pursue new overseas business. GE made the move to adjust to the

U.S. Congress's failure to reauthorize the Export-Import Bank, the

export-financing entity in the U.S.

A global buyout firm, Advent manages about $41 billion in assets

across a range of sectors from industrial to financial services and

telecommunications and media.

The expected deal with Advent is somewhat surprising as buyout

firms typically are at a disadvantage in bidding against industry

players because they have fewer opportunities to cut overlapping

costs. Advent, together with Bain Capital LP, in March lost out to

a group led by Carlyle Group LP in the high-profile auction for the

specialty-chemicals business of Dutch paints giant Akzo Nobel

NV.

Thomas Gryta contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com and Dana Mattioli at

dana.mattioli@wsj.com

(END) Dow Jones Newswires

June 24, 2018 18:42 ET (22:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

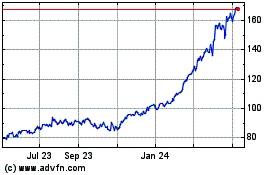

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

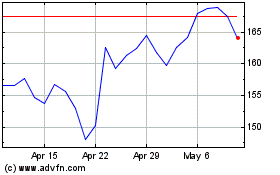

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024