The Score: The Business Week in 7 Stocks

June 22 2018 - 6:52PM

Dow Jones News

By Laine Higgins and Caitlin Ostroff

Boeing Co. - 3.8% Tuesday

Investors are waking up to the idea that the trade war between

the U.S. and China could be the real deal. After China pushed back

against U.S. tariffs on $50 billion in Chinese products, saying it

would levy similar penalties against American goods, President

Donald Trump threatened Monday to retaliate with another $200

billion in tariffs. That sent a wide swath of the stock market

tumbling Tuesday. Boeing, which counts China as its largest market,

single-handedly took 94 points off the Dow Jones Industrial Average

that day.

Amazon.com Inc. - 0.9% Wednesday

The health-care partnership jointly announced by Amazon,

Berkshire Hathaway Inc. and JPMorgan Chase & Co. in January now

has a face. The business giants on Wednesday appointed Dr. Atul

Gawande as chief executive of a yet-to-be-named company tasked with

tackling rising employee health-care costs. Dr. Gawande's resume

includes practicing surgery at Brigham and Women's Hospital,

teaching at Harvard, writing for the New Yorker and serving as

executive director of Ariadne Labs, commitments he will maintain in

various capacities when he begins his new role July 9.

Walgreens Boots Alliance Inc. - 5.3% Wednesday

For the first time since 1907, General Electric Co. will not

trade as part of the 30-stock Dow Jones Industrial Average. It's

ceding its spot to drugstore retailer Walgreens, a move that gives

more weight to the consumer and health-care sectors of the U.S.

economy. Walgreens, which dates back to 1901, has expanded in

recent years by merging with a European drug wholesaler and buying

up stores from Rite Aid Corp. Its shares have declined 13% in the

past year, and it now has a market capitalization of $67 billion.

GE has declined 53% in that same span.

Starbucks Corp. - 9.1% Wednesday

Starbucks' stock was in need of a pick-me-up Wednesday after the

company announced it would close 150 U.S. stores and expected

global same-store sales growth of 1% in the current quarter, far

below Wall Street's expectations. The closures, which are

concentrated in urban areas where stores are clustered and rents

are high, are a sign the coffee giant overestimated Americans'

caffeine cravings and expanded too quickly. Chief Executive Kevin

Johnson said the company now plans to focus on growing the chain's

"digital relationship" with customers.

21st Century Fox - 7.5% Wednesday

Walt Disney Co. upped the ante in its bidding war with Comcast

Corp. for 21st Century Fox assets Wednesday, raising its offer to

more than $70 billion in cash and stock. That's up from its

original $52.4 billion stock bid and tops Comcast's unsolicited $65

billion all-cash proposal. The Fox board accepted the offer, which

equates to $38 a share, describing it as "superior to the proposal"

made by Comcast earlier this month. If the deal closes, Fox

shareholders would own 19% of the combined company. (21st Century

Fox and Wall Street Journal-parent News Corp share common

ownership.)

Intel Corp. - 2.4% Thursday

Intel Chief Executive Brian Krzanich resigned Wednesday after

the company learned that he'd had a relationship with an employee,

a violation of company policy. Chief Financial Officer Robert Swan

will serve as interim CEO until the company's search yields a

replacement leader. If the board picks an outsider, it will be the

first in the chipmaker's 50-year history. To counter the news,

Intel offered a rosy second-quarter forecast ahead of its earnings

call on July 26, but investors uncertain about the executive

shake-up sent the stock down anyway.

Chevron Corp. - 2% Friday

Members of the Organization of the Petroleum Exporting Countries

agreed Friday to boost output by about 600,000 barrels a day. That

was less than some observers had expected, and the news that the

world wasn't suddenly going to be awash in oil sent crude prices

higher. The energy sector led the S&P 500, while Chevron and

Exxon Mobil Corp. collectively added 29 points to the Dow's rise.

The deal still needs final approval from Russia and other non-OPEC

members. That's expected to come Saturday.

(END) Dow Jones Newswires

June 22, 2018 18:37 ET (22:37 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

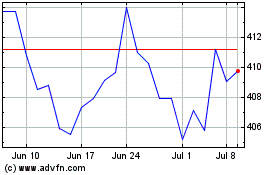

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

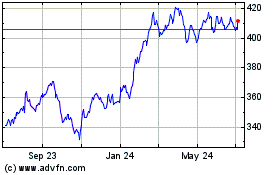

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024