Cable titan labors to woo Rupert Murdoch away from Disney in

epic bidding war

By Shalini Ramachandran and Keach Hagey

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 22, 2018).

At one point last fall, Comcast Corp. Chief Executive Brian

Roberts and other top executives at the cable giant thought they

were near the deal of a lifetime to buy Rupert Murdoch's

entertainment assets.

Then everything went quiet. Mr. Murdoch's 21st Century Fox

postponed phone calls and didn't share promised data on its

business, people familiar with the talks said. There were days of

silence when Comcast expected heavy negotiations.

Weeks later, Mr. Murdoch announced a deal with rival Walt Disney

Co. for $52.4 billion, nearly $12 billion less than the Comcast

offer.

Mr. Roberts took the outcome personally. "I don't know what more

I could do," he told a close friend. After the holidays, he began

gaming out strategies that could torpedo Disney's Fox deal, people

close to the company said, setting into motion media's

highest-stakes bidding war in years and the biggest bet of his

career.

Comcast lobbed in an unsolicited, $65 billion all-cash offer for

the Fox assets last week, and Disney responded Wednesday, raising

its offer to about $71.3 billion in cash and stock through a

reworked deal with Fox, putting the ball back in Comcast's

court.

Throughout this drama, Comcast appears to have been on the

outside looking in. One big reason is Mr. Roberts's strained

relationships with the other executives at the table: 21st Century

Fox Executive Chairman Mr. Murdoch, who is selling prime pieces of

the empire he created over six decades, and Disney Chief Executive

Robert Iger, a onetime TV weatherman who has built one of America's

most valuable media conglomerates.

"Rupert loves Bob Iger, though their politics are completely

different," a person close to him said. "He doesn't want Brian

Roberts."

Comcast has a reputation as the industry boogeyman thanks to the

cable company's hard-nosed negotiations over rates it pays content

companies to carry their TV channels. Mr. Murdoch and his sons

believe Comcast and Mr. Roberts didn't always deal in good faith,

people close to the Murdochs say.

For the Murdochs, a stinging episode came three years ago when

Comcast dropped Fox's YES Network, home of the New York Yankees.

The Murdochs believed Comcast reneged on a handshake deal, people

familiar with the situation say. Comcast executives disagree that

there was ever a done deal.

Meanwhile, Messrs. Iger and Roberts have at times been friendly,

sharing a love for sailing and exchanging pictures of their boats,

according to a person familiar with the relationship. But Mr.

Roberts's continuing pursuit of Fox assets has upset Mr. Iger and

churned up old feelings of resentment stemming from Comcast's 2004

hostile attempt to buy Disney, while Mr. Iger was president,

according to people who know both men.

"Generally speaking, they bang into each other," said cable

pioneer and media magnate John Malone, who knows all three men.

"There is respect but there is also rivalry."

This account of the shifting battle for control of the 21st

Century Fox assets is based on interviews with more than two dozen

people close to the negotiations and familiar with the players

involved.

The winner of the Fox assets will have a head start in the race

to build an entertainment behemoth and respond to how the industry

has been ravaged by consumers cutting the cable TV cord. The goal

is to build the content, international scale and customer

relationships to mount a challenge to tech giants such as Netflix

Inc., Alphabet Inc.'s Google and Facebook Inc.

The assets for sale include the Twentieth Century Fox studio, a

stake in streaming service Hulu, U.S. cable networks and

fast-growing international businesses. Fox News and the Fox

broadcast network aren't part of the deal and will be spun off into

a new company. 21st Century Fox and Wall Street Journal parent News

Corp share common ownership.

For Mr. Roberts, a cable industry scion who was punching coupon

books for Comcast at age 8, the pursuit of Fox is a chance to

cement his legacy as one of the great deal makers of media and

position Comcast for the future.

Comcast has tried to drive a wedge between Messrs. Iger and

Murdoch. In a meeting last November over wine at Mr. Murdoch's

Bel-Air, Calif., estate, Mr. Roberts and NBCUniversal Chief

Executive Steve Burke said they believed Mr. Iger had been

exploring a presidential run and noted he had sidelined potential

successors over the years, while Comcast had a proven management

team, people familiar with the meeting say.

Mr. Roberts also told Mr. Murdoch that his son James Murdoch,

Fox's chief executive, should be wary of any promises of a job from

Mr. Iger, the people familiar with the interaction said. Mr. Iger

gave the Murdochs the impression that James could be in line for a

senior role at Disney, other people familiar with the talks said.

In May, The Wall Street Journal reported that the younger Mr.

Murdoch won't move to Disney if a deal between the companies is

reached, and will strike out on his own.

Other people close to Rupert Murdoch said he had other reasons

to be skeptical about a Comcast bid, such as possible regulatory

risks. They said he is also unemotional about the auction process

and will take the highest bidder.

The Murdochs showed a keen interest in Disney from the start.

When Disney made its first approach early in the fall, they held a

family conference call in which they decided to sell most of the

company. Earlier, when Verizon Communications Inc. had made an

approach, there was no such meeting or signoff, a person familiar

with the family's deliberations said.

Lachlan Murdoch, James's older brother and Fox's executive

co-chairman, initially resisted selling but eventually came around

to the idea and was relatively more open to Comcast than others in

the family, the person said. He felt Disney's offer was too low.

Lachlan Murdoch met Mr. Roberts in Los Angeles and was impressed,

though he shared some of his father's concerns, the person

said.

At the November meeting with Rupert Murdoch in Bel-Air, Mr.

Roberts and NBCUniversal's Mr. Burke said Comcast's stock has

outperformed Disney's, NBC was beating Disney's ABC in ratings and

Universal's theme parks were growing faster than Disney's

much-bigger parks. Mr. Murdoch said he was impressed, leaving

Messrs. Roberts and Burke with a good feeling, people familiar with

the meeting said.

Comcast put a $64 billion all-stock offer on the table, in line

with what its executives believe was Mr. Murdoch's asking price,

people familiar with the talks said. They felt they were closing in

on the deal.

In the background, Fox was busy negotiating with Disney after

initial talks had fallen apart. On Dec. 7, Mr. Murdoch called Mr.

Roberts and said Fox was going in a different direction, according

to a Fox securities filing.

Fox said in the filing it rejected the higher Comcast offer

because of the regulatory risks. The Murdochs and the Fox board

were worried that the Justice Department's lawsuit to block

AT&T Inc.'s acquisition of Time Warner Inc. indicated the

government would oppose a Comcast-Fox tie-up.

The board was concerned Comcast didn't offer a breakup fee in

case the deal ran into regulatory hurdles, according to the filing.

People in the Comcast camp felt Fox's filing made it appear as if

Comcast refused to offer a breakup fee when in fact Mr. Roberts

showed openness to it during negotiations, people familiar with the

matter said. Senior Fox executives say its filing, which says Fox

asked Comcast multiple times for a breakup fee, is accurate.

Mr. Murdoch also considered that Disney's stock has no

controlling shareholder, while the Roberts family controls a

one-third voting stake in Comcast, so the Murdochs would be a

relatively small voice after a Comcast deal, people familiar with

Fox's deliberations say.

To Mr. Roberts, the fact Mr. Murdoch would rather take Disney's

stock over his -- with such a larger gap in their offer amounts --

was an insult. Comcast felt it wasn't taken seriously by Fox,

people familiar with the talks said.

A dejected Mr. Roberts told his deal team to take a breather for

the holidays. In January, he told them: We're not giving up,

according to people who attended.

Comcast viewed European pay-TV operator Sky PLC as a potential

side door into the Fox deal because it was already in play. Fox,

which owns 39% of Sky, had run into regulatory hurdles in its

effort to buy the rest. After hunkering down in a war room in

London, Mr. Roberts surprised Disney and Fox in February with a $31

billion informal offer for Sky.

Comcast's 50-person deal team began working full-throttle on a

possible larger move for the Fox assets Disney was buying. At one

point, Comcast signaled to Disney it would be willing to split the

spoils, where Comcast would take international assets including

Star India and Sky, and Disney would take domestic assets, people

familiar with the matter said. Disney didn't engage and has since

ruled out that possibility.

Comcast also entertained discussions with Amazon.com Inc. to see

whether carving up the Fox assets could offer a smoother regulatory

path, these people said.

A month ago, Mr. Roberts's Chief Financial Officer Michael

Cavanagh came up with a plan to offer all cash, something Disney

might struggle to match -- cable investors have more tolerance for

big debt loads. "That's when we realized, 'here's a path to win,' "

a person close to Comcast said.

On June 12, Comcast executives were glued to their TVs and

Twitter, awaiting the judge's decision on the AT&T case. When

the court ruled unequivocally against the Justice Department, "we

looked at it and said, this is the absolute best outcome," a person

there said.

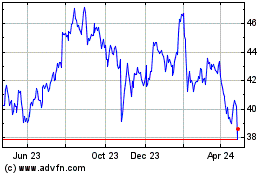

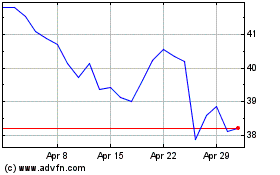

The question now is how far Comcast will go to match Disney. The

pursuit has already weighed on its stock, which has lost more than

$32 billion in value since the Sky proposal.

Fox has indefinitely postponed the shareholder meeting, which

had been set for July 10.

Mr. Roberts and Mr. Murdoch have tangled with each other for

decades, including over Mr. Murdoch's satellite provider BSkyB and

Hulu, a streaming service co-owned by Comcast, Fox, Disney and

AT&T.

At the annual media gathering in Sun Valley, Idaho, in 2013,

assurances from Mr. Roberts helped influence his co-owners to take

Hulu off the sale block. Two top bidders were Comcast rivals,

DirecTV and AT&T. Mr. Roberts told Mr. Iger and Fox's

then-Chief Operating Officer Chase Carey he would help Hulu become

the streaming platform for the cable-TV industry, people familiar

with the discussions said. Fox and Disney felt Comcast never

followed through, the people said. Comcast executives believe the

cable giant made a good-faith effort but the content rights tangled

the complicated talks.

In 2015, the Murdochs thought they had a deal with Comcast on a

higher rate the cable giant would pay to carry the YES Network. The

two sides agreed to extensions over the summer -- a sign of good

faith from Fox, since it would have less leverage after the

baseball season.

At the end of the Yankees season, Comcast informed Fox

executives it was going to drop YES Network because of low

viewership relative to its price. People close to Comcast said its

earlier agreement on a higher rate was tied to its proposed

acquisition of Time Warner Cable, which had fallen apart amid

regulatory opposition.

James Murdoch made a last-ditch effort to save the deal in a

phone call with Mr. Roberts, who told him that it was the cable

division's decision and he wouldn't interfere with it, people

familiar with the call say. The blackout lasted more than a year.

Only after the elder Mr. Murdoch got involved and tied YES's

renewal with that of powerhouse Fox News that Fox was able to

secure YES's position in January 2017.

"That did some serious reputational damage in Rupert's mind,"

one executive close to Fox said, referring to Mr. Murdoch's view of

Comcast. Rupert "doesn't forget things like that," the executive

said.

Since it acquired NBCUniversal in 2011, Comcast hasn't been shy

about its intention to copy the Disney playbook, investing in

family animation, theme parks and consumer-products businesses. At

a meeting with executives after acquiring DreamWorks Animation SKG

Inc. in 2016, Mr. Roberts said he had "Disney envy," according to a

person who was present.

Messrs. Roberts and Mr. Iger have taken vastly different

approaches to building up their companies. Mr. Roberts has done a

series of mammoth deals, including a $47.5 billion deal to buy

AT&T Broadband in 2001 and the $39.4 billion acquisition of

NBCUniversal. He hasn't shied away from competitive bidding

situations, even if it means muddying relationships with friends

and mentors.

During his tenure as CEO, Mr. Iger has gone for relatively

smaller content targets including Pixar Animation Studios, Marvel

Entertainment and Lucasfilm. Those three acquisitions added up to

less than $16 billion, a fraction of the proposed Fox deal.

Over the course of several meetings, the elder Mr. Murdoch was

sold on Mr. Iger's vision.

--Ben Fritz and Cara Lombardo contributed to this article.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Keach Hagey at keach.hagey@wsj.com

(END) Dow Jones Newswires

June 22, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024