Filed by Sprint Corporation

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Sprint Corporation

Commission File No.: 001-04721

21-Jun-2018

Sprint Corp. (S)

Wells Fargo Securities 5G Forum

Transcript

Each Question (“Q”) is from:

Unverified Participant

CORPORATE PARTICIPANTS

Each Answer (“A”)

is from:

John C. B. Saw

Chief Technology Officer, Sprint

Corp.

MANAGEMENT DISCUSSION SECTION

Unverified

Participant:

Great. If everyone could grab a seat. We’re excited here to have Dr. John Saw, the CTO of Sprint. John and I have known each other

a long time, dating back to Clearwire days, so a lot of history here. So, John, welcome. Thank you for coming.

John C. B. Saw, Chief Technology Officer,

Sprint Corp.:

Thank you. Thanks for having me.

QUESTION

AND ANSWER SECTION

Q:

It’s clearly been a busy

spring and probably a lot longer than I know about for you and – dealing with all that merger mania surrounding Sprint these days. A kind of a loaded question, but your – can you comment on your current

to-do

list these days? Where are you spending most of your time?

A:

Well, my number one

to-do

list is to get enough sleep.

Q:

A lot of planes, right?

A:

Number two is to get home and get my laundry done.

Q:

Okay. Oh my God!

A:

Other than that, the rest is just work. Other than helping

with the regulatory process, I’ve been spending most of my time on making sure that the Sprint next generation that we built stays on track. So that includes the site expansion and upgrades that we have been doing and in particular to add more

2.5 gigahertz on our footprint.

Q:

Okay.

A:

Building more small cells. I think took us a little bit

longer to get some traction, but we are really starting to get some momentum with small cells. And then more recently, testing and adding Massive MIMO sites. That’s going to allow us to enable LTE and 5G at the same time at those sites.

And I think that – if you look at the benchmarks that’s come in recently, you can see the improvement. I think Ookla is now saying that in the last

12 months, Sprint has the most improved network in terms of just download speed that our customers have been getting. So the signs are there. So, that has been busy and we’re going to continue to push ahead with the build – with the

momentum that we have.

Q:

And I won’t touch the

regulatory process, because who knows at this point? But if you are successful in getting this done, if you and

T-Mobile

– we are at a 5G conference; a large part of the talking points from the deal was

announced in late April was certainly around 5G. I think even the website was involving 5G with the slides. How do you see the

Sprint/T-Mobile

or

T-Mobile/Sprint

advantage in a 5G world versus the two other incumbents?

A:

I think together, we can build a much bigger 5G footprint with much higher capacity at a faster rate.

Q:

Okay.

A:

If you look at what Sprint brings to the table, it’s

obviously the depth that we have with our 2.5 gig spectrum, most of which is unused that can be used for 5G. I mean, the race for 5G is all about finding available spectrum that is not encumbered by LTE. Right? So, for Sprint it’s going to be

2.5 gig.

T-Mobile

brings available 600 megahertz spectrum that they just acquired...

Q:

Right.

A:

... that will be used for 5G. If you put together the two, you can really build a nationwide 5G network. There is a window of opportunity that we have to do

this fast, and I think that’s probably the most compelling argument in terms of building a 5G network faster and building in a more robust fashion with a bigger footprint.

Q:

You mentioned,

too, that 5 – I mean, it is unfortunate you were unable to see the prior speaker. Right as you walked in, he had just finished being very positive on the Magic Box and 2.5 gig in general. But in my mind, it’s the only spectrum now

available to support mobile 5G. You mentioned

T-Mobile

brings 600 megahertz, but is it really an opportunity, the driver of the merger to get that $40 billion in synergies or is it just combining that

– like, in my mind you get the big empty airplane if this gets done – not empty, but with the ability to fill that up, given the massive amount of spectrum you guys have.

A:

Sure. I think both companies have very extremely

complementary spectrum assets, like I said. So that’s right up there in terms of why this merger makes sense, right? We choose like, say, 2.5 gigahertz fresh spectrum for 5G, marry it with the 600 megahertz fresh spectrum for 5G, right? You can

then finally build – really build a truly ubiquitous footprint.

So, the spectrum story is very complementary. And then you also look at – 5G is

all about driving for a very intense densification of a coverage, right, and

once-in-a-lifetime

opportunity to look at cell sites

from both companies and to be able to densify your network at a faster rate. As you know, it takes a while to build new towers than do cell splits, right? But now, if you’re looking at what’s available on the towers from both company, you

can actually densify your network a lot faster. And it certainly is what you mentioned; there is about $43 billion of synergy there, most of which is coming from a network.

If we build the network, now is the time to do it. Before we have actually gone in and [ph] plowed in (00:05:42) a lot more capital on our own individual 5G

build, now is the time to look at the synergy to build one 5G network together, put all the spectrum bands strategically and optimally on the right cell site...

Q:

Got it.

A:

...to do it now and that’s where the synergy savings

comes in.

Q:

That brings up a good point. So, it’s

logical to look at. There has been some – can you comment I guess on your current relationship with your vendors, because we have gotten some mix messages that there has been, you know more methodical look at it, and not putting on hold but

maybe kicking the can is maybe the proper term.

How do you see this, because I guess the risk – the obvious question is, if we get to D.C. and they

say, sorry, not happening, is there a risk of you, Sprint [ph] solo (00:06:37) under-spending on their network and then it’s like a

now-what

situation if that doesn’t go your way?

A:

So, let me

emphasize – and actually to emphasize what Michel Combes said last month in a conference, we’re not slowing down our investment.

Q:

Okay.

A:

And merger or no merger, we are still going ahead and improving our network. A lot of what we do actually is going to be foundational, not just for stand-alone

Sprint but for the new company as well if the merger gets approved.

Q:

Got it.

A:

Case in point is Massive MIMO; that’s going to be a key enabler for any 5G build, right? And a lot of our investment is focused on making sure that we

densify our network and we add Massive MIMO where we need them for capacity and also where we need them for 5G eventually, right?

And I think some of the

noise they are hearing potentially – I am not sure which way – which vendors they hear it from; might be from the fact that we have been making adjustments to how many Massive MIMO sites we are building and which towers are going to be

getting Massive MIMO, which is not...

Q:

Okay.

A:

We have seen some really good results in Massive MIMO

recently with the field tests we have done in Seattle and in Texas and even in Korea, the lab test that we are seeing today. We do have some sites carrying large traffic. As we run our tests and we get more confident, we will make adjustments to

launch even more Massive MIMO sites. I think we have announced there will be nine markets that’s going to have some fairly big 5G footprint. They are all based on Massive MIMO.

So as we look at opportunities and new capabilities that we feel more confident on, we’re going to be making the adjustment to be more optimal. Like, in

the last few months, we have released almost $1 billion of purchase orders for Massive MIMO capabilities.

Q:

Interesting. Okay. So that feeds on [indiscernible] (00:08:36)...

A:

That might be where you hear the noise; hey, these guys may

be making some shifts and adjustments. I think that’s for – that’s not because we’re slowing down. That’s because we are optimizing to get a bigger bang for the buck.

Q:

Because you are

– I mean, I don’t – I don’t want to say hedging your bets, but you are prepared for a scenario where if it doesn’t happen, a regulatory approval, you don’t want to make a mistake that maybe others made.

A:

Absolutely.

Q:

Yeah. Okay.

A:

Absolutely. So we’re still forecasting a capital spend

of between $5 billion to $6 billion this fiscal year. I think this quarter, we’re going to come in at about $1 billion, and it’s going to continue to ramp from there.

Q:

Okay. Got it. I want to explore Massive MIMO, because

it’s definitely the buzzword these days and I think there is a misunderstanding – it’s underappreciated in my view that Sprint has a significant advantage in terms of the size of the equipment. And maybe – I mean, you’re the

perfect guy to talk about that. So, can you comment on that?

A:

Actually, Mike would be even a better guy to talk about it, but the guy before that. But here’s the thing. Not all Massive MIMO is created equally. I

mean, I know it’s a big buzzword right now. Everybody wants to throw some Massive MIMO in there. For Sprint, our – Massive MIMO doesn’t work well when you have

low-band

spectrum, so you got

– it’s going to be really massive, the size [ph] of the (00:10:00) cost.

Q:

Like someone said, it’s like a Volkswagen [ph] Bug (00:10:03), not a tower or something.

A:

Yeah. It would be a big car. But at

2.5-gigahertz

and at higher frequency bands, that’s where Massive MIMO would make sense because of the size. For Sprint, the Massive MIMO, we have 128 antenna elements in our Massive MIMO design. That is a lot

more antennas than the typical 4 antennas or even 8 antennas that you see in a more traditional build. And with the advances in radio technology, our Massive MIMO antenna actually has the radio built in; it’s integrated. So, it’s a

one-box

solution with a radio built in. Now that – if you compare that to what we have today on our cell sites, you have the 8 transmit, 8 receive antenna. And then you have a separate remote radio head that

needs to be bolted on the tower as well.

Q:

Okay.

A:

And then you

have a lot of coax which by itself is heavy. So if you look at the overall weight, it’s about the same.

Q:

Okay.

A:

If you look at the ability to install, it’s so much simpler to install a

one-box

solution, right?

Q:

It’s like a one [ph] truck roll (00:10:51)...

A:

Absolutely. So we have not seen a lot of structural

challenges when we deploy the Massive MIMO that we have because it’s actually easier. You are taking down basically three major elements and putting that op one box that doesn’t weigh more...

Q:

Got it.

A:

...than a combined – the combination of a three.

Q:

Okay.

A:

Right? So we do this, because with Massive MIMO, you can get

anywhere from 4 times to 10 times the capacity improvement over an LTE system, right? That was the whole reason why we developed Massive MIMO in the first place. But then the one added capability that Sprint brings to the table because of our

spectrum depth is that we can also enable split mode and split the antenna elements into two to support LTE and 5G at the same time. I was on a roadshow with the employees just yesterday, I called it ambidextrous...

Q:

Okay.

A:

...where you can use the left hand and right hand at the

same time. The competition can build a Massive MIMO radios like we could, but their radios will not be ambidextrous because they just don’t have the spectrum. We do. I can assign 60 megahertz of LTE on 2.5 gig and 60 megahertz on 5G on the same

radio.

Q:

Within the same

radio?

A:

Yeah. So you don’t have to find new towers.

We are just going through existing sites – Sprint towers and upgrading them with Massive MIMO. The other difference with Massive MIMO as well, there is a big difference in Massive MIMO performance, whether you are TDD or FDD.

Massive MIMO was originally developed for TDD systems where your channel estimation is almost 100% accurate, thus you transmit and receive on the same

channel. So you know what the channel conditions are. With FDD, less certain, because you transmit and receive on different bands, right, which means that the FDD’s MIMO system is less efficient...

Q:

Right.

A:

...less antenna elements. And a big difference is that on a

TDD Massive MIMO system like Sprint, it works for all phones, even the phones that we have really started – and the customers have. So as long as you have Band 41 on your phone, you can use the – you can enjoy the benefits of Massive MIMO.

Not the case for FDD. You need new release [ph] working (00:13:13) phones to really enjoy the benefits of

FDD-based

Massive MIMO.

Q:

And just to be clear, for those in the audience who

don’t know, Sprint is the only North American carrier that has TDD spectrum, correct or...?

A:

Correct. We are the only North American carrier that has TDD spectrum for LTE. Not for 5G.

Q:

Okay.

A:

I think for 5G, a lot of the new systems are all TDD.

Q:

Got it. Okay. We talked in the prior panel a lot about

millimeter wave spectrum. What is Sprint’s thoughts on that? What are your thoughts about fixed wireless? I mean, it seems like Sprint is more mobile 5G just because you have the ability to do that. Is that right?

A:

Yeah. So, yes,

a

two-part

question there. Let me address the fixed wireless one first. So, we could launch fixed wireless today. I think my old company, Clearwire, certainly has done that. But, today, for stand-alone Sprint,

the economics for mobile is so much better. I think if you look at the merger again...

Q:

Yeah.

A:

...and with 5G, well, you have better spectral efficiency and if the merger is approved, we will have a fairly big 5G footprint covering rural markets and

rural areas. That’s when I think the fixed wireless story becomes very compelling. Half of the American households do not have fixed broadband, or only have one fixed broadband provider. I think this is the space that the new company can

disrupt. I think with a bigger 5G footprint – and if you look at the SEC’s definition of what rural is, which is about...

Q:

10 meg...

A:

No, 62 million households [indiscernible] (00:15:13).

Q:

But isn’t it speeds of like 10 meg? I know that was [ph] CAF (00:15:16).

A:

Yeah, 10 meg but we are talking about fixed wireless with

let’s say 25 megabits a second, down 2 megabits per second.

Q:

Okay.

A:

I think the new company can cover I think almost 85% of that, right. So that’s when the fixed wireless play becomes very compelling and very disruptive.

Q:

And I know this was mentioned – this point in the

Public Interest Statement released earlier this week. Is your view that the lens should be wider then as to who really is the competition, because then it’s – aren’t you including like some of the RLECs who maybe haven’t invested

the money necessarily?

A:

Potentially. Yeah. I just think

that that’s an opportunity that it’s right for disruption.

Q:

Got it. Okay.

A:

Yeah.

Q:

And then yes, you’re right. I did throw a lot at you.

Millimeter wave spectrum, there’s an auction coming up in November.

A:

I think millimeter wave, from a Sprint perspective, it is certainly complementary and millimeter wave can be used as an overlay on our 2.5G deployments where

you need a lot of – a lot more capacity. You can use millimeter wave very surgically where you need a lot of capacity in a certain area. And we will be very open to look at opportunities to acquire some if they are economically right.

Q:

And there’s nothing holding – can you both –

I’m just honestly forgetting, with the auction under the terms of the merger agreement, can you both participate as separate and independent entities? Is that...?

A:

I don’t think we have looked that one out yet.

Q:

Got it. Okay. Perfect. Can you discuss your thoughts on

backhaul? Our – checks show that you’ve been doing a fairly large fiber projects build. Is fiber always your preferred solution, or would you do wireless? I mean, 2.5 gig can be a pretty good backhaul in itself.

A:

Sure. We use 2.5 gig as backhaul for small cells, especially

in places where we cannot get access to fiber or in places where fiber is too expensive. That should allow flexibility when you put up a small cells without worrying about where your fiber [ph] on is (00:17:33) because I can really put it at a spot

where my – it [ph] sticks as (00:17:36) a customer pain point. So we have done that. But we also want to be cognizant of the fact that there is an opportunity cost for using 2.5 gig as a backhaul when I can be now using it for LTE and 5G at the

same time.

We have used a lot of microwave for backhaul. I think we are one of the largest backhaul providers for microwave, more than 10,000 links. And

that microwave – microwave still has its place where it’s expensive or there is just no fiber available.

Fiber is becoming an important part of

our build, especially if we’re looking at launching Massive MIMO where you need to support enhanced dual connect on the cell sites with LTE and 5G. And that’s when you need fiber. We have recently done some dark fiber builds. We have also

continued to use lit fiber. Lit fiber pricing has been getting very comparative lately. So basically, we look at all types of backhaul where it makes the most sense.

Q:

But is dark

fiber the preferred solution if the price was right because you have more control over that asset?

A:

You certainly could. Yeah, you have more control on the asset. But we have not walked away from getting good lit fiber deals either where it makes sense.

We’ll look at the economics.

Q:

Got it. I wanted to

– you mentioned small cells – I wanted to walk through the exercise of small cells versus macros in your build today. I mean, you’ve inked two deals with the tower companies – two of the three tower companies that I think has

been publicly disclosed. How are you thinking – like for every dollar of capital you’re spending, what’s your allocation, is it – between small cells and macro?

A:

I think it depends on the need, the situation. We have

invested in both.

Q:

Okay.

A:

I think if you look ahead, for a 5G build which requires

massive densification, I think you cannot just rely on macro cells. You need to build a lot of small cells as well to provide a density and a low latency that you need. So, you need both and we have invested in both, certainly in macro towers and

more recently in small cells. So, it depends on the situation that we need to.

Q:

And if the tower companies, how do you feel like they’re – are they getting the carrier to ask these days in terms of what was the, I’ll call

it, irritants by a lot of the carriers? I mean, you guys weren’t the most vocal one. And there was another one who was very loud in their grievances against the towers.

A:

I think the towers owned by the tower companies is going to

continue to be a strategic part of our network. And tower economics is always a big topic of discussion at Sprint because it is one of my largest cost item on my OpEx. And recently – you mentioned the two deals that we signed. It comes down to

being able to work with the tower companies and getting better tower economics for Sprint. In return for them, they’ll get more certainty that Sprint is going to remain a long-term customer. So, I think recently, I think, the agreements, in my

view, has been more balanced, and that’s what we strive to do with a tower company. So, I think they are going to remain a strategic part of our assets.

Q:

Got it.

A:

Yeah.

Q:

We had a private tower company panel earlier, and one of the

gentlemen said, I think Sprint, one thing they could do also would be to sign tower deals and say almost like a early exit, like if this

T-Mobile

deal gets approved, then we don’t have to adhere to this.

But is that part of the dialogue at all? I’m forgetting the word to use, that’s early termination if the deal went through.

A:

I don’t think we have gone into that much details in discussions yet. I think we’re still independent company, a stand-alone company in trying to do

the right things. Like I said, tower economics is always a big topic for any wireless carrier because it’s such a big item on the operational costs. So, we need both – everybody needs to look at trying new ways to work with the tower

companies to optimize the economics.

Q:

What about other

parts of the infrastructure? Specifically, can you discuss the role – we’re talking about this, the Magic Box, air strands and mini-macros?

A:

Sure. So, again, this is all in the name of getting enough tools, enough arrows in our quivers to solve different challenges that we see especially with

5G. The Magic Box is fairly unique. By the way, it won a lot of awards recently and I’m glad Mike loved it.

Q:

I have one in my house, though.

A:

I didn’t even know he was actually testing a Magic Box, while I loved the report he wrote. It’s unique in a sense that it’s an indoor femto, but

all you need to do is just power it up. You don’t need a wired backhaul. We developed that box originally for small businesses, because we know CIOs do not like to share their backhaul with operators.

So, we placed the Magic Box. As long as it can connect to a Sprint tower, it basically regenerates a whole new spectrum band in 2.5 inside a house as well as

an outdoor sector as well. So, it’s not a repeater, it’s actually a little base station in the house. And originally, we designed it for small businesses, but we found it’s also helpful for residential customers who may not get the

best LTE experience indoors.

And we have seen like 200% improvement in the LTE speeds when you deploy that. And so, we have actually distributed more

than 200,000 Magic Boxes now. So, that’s one solution we have to improve indoor experiences for our customers in small band use and places like that. Small cells, you mentioned strands. The strand mount small cell is something that we developed

to try to leverage the – in foreign asset the cable companies have. And...

Q:

And for those

who don’t know what a strand mount is...

A:

It is

mounted on outdoor fiber strands. They have rights to install equipment within 18 to 20 inches of the space along the strands, and we just put a small cell worth of strands. It has a different timeline, let’s say, in terms of getting approvals

[ph] and so (00:25:19) essentially, they can do it a lot faster. They run DOCSIS over those strands, so we use those as backhaul. And we are very pleased with the progress we have seen working with the two cable companies. In a span of six months,

we have installed more than 7,000 small cell strands.

Q:

Well, just with Altice and Cox’s.

A:

Yes.

Q:

Okay.

A:

So, excellent progress. Certainly, they can build this at a pace that will be hard to do with other small cells. I mean, it’ll take me six months just to

get a permit for one pole, and with these guys we can build so much more and add so much more density. So, certainly very impressed with the progress we have made.

Q:

In the cable infrastructure, it’s just a whole other

question because you have relationship with two, but there’s two other ones that – just your opinion, do you ever feel like the other two cable partners might have the conversation in their head of if Verizon is successful in 5G, we cable

companies have to be cognizant of the fact that they’re going after our core business and that is problematic? I mean, because it’s interesting to me that cable to me should probably be in wireless in a bigger way, but I don’t know,

I’m just more curious of your thoughts.

A:

I think

they are starting to make progress into the wireless business. Both I think the big cable companies have already launched a wireless service and we’ll be launching one. So, I think they would be effective in the competitiveness in the wireless

space.

Q:

You think there’ll be a bigger role to

play?

A:

I think that’s starting to. I’m not

sure how big a role that would be. You should ask them.

Q:

Okay.

A:

Yeah.

Q:

Yeah. Maybe the last question, just as you – the merger

coming together, I know you well, I know Neville well, do you feel like you’re thinking about things the same way? It seems like, to me,

T-Mobile

used to not be as positive on 2.5 and then [ph] what is

secret sauce special (00:27:27), are they starting to get more positive well before April, even well before November when you called the talks initially off? How do you think they view the world? Is it again about synergies or the spectrum and just

the opportunity?

A:

I think if you look at the public

interest statement that we filed, you will see basically what the combined synergies are. It’s basically very complementary assets. 2.5 plays a big role in the new companies, so does 600.

T-Mobile

has a

very well-built network that we’re going to leverage. One thing I’ll say, I think in working with Neville’s team, it’s amazing how aligned we are in terms of seeing ahead and what we need to do for 5G together. I think there is a

lot of alignment between the two teams.

Q:

And do you

think that – I mean, that mystery 5G report came out of the Trump way back when. Do you think Washington views 5G as a priority? Is that your sense?

A:

Certainly, that was an interesting report and I’m not

surprised that they would view 5G being a national priority. It should be.

Q:

It should be.

A:

If you look at what 4G LTE has brought us, I mean most of us got here with Uber. Well, with Uber, we build our LTE or Airbnb or Lyft or Snapchat, right? So,

lot of companies have been built on the backs of a strong LTE network. Imagine what 5G – who the next Uber will be with 5G in the healthcare space. There’s just so many exciting possibilities that we do not want to lose the lead.

Q:

Is your view that the investment has to happen and that will

drive the innovation of the next Ubers in line?

A:

I

believe so.

Q:

Yes.

A:

I think we need to make sure that we’ve built a strong

enough infrastructure with LTE and continue that with 5G so as to attract the entrepreneurs, the innovation, and make sure that it’s invested in this country.

Q:

Yeah. Great. Thank you so much.

A:

Thank you.

Important Additional Information

In connection with the proposed transaction,

T-Mobile

US, Inc.

(“T-Mobile”)T-Mobile

will file a registration statement on Form

S-4,

which will contain a joint consent solicitation statement of

T-Mobile

and Sprint Corporation (“Sprint”), that also constitutes a prospectus of

T-Mobile

(the “joint consent solicitation statement/prospectus”), and

each party will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT CONSENT SOLICITATION STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. When final, a definitive copy of the joint consent solicitation statement/prospectus will be sent to

T-Mobile

and Sprint stockholders.

Investors and security holders will be able to obtain the registration statement and the joint consent solicitation statement/prospectus free of charge from the SEC’s website or from

T-Mobile

or Sprint.

The documents filed by

T-Mobile

with the SEC may be obtained free of charge at

T-Mobile’s

website, at

www.t-mobile.com

, or at the SEC’s website, at

www.sec.gov

. These documents may also be obtained free of charge from

T-Mobile

by requesting them by

mail at

T-Mobile

US, Inc., Investor Relations, 1 Park Avenue, 14th Floor, New York, NY 10016, or by telephone at

212-358-3210.

The documents filed by Sprint with the SEC may be obtained free of charge at Sprint’s website, at

www.sprint.com

, or at the SEC’s website, at

www.sec.gov

. These documents may also be obtained free of charge from Sprint by

requesting them by mail at Sprint Corporation, Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B679, Overland Park, Kansas 66251, or by telephone at

913-794-1091.

Participants in the Solicitation

T-Mobile

and Sprint and their respective directors and executive officers and other members of management and employees

may be deemed to be participants in the solicitation of consents in respect of the proposed transaction. Information about

T-Mobile’s

directors and executive officers is available in

T-Mobile’s

proxy statement dated April 26, 2018, for its 2018 Annual Meeting of Stockholders. Information about Sprint’s directors and executive officers is available in Sprint’s proxy statement

dated June 19, 2017, for its 2017 Annual Meeting of Stockholders, and Sprint’s Current Reports on Form

8-K,

filed with the SEC on January 4, 2018 and January 17, 2018. Other information

regarding the participants in the consent solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint consent solicitation statement/prospectus and other relevant materials

to be filed with the SEC regarding the acquisition when they become available. Investors should read the joint consent solicitation statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may

obtain free copies of these documents from

T-Mobile

or Sprint as indicated above.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain forward-looking statements concerning

T-Mobile,

Sprint and the proposed transaction

between

T-Mobile

and Sprint. All statements other than statements of fact, including information concerning future results, are forward-looking statements. These forward-looking statements are generally

identified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could” or similar expressions. Such forward-looking statements include, but are not

limited to, statements about the benefits of the proposed transaction, including anticipated future financial and operating results, synergies, accretion and growth rates,

T-Mobile’s,

Sprint’s and

the combined company’s plans, objectives, expectations and intentions, and the expected timing of completion of the proposed transaction. There are several factors which could cause actual plans and results to differ materially from those

expressed or implied in forward-looking statements. Such factors include, but are not limited to, the failure to obtain, or delays in obtaining, required regulatory approvals, and the risk that such approvals may result in the imposition of

conditions that could adversely affect the combined company or the expected benefits of the proposed transaction, or the failure to satisfy any of the other conditions to the proposed transaction on a timely basis or at all; the occurrence of events

that may give rise to a right of one or both of the parties to terminate the business combination agreement; adverse effects on the market price of

T-Mobile’s

or Sprint’s common stock and on

T-Mobile’s

or Sprint’s operating results because of a failure to complete the proposed transaction in the anticipated timeframe or at all; inability to obtain the financing contemplated to be obtained in

connection with the proposed transaction on the expected terms or timing or at all; the ability of

T-Mobile,

Sprint and the combined company to make payments on debt or to repay existing or future indebtedness

when due or to comply with the covenants contained therein; adverse changes in the ratings of

T-Mobile’s

or Sprint’s debt securities or adverse conditions in the credit markets; negative effects of

the announcement, pendency or consummation of the transaction on the market price of

T-Mobile’s

or Sprint’s common stock and on

T-Mobile’s

or

Sprint’s operating results, including as a result of changes in key customer, supplier, employee or other business relationships; significant transaction costs, including financing costs, and unknown liabilities; failure to realize the expected

benefits and synergies of the proposed transaction in the expected timeframes or at all; costs or difficulties related to the integration of Sprint’s network and operations into

T-Mobile;

the risk of

litigation or regulatory actions; the inability of

T-Mobile,

Sprint or the combined company to retain and hire key personnel; the risk that certain contractual restrictions contained in the business

combination agreement during the pendency of the proposed transaction could adversely affect

T-Mobile’s

or Sprint’s ability to pursue business opportunities or strategic transactions; effects of

changes in the regulatory environment in which

T-Mobile

and Sprint operate; changes in global, political, economic, business, competitive and market conditions; changes in tax and other laws and regulations;

and other risks and uncertainties detailed in Sprint’s Annual Report on Form

10-K

for the fiscal year ended March 31, 2017 and in its subsequent reports on Form

10-Q,

including in the sections thereof captioned “Risk Factors” and “MD&A – Forward-Looking Statements,” as well as in its subsequent reports on Form

8-K,

all of which are filed with the SEC and available at

www.sec.gov

and

www.sprint.com

. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and

uncertainties that may cause actual results to differ materially from those

expressed in or implied by such forward-looking statements. Given these risks and uncertainties, persons reading this communication are cautioned not to place undue reliance on such

forward-looking statements. Sprint assumes no obligation to update or revise the information contained in this communication (whether as a result of new information, future events or otherwise), except as required by applicable law.

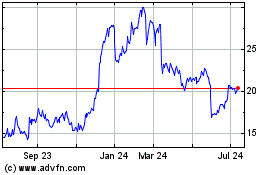

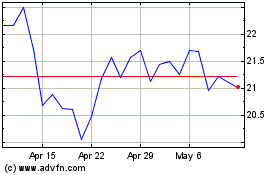

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024