By Keach Hagey and Erich Schwartzel

Walt Disney Co. raised its offer to purchase most of 21st

Century Fox to more than $71.3 billion in cash and stock, topping

an unsolicited offer from rival Comcast Corp. and escalating the

bidding war for the coveted media properties.

Disney's new offer is far higher than its original deal, $52.4

billion in stock, and surpasses Comcast's all-cash offer of roughly

$65 billion. In addition to having the higher offer, Disney said it

also has the regulatory advantage over Comcast in winning a company

to help it fight back against new-media competitors like Netflix

Inc.

Fox, in a news release, said the new Disney deal "is superior to

the proposal" made by Comcast earlier this month. A Comcast

spokeswoman had no immediate comment.

Disney and Comcast are battling for prized media assets

including the Twentieth Century Fox film and TV studio; U.S. cable

networks FX and regional sports channels; international assets such

as Sky PLC and Star India; and Fox's one-third stake in the

streaming service Hulu.

Fox and Disney were negotiating terms of an amended agreement

over the weekend and had the outlines of a deal by Tuesday, though

they were nailing down details like the mix of cash and stock, a

person close to the situation said.

Disney submitted its bid Wednesday ahead of a Fox board meeting

in London, another person familiar with the situation said. Fox

Executive Chairman Rupert Murdoch and Disney Chief Executive Bob

Iger met to discuss the new pact.

Disney agreed to pay Fox shareholders roughly 50% in cash and

50% in stock. If the current deal closes, Fox shareholders would

own 19% of the combined company, compared with 25% under the old

deal.

Mr. Iger said on a conference call Wednesday that the

possibility of meeting with Comcast to divide the Fox assets among

the two companies is a nonstarter. "We have an agreement in place

with [Fox] that precludes that," he said.

Disney also has time on its side, Mr. Iger said, because the

company's deal with Fox has undergone several months of regulatory

review and would presumably be approved sooner than if Comcast

started the process today.

"We believe that we have a much better opportunity, both in

terms of approval and the timing of that approval, than Comcast

does in this case, " he said.

The CEO also highlighted how Fox's programming would boost his

company's efforts to launch a Disney-branded streaming service next

year and directly compete with Netflix Inc. "Direct-to-consumer

distribution has become an even more compelling proposition in the

six months since we announced the deal. The consumer is voting --

loudly," he said.

Neither proposed deal includes Fox News, Fox Sports 1, the Fox

broadcast network or its television stations. In either scenario,

those assets would be spun off into a new company, for the moment

dubbed "New Fox."

On a per-share basis, the new Disney deal values the Fox assets

being acquired at $38 a share, compared with the original deal of

$28 a share and Comcast's offer of $35 a share.

In afternoon trading, Fox's class A shares rose 7.3% to $47.97,

and Comcast shares added 3% to $33.47.

Disney shareholders didn't appear to mind stomaching the higher

price as the stock rose 1.3% to $107.40 in afternoon trading, but

some analysts said the move was foolish. "We didn't like the deal

at the prior price, and we like it substantially less now," said

Doug Creutz of Cowen & Co. The analyst said a Disney-Fox tie-up

is not the way to win the direct-to-consumer fight.

A continuing bidding war between Disney and Comcast could be a

strain on both companies' balance sheets. Disney Chief Financial

Officer Christine McCarthy said the company no longer expects to

complete a $20 billion share repurchase announced with the initial

deal in December.

Fox's board and shareholders have had to weigh a number of

factors as they measure the offer, including the structure. More

stock in the deal has tax advantages for shareholders.

These tax advantages might be particularly large for Fox

shareholders, such as the Murdoch family, who have held Fox's stock

for a long time and thus face a potentially large capital gain to

pay taxes on if it is sold for cash. Rupert Murdoch and his family

have a 17% economic interest in 21st Century Fox. 21st Century Fox

and Wall Street Journal-parent News Corp share common

ownership.

Disney said the stock part of the deal is expected to be

tax-free to 21st Century Fox shareholders. Other shareholders,

particularly the large institutional shareholders that are Fox's

biggest investors, may care less about taxes.

People close to Fox have said that the Murdochs are looking for

the best financial deal and are working in the best interests of

all shareholders.

As a result of the new Disney offer, Fox postponed the special

meeting of shareholders it had originally scheduled on July 10 to

"a future date."

Disney's offer puts a "collar" on the stock portion, saying Fox

shareholders would receive Disney shares equal to the $38 price so

long as Disney's stock price is between $93.53 and $114.32.

Regulatory hurdled have been a consideration. The Justice

Department would have to sign off on either deal, and Fox cited

regulatory concerns among its reasons for rebuffing Comcast's

initial approach.

However, last week, a judge struck down the Justice Department's

attempt to block AT&T's acquisition of Time Warner Inc. Comcast

believes the court's approval of a "vertical" merger between a

distributor and a content company should nullify Fox's regulatory

concerns, since a Comcast-Fox tie-up would have similar

characteristics, people close to the cable giant say.

Mr. Iger said Wednesday that he still believed a "vertical"

merger of the kind Comcast proposed for the Fox assets faced

regulatory headwinds.

--Austen Hufford, Dana Mattioli and Allison Prang contributed to

this article.

Write to Keach Hagey at keach.hagey@wsj.com and Erich Schwartzel

at erich.schwartzel@wsj.com

(END) Dow Jones Newswires

June 20, 2018 15:39 ET (19:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

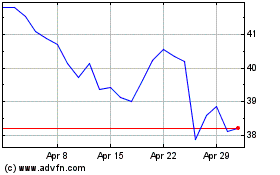

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024