Japanese Sales App Soars in IPO -- WSJ

June 20 2018 - 3:02AM

Dow Jones News

By Mayumi Negishi and Takashi Mochizuki

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 20, 2018).

TOKYO -- Japanese flea-market app Mercari Inc.'s valuation

soared to $6.5 billion on its first day of trading, as investors

celebrated the eBay Inc. rival's debut in a country that is nearly

bereft of influential technology startups.

Shares in Mercari closed up 77% over the offering price after

the company raised Yen130.5 billion ($1.2 billion) through its

initial public offering on the Tokyo Stock Exchange's Mothers

market for startup companies. It was Japan's biggest tech IPO since

messaging app Line Corp. listed in July 2016 and the largest IPO in

Japan this year.

Mercari's app allows people to buy and sell mostly used goods

such as jeans, handbags and games. It has been a hit in its home

market, drawing many young people who have become accustomed to

penny-pinching in the nation's long economic doldrums. Mercari

takes a cut of each sale.

"In an era overflowing with things, there's less premium on

ownership," said Yutaka Suzuki, senior researcher at the

Distribution Economics Institute of Japan. He said young consumers

tend to sell their possessions as soon as they grow tired of

them.

Now Mercari hopes to carve out growth in the U.S. and U.K. with

features that it says differentiate it from rivals. Sellers can

remain anonymous and buyers don't have to pay until they confirm

the item has arrived.

But in the U.S., Mercari's growth has been stymied by bigger

marketplaces such as eBay and Craigslist. Volume remains relatively

low compared with Japan, where delivery in urban areas is fairly

inexpensive and Mercari has tapped a dense network of convenience

stores to help people ship easily.

"In many ways, Japan is another planet," said John Lagerling,

head of Mercari's U.S. operations. The company has negotiated lower

shipment fees from United Parcel Service Inc. and FedEx Corp., and

it is advertising more on YouTube and on the radio, he said. "How

we do in the U.S. and in the U.K. will determine how we do in the

rest of the world."

Mercari logged a net loss of Yen4.2 billion in the 12 months

ended June last year on Yen22 billion in revenue, dragged down by

losses in the U.S.

In Japan, Mercari's growth stems from its easy-to-use mobile

app, which uses its database to automatically complete postings

from just a smartphone photo.

"I can post with just a photo, and neither I nor the seller has

to share an address," said Shingo Fuchigami, a 31-year-old web

producer. He said he began selling when he moved into a home with

less storage and has sold hundreds of dollars' worth of products

such as videogame software after he is done playing with it.

Ease of use helped Mercari get a leg up on Yahoo Japan Corp.,

the nation's top web portal, which has long provided people a

platform to unload used goods. Craigslist and eBay aren't widely

used in Japan.

Investors are betting that secondhand apps like Mercari will

help people around the world deal with closets full of unused

items. Mercari's shares shot up to Yen5,300 on Tuesday, from the

IPO price of Yen3,000, giving the company a market capitalization

of Yen717 billion, or about $6.5 billion.

Startups with valuations of more than $1 billion -- so called

unicorns -- are a rarity in Japan, the world's third-largest

economy, despite easy money from the Bank of Japan, government

subsidies and corporate efforts to incubate ventures.

With the stock-exchange listing of Mercari, only one unicorn

remains in Japan, according to research firm CB Insights. That is

machine-learning developer Preferred Networks Inc., with a

valuation of $2 billion. By comparison, China has 71 unicorns and

the U.S. has 115, according to CB Insights.

Although growing, investment in Japanese ventures came to less

than 2% of the amount venture capitalists and others invested in

startups in the U.S., and less than 3% of the amount Chinese

ventures received last year, according to Venturesource.

Mercari's opening-day performance puts it on par with some of

Japan's best-known names by market capitalization, roughly equaling

Nikon Corp. and convenience-store operator Lawson Inc.

"We want to do away with throwing out things," said Mercari

Chief Executive Shintaro Yamada. "I think we fill a universal

need."

Write to Mayumi Negishi at mayumi.negishi@wsj.com and Takashi

Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

June 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

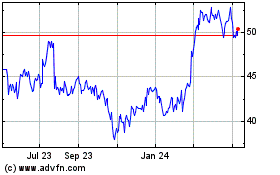

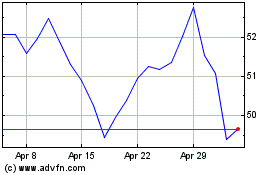

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024