UPS Is Adding 730 Alternative-Fuel Trucks to Its Fleet

June 19 2018 - 3:05PM

Dow Jones News

By Jennifer Smith

United Parcel Service Inc. is growing its fleet of

alternative-fuel trucks as the delivery giant pushes to reduce fuel

costs and vehicle emissions.

The parcel carrier is spending $130 million to buy 730

compressed natural-gas vehicles, boosting its current CNG fleet by

about 19%, and to add five CNG fueling stations to its existing

network of more than 50 stations, UPS announced Tuesday. The new

equipment includes 400 Freightliner and Kenworth big rigs from

Daimler Trucks North America and Paccar Inc., respectively, and 330

terminal trucks, which move trailers around UPS facilities, from

TICO Manufacturing and Power Solutions International, Inc.

The UPS investment is part of a broader effort to trim the

company's greenhouse-gas emissions from its ground operations by

12% by 2025. It comes as the company is investing $20 billion to

automate its facilities and upgrade technology as it adjusts to

swelling volumes of e-commerce packages bound for consumers'

doorsteps. Such deliveries tend to be less profitable than

drop-offs at businesses.

Fuel is historically the biggest expense for transportation

companies. While diesel prices dipped in 2015 and 2016, the cost

has been climbing again. Over the past four weeks, the average

on-highway price hovered between $3.239 to $3.288 a gallon,

according to the U.S. Energy Information Administration. Last year,

UPS's fuel expenses jumped 27% on higher prices for jet, diesel and

gasoline fuel and on increased package volumes, according to the

company's annual report. Some of those costs get passed on to

customers via fuel surcharges.

Companies are exploring alternatives. In recent months, trucking

operator U.S. Xpress Inc. and beer-maker Anheuser-Busch, the U.S.

subsidiary of Anheuser-Busch InBev, have reserved hundreds of

hydrogen-electric trucks from Nikola Motor Co. Companies are also

lining up to test out Tesla Inc.'s all-electric Semi big rig,

including Walmart Stores Inc. and J.B. Hunt Transport Services

Inc., which each operate thousands of trucks, and Deutsche Post

AG's DHL Supply Chain and truck-leasing and fleet-management

company Ryder System Inc.

Still, alternative-fuel vehicles account for a slim portion of

the overall truck market. New models provide significantly better

fuel economy than a decade ago, and the market for natural-gas

powered commercial trucks contracted when diesel prices retreated

and initial buyers had trouble selling the vehicles, which carry a

higher up-front cost. About 11% of carriers said they have vehicles

that use a fuel other than diesel or biodiesel blends, according to

a 2016 survey by the American Transportation Research

Institute.

In UPS's case, by 2020 the company aims to have one in four new

vehicles purchased be an alternative fuel or advanced technology

vehicle, such as a hybrid truck or one incorporating lightweight

materials that improve fuel efficiency. It also wants to swap out

40% of all fuel for its ground operations with sources other than

conventional gasoline and diesel. Between 2008 and 2018 UPS will

have invested more than $1 billion in alternative-fuel and

advanced-technology vehicles and fueling stations, according to the

company.

Businesses with large logistics operations also are grappling

with rising freight expenses, from trucking companies to

manufacturers and retailers. Companies spent a record of nearly

$1.5 trillion on shipping costs last year, according to a report by

the Council of Supply Chain Management Professionals, as demand for

transportation surged on economic expansion, while rising fuel

costs and a limited supply of trucks drove up freight rates.

The volume of goods moved by truck year-to-date jumped 8% in May

compared with the same period in 2017, according to the American

Trucking Associations.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

June 19, 2018 14:50 ET (18:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

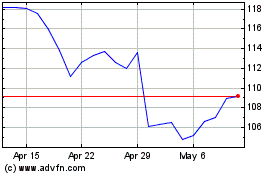

PACCAR (NASDAQ:PCAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

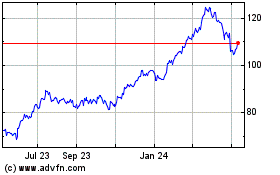

PACCAR (NASDAQ:PCAR)

Historical Stock Chart

From Apr 2023 to Apr 2024