Acquisition of the Newest Resort in the

Bossier City/Shreveport Market Expected to be Immediately Accretive

to Operating Results

Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or

the “Company”), announced today that it has entered into a

definitive agreement to acquire the operations of

Margaritaville Resort Casino in Bossier City, Louisiana

(“Margaritaville”) for approximately $115 million cash in a

transaction that is expected to be immediately accretive to

operating results upon closing.

Timothy J. Wilmott, Penn National’s Chief Executive Officer,

stated, “We are pleased to partner with VICI Properties Inc. to

structure this tuck-in acquisition of Bossier City’s newest casino

resort, which is consistent with our criteria for transactions that

are accretive to free cash flow, strategically diversify our

revenue and operating base, and present well-defined paths to the

realization of significant synergies. With a purchase multiple of

5.5x trailing twelve months adjusted earnings before interest,

taxes, depreciation, amortization, and management fees which we

believe declines to below 5.0x with synergies, Penn National

believes this transaction further supports our efforts to enhance

shareholder value.”

Simultaneous with the closing of the transaction, Penn National

will enter into a triple net lease agreement with VICI Properties

Inc. (NYSE: VICI) (“VICI”) for the Margaritaville facility. The

lease will have an initial annual rent of approximately $23 million

and an initial term of 15 years, with four 5-year renewal options.

The rent coverage ratio in the first year after closing is expected

to be 1.9x and the Tenant’s obligations under the lease will be

guaranteed by Penn National.

The proposed transaction will further expand Penn National’s

regional gaming platform with a property that is complementary to

its pro-forma operating base following the completion of the

Company’s pending acquisition of Pinnacle Entertainment, Inc.

(NASDAQ: PNK) (“Pinnacle”). Upon closing the Margaritaville

transaction and the pending Pinnacle transaction (and taking into

account announced divestitures), Penn National’s portfolio of

regional gaming facilities will increase to 40 properties in 18

jurisdictions.

Penn National does not anticipate that this transaction will

alter the Company’s expectation that it will end the year with net

rent-adjusted leverage in the mid-5x range, pro forma for the

completion of the Pinnacle acquisition.

Built in 2013, Margaritaville Resort Casino is the premier venue

for gaming, lodging, dining and entertainment experiences in

Northern Louisiana. The property features 26,500 square feet of

casino space, 395 hotel rooms, an island-style escape theme, 6

restaurants and food and beverage outlets, a 15,000 square foot

1,000-seat theater and 9,500 square feet of meeting space.

Margaritaville Resort Casino generated adjusted EBITDAM of

approximately $44 million for the twelve month period ended March

31, 2018.

The transaction, expected to close in the second half

of 2018, is subject to the approval of the Louisiana Gaming Control

Board and other customary closing conditions.

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests

in gaming and racing facilities and video gaming terminal

operations with a focus on slot machine entertainment. At March 31,

2018, the Company operated twenty-nine facilities in seventeen

jurisdictions, including California, Florida, Illinois, Indiana,

Kansas, Maine, Massachusetts, Mississippi, Missouri, Nevada, New

Jersey, New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and

Ontario, Canada. At March 31, 2018, in aggregate, Penn National

Gaming operated approximately 36,100 gaming machines, 810 table

games and 4,800 hotel rooms. The Company also offers social online

gaming through its Penn Interactive Ventures division.

Important Additional Information

In connection with the proposed Pinnacle transaction, on

February 8, 2018, Penn filed with the Securities and Exchange

Commission (the “SEC”) a registration statement on Form S-4 that

contains a joint proxy statement of Penn and Pinnacle and also

constitutes a prospectus of Penn (the “joint proxy

statement/prospectus”). The registration statement was declared

effective by the SEC on February 28, 2018 and Penn and Pinnacle

commenced mailing the definitive joint proxy statement/prospectus

to their respective shareholders and stockholders on February 28,

2018. This communication does not constitute an offer to sell or

the solicitation of an offer to buy any securities or a

solicitation of any vote or approval. Shareholders of Penn and

stockholders of Pinnacle are urged to read the definitive joint

proxy statement/prospectus regarding the proposed transaction and

any other relevant documents filed or that will be filed with the

SEC, as well as any amendments or supplements to those documents,

because they contain or will contain important information.

Investors may obtain a free copy of the registration statement and

the joint proxy statement/prospectus, as well as other filings

containing information about Penn and Pinnacle, without charge, at

the SEC’s website at www.sec.gov. Copies of the documents filed

with the SEC by Penn can be obtained, without charge, by directing

a request to Justin Sebastiano, Penn National Gaming, Inc., 825

Berkshire Boulevard, Suite 200, Wyomissing, Pennsylvania 19610,

Tel. No. (610) 401-2029. Copies of the documents filed with the SEC

by Pinnacle can be obtained, without charge, by directing a request

to Vincent Zahn, Pinnacle Entertainment, Inc., 3980 Howard Hughes

Parkway, Las Vegas, Nevada 89169, Tel. No. (702) 541-7777.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding the expected impact of the

acquisition of Margaritaville on the Company’s operations and

statements regarding the anticipated timing of closing of the

acquisition. These statements can be identified by the use of

forward looking terminology such as “expects,” “believes,”

“estimates,” “projects,” “intends,” “plans,” “seeks,” “may,”

“will,” “should” or “anticipates” or the negative or other

variations of these or similar words, or by discussions of future

events, strategies or risks and uncertainties. Although the Company

believes that its expectations are based on reasonable assumptions

within the bounds of its knowledge of its business, there can be no

assurance that actual results will not differ materially from our

expectations. Meaningful factors that could cause actual results to

differ from expectations include, but are not limited to, risks

related to the acquisition of the Margaritaville operations by the

Company and the integration of the business to be acquired; the

possibility that the proposed transaction does not close when

expected or at all because required regulatory or other approvals

are not received or other conditions to the closing are not

satisfied on a timely basis or at all; potential adverse reactions

or changes to business or employee relationships, including those

resulting from the announcement or completion of the transaction;

potential litigation challenging the transaction; the possibility

that the anticipated benefits of the transaction are not realized

when expected or at all, including as a result of the impact of, or

issues arising from, the integration of the companies; our ability

to realize potential synergies or projected financial results; the

various risks relating to the Company’s pending acquisition of

Pinnacle Entertainment, Inc., and other factors as discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2017, subsequent Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, each as filed with the United States

Securities and Exchange Commission. The Company does not intend to

update publicly any forward-looking statements except as required

by law. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this press release may not

occur.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180619005466/en/

Penn National Gaming, Inc.William J. Fair, 610-373-2400Chief

Financial OfficerorJCIRJoseph N. Jaffoni, Richard

Land212-835-8500penn@jcir.com

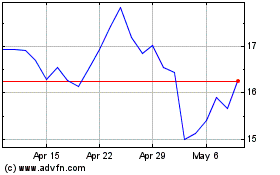

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024