UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

☒

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☐

|

Definitive Information Statement

|

|

PETROGRESS

, INC.

|

|

(Name of Registrant as Specified in its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

PETROGRESS

, INC.

757 Third Avenue, Suite 2110

New York, New York 10017

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

To the Stockholders of Petrogress, Inc.:

This Information Statement is furnished to holders of shares of Common Stock, $0.001 par value (the “Common Stock”) of Petrogress, Inc. (“Petrogress,” “we,” “us” or the “Company”). We are sending you this Information Statement to inform you that the holder of a majority of our Common Stock and all of our issued and outstanding shares of Series A Preferred Stock has approved an amendment (the “Amendment”) to the Company’s Certificate of Incorporation that will (a) effect reverse split of the Company’s Common Stock at a ratio of one-for-50, one-for-200, or any ratio in between (the “Split Ratio”), to be determined by our Board of Directors, (b) reduce the number of authorized shares of Common Stock from 490,000,000 to 19,000,000 and (c) reduce the number of authorized shares of preferred Stock, $0.001 par value, of the Company (the “Preferred Stock”) from 10,000,000 to 1,000,000.

The accompanying Information Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. As described in this Information Statement, the foregoing Amendment was approved by our Board of Directors (the “Board”) by written consent on June 6, 2018. Thereafter, on June 16, 2018, the stockholder of the Company (the “Consenting Stockholder”), holding a majority of our issued and outstanding Common Stock and all of our issued and outstanding shares of Series A Preferred Stock, adopted by written consent a resolution approving the Amendment. Such written consent constitutes the only stockholder approval required to amend the Company’s Certificate of Incorporation under the Delaware General Corporation Law. Because the written consent of the Consenting Stockholder satisfies all applicable stockholder voting requirements, the Board is not soliciting your proxy or consent in connection with the matters discussed above. You are urged to read the Information Statement carefully and in its entirety for a description of the action taken by the Company.

The actions will not become effective before the date which is 20 days after this Information Statement was first mailed to stockholders. This Information Statement is being mailed on or about June [__], 2018 to stockholders of record on June 16, 2018 (the “Record Date”).

|

|

By order of the Board of Directors

|

|

|

|

|

|

/s/ Christos Traios

|

|

|

|

|

|

Christos Traios

President and Chief Executive Officer

|

New York, New York

June [__], 2018

PETROGRESS, INC.

757 Third Avenue, Suite 2110

New York, New York 10017

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

This Information Statement (the “Information Statement”) is being mailed on or about June [__], 2018 to the holders of record at the close of business on June 16, 2018 (the “Record Date”), of the Common Stock (the “Common Stock”) of Petrogress, Inc., a Delaware corporation (“Petrogress,” “we,” “us” or the “Company”), in connection with an action taken by written consent of the holder of a majority of our Common Stock and all of our issued and outstanding shares of Series A Preferred Stock in lieu of a meeting to approve an Amendment (the “Amendment”) to our Certificate of Incorporation, as amended to date (the “Certificate”), (a) effecting a reverse split of the Company’s Common Stock (the “Reverse Stock Split”) at a ratio of one-for-50, one-for-200, or any ratio in between (the “Split Ratio”), to be determined by our Board of Directors, (b) reducing the number of authorized shares of Common Stock from 490,000,000 to 19,000,000 and (c) reducing the number of authorized shares of preferred Stock, $0.001 par value, of the Company (the “Preferred Stock”) from 10,000,000 to 1,000,000.

The sole member of the Board of Directors (the “Board”) and the stockholder beneficially owning 301,611,865 shares of our issued and outstanding Common Stock and all 100 shares of our Series A Preferred Stock (the “Consenting Stockholder”) has executed a written consent approving the Amendment. The Consenting Stockholder held of record on the Record Date approximately 87.5% of the total issued and outstanding Common Stock of the Company and 100% of our issued and outstanding Series A Preferred Stock, which was sufficient to approve the proposed Amendment. Dissenting stockholders do not have any statutory appraisal rights as a result of the action taken. The Board does not intend to solicit any proxies or consents from any other stockholders in connection with this action. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely to advise stockholders of the actions taken by written consent.

Section 228 of the Delaware General Corporation Law (the “DGCL”) generally provides that any action required to be taken at a meeting of the stockholders may be taken without a meeting, without prior notice and without a vote, if a written consent thereto is signed by stockholders having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Pursuant to Section 242 of the DGCL, a majority of the outstanding voting shares of stock entitled to vote thereon is required in order to amend our Certificate to effect the proposed Reverse Stock Split and reduction of authorized shares of Common and Preferred Stock. In order to eliminate the costs and management time involved in obtaining proxies and in order to effect the above actions as early as possible in order to accomplish the purposes of the Company as herein described, the Board consented to the utilization of, and did in fact obtain, the written consent of the Consenting Stockholder who owns shares representing a majority of our Common Stock and all of our Series A Preferred stock.

This Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to the Company’s stockholders of record on the Record Date. The corporate action described herein may be effective as early as 20 days (the “20-day Period”) after the mailing of this Information Statement. The 20-day Period is expected to conclude on or about July ___, 2018.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

Forward Looking Statements

This Information Statement and other reports that the Company files with the U.S. Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical information provided herein are forward-looking and may contain information about financial results, economic conditions, trends and known uncertainties. We caution the reader that actual results could differ materially from those expected by us depending on the outcome of certain factors, including, without limitation, the risk that the assumptions upon which the forward-looking statements are based ultimately may prove to be incorrect or incomplete, that the Reverse Stock Split and reduction of authorized shares will not be consummated in a timely manner or at all, as well as other risks and uncertainties that are described in the Company’s filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligations to release publicly the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this information statement, including, without limitation, changes in our business strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

VOTE

RE

QUIRED TO APPROVE THE AMENDMENT

As of the Record Date, there were 344,607,672 shares of Common Stock and 100 shares of our Series A Preferred Stock issued and outstanding. Each share of Common Stock is entitled to one vote. The holder of the Series A Preferred shares has the right to a number of votes equal to two (2) times the sum of: (i) the total number of shares of Common Stock which are issued and outstanding at the time of any election or vote by the stockholders; plus (ii) the number of shares of Preferred Stock issued and outstanding of any other class that has voting rights, if any. For the approval of the Amendment, the affirmative vote of the Consenting Stockholder who holds a majority of the issued and outstanding Common Stock and all of the issued and outstanding Series A Preferred Stock entitled to vote at the Record Date (totaling 990,827,209 out of 1,033,823,016 (representing 98%) total stockholder votes) was required for approval.

CONSENTING STOCK

HOLDER

On June 6, 2018, the Board unanimously adopted resolutions declaring the advisability of, and recommending that stockholders approve, the Amendment to the Company’s Certificate to (a) effect a Reverse Stock Split of the issued and outstanding shares of our Common Stock at a Split Ratio (within a range between one-for-50 and one-for-200) determined by the Board (b) reduce the number of authorized shares of Common Stock from 490,000,000 to 19,000,000 and (c) reduce the number of authorized shares of Preferred Stock from 10,000,000 to 1,000,000. In connection with the adoption of such resolutions, the Board elected to seek the written consent of the holder of majority of the issued and outstanding Common Stock and all of our issued and outstanding shares of Series A Preferred Stock in order to reduce the costs and implement the proposal in a timely manner.

On June 16, 2018, Christos Traios, the Consenting Stockholder who beneficially owns 301,611,865 shares of our issued and outstanding Common Stock (approximately 87.5%) and all 100 shares of our Series A Preferred Stock (100%), representing 98% of the stockholder voting power, consented in writing to the proposed Amendment.

Under Section 14(c) of the Exchange Act, the filing of the Amendment effecting the Reverse Stock Split cannot become effective until the expiration of the 20-day Period.

The Company is not seeking written consent from any of our other stockholders, and stockholders other than the Consenting Stockholder will not be given an opportunity to vote with respect to the Amendment. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for the purpose of providing stockholders advance notice of the actions taken, as required by the Exchange Act.

Stockholders who were not afforded an opportunity to consent or otherwise vote with respect to the actions taken have no right under the DGCL to dissent or require a vote of all stockholders.

APPROVAL OF THE

REVERSE STOCK SPLIT

OF

OUR

OUTSTANDING COMMON STOCK

General

Our Board has unanimously approved a proposal to amend the FOURTH paragraph of our Certificate to effect a Reverse Stock Split of the Company's outstanding Common Stock at a Split Ratio (within a range between one-for-50 and one-for-200) determined by the Board. The Consenting Stockholder has also approved this Amendment. The text of the Amendment is set forth in the Certificate of Amendment to Certificate of Incorporation of Petrogress, Inc. attached to this Information Statement as

Appendix A

.

The Amendment provides for the combination of our presently issued and outstanding shares of Common Stock into a smaller number of shares of identical Common Stock. This is known as a "reverse stock split." Under the proposal, shares of our presently issued and outstanding Common Stock as of the close of business on the effective date of the Amendment will be converted automatically into one share of our post-reverse stock split Common Stock in proportion to the Split Ratio deteeminted by the Board. As discussed further below, we will pay cash in lieu of fractional shares.

Reasons for the Reverse Stock Split

The Board is effectuating the Reverse Stock Split, with the approval of the Consenting Stockholder, with the primary intent of increasing the market price of the Company’s Common Stock to make the Common Stock more attractive to a broader range of institutional and other investors and to facilitate potential uplisting to the OTCQB Marketplace or another national securities exchange. In addition to potentially increasing the market price of the Common Stock, the Reverse Stock Split would also reduce certain costs to stockholders, as discussed below. Accordingly, for these and other reasons discussed below, the Company believes that effecting the Reverse Stock Split is in the Company’s and the Company’s stockholders’ best interests.

The Board believes that an increased stock price may encourage investor interest and improve the marketability of the Common Stock to a broader range of investors, and thus enhance liquidity. Because of the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Additionally, because brokers’ commissions on lower-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current share price of the Common Stock can result in an individual stockholder paying transaction costs that represent a higher percentage of total share value than would be the case if the share price of the Common Stock were substantially higher. This factor may also limit the willingness of institutions to purchase the Common Stock. The Board believes that the anticipated higher market price resulting from the Reverse Stock Split could enable institutional investors and brokerage firms with such policies and practices to invest in the Common Stock. In addition, the Reverse Stock Split would increase the likelihood that shares of our Common Stock could be listed on the OTCQB Marketplace or another national securities exchange. The listing rules of the OTCQB Marketplace require, among other things, that issuers maintain a minimum closing bid price of at least $0.01 per share. By potentially increasing the market price of the Common Stock as a result of the Reverse Stock Split, the Company would be more likely to qualify for the “OTCQB” designation.

For the above reasons, the Board believes that the Reverse Stock Split is in the best interests of Petrogress and the stockholders. However, there can be no assurances that the Reverse Stock Split will have the desired consequences.

Effects of the Reverse Stock Split

The Reverse Stock Split will be effected by filing the Amendment with the Secretary of State of the State of Delaware and will be effective upon a date on or after the expiration of the 20-day Period after the mailing of this Information Statement. The 20-day Period is expected to conclude on or about July ___, 2018. However, the actual timing of the filing will be determined by our Board based upon its evaluation as to when the filing will be most advantageous to the Company and our stockholders. We reserve the right to forego or postpone filing the Amendment for up to a year if we determine that action to be in the best interests of Petrogress and the stockholders. Our Board has the maximum flexibility to react to current market conditions and to therefore achieve the purposes of the Reverse Stock Split, if implemented, and to act in the best interests of the Company and our shareholders. Because the Split Ratio is a range, the actual Ratio will be determined by our Board, in its sole discretion.

We are currently authorized to issue 490,000,000 shares of Common Stock of which 344,607,672 shares were issued and outstanding at the close of business on the Record Date. Adoption of the Reverse Stock Split will reduce the shares of Common Stock outstanding and will also significantly reduce the number of authorized shares of Common Stock as described elsewhere in this Information Statement. The Reverse Stock Split will have no effect on the par value of the Common Stock.

The effect of the reverse stock split upon holders of Common Stock will be that the total number of shares of our Common Stock held by each stockholder will be automatically converted into the number of whole shares of Common Stock equal to the number of shares of Common Stock owned immediately prior to the Reverse Stock Split divided by the Split Ratio, then further adjusted to account for purchase of any fractional shares by the Company.

The Reverse Stock Split will affect all of the stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of the Company’s stockholders owning a fractional share. As described below, stockholders holding fractional shares will be entitled to cash payments in lieu of such fractional shares. Such cash payments will reduce the number of post-split stockholders to the extent there are stockholders presently holding fewer shares than the to-be-determined Split Ratio, however that is not the purpose for which the Company is effecting the Reverse Stock Split. The Company will continue to be subject to the periodic reporting requirements of the Securities and Exchange Act of 1934, as amended.

Fractional Shares

No scrip or fractional share certificates will be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares of the Common Stock not evenly divisible by the Split Ratio will be entitled, upon surrender of certificate(s) representing such shares, to a cash payment in lieu thereof. The cash payment will equal the product obtained by multiplying multiplying (a) the average of the closing trading prices of the Common Stock, as reported on the OTC Pink tier of the OTC Markets Group, Inc., during the 20 consecutive trading days ending on the trading day immediately prior to the Effective Time, by (b) the fraction of one share owned by the stockholder. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment therefor as described herein.

Authorized but Unissued Shares; Potential Dilution and Anti-Takeover Effects

Adoption of the Reverse Stock Split will reduce the shares of Common Stock outstanding and will also reduce the number of authorized shares of Common Stock as described elsewhere in this Information Statement.Nevertheless, after effecting the Reverse Stock Split and reduction of authorized shares, additional shares will still be available for issuance from time to time for business purposes as reasonably determined by the Board, without the necessity of soliciting further stockholder approval. Depending upon the Split Ratio determined by the Board, the Reverse Stock Split may increase the proportion of unissued authorized shares to issued shares after the Reverse Stock Split.

If the Board issues additional shares, the aggregate ownership interest of our current stockholders, and the interest of each such existing stockholder, would be diluted, and such dilution could be substantial. Although we continually examine potential opportuinties that may involve issuance of additional Common Stock, we have no current plans or arrangements to issue any additional shares of Common Stock.

The significant increase in the proportion of unissued authorized shares to issued shares after the Reverse Stock Split could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board or contemplating a tender offer or other transaction for the combination of our Company with another company).

Discretionary Authority of the Board of Directors to

Determine the Split Ratio,

file the Amendment and

Abandon

Reverse Stock Split

Because the Split Ratio is a range, the actual Ratio will be determined by our Board, in its sole discretion.

The Reverse Stock Split will become effective upon the filing of the Amendment to our Certificate with the Secretary of State of the State of Delaware. The timing of the filing of the Certificate of Amendment that will effectuate the Reverse Stock Split will be determined by our Board based on its evaluation as to when such action will be the most advantageous to us and our stockholders. Our Board also reserves the right to abandon the Amendment without further action by our stockholders at any time before the effectiveness of the filing with the Delaware Secretary of State of the Amendment, notwithstanding the approval of the Reverse Stock Split by the Consenting Stockholder.

If the Amendment effecting the Reverse Stock Split has not been filed with the Secretary of State of the State of Delaware by the close of one year from the Record Date, our Board will abandon the Reverse Stock Split.

No Dissenters’ Rights

Under the DGCL, the Company’s stockholders are not entitled to dissenters’ rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such right.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

After the filing of the Amendment, our Common Stock will have a new CUSIP number, which is a number used to identify our equity securities, and stock certificates with the older CUSIP number will need to be exchanged for stock certificates with the new CUSIP number by following the procedures described below.

As soon as practicable after the Amendment is filed, we will cause a letter of transmittal to be forwarded to each holder of record of shares of our Common Stock outstanding as of such date. The letter of transmittal will contain instructions for the surrender of certificates representing shares of pre-reverse stock split Common Stock to our transfer agent in exchange for certificates representing the number of whole shares of post-reverse stock split Common Stock into which the shares of pre-reverse stock split Common Stock have been converted as a result of the Reverse Stock Split. Persons who hold their shares in brokerage accounts or “street name” will not be required to take any further actions to effect the exchange of their certificates because your broker will make the appropriate adjustment to the number of shares held in your account following the Effective Date.

CERTIFICATES SHOULD NOT BE SENT TO US OR THE TRANSFER AGENT BEFORE RECEIPT OF SUCH LETTER OF TRANSMITTAL FROM US.

Until a stockholder forwards a completed letter of transmittal, together with certificates representing such stockholder's shares of pre-reverse stock split Common Stock to the transfer agent and receives in return a certificate representing shares of post-reverse stock split Common Stock, such stockholder's pre-reverse stock split Common Stock shall be deemed equal to the number of whole shares of post-reverse stock split Common Stock to which such stockholder is entitled as a result of the reverse stock split.

Certain Federal Income Tax Considerations

The following discussion describes certain material federal income tax considerations relating to the Reverse Stock Split. This discussion is based upon the Internal Revenue Code, existing and proposed regulations thereunder, legislative history, judicial decisions and current administrative rulings and practices, all as amended and in effect on the date hereof. Any of these authorities could be repealed, overruled or modified at any time. Any such change could be retroactive and, accordingly, could cause the tax consequences to vary substantially from the consequences described herein. No ruling from the Internal Revenue Service (the "IRS") with respect to the matters discussed herein has been requested, and there is no assurance that the IRS would agree with the conclusions set forth in this discussion.

This discussion may not address certain federal income tax consequences that may be relevant to particular stockholders in light of their personal circumstances or to stockholders who may be subject to special treatment under the federal income tax laws. This discussion also does not address any tax consequences under state, local or foreign laws.

STOCKHOLDERS ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT FOR THEM, INCLUDING THE APPLICABILITY OF ANY STATE, LOCAL OR FOREIGN TAX LAWS, CHANGES IN APPLICABLE TAX LAWS AND ANY PENDING OR PROPOSED LEGISLATION.

Other than the cash payments for fractional shares discussed below, no gain or loss will be recognized by a stockholder upon such stockholder’s exchange of shares held before the Reverse Stock Split for shares after the Reverse Stock Split. The aggregate tax basis of the shares of the Common Stock received in the Reverse Stock Split (including any fraction of a share deemed to have been received) will be the same as the Stockholder’s aggregate tax basis in the shares of our Common Stock exchanged therefor. In general, Stockholders who receive cash instead of their fractional share interests in the shares of our Common Stock as a result of the Reverse Stock split will recognize a gain or loss based on their adjusted basis in the fractional share interests redeemed. The Stockholder’s holding period for the shares of our Common Stock after the Reverse Stock Split will include the period during which the Stockholder held the shares of our Common Stock surrendered in the Reverse Stock Split.

APPROVAL OF THE REDUCTION IN AUTHORIZED NUMBER OF SHARES OF COMMON AND PREFERRED STOCK

General

Our Board has unanimously approved a proposal to amend the FOURTH paragraph of our Certificate to to reduce the number of authorized shares of the Company’s Common Stock and Preferred Stock. Currently, we may issue up to 490,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock, and we propose to reduce those numbers at the same time that we effect the Reverse Stock Split. If the Board, in its sole discretion, determines not to implement the Reverse Stock Split, then we will not reduce our authorized shares and we will continue to be authorized to issue up to 490,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock. The proposed form of Amendment to our Certificate to implement the reduction in the authorized number of shares of Common and Preferred Stock is attached to this Information Statement as

Appendix A

. The Consenting Stockholder has also approved this Amendment.

Reasons for the Reduction in Authorized Stock

The Company pays franchise tax in Delaware based upon the number of shares of Common Stock and Preferred Stock that the Company is authorized to issue applying either the par value or an assumed par value (based upon the total assets divided by the number of shares that are authorized which are not currently outstanding). Without a reduction in the authorized shares of Common and Preferred Stock, the estimated annual franchise tax is expected to increase as a result of the Reverse Stock Split. Additionally, the reduction in the number of authorized shares would decrease the potential dilution to our stockholders following the Reverse Stock Split. Of the 490,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock we are currently authorized to issue, 344,607,672 and 100 shares, respectively, are now outstanding.

The Board also believes that 490,000,000 authorized shares of Common Stock would be disproportionately large in relation to the Company’s outstanding Common Stock after the Reverse Stock Split. This could make it more difficult for the Company to obtain equity financing in the future because the Company would have the ability to significantly dilute equity investments at any time.

No Dissenters’ Rights

Under the DGCL, the Company’s stockholders are not entitled to dissenters’ rights with respect to the Amendment effecting the reduction in authorized shares of Common and Preferred Stock, and the Company will not independently provide stockholders with any such right.

Security Ownership of

Certain Beneficial Owners and Management

The following table sets forth certain information, as of June 16, 2018, with respect to the holdings of: (1) each person known to us to be the beneficial owner of more than 5% of our Common Stock; (2) each of our directors, nominees for director and named executive officers; and (3) all directors and executive officers as a group. To the best of our knowledge, each of the persons named in the table below as beneficially owning the shares set forth therein has sole voting power and sole investment power with respect to such shares, unless otherwise indicated. Applicable percentages are based upon 344,607,672 shares of Common Stock and 100 shares of Series A Preferred Stock outstanding as of June 16, 2018. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company, at the address of 757 Third Avenue, Suite 2110, New York, New York 10017.

|

Title of Class

|

Name and Address of

Beneficial Owner

|

Amount and

Nature of

Beneficial Owner

|

Percent of

Class

|

|

Common Stock

|

|

|

|

|

As a Group

|

Officers and Directors (1 person)

|

301,611,865(1)

|

87.52%

|

|

|

|

|

|

|

As Individuals

|

Christos Traios

|

301,611,865(1)

|

87.52%

|

|

|

|

|

|

|

Series A Preferred Stock

|

|

|

|

|

As a Group

|

Officers and Directors (1 person)

|

100

|

100.00%

|

|

|

|

|

|

|

As Individuals

|

Christos Traios

|

100

|

100.00%

|

|

|

|

|

|

(1) Represents 281,611,865 shares of the Company’s Common Stock and 100 shares of the Company’s Series A Preferred Stock owned directly and 20,000,000 shares for which the beneficial owner holds irrevocable proxies to exercise voting rights with respect to such shares of Common Stock held by certain third party stockholders.

Stockholders Sharing the Same Last Name and Address

Some banks, brokers, and other record holders may participate in the practice of “householding” information statements. This means that, unless stockholders give contrary instructions, only one copy of this information statement may be sent to multiple stockholders sharing an address. The Company will promptly deliver a separate copy of this document to any stockholder at a shared address upon written or oral request by such stockholder at the following address or telephone number: Petrogress, Inc., 757 Third Avenue, Suite 2110, New York, New York 10017, Attn: Corporate Secretary, telephone (212) 376-5228. Any stockholder who wants to receive a separate copy of this information statement in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact such stockholder’s bank, broker, or other record holder, or contact the Company at the above address or telephone number.

A

DDITIONAL

INFORMATION

The Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website that contains reports and other information about issuers that file electronically with the SEC. The address of that website is www.sec.gov.

the Consenting Stockholder who ownS shares representing a majority of our Common Stock AND ALL OF OUR SERIES A PREFERRED SHARES HAS CONSENTED TO THE AMENDMENT EFFECTING THE REVERSE STOCK SPLIT. NO FURTHER VOTES OR PROXIES ARE NEEDED AND NONE ARE REQUESTED. THE BOARD IS NOT REQUESTING A PROXY FROM YOU AND YOU ARE REQUESTED NOT TO SEND A PROXY.

|

|

BY ORDER OF THE BOARD OF

DIRECTORS

|

|

|

|

|

|

/s/ Christos Traios

|

|

|

Christos Traios

|

|

|

President and Chief Executive Officer

|

|

|

|

New York, New York

June [__], 2018

APPENDIX A

CERTIFICATE OF AMENDMENT

TO

CERTIFICATE OF INCORPORATION

OF

PETROGRESS, INC.

(a Delaware corporation)

Petrogress, Inc. (the “

Corporation

”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “

DGCL

”), hereby certifies as follows:

1. This Certificate of Amendment (the “

Certificate of Amendment

”) amends the provisions of the Corporation's Certificate of Incorporation filed with the Secretary of State on November 16, 2016 (the “

Certificate of Incorporation

”).

2. The Board of Directors of the Corporation has duly adopted a resolution pursuant to Section 242 of the DGCL setting forth a proposed amendment to the Certificate of Incorporation and declaring said amendment to be advisable. The amendment amends the Certificate of Incorporation as follows:

The FOURTH paragraph of the Certificate of Incorporation is hereby deleted in its entirety and replaced with the following:

“FOURTH:

A.

Classes and Number of Shares

. The total number of shares of stock that the Corporation shall have authority to issue is Twenty Million (20,000,000). The classes and aggregate number of shares of each class which the Corporation shall have authority to issue are as follows:

1. Nineteen Million (19,000,000) shares of common stock, par value $0.001 per share (the “

Common Stock

”): and

2. One Million (1,000,000) shares of preferred stock, par value $0.001 per share (the “

Preferred Stock

”).

3. Effective as of 5:00 p.m. Eastern Time on [___________] (the “

Effective Time

”), each _______ (__) shares of Common Stock issued and outstanding immediately prior to the Effective Time (referred to in this paragraph as the ‘‘

Old Common Stock

’’) shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock (referred to in this paragraph as the ‘‘

New Common Stock

’’), subject to the treatment of fractional share interests as described below. Each holder of a certificate or certificates that immediately prior to the Effective Date represented outstanding shares of Old Common Stock (the ‘‘

Old Certificates

’’) will be entitled to receive, upon surrender of such Old Certificates to the Corporation for cancellation, a certificate or certificates (the ‘‘

New Certificate

,’’ whether one or more) representing the number of whole shares of the New Common Stock into which and for which the shares of the Old Common Stock formerly represented by such Old Certificates so surrendered are reclassified under the terms hereof. From and after the Effective Date, Old Certificates shall represent only the right to receive New Certificates pursuant to the provisions hereof. No certificates or scrip representing fractional share interests in New Common Stock will be issued. Stockholders who otherwise would be entitled to receive fractional shares of New Common Stock shall be entitled to receive cash (without interest or deduction) from the Corporation’s transfer agent in lieu of such fractional share interests upon the submission of a transmission letter by a stockholder holding the shares in book-entry form and, where shares are held in certificated form, upon the surrender of the stockholder’s Old Certificates, in an amount equal to the product obtained by multiplying (a) the average of the closing trading prices of the Common Stock, as reported on the OTC Pink tier of the OTC Markets Group, Inc., during the 20 consecutive trading days ending on the trading day immediately prior to the Effective Time, by (b) the fraction of one share of New Common Stock owned by the stockholder.

If more than one Old Certificate shall be surrendered at one time for the account of the same stockholder, the number of full shares of New Common Stock for which New Certificates shall be issued shall be computed on the basis of the aggregate number of shares represented by the Old Certificates so surrendered. In the event that the Company determines that a holder of Old Certificates has not tendered all his, her or its certificates for exchange, the Company shall carry forward any fractional share until all Old Certificates of that holder have been presented for exchange. The Old Certificates surrendered for exchange shall be properly endorsed and otherwise in proper form for transfer. From and after the Effective Time, the amount of capital represented by the shares of the New Common Stock into which and for which the shares of the Old Common Stock are reclassified under the terms hereof shall be an amount equal to the product of the number of issued and outstanding shares of New Common Stock and the $0.001 par value of each such share.

B.

Designations. Preferences. Voting Rights. Limitations and Relative Rights of

Holders of Stock

.

1.

Common Stock

. The terms of the Common Stock of the Corporation shall be as follows:

(a)

Dividends

. Whenever cash dividends upon the Preferred Shares of all series thereof at the time outstanding, to the extent of the preference to which such shares are entitled, shall have been paid in full for all past dividend periods, or declared and set apart for payment, such dividends, payable in cash or otherwise, as may be determined by the Board of Directors, may be declared by the Board of Directors and paid from time to time to the holders of the Common Stock out of the remaining net profits or surplus of the Corporation.

(b)

Liquidation

. In the event of any liquidation, dissolution, or winding up of the affairs of the Corporation, whether voluntary or involuntary, all assets and funds of the Corporation remaining after the payment to the holders of the Preferred Stock of all series thereof of the full amounts to which they shall be entitled as hereinafter provided, shall be divided and distributed among the holders of the Common Stock according to their respective shares.

(c)

Voting Rights

. Each holder of Common Stock shall have one vote in respect of each share of such stock held by him. There shall not be cumulative voting.

2.

Preferred Stock

. The Corporation may issue any class of the Preferred Stock in any series. The Board of Directors shall have authority to establish and designate series, and to fix the number of shares included in each such series and the variations in the relative rights, preferences and limitations as between series, provided that, if the stated dividends and amounts payable on liquidation are not paid in full, the shares of all series of the same class shall share ratably in the payment of dividends including accumulations, if any, in accordance with the sums which would be payable on such shares if all dividends were declared and paid in full, and in any distribution of assets other than by way of dividends in accordance with the sums which would be payable on such distribution if all sums payable were discharged in full. Shares of each such series when issued shall be designated to distinguish the shares of each series from shares of all other series.”

3. The requisite stockholders of the Corporation have duly approved this Certificate of Amendment in accordance with Section 242 of the DGCL.

4. This Certificate of Amendment shall be effective at 5:00 p.m. Eastern Time on [_____________].

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed as of the date set forth below.

|

Dated: [_____________]

|

PETROGRESS, INC.

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name: Christos Traios

|

|

|

|

Title: President and Chief Executive Officer

|

|

3

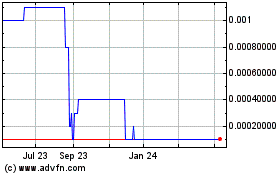

Petrogress (CE) (USOTC:PGAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

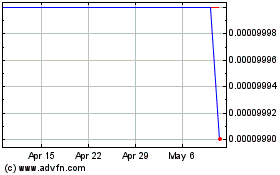

Petrogress (CE) (USOTC:PGAS)

Historical Stock Chart

From Apr 2023 to Apr 2024