Uncertainty Over Nafta Makes Market Worry More Acute

June 17 2018 - 10:29AM

Dow Jones News

By Ira Iosebashvili and Akane Otani

Escalating trade tensions are rattling markets as a new round of

tariffs raises investors' concerns about everything from U.S.-China

relations to the fate of the North American Free Trade

Agreement.

The mounting strains left investors struggling to understand the

sweeping ramifications of those conflicts, including their impact

on economies, interest rates, inflation and stock valuations.

President Donald Trump approved tariffs on about $50 billion of

Chinese goods Friday, prompting Chinese officials to hit back with

tariffs of their own.

The moves, which investors said exacerbated fears that the

world's two biggest economies could descend into a full trade war,

buffeted government bond yields and shares of agricultural and

industrial companies that could suffer under tighter trade

policies. Caterpillar Inc. slid 2%, while farm-machinery maker

Deere & Co. lost 1%, Boeing Co. fell 1.3% and United States

Steel Corporation declined 4.2%. Declines in industrial

heavyweights pulled the Dow Jones Industrial Average to its biggest

one-week slide since March.

Now, investors are debating whether financial markets that had

already been struggling for momentum this year will be able to

shake off an increasingly uncertain outlook for global trade and

growth.

While the U.S. economy continues to exhibit signs of strength,

investors and analysts say they are concerned about the rise of

restrictive trade policies because so much activity depends on

cross-border transactions. The feud over Nafta poses a particularly

acute manifestation of those fears. Mr. Trump, who has threatened

to withdraw entirely from the accord, removed the U.S. from the

Trans-Pacific Partnership as one of his first official acts in

office.

The move "would be a strong signal to the global community that

the U.S. is really embracing the America-first agenda," said Mark

McCormick, North American head of FX strategy at TD Securities.

"That's probably bad for globalization, bad for equities, bad for

risk."

Any signs that the deal might be replaced with bilateral

agreements between the U.S., Canada and Mexico would likely soothe

investors and take the edges off market moves, analysts said. On

the other hand, emerging-market currencies, commodities prices and

Mexican and Canadian assets could slide if it appeared that the

Nafta conflict was the prelude to an all-out global trade war.

Many investors and analysts fear that a U.S. withdrawal from

Nafta could further hamper a U.S. stock market that has struggled

to gain ground this year, denting profits for companies that

produce and export automobiles, agricultural goods -- including

corn, soybean and beef -- and industrial machinery.

Through Nafta, U.S. car manufacturers like Ford Motor Co. and

General Motors Co. have been able to shift production to Mexico,

where wages are typically lower. Some economists argue that without

access to lower-cost production hubs, the U.S. auto industry could

lose ground to competitors in Asia. The disruptions could also

cause foreign car makers to rethink their investments in U.S.

production facilities.

"These sort of linkages, which have given U.S. auto makers an

advantage in relation to China, would be much more difficult

without NAFTA's tariff reductions and protections for intellectual

property," a 2017 analysis by the Council on Foreign Relations

said.

Shares of agricultural and industrial firms could also take a

hit. The U.S. exported $43 billion worth of prepared food,

vegetables, fruit and other food and beverages and $85 billion

worth of machinery to Canada and Mexico last year, according to

federal data. Withdrawal from Nafta could squeeze profit margins at

companies like Constellation Brands Inc., which brews Corona and

Modelo beer in Mexico, as well as agricultural giants like Archer

Daniels Midland Co.

More broadly, some fear a U.S. exit from Nafta could trigger

tit-for-tat trade measures that weigh on an even wider range of

industries.

"Even if it ended up being replaced with something better for

the U.S., that would take time, which adds to uncertainty among

investors," said Karyn Cavanaugh, senior market strategist at Voya

Investment Management, who added that she would expect an immediate

pullback across the stock market.

Uncertainty over Nafta has already taken a toll on Mexican and

Canadian markets. Stocks in both countries have stagnated this

year, along with the S&P 500, which remains below its all-time

high hit January. The Mexican peso is down 4.7% against the dollar

this year, while Canada's currency has fallen 4.6%.

Alan Robinson, global portfolio adviser at RBC Wealth

Management, said his firm now sees a 25% chance that Nafta

negotiations will fail, up from 10% earlier in the year. Analysts

at Toronto-based Gluskin Sheff + Associates believe there is a 40%

chance the deal will fall apart and be replaced with bilateral

agreements.

"Do we assume cooler heads prevail? You try to be optimistic,

but we're talking about human beings here and human beings make

mistakes," said David Rosenberg, chief economist and strategist at

Gluskin Sheff.

(END) Dow Jones Newswires

June 17, 2018 10:14 ET (14:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

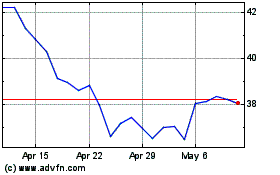

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

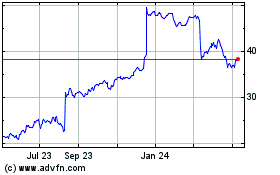

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024