Adobe Document Cloud Achieves Year-Over-Year Growth of 22

Percent

Adobe (Nasdaq:ADBE) today reported strong financial results for

its second quarter fiscal year 2018 ended June 1, 2018.

Financial Highlights

- Adobe achieved record quarterly revenue

of $2.20 billion in its second quarter of fiscal year 2018, which

represents 24 percent year-over-year revenue growth.

- Diluted earnings per share was $1.33 on

a GAAP-basis, and $1.66 on a non-GAAP basis.

- Digital Media segment revenue was $1.55

billion, with Creative revenue growing to $1.30 billion and

Document Cloud achieving record revenue of $243 million, which

represents 22 percent year-over-year growth.

- Digital Media Annualized Recurring

Revenue (“ARR”) grew to $6.06 billion exiting the quarter, a

quarter-over-quarter increase of $343 million. Creative ARR grew to

$5.37 billion, and Document Cloud ARR grew to $694 million.

- Digital Experience segment revenue was

$586 million, which represents 18 percent year-over-year

growth.

- Operating income grew 39 percent and

net income grew 77 percent year-over-year on a GAAP-basis;

operating income grew 33 percent and net income grew 62 percent

year-over-year on a non-GAAP basis.

- Cash flow from operations was $976

million, and deferred revenue grew 27 percent year-over-year to

approximately $2.63 billion.

- Adobe repurchased approximately 2.6

million shares during the quarter, returning $589 million of cash

to stockholders.

A reconciliation between GAAP and non-GAAP results is provided

at the end of this press release and on Adobe’s website.

Executive Quotes

"Adobe delivers all the capabilities to enable transformative

digital experiences, including content creation and management,

predictive analytics and commerce," said Shantanu Narayen,

president and CEO, Adobe. "Our record results in Q2 reflect

continued execution against this significant opportunity where

Adobe is the clear market leader."

“Adobe delivered record revenue with strong earnings and cash

flow, and we expect our momentum to continue in the second half of

fiscal 2018," said John Murphy, executive vice president and CFO,

Adobe.

Adobe to Webcast Earnings Conference Call

Adobe will webcast its second quarter fiscal year 2018 earnings

conference call today at 2 p.m. Pacific Time from its investor

relations website: www.adobe.com/ADBE. Earnings documents,

including Adobe management’s prepared conference call remarks with

slides, financial targets and an investor datasheet are posted to

Adobe’s investor relations website in advance of the conference

call for reference. A reconciliation between GAAP and non-GAAP

earnings results and financial targets is also provided on the

website.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements,

including those related to business momentum, our market

opportunity, revenue, annualized recurring revenue, non-operating

other expense, tax rate on a GAAP and non-GAAP basis, earnings per

share on a GAAP and non-GAAP basis, and share count, all of which

involve risks and uncertainties that could cause actual results to

differ materially. Factors that might cause or contribute to such

differences include, but are not limited to: failure to develop,

acquire, market and offer products and services that meet customer

requirements, failure to compete effectively, introduction of new

technology, complex sales cycles, risks related to the timing of

revenue recognition from our subscription offerings, fluctuations

in subscription renewal rates, potential interruptions or delays in

hosted services provided by us or third parties, risks associated

with cyber-attacks, information security and privacy, failure to

realize the anticipated benefits of past or future acquisitions,

changes in accounting principles and tax regulations, uncertainty

in the financial markets and economic conditions in the countries

where we operate, and other various risks associated with being a

multinational corporation. For a discussion of these and other

risks and uncertainties, please refer to Adobe’s Annual Report on

Form 10-K for our fiscal year 2017 ended Dec. 1, 2017, and Adobe's

Quarterly Reports on Form 10-Q issued in fiscal year 2018.

The financial information set forth in this press release

reflects estimates based on information available at this time.

These amounts could differ from actual reported amounts stated in

Adobe’s Quarterly Report on Form 10-Q for our quarter ended June 1,

2018, which Adobe expects to file in June 2018.

Adobe assumes no obligation to, and does not currently intend

to, update these forward-looking statements.

About Adobe

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2018 Adobe Systems Incorporated. All rights reserved. Adobe,

Adobe Document Cloud and the Adobe logo are either registered

trademarks or trademarks of Adobe Systems Incorporated in the

United States and/or other countries. All other trademarks are the

property of their respective owners.

Condensed Consolidated Statements of

Income

(In thousands, except per share data;

unaudited)

Three Months Ended Six Months

Ended June 1, 2018 June 2,

2017 June 1, 2018 June 2,

2017 Revenue: Subscription $ 1,923,131 $ 1,483,690 $

3,716,489 $ 2,867,546 Product 150,993 171,545 322,601 354,930

Services and support 121,236 116,955 235,217

231,360 Total revenue 2,195,360 1,772,190

4,274,307 3,453,836 Cost of revenue:

Subscription 186,355 142,734 351,040 283,915 Product 10,779 15,488

23,656 29,821 Services and support 84,210 81,138

165,550 162,961 Total cost of revenue 281,344

239,360 540,246 476,697 Gross profit

1,914,016 1,532,830 3,734,061 2,977,139 Operating expenses:

Research and development 374,128 299,401 722,897 584,478 Sales and

marketing 646,215 553,098 1,227,172 1,073,395 General and

administrative 178,040 156,929 348,480 307,737 Amortization of

purchased intangibles 17,149 19,320 34,295

38,448 Total operating expenses 1,215,532 1,028,748

2,332,844 2,004,058 Operating income

698,484 504,082 1,401,217 973,081 Non-operating income

(expense): Interest and other income (expense), net 11,599 5,154

28,271 12,360 Interest expense (20,363 ) (18,347 ) (40,262 )

(36,477 ) Investment gains (losses), net 1,079 1,729

4,075 4,286 Total non-operating income (expense), net

(7,685 ) (11,464 ) (7,916 ) (19,831 ) Income before income taxes

690,799 492,618 1,393,301 953,250 Provision for income taxes 27,632

118,228 147,058 180,414 Net income $

663,167 $ 374,390 $ 1,246,243 $ 772,836

Basic net income per share $ 1.35 $ 0.76 $ 2.53

$ 1.56 Shares used to compute basic net income per

share 491,914 494,371 491,993 494,492

Diluted net income per share $ 1.33 $ 0.75 $ 2.50

$ 1.54 Shares used to compute diluted net income per

share 498,252 500,351 499,166 501,032

Condensed Consolidated Balance

Sheets

(In thousands, except par value;

unaudited)

June 1, 2018 December 1, 2017

ASSETS Current assets: Cash and cash equivalents $ 2,987,986

$ 2,306,072 Short-term investments 3,346,078 3,513,702 Trade

receivables, net of allowances for doubtful accounts of $9,869 and

$9,151, respectively 1,074,877 1,217,968 Prepaid expenses and other

current assets 332,503 210,071 Total current assets

7,741,444 7,247,813 Property and equipment, net 993,486

936,976 Goodwill 5,823,792 5,821,561 Purchased and other

intangibles, net 320,478 385,658 Deferred income taxes 117,970 —

Other assets 166,234 143,548 Total assets $

15,163,404 $ 14,535,556 LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Trade payables $

117,194 $ 113,538 Accrued expenses 1,030,367 993,773 Income taxes

payable 37,933 14,196 Deferred revenue 2,543,462 2,405,950

Total current liabilities 3,728,956 3,527,457

Long-term liabilities: Debt 1,874,057 1,881,421 Deferred revenue

90,805 88,592 Income taxes payable 611,509 173,088 Deferred income

taxes — 279,941 Other liabilities 152,494 125,188

Total liabilities 6,457,821 6,075,687 Stockholders’ equity:

Preferred stock, $0.0001 par value; 2,000 shares authorized — —

Common stock, $0.0001 par value 61 61 Additional paid-in-capital

5,354,175 5,082,195 Retained earnings 10,471,066 9,573,870

Accumulated other comprehensive income (loss) (129,230 ) (111,821 )

Treasury stock, at cost (110,399 and 109,572, respectively), net of

reissuances (6,990,489 ) (6,084,436 ) Total stockholders’ equity

8,705,583 8,459,869 Total liabilities and

stockholders’ equity $ 15,163,404 $ 14,535,556

Condensed Consolidated Statements of

Cash Flows

(In thousands; unaudited)

Three Months Ended June 1, 2018

June 2, 2017 Cash flows from operating activities:

Net income $ 663,167 $ 374,390 Adjustments to reconcile net income

to net cash provided by operating activities: Depreciation,

amortization and accretion 76,360 81,635 Stock-based compensation

144,322 116,049 Unrealized investment (gains) losses, net (573 )

(1,579 ) Changes in deferred revenue 62,063 14,746 Changes in other

operating assets and liabilities 31,067 59,586 Net

cash provided by operating activities 976,406 644,827

Cash flows from investing activities: Purchases, sales and

maturities of short-term investments, net 131,896 (30,079 )

Purchases of property and equipment (45,316 ) (55,297 ) Purchases

and sales of long-term investments, intangibles and other assets,

net (4,287 ) (2,171 ) Acquisitions, net of cash (14,614 ) —

Net cash provided by (used for) investing activities 67,679

(87,547 ) Cash flows from financing activities: Purchases of

treasury stock (700,000 ) (300,000 ) Taxes paid related to net

share settlement of equity awards, net of proceeds from treasury

stock reissuances (16,854 ) (13,788 ) Repayment of capital lease

obligations (511 ) (644 ) Net cash used for financing activities

(717,365 ) (314,432 ) Effect of exchange rate changes on cash and

cash equivalents (5,715 ) 5,206 Net increase in cash and

cash equivalents 321,005 248,054 Cash and cash equivalents at

beginning of period 2,666,981 1,068,896 Cash and cash

equivalents at end of period $ 2,987,986 $ 1,316,950

Non-GAAP Results

(In thousands, except per share data)

The following tables show Adobe's GAAP

results reconciled to non-GAAP results included in this

release.

Three Months Ended June 1, 2018

June 2, 2017 March 2, 2018

Operating income: GAAP operating income $ 698,484 $ 504,082

$ 702,733 Stock-based and deferred compensation expense 146,773

118,591 136,414 Restructuring and other charges — (97 ) —

Amortization of purchased intangibles 32,378 36,556

31,704 Non-GAAP operating income $ 877,635 $ 659,132

$ 870,851 Net income: GAAP net income $

663,167 $ 374,390 $ 583,076 Stock-based and deferred compensation

expense 146,773 118,591 136,414 Restructuring and other charges —

(97 ) — Amortization of purchased intangibles 32,378 36,556 31,704

Investment (gains) losses, net (1,079 ) (1,729 ) (2,996 ) Income

tax adjustments (15,812 ) (17,419 ) 23,987 Non-GAAP net

income $ 825,427 $ 510,292 $ 772,185

Diluted net income per share: GAAP diluted net income per

share $ 1.33 $ 0.75 $ 1.17 Stock-based and deferred compensation

expense 0.29 0.23 0.27 Amortization of purchased intangibles 0.06

0.07 0.06 Income tax adjustments (0.02 ) (0.03 ) 0.05

Non-GAAP diluted net income per share $ 1.66 $ 1.02 $

1.55 Shares used in computing diluted net income per

share 498,252 500,351 499,433

Three Months Ended June 1, 2018

Effective income tax rate: GAAP effective income tax rate

4.0 % Trading structure change 6.0 Impacts of the Tax Act (3.0 )

Income tax adjustments (2.0 ) Non-GAAP effective income tax rate*

5.0 %

_________________________________________

* The GAAP effective income tax rate of 4% is

the rate for the quarter based on tax events within the quarter.

Income tax adjustments, which are included in both GAAP and

non-GAAP earnings, will fluctuate from quarter-to-quarter but will

normalize over the fiscal year due to the timing of tax events

including the timing of recognition of excess tax benefits within

each quarter.

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information as well

as non-GAAP measures, which may exclude items such as stock-based

and deferred compensation expenses, restructuring and other

charges, amortization of purchased intangibles and certain activity

in connection with technology license arrangements, investment

gains and losses, the related tax impact of all of these items,

income tax adjustments, and the income tax effect of the non-GAAP

pre-tax adjustments from the provision for income taxes. Adobe uses

these non-GAAP measures in order to assess the performance of

Adobe's business and for planning and forecasting in subsequent

periods. Whenever such a non-GAAP measure is used, Adobe provides a

reconciliation of the non-GAAP financial measure to the most

closely applicable GAAP financial measure. Investors are encouraged

to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measure as detailed above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180614006075/en/

AdobeInvestor Relations ContactMike Saviage,

408-536-4416ir@adobe.comorPublic

Relations ContactDan Berthiaume, 408-536-2584dberthia@adobe.com

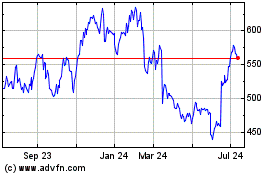

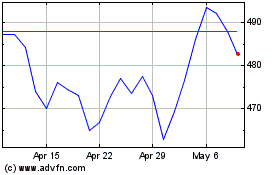

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024