FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2018

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing

the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate

below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table of Contents

|

Item

|

|

|

|

|

|

1.

|

Press Release dated June 12, 2018

|

|

|

|

Item 1

Rating

Action:

Moody's assigns Counterparty Risk Ratings to 15 Indian banks

12 Jun 2018

Singapore, June 12, 2018 -- Moody's Investors Service

has today assigned Counterparty Risk Ratings (CRRs) to 15 rated banks and their branches, as applicable.

The 15 Indian banks comprise: 1) Axis Bank Ltd,

2) Bank of Baroda, 3) Bank of India, 4) Canara Bank, 5) Central Bank of India, 6) HDFC Bank Limited, 7) ICICI Bank Limited, 8)

IDBI Bank Ltd, 9) Indian Overseas Bank, 10) Oriental Bank of Commerce, 11) Punjab National Bank, 12) State Bank of India, 13)

Syndicate Bank, 14) Union Bank of India, and 15) Yes Bank Limited.

At the same time, Moody's has upgraded the Counterparty

Risk Assessments (CR Assessments) of Axis Bank Ltd, Bank of Baroda, ICICI Bank Limited and their branches, as applicable to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr). The CR assessment of Punjab National Bank was upgraded to Baa3(cr)/P-3(cr) from Ba1(cr)/NP(cr).

Moody's Counterparty Risk Ratings are

opinions of the ability of entities to honor the uncollateralized portion of non-debt counterparty financial liabilities (CRR

liabilities) and also reflect the expected financial losses in the event that such liabilities are not honored. CRR

liabilities typically relate to transactions with unrelated parties. Examples of CRR liabilities include the uncollateralized

portion of payables arising from derivatives transactions and the uncollateralized portion of liabilities under sale and

repurchase agreements. CRRs are not applicable to funding commitments or other obligations associated with covered bonds,

letters of credit, guarantees, servicer and trustee obligations, and other similar obligations that arise from a bank

performing its essential operating functions.

RATINGS RATIONALE

The CRRs assigned to the 15 Indian banks are in line

with the CR Assessments.

Because Moody's considers that India (Baa2 stable)

does not have an operational resolution regime, in assigning CRRs to the Indian banks subject to these rating actions, Moody's

applies its basic Loss Given Failure (LGF) approach. Moody's basic LGF analysis positions CRRs in line with the bank's CRA, one

notch above the banks' adjusted BCAs, prior to government support.

The CRR also incorporates between zero to three

notches of uplift due to Moody's assessment of government support for the 15 banks in times of need, based on the banks' systemic

importance India. The uplifts are in line with those applied to the CR Assessments.

OUTLOOK

CRRs do not carry outlooks.

AXIS BANK - WHAT COULD CHANGE THE RATING UP

Moody's could upgrade Axis Bank's deposit ratings

if Moody's upgrades the bank's BCA. Nevertheless, Moody's could revise the ratings outlook to positive if the bank is able to improve

its asset quality and profitability profile on a sustained basis or its capital position significantly strengthens.

AXIS BANK - WHAT COULD CHANGE THE RATING DOWN

Axis Bank's BCA could be downgraded if: (1) the

bank's nonperforming loan (NPL) ratio deteriorates significantly from current levels, (2) a decline in earnings leads to a significant

decrease in its internal capital generation, or (3) there is a material weakening of its capital from current levels. Moody's could

also downgrade the deposit ratings if Moody's downgrades the Government of India's sovereign rating.

BANK OF BARODA - WHAT COULD CHANGE THE RATING UP

Given the stable ratings outlook, Bank of

Baroda's ratings are unlikely to face upward pressure over the next 12-18 months. Nevertheless, Moody's could revise the

ratings outlook to positive if the bank is able to improve

its profitability profile on a sustained basis

or its capital position significantly strengthens.

BANK OF BARODA - WHAT COULD CHANGE THE RATING DOWN

Bank of Baroda's ratings could be downgraded if

further credit losses worsen the bank's capital position. Any indication of diminishing government support to levels below what

Moody's expect could also lead to a downgrade of the bank's ratings.

BANK OF INDIA - WHAT COULD CHANGE THE RATING UP

Given the stable ratings outlook, Bank of India's

ratings are unlikely to face upward pressure over the next 12-18 months. Nevertheless, Moody's could revise the outlook to positive

if the bank returns to profitability on a sustained basis, which will help in internal capital generation.

BANK OF INDIA - WHAT COULD CHANGE THE RATING DOWN

Bank of India's BCA and ratings

could face downward pressure if further credit losses worsen the bank's capital position. Any indication that government support

has diminished for the bank could also lead to a downgrade of the bank's ratings.

CANARA BANK - WHAT COULD CHANGE THE RATING UP

Given the stable ratings outlook, Canara Bank's ratings

are unlikely to face upward pressure over the next 12-18 months. Nevertheless, Moody's could revise the outlook to positive if

the bank is able to improve its overall asset quality or improve its profitability profile on a sustained basis.

CANARA BANK - WHAT COULD CHANGE THE RATING DOWN

Canara Bank's ratings could face downward pressure,

if further credit losses worsen its capital position. Any indication that government support has diminished to levels below what

Moody's expects could also lead to a downgrade of the bank's ratings.

CENTRAL BANK OF INDIA - WHAT COULD CHANGE THE RATING

UP

Given the positive ratings outlook, Moody's could

upgrade Central Bank of India's ratings over the next 12-18 months, if the capital infusion from the Indian government helps strengthen

the bank's capital to a level above minimum regulatory requirements (including the capital conservation buffer) under Basel III

standards, or the bank returns to profitability on a sustainable basis.

CENTRAL BANK OF INDIA - WHAT COULD CHANGE THE RATING

DOWN

Downward pressure on Central Bank of India's ratings

will emerge if further credit losses worsen the bank's capital position. Any indication that government support has diminished

to levels below what Moody's expects in this rating action could also lead to a ratings downgrade.

HDFC BANK LIMITED - WHAT COULD CHANGE THE RATING UP

Moody's could upgrade HDFC Bank Limited's senior unsecured

debt and deposit ratings if Moody's upgrades India's sovereign rating.

HDFC BANK LIMITED - WHAT COULD CHANGE THE RATING DOWN

Downward pressure on HDFC Bank's BCA could arise

from: (1) a sustained deterioration in impaired loans or loan-loss reserves; (2) a significantly higher new NPL formation rate

than previously experienced; (3) a decline in earnings, leading to a significant decrease in internal capital generation; or (4)

a downgrade in the sovereign foreign-currency debt rating.

ICICI BANK LIMITED - WHAT COULD CHANGE THE RATING UP

Moody's could upgrade ICICI Bank Limited's deposit

ratings if Moody's upgrades both the bank's BCA and the Government of India's sovereign rating. Nevertheless, Moody's could revise

the ratings outlook to positive if the bank is able to improve its asset quality and profitability profile on a sustained basis

or its capital position significantly strengthens.

ICICI BANK LIMITED - WHAT COULD CHANGE THE RATING DOWN

ICICI Bank's BCA could be

downgraded if: (1) the bank's NPL ratio deteriorates significantly from the current level, or (2) a decline in earnings leads to

a significant decrease in internal capital generation. Moody's could also downgrade the deposit ratings if Moody's downgrades India's

sovereign rating.

IDBI BANK LTD - WHAT COULD CHANGE THE RATING UP

Given the positive outlook, Moody's could upgrade

IDBI Bank's ratings over the next 12-18 months, if the government capital infusion helps strengthen the bank's capital to a level

above minimum regulatory requirements (including the capital conservation buffer) under Basel III standards, or the bank returns

to profitability on a sustained basis.

IDBI BANK LTD - WHAT COULD CHANGE THE RATING DOWN

Downward pressure on IDBI

Bank's ratings will emerge if further credit losses worsen its capital position. Any indication that government support has diminished

to levels below what Moody's expects in this rating action could also lead to a ratings downgrade.

INDIAN OVERSEAS BANK - WHAT COULD CHANGE THE RATING

UP

Given the positive outlook, Moody's could upgrade

Indian Overseas Bank's ratings over the next 12-18 months if: (1) the government capital infusion helps strengthen the bank's capital

to a level above minimum regulatory requirements (including a capital conservation buffer) under Basel III standards, or (2) the

bank returns to profitability on a sustained basis.

INDIAN OVERSEAS BANK - WHAT COULD CHANGE THE RATING

DOWN

Downward pressure on Indian Overseas Bank's ratings

will emerge if further credit losses worsen the bank's capital position. Any indication that government support has diminished

to levels below what Moody's expects in this rating action could also lead to a rating downgrade.

ORIENTAL BANK OF COMMERCE - WHAT COULD CHANGE THE RATING

UP

Given the stable outlook, Oriental Bank of Commerce's

ratings are unlikely to face upward pressure over the next 12-18 months. Nevertheless, Moody's could revise the ratings outlook

to positive if the bank returns to profitability on a sustained basis, which will help in internal capital generation.

ORIENTAL BANK OF COMMERCE - WHAT COULD CHANGE THE RATING

DOWN

Moody's could downgrade Oriental Bank of Commerce's

BCA and ratings if further credit losses worsen the bank's capital position. Any indication that government support has diminished

for the bank could also lead to a downgrade of the bank's ratings.

PUNJAB NATIONAL BANK - WHAT COULD CHANGE THE RATING

UP

Moody's could upgrade Punjab National Bank's BCA

and ratings if the capital infusion received from the Government of India or any actions taken by management improves the bank's

capitalization to a level that is in line with that of its higher-rated Indian peers.

PUNJAB NATIONAL BANK - WHAT COULD CHANGE THE RATING

DOWN

Moody's will downgrade Punjab

National Bank's BCA and ratings if the bank's capitalization worsens to levels below what Moody's currently expects. Any indication

that government support to the bank has diminished will also lead to a rating downgrade.

STATE BANK OF INDIA - WHAT COULD CHANGE THE RATING

UP

Moody's could upgrade State

Bank of India's senior unsecured debt and deposit ratings if Moody's upgrades India's sovereign rating, given Moody's expectation

of a very high level of government support to the bank in times of need.

STATE BANK OF INDIA - WHAT COULD CHANGE THE RATING

DOWN

Downward pressure on State Bank of India's BCA

will arise if further credit losses worsen its capital position. Additionally, any indications that support from the Indian government

has diminished or that additional capital requirements may arise beyond the government's budgeted amount could put the bank's deposit

and senior unsecured debt ratings under pressure.

A downgrade of India's sovereign rating or any

downward changes in the sovereign's ceilings will also negatively affect the bank's deposit and senior unsecured debt ratings.

SYNDICATE BANK - WHAT COULD CHANGE THE RATING UP

Moody's could upgrade Syndicate Bank's ratings

if the bank is able to improve its profitability on a sustained basis or its capital position is strengthened significantly by

way of external capital.

SYNDICATE BANK - WHAT COULD CHANGE THE RATING DOWN

Syndicate Bank's ratings

would face downward pressure if further credit losses worsened the bank's capital position. Any indication of government support

diminishing to levels below Moody's expectations could also lead to a downgrade of the bank's ratings.

UNION BANK OF INDIA - WHAT COULD CHANGE THE RATING

UP

Given the stable ratings outlook, Union Bank

of India's ratings are unlikely to face upward pressure over the next 12-18 months. Nevertheless, Moody's could revise the ratings

outlook to positive if the bank returns to profitability on a sustained basis, which will help in internal capital generation.

UNION BANK OF INDIA - WHAT COULD CHANGE THE RATING

DOWN

Moody's could downgrade Union Bank's BCA and ratings

if further credit losses worsen its capital position. Any indication that government support for the bank has diminished could

also lead to a downgrade of the bank's ratings.

YES BANK LIMITED - WHAT COULD CHANGE THE RATING UP

Upward pressure on Yes Bank's BCA could develop

if: (1) the bank maintains its current asset quality ratios, while reducing its credit risk concentration to large borrowers; (2)

the bank's funding profile improves, for example, by growing its proportion of CASA/total deposits to levels in line with the industry

average, without adversely affecting its net interest margin; and (3) the bank sustains its profitability and maintains adequate

loss-absorbing buffers.

YES BANK LIMITED - WHAT COULD CHANGE THE RATING DOWN

A downward revision of India's sovereign rating

could lead to a downgrade in Yes Bank's deposit rating. Downward pressure on the bank's BCA could develop from: (1) a sustained

deterioration in impaired loans or loan-loss reserves, or if the rate of new NPL formation is significantly higher than previously

experienced; or (2) a decline in earnings, which would lead to a significant decrease in internal capital generation.

List of affected ratings/inputs:

Axis Bank Ltd:

Assigned Local currency long-term Counterparty

Risk Rating of Baa2.

Assigned Local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

Axis Bank Ltd, Singapore Branch:

Assigned Local currency long-term Counterparty

Risk Rating of Baa2.

Assigned Local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr) Axis Bank Limited, Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

Axis Bank Limited, DIFC Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

Bank of Baroda:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

Bank of Baroda (London):

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

Bank of India:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Bank of India (London):

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Bank of India,

Jersey Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Canara Bank:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Canara Bank, London

Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Central Bank of

India:

Assigned local currency

long-term Counterparty Risk Rating of Ba2.

Assigned local currency short-term Counterparty Risk Rating of NP.

HDFC Bank Limited:

Assigned local currency

long-term Counterparty Risk Rating of Baa1.

Assigned local currency short-term Counterparty Risk Rating of P-2.

HDFC Bank Limited,

Bahrain Branch:

Assigned local currency

long-term Counterparty Risk Rating of Ba1.

Assigned local currency short-term Counterparty Risk Rating of NP.

HDFC Bank Limited,

Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa1.

Assigned local currency short-term Counterparty Risk Rating of P-2.

ICICI Bank Limited:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

ICICI Bank Limited, Bahrain Branch:

Assigned local currency

long-term Counterparty Risk Rating of Ba1.

Assigned local currency short-term Counterparty Risk Rating of NP.

ICICI Bank Limited,

Dubai Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

ICICI Bank Limited, Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

ICICI BANK LIMITED, NEW YORK BRANCH:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

ICICI Bank Ltd, Singapore Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

Counterparty risk assessment upgraded to Baa2(cr)/P-2(cr)

from Baa3(cr)/P-3(cr)

IDBI Bank Ltd:

Assigned local currency

long-term Counterparty Risk Rating of Ba3.

Assigned local currency

short-term Counterparty Risk Rating of NP.

IDBI Bank Ltd, DIFC Branch:

Assigned local currency

long-term Counterparty Risk Rating of Ba3.

Assigned local currency short-term Counterparty Risk Rating of NP.

Indian Overseas Bank:

Assigned local currency

long-term Counterparty Risk Rating of Ba2.

Assigned local currency short-term Counterparty Risk Rating of NP.

Indian Overseas Bank,

Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Ba2.

Assigned local currency short-term Counterparty Risk Rating of NP.

Oriental Bank of

Commerce:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Punjab National

Bank:

Assigned local currency long-term Counterparty

Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Counterparty risk assessment upgraded

to Baa3(cr)/P-3(cr) from Ba1(cr)/NP(cr)

State Bank of India:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

State Bank of India,

DIFC Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

State Bank of India,

Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

State Bank of India,

London Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2.

State Bank of India,

Nassau Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa2.

Assigned local currency short-term Counterparty Risk Rating of P-2. Syndicate Bank:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Syndicate Bank,

London Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Union Bank of India:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Union Bank of India,

Hong Kong Branch:

Assigned local currency

long-term Counterparty Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

Yes Bank Limited:

Assigned local currency long-term Counterparty

Risk Rating of Baa3.

Assigned local currency short-term Counterparty Risk Rating of P-3.

The principal

methodology used in these ratings was Banks published June 2018. Please see the Rating Methodologies page on www.moodys.com

for a copy of this methodology.

Axis Bank Ltd, headquartered in Mumbai, reported

total assets of INR6.9 trillion (USD106 billion) at 31 March 2018.

Bank of Baroda, headquartered in Baroda (Gujarat),

reported total assets of INR7.2 trillion (USD111 billion) at 31 March 2018.

Bank of India, headquartered in Mumbai, reported

total assets of INR6.1 trillion (USD94 billion) at 31 March 2018.

Canara Bank, headquartered in Bangalore,

reported total assets of INR6.2 trillion (USD95 billion) at 31 March 2018.

Central Bank of India, headquartered in Mumbai,

reported total assets of INR3.3 trillion (UD$50 billion) at 31 March 2018.

HDFC Bank Limited, headquartered in Mumbai,

reported total assets of INR10.6 trillion (USD163 billion) 31 March 2018.

ICICI Bank Limited, headquartered in Mumbai,

reported total assets of INR8.8 trillion (USD135 billion) at 31 March 2018.

IDBI Bank Ltd, headquartered in Mumbai, reported

total assets of INR3.5 trillion (USD54 billion) at 31 March 2018.

Indian Overseas Bank, headquartered in Chennai,

reported total assets of INR2.5 trillion (USD38 billion) 31 March 2018.

Oriental Bank of Commerce, headquartered in New

Delhi, reported total assets of INR2.3 trillion (USD36 billion) 31 March 2018.

Punjab National Bank, headquartered in New

Delhi, reported total assets of INR7.7 trillion (USD118 billion) 31 March 2018.

State Bank of India, headquartered

in Mumbai, reported total assets of INR34.5 trillion (USD531 billion) 31

March 2018.

Syndicate Bank, headquartered in Bangalore, reported total assets

of INR3.2 trillion (USD50 billion) at 31 March 2018.

Union Bank of India, headquartered in Mumbai, reported total assets

of INR4.9 trillion (USD75 billion) 31 March 2018.

Yes Bank Limited, headquartered in Mumbai, reported total assets

of INR3.1 trillion (USD48 billion) 31 March 2018.

REGULATORY DISCLOSURES

For ratings issued on a program, series or category/class

of debt, this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or

note of the same series or category/class of debt or pursuant to a program for which the ratings are derived exclusively from existing

ratings in accordance with Moody's rating practices. For ratings issued on a support provider, this announcement provides certain

regulatory disclosures in relation to the credit rating action on the support provider and in relation to each particular credit

rating action for securities that derive their credit ratings from the support provider's credit rating. For provisional ratings,

this announcement provides certain regulatory disclosures in relation to the provisional rating assigned, and in relation to a

definitive rating that may be assigned subsequent to the final issuance of the debt, in each case where the transaction structure

and terms have not changed prior to the assignment of the definitive rating in a manner that would have affected the rating. For

further information please see the ratings tab on the issuer/entity page for the respective issuer on www.moodys.com.

For any affected securities or rated entities

receiving direct credit support from the primary entity(ies) of this credit rating action, and whose ratings may change as a result

of this credit rating action, the associated regulatory disclosures will be those of the guarantor entity. Exceptions to this approach

exist for the following disclosures, if applicable to jurisdiction: Ancillary Services, Disclosure to rated entity, Disclosure

from rated entity.

Regulatory disclosures contained in this press

release apply to the credit rating and, if applicable, the related rating outlook or rating review.

The below contact information

is provided for information purposes only. Please see the ratings tab of the issuer page at www.moodys.com, for each of the ratings

covered, Moody's disclosures on the lead rating analyst and the Moody's legal entity that has issued the ratings.

Please see www.moodys.com for any updates on changes

to the lead rating analyst and to the Moody's legal entity that has issued the rating.

Please see the ratings tab on the issuer/entity

page on www.moodys.com for additional regulatory disclosures for each credit rating.

Alka Anbarasu

VP - Senior Credit Officer

Financial Institutions Group

Moody's Investors Service Singapore Pte. Ltd.

50 Raffles Place #23-06

Singapore Land Tower

Singapore 48623

Singapore

JOURNALISTS: 852 3758 1350

Client Service: 852 3551 3077

Graeme Knowd

MD - Banking

Financial Institutions Group

JOURNALISTS: 81 3 5408 4110

Client Service: 81 3 5408 4100

Releasing Office:

Moody's Investors Service Singapore Pte. Ltd.

50 Raffles Place #23-06

Singapore Land Tower

Singapore 48623

Singapore

JOURNALISTS: 852 3758 1350

Client Service: 852 3551 3077

© 2018 Moody’s Corporation, Moody’s

Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”).

All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC.

AND ITS RATINGS AFFILIATES (“MIS”) ARE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF

ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MOODY’S PUBLICATIONS MAY INCLUDE MOODY’S

CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES.

MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME

DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT

LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY’S OPINIONS INCLUDED IN

MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE

QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS,

INC. CREDIT RATINGS AND MOODY’S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT

RATINGS AND MOODY’S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR

SECURITIES. NEITHER CREDIT RATINGS NOR MOODY’S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY

PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY’S PUBLICATIONS WITH THE EXPECTATION

AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER

CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS AND MOODY’S PUBLICATIONS

ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S

CREDIT RATINGS OR MOODY’S PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL

OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY

LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED,

FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN

WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT.

CREDIT RATINGS AND MOODY’S

PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR REGULATORY PURPOSES AND MUST NOT

BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by

MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error

as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind.

MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and

from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S

is not an auditor and cannot in every instance independently verify or validate information received

in the rating process or in preparing the Moody’s

publications.

To the extent permitted by law, MOODY’S and

its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity

for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information

contained herein or the use of or inability to use any such information, even if MOODY’S or any of its directors, officers,

employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages,

including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant

financial instrument is not the subject of a particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and

its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful

misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency

within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising

from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY,

TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION

IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned

credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities

(including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors

Service, Inc. have, prior to assignment of any rating, agreed to pay to Moody’s Investors Service, Inc. for appraisal and

rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures

to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist

between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to

the SEC an ownership interest in MCO of more than 5%, is posted annually at

www.moodys.com

under the heading “Investor Relations — Corporate Governance — Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia

of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors

Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569

(as applicable). This document is intended to be provided only to “wholesale clients” within the meaning of section

761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S

that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor

the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients”

within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness

of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail

investors. It would be reckless and inappropriate for retail investors to use MOODY’S credit ratings or publications when

making an investment decision. If in doubt you should contact your financial or other professional adviser.

Additional terms for Japan only: Moody's Japan K.K.

(“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by

Moody’s Overseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a

wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally Recognized Statistical Rating Organization

(“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are

assigned by an entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of

treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered with the Japan Financial Services Agency and

their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that

most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any rating, agreed to pay to MJKK or MSFJ (as applicable)

for appraisal and rating services rendered by it fees ranging from JPY200,000 to approximately JPY350,000,000.

MJKK and MSFJ also maintain policies and procedures

to address Japanese regulatory requirements.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorised.

|

|

|

For

ICICI Bank Limited

|

|

|

|

|

|

Date:

|

June 13, 2018

|

|

By:

|

/s/ Shanthi Venkatesan

|

|

|

|

|

|

|

|

|

|

|

|

Name :

|

Ms. Shanthi Venkatesan

|

|

|

|

|

|

Title :

|

Deputy General Manager

|

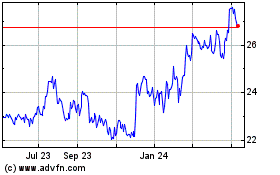

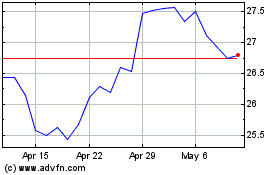

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024