Current Report Filing (8-k)

June 11 2018 - 4:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 7, 2018

MEDICAL PROPERTIES TRUST, INC.

MPT OPERATING PARTNERSHIP, L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Maryland

Delaware

|

|

001-32559

333-177186

|

|

20-0191742

20-0242069

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

1000 Urban Center Drive, Suite 501

|

|

|

|

Birmingham, AL

|

|

35242

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(205) 969-3755

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act

(17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 7, 2018, affiliates of Medical

Properties Trust, Inc. and MPT Operating Partnership, L.P. (together with their consolidated subsidiaries, the “Company”) entered into a subscription agreement (the “Subscription Agreement”) with Primotop Holding S.à.r.l.

(“Primotop”), a company managed by an entity of the Primonial group pursuant to which Primotop will acquire a 50% interest by way of a joint venture in the real estate of 71 post-acute hospitals in Germany (the “Portfolio”)

currently owned by the Company, with an aggregate agreed valuation of approximately €1.635 billion.

Pursuant to the

Subscription Agreement, which was entered into among MPT Operating Partnership, L.P., Primotop and MPT RHM Holdco S.à.r.l., a subsidiary of the Company and the current indirect owner of the Portfolio, Primotop will subscribe for new shares

representing, following issuance, 50% of the outstanding interests in MPT RHM Holdco S.à.r.l. (the “Joint Venture”) in exchange for a cash amount equal to 50% of the estimated net asset value of the Portfolio at the closing of the

transaction (the “Closing”), subject to certain adjustments set forth in the Subscription Agreement. The remaining 50% interest in the Joint Venture will be retained by the Company. Immediately following the Closing, which is expected to

occur during the third quarter of 2018, the Joint Venture is expected to make cash distributions to the Company in an aggregate amount of approximately €1.14 billion from the proceeds of the cash contributions and certain debt financings.

The Subscription Agreement provides that the Joint Venture will be governed by a Shareholders’ Agreement to be entered into upon

Closing by and among the parties to the Subscription Agreement. In addition, affiliates of the Company will continue to manage the Portfolio pursuant to a management agreement to be entered into upon Closing.

The Subscription Agreement contains customary mutual representations, warranties and covenants by the parties in connection with transactions

of this nature, including a covenant for the Company to conduct the business of the Portfolio as a going concern in the ordinary course prior to the Closing.

Pursuant to the Subscription Agreement, the Closing is subject to certain closing conditions, including (i) the receipt of governmental

approval for the transaction from the German Federal Cartel Office, (ii) obtaining third-party financing in the form of a syndicated secured financing facility, and (iii) the completion of certain

pre-Closing

reorganization transactions. In addition to providing the parties with certain customary termination rights, the Subscription Agreement also grants the Company with a termination right in the event

of certain changes in German real estate transfer tax law that would trigger indemnity obligations by the Company to Primotop. The Company has also agreed to indemnify Primotop, subject to certain limitations, for certain customary

pre-close

indemnifiable losses.

The foregoing description of the Subscription Agreement does not

purport to be complete and is qualified in its entirety by reference to the text of the Subscription Agreement, which the Company expects to file as an exhibit to its Quarterly Report on Form

10-Q

for the

quarter ended June 30, 2018.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On June 7, 2018, we issued a press release announcing

the joint venture transaction described above in Item 1.01 of this Current Report on Form

8-K. A

copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by

reference.

The information contained in this Item 7.01 is being “furnished” and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or

into any filing or other document pursuant to the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

2

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunder duly authorized.

|

|

|

|

|

MEDICAL PROPERTIES TRUST, INC.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: June 11, 2018

|

|

|

|

|

MPT OPERATING PARTNERSHIP, L.P.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer of the sole member of the general partner of MPT Operating Partnership, L.P.

|

Date: June 11, 2018

4

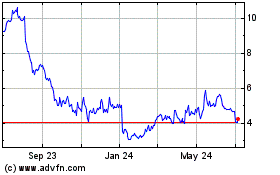

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

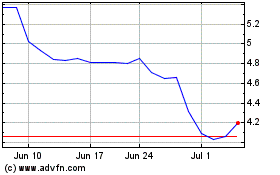

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Apr 2023 to Apr 2024