UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF

1934

For June 5,

2018

Harmony Gold Mining Company

Limited

Randfontein

Office Park

Corner Main Reef

Road and Ward Avenue

Randfontein,

1759

South

Africa

(Address of principal executive

offices)

*-

(Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20- F or Form 40-F.)

(Indicate by

check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.)

Harmony Gold Mining Company Limited

Registration

number 1950/038232/06

Incorporated in

the Republic of South Africa

ISIN:

ZAE000015228

JSE share code:

HAR

(“

Harmony

”

or the "

Company

")

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE OR FORM A PART OF ANY OFFER OR SOLICITATION TO PURCHASE

OR SUBSCRIBE FOR SECURITIES IN THE UNITED STATES OR IN ANY OTHER

JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD REQUIRE

APPROVAL OF LOCAL AUTHORITIES OR OTHERWISE BE UNLAWFUL (EACH, A

“RESTRICTED JURISDICTION”). THIS ANNOUNCEMENT AND THE

INFORMATION CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR

PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES OF AMERICA, INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE

DISTRICT OF COLUMBIA (THE “UNITED STATES”), CANADA,

AUSTRALIA OR JAPAN, OR IN ANY RESTRICTED JURISDICTION. PLEASE SEE

THE “IMPORTANT NOTICE” SECTION AT THE END OF THIS

ANOUNCEMENT.

PROPOSED PLACING OF NEW ORDINARY SHARES

Harmony Gold

Mining Company Limited (“

Harmony

” or the

“

Company

”)

announces its intention to conduct a placing (the

“

Placing

”) of

new ordinary shares in the Company (“

Placing Shares

”) to qualifying

investors to raise up to ZAR1.26 billion / US$100 million (the

"

Proceeds

"), which

represents approximately 15 per cent of the Company’s

existing issued ordinary share capital based on the closing share

price as at 5 June 2018. The Placing is being conducted through an

accelerated bookbuilding process (the “

Bookbuild

”) which will be launched

immediately following this Announcement.

Use of proceeds

As announced on

20 February 2018, Harmony has successfully completed the Moab

Khotsong acquisition, with the transaction becoming effective on 1

March 2018. This value-accretive acquisition is in line with

Harmony’s strategy to grow, produce safe profitable ounces

and increase margins. Harmony believes the acquisition will enhance

its position as a robust cash-generative gold mining company, with

a proven track-record of running assets effectively and

efficiently.

The net proceeds

of the Placing will be used to pay down part of the outstanding

US$150 million bridge loan raised for the acquisition of Moab

Khotsong, as approved by Harmony shareholders on 1 February 2018.

US$50 million of the initial bridge loan of US$200 million drawn

was repaid in April 2018. The remaining balance outstanding on the

bridge loan (following the use of the proposed Placing proceeds) is

expected to be repaid from internal operating cash flows, existing

cash resources and existing undrawn debt facilities. The

Bookrunners (as defined below) or their respective affiliates are

lenders under the bridge loan.

Details of the Placing

The Placing will

be conducted through the Bookbuild and the book will open with

immediate effect following this Announcement. J.P. Morgan

Securities plc and UBS AG, London Branch are acting as Joint Global

Co-ordinators and Joint Bookrunners (the "

Joint Global Co-ordinators

") and Nedbank

Limited (acting through its Corporate and Investment Banking

division) and Absa Bank Limited (acting through its Corporate and

Investment Banking division) are acting as Joint Bookrunners (the

“

Joint

Bookrunners

”) in connection with the Placing. The

Joint Global Co-ordinators and the Joint Bookrunners are

collectively referred to as the “

Bookrunners

”.

The Placing will

be carried out under the vendor consideration placing rules in

terms of paragraph 5.62 of the JSE Limited ("

JSE"

) Listings Requirements. The

Bookbuild is being offered to qualifying investors only (as set out

in greater detail under “Important Notice” below) and

is not an offer to the public in any jurisdiction.

The price per

share at which the Placing Shares are to be placed (the

“

Placing Price

”)

will be determined at the close of the Bookbuild. The timing of the

closing of the Bookbuild, the Placing Price and allocations are at

the discretion of Harmony and the Bookrunners. Details of the

number of Placing Shares and the Placing Price will be announced as

soon as practicable following the closing of the Bookbuild. Listing

and trading ("

Admission

") of

the Placing Shares on the JSE is expected to commence on or around

11 June 2018 (or such later date as may be agreed between the

Company and the Bookrunners) and that dealings in the Placing

Shares will commence at the same time. The Placing is conditional

upon, amongst other things, Admission of the Placing Shares on the

JSE becoming effective and the placing agreement between the

Company, the Joint Global Co-ordinators and the Joint Bookrunners

not being terminated in accordance with its terms prior to

Admission.

The Placing

Shares, when issued, will rank

pari passu

in all respects with the

existing Harmony ordinary shares, including the right to receive

all dividends and other distributions declared, made or paid after

the date of issue of the Placing Shares.

Harmony has

agreed, subject to certain exclusions, to a lock-up of 90 days from

settlement of the Placing.

Participation of ARM

African Rainbow

Minerals Limited ("

ARM

"),

Harmony's strategic black economic empowerment partner, has agreed,

at the price determined by the Bookbuild, to subscribe for so many

shares as necessary to ensure that its current shareholding of

14.29% will be maintained post the Placing. ARM's participation is

subject to Harmony shareholder approval and will form part of the

Proceeds.

Notes

The US dollar to

South African rand exchange rate used in this Announcement is 12.6

as at noon South Africa time.

Johannesburg

5 June

2018

For further

information please contact:

Lauren

Fourie

Investor

Relations Manager

+27 (0) 71 607

1498 (mobile)

Marian van der

Walt

Executive:

Corporate and Investor Relations

+27 (0) 82 888

1242 (mobile)

JSE Sponsor: J.P.

Morgan Equities South Africa Proprietary Limited

Joint Global

Co-ordinators: J.P. Morgan Securities plc and UBS AG, London

Branch

Joint

Bookrunners: Nedbank Limited (acting through its Corporate and

Investment Banking division) and Absa Bank Limited (acting through

its Corporate and Investment Banking division)

South African

legal counsel to the Company: Bowman Gilfillan Inc.

International

legal counsel to the Company: Hogan Lovells International

LLP

Legal counsel to

the Joint Global Co-oridnators and Joint Bookrunners: Davis Polk

& Wardwell London LLP

IMPORTANT NOTICE

This Announcement

is for information purposes only and shall not constitute or form a

part of any offer or solicitation to purchase or subscribe for

securities in the United States or any other Restricted

Jurisdiction. This Announcement and the information contained

herein is restricted and is not for publication or distribution,

directly or indirectly, in whole or in part, in or into the United

States, Canada, Australia or Japan, or in any other Restricted

Jurisdiction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of such

jurisdictions.

The Placing

Shares have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (“Securities Act”),

or with any securities regulatory authority of any state or other

jurisdiction of the United States and may not be offered, sold,

resold, delivered or otherwise distributed in or into the United

States absent registration, except in reliance on an applicable

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. There will be no public offering

of the Placing Shares in the United States or in any other

Restricted Jurisdiction.

THE PLACING SHARES PURCHASED BY PERSONS OUTSIDE THE UNITED STATES

MAY NOT BE OFFERED, SOLD, RESOLD, DELIVERED OR OTHERWISE

DISTRIBUTED IN OR INTO THE UNITED STATES OR TO ANY U.S. PERSON (AS

DEFINED BY REGULATION S UNDER THE SECURITIES ACT) OR DEPOSITED INTO

THE COMPANY’S AMERICAN DEPOSITARY RECEIPT (“ADR”)

PROGRAM UNTIL A MINIMUM OF 40 DAYS AFTER THE SETTLEMENT OF THE

PLACING AND THE COMPANY’S ADRS MAY NOT BE USED IN ANY HEDGING

TRANSACTION THAT INCLUDES THE PLACING SHARES AND BY PURCHASING

PLACING SHARES IN THE OFFERING FROM OUTSIDE THE UNITED STATES, YOU

WILL BE DEEMED TO AGREE TO THE FOREGOING RESTRICTIONS.

The Company will

instruct Deutsche Bank Trust Company Americas, as depositary, not

to accept any Placing Shares for deposit into the Company’s

American Depositary Receipt Program in exchange for the issueance

of ADRs evidencing Harmony’s American Depositary Shares for

40 days after settlement of the Placing.

Any offer, sale,

resale, delivery or other distribution of the Placing Shares within

the United States during this 40 day period by any dealer (whether

or not participating in the Placing) may violate the registration

requirements of the Securities Act if such offer or sale is made

otherwise than pursuant to an exemption from, on in a transaction

not subject to, the registration requirements of the Securities

Act.

In South Africa,

the Placing will only be made by way of separate private placements

to: (i) selected persons falling within one of the specified

categories listed in section 96(1)(a) of the South African

Companies Act, 71 of 2008, as amended ("South African Companies

Act"); and (ii) selected persons, acting as principal, acquiring

Placing Shares for a total acquisition cost of R1,000,000 or more,

as contemplated in section 96(1)(b) of the South African Companies

Act ("South African Qualifying Investors"). This Announcement is

only being made available to such South African Qualifying

Investors. Accordingly: (i) the Placing is not an “offer to

the public” as contemplated in the South African Companies

Act; (ii) this Announcement does not, nor does it intend to,

constitute a “registered prospectus” or an

“advertisement”, as contemplated by the South African

Companies Act; and (iii) no prospectus has been filed with the

South African Companies and Intellectual Property Commission

("CIPC") in respect of the Placing. As a result, this Announcement

does not comply with the substance and form requirements for a

prospectus set out in the South African Companies Act and the South

African Companies Regulations of 2011, and has not been approved

by, and/or registered with, the CIPC, or any other South African

authority.

The information

contained in this Announcement constitutes factual information as

contemplated in section 1(3)(a) of the South African Financial

Advisory and Intermediary Services Act, 37 of 2002, as amended

("FAIS Act") and should not be construed as an express or implied

recommendation, guide or proposal that any particular transaction

in respect of the Placing Shares or in relation to the business or

future investments of the Company, is appropriate to the particular

investment objectives, financial situations or needs of a

prospective investor, and nothing in this Announcement should be

construed as constituting the canvassing for, or marketing or

advertising of, financial services in South Africa. The Company is

not a financial services provider licensed as such under the FAIS

Act.

No public

offering of the Placing Shares is being made in the United Kingdom.

In the United Kingdom, all offers of the Placing Shares will be

made pursuant to an exemption under the Prospectus Directive (as

defined below) from the requirement to produce a prospectus. This

Announcement is being distributed to persons in the United Kingdom

only in circumstances in which section 21(1) of the Financial

Services and Markets Act 2000, as amended (“FSMA”) does

not apply. No prospectus will be made available in connection with

the Placing and no such prospectus is required to be published in

accordance with the Prospectus Directive.

This Announcement

is for information purposes only and is directed only at persons in

Member States of the European Economic Area who are (a) qualified

investors (“Qualified Investors”) within the meaning of

article 2(1)(e) of the EU Prospectus Directive (which means

Directive 2003/71/EC as amended, and includes the 2010 PD Amending

Directive (Directive 2010/73/EU) to the extent implemented in the

relevant Member State) (the “Prospectus Directive”) and

(b) in the United Kingdom and (i) investment professionals falling

within Article 19(5) of the UK Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (the “Order”),

(ii) high net worth entities falling within Article 49(2)(a) to (d)

of the Order or (iii) other persons to whom they may lawfully be

communicated, all such persons together being referred to as

“Relevant Persons”. In Member States of the European

Economic Area, this Announcement must not be acted on or relied on

by persons who are not Relevant Persons. Persons distributing this

Announcement must satisfy themselves that it is lawful to do so.

Any investment or investment activity to which this Announcement

relates is available only to Relevant Persons and will be engaged

in only with Relevant Persons.

This Announcement

has been issued by, and is the sole responsibility of, the Company.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by J.P. Morgan Securities plc or UBS AG,

London Branch (the “Joint Global Co-ordinators”), or

Nedbank Limited (acting through its Corporate and Investment

Banking division) or Absa Bank Limited (acting through its

Corporate and Investment Banking division) (the “Joint

Bookrunners”, together with the Joint Global Co-ordinators,

the “Bookrunners”), or by any of their respective

affiliates or agents as to or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

Each Bookrunner

and its respective affiliates are acting solely for the Company and

no one else in connection with the Placing and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients nor for providing advice in

relation to the Placing and/or any other matter referred to in this

Announcement. Apart from the responsibilities and liabilities, if

any, which may be imposed on each Bookrunner or its affiliates by

its respective regulatory regimes, neither any Bookrunner nor any

of its respective affiliates accepts any responsibility whatsoever

for the contents of the information contained in this Announcement

or for any other statement made or purported to be made by or on

behalf of any Bookrunner or any of its respective affiliates in

connection with the Company, the Placing Shares or the Placing.

Each Bookrunner and each of its respective affiliates accordingly

disclaim all and any responsibility and liability whatsoever,

whether arising in tort, contract or otherwise (save as referred to

above) in respect of any statements or other information contained

in this Announcement and no representation or warranty, express or

implied, is made by each Bookrunner or any of its respective

affiliates as to the accuracy, completeness or sufficiency of the

information contained in this Announcement.

The distribution

of this Announcement and the offering of the Placing Shares in

certain jurisdictions may be restricted by law. No action has been

taken by the Company or any Bookrunner that would permit an

offering of such shares or possession or distribution of this

Announcement or any other offering or publicity material relating

to such shares in any jurisdiction where action for that purpose is

required. Persons into whose possession this Announcement comes are

required by the Company and the Bookrunners to inform themselves

about, and to observe, such restrictions.

This Anouncement

contains forward-looking statements within the meaning of the safe

harbor provided by Section 21E of the U.S. Securities Exchange Act

of 1934, as amended, and Section 27A of the Securities Act with

respect to the Company’s financial condition, results of

operations, business strategies, operating efficiencies,

competitive positions, growth opportunities for existing services,

plans and objectives of management, markets for stock and other

matters. These include all statements other than statements of

historical fact, including, without limitation, any statements

preceded by, followed by, or that include the words

“targets”, “believes”,

“expects”, “aims”, “intends”,

“will”, “may”, “anticipates”,

“would”, “should”, “could”,

“estimates”, “forecast”,

“predict”, “continue” or similar

expressions or the negative thereof.

Any

forward-looking statements, including, among others, those relating

to the Company’s future business prospects, revenues and

income, wherever they may occur in this Announcement, are

necessarily estimates reflecting the best judgment of the

Company’s senior management and involve a number of risks and

uncertainties that could cause actual results to differ materially

from those suggested by the forward-looking statements. As a

consequence, you should not place undue reliance on forward-looking

statements as a prediction of actual results. Statements contained

in this Announcement regarding past trends or activities should not

be taken as a representation that such trends or activities will

continue in the future. No statement in this Announcement is or is

intended to be a profit forecast or profit estimate or to imply

that the earnings of the Company for the current or future

financial years will necessarily match or exceed the historical or

published earnings of the Company.

The information

contained in this Announcement is subject to change without notice

and, except as required by applicable law, the Company and each

Bookrunner do not assume any responsibility or obligation to update

publicly or review any of the forward-looking statements contained

in it and nor do they intend to.

This Announcement

does not identify or suggest, or purport to identify or suggest,

the risks (direct or indirect) that may be associated with an

investment in the Placing Shares. Any investment decision to buy

Placing Shares in the Placing must be made solely on the basis of

publicly available information, which has not been independently

verified by any Bookrunner.

The information

in this Announcement may not be forwarded or distributed to any

other person and may not be reproduced in any manner whatsoever.

Any forwarding, distribution, reproduction or disclosure of this

information in whole or in part is unauthorised. Failure to comply

with this directive may result in a violation of the Securities Act

or the applicable laws of other jurisdictions.

This Announcement

does not represent the announcement of a definitive agreement to

proceed with the Placing and, accordingly, there can be no

certainty that the Placing will proceed. Harmony reserves the right

not to proceed with the Placing or to vary any terms of the Placing

in any way.

The Placing

Shares to be issued pursuant to the Placing will not be admitted to

trading on any stock exchange other than the Johannesburg Stock

Exchange.

Persons who are

invited to and who choose to participate in the Placing by making

an offer to take up Placing Shares, will be deemed to have read and

understood this Announcement in its entirety and to be making such

offer on the terms and conditions, and to be providing the

representations, warranties, acknowledgements and undertakings,

contained herein. Each such placee represents, warrants and

acknowledges that it is a person eligible to purchase or subscribe

for the Placing Shares in compliance with the restrictions set

forth herein and applicable laws and regulations in its home

jurisdiction and in the jurisdiction (if different) in which it is

physically resident. Unless otherwise agreed in writing, each

placee represents, warrants and acknowledges that it is (a) not

located in, a resident of, or physically present in, the United

States, Canada, Australia, Japan or any Restricted Jurisdiction and

it is not acting on behalf of someone who is located in, a resident

of, or physically present in, the United States, Canada, Australia,

Japan or any Restricted Jurisdiction and (b) not a U.S. person (as

that term is defined in Regulation S under the Securities

Act).

Information to

Distributors

Solely for the

purposes of the product governance requirements contained within:

(a) EU Directive 2014/65/EU on markets in financial instruments, as

amended (“MiFID II”); (b) Articles 9 and 10 of

Commission Delegated Directive (EU) 2017/593 supplementing MiFID

II; and (c) local implementing measures (together, the “MiFID

II Product Governance Requirements”), and disclaiming all and

any liability, whether arising in tort, contract or otherwise,

which any “manufacturer” (for the purposes of the MiFID

II Product Governance Requirements) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that such securities are: (i)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each as defined in MiFID II; and (ii)

eligible for distribution through all distribution channels as are

permitted by MiFID II (the “Target Market Assessment”).

Notwithstanding the Target Market Assessment, distributors should

note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, the Bookrunners will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance

of doubt, the Target Market Assessment does not constitute: (a) an

assessment of suitability or appropriateness for the purposes of

MiFID II; or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Placing Shares.

Each distributor

is responsible for undertaking its own target market assessment in

respect of the Placing Shares and determining appropriate

distribution channels.

NOTWITHSTANDING

ANYTHING IN THE FOREGOING, NO PUBLIC OFFERING OF THE PLACING SHARES

IS BEING MADE BY ANY PERSON ANYWHERE AND THE COMPANY HAS NOT

AUTHORISED OR CONSENTED TO ANY SUCH OFFERING IN RELATION TO THE

PLACING SHARES.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused

this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

Harmony Gold Mining Company

Limited

|

|

|

|

|

|

|

|

Date:

June 5,

2018

|

By:

|

/s/

Frank Abbott

|

|

|

|

|

Name

Frank

Abbott

|

|

|

|

|

Title

Financial

Director

|

|

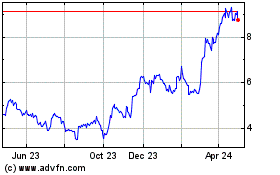

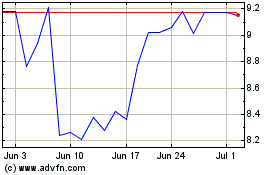

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024