SFL - Acquisition of 4 x 14,000 TEU container vessels

May 31 2018 - 6:06AM

Ship Finance International Limited (NYSE: SFL)

("Ship Finance" or the "Company") announces that it has agreed to

acquire four large container vessels in combination with long-term

time-charters to a leading container line.

The vessels are modern eco-design built in 2014

with approximately 14,000 TEU carrying capacity. The Company

expects to take delivery of the vessels in the near term, and the

purchase price is confidential.

The time-charters to a leading Asia-based

container line run until 2024, with options to extend the charters

by 18 additional months. Our fixed-rate charter backlog will

increase by nearly $450 million and the EBITDA contribution from

these new vessels is estimated to approximately $60 million per

year.

The consideration to the sellers will be cash

plus approximately 4 million newly issued shares in Ship Finance.

The cash consideration is financed with cash on the balance sheet

and a $320 million unsecured loan facility provided by an affiliate

of Hemen Holding Ltd., the Company's largest shareholder. This loan

facility is non-amortizing and with a term of more than one year.

The Company is exploring long-term financing alternatives for these

vessels in the Asian capital market.

Ole B. Hjertaker, CEO of Ship Finance Management

AS, said in a comment: "This acquisition highlights Ship Finance's

strength and ability to achieve sustained growth and continued

diversification. We are deploying a part of the recently raised

capital, but still have capacity for new accretive opportunities.

Over the last two months we have added nearly $600 million to our

charter backlog and expect to continue increasing our fleet of

vessels and charter backlog in 2018".

May 31, 2018

The Board of DirectorsShip Finance International

LimitedHamilton, Bermuda

Questions can be directed to Ship Finance

Management AS:

Investor and Analyst Contacts: Harald

Gurvin, Chief Financial Officer, Ship Finance Management AS +47 23

11 40 09 André Reppen, Senior Vice President, Ship Finance

Management AS +47 23 11 40 55

Media Contact: Ole B. Hjertaker, Chief

Executive Officer, Ship Finance Management AS +47 23 11 40 11

About Ship Finance

Ship Finance International Limited (NYSE: SFL)

has a unique track record in the maritime industry, being

consistently profitable and paying dividends every quarter since

2004. The Company's fleet of more than 80 vessels is split between

tankers, bulkers, container vessels and offshore assets, and Ship

Finance's long term distribution capacity is supported by a

portfolio of long term charters and significant growth in the asset

base over time. More information can be found on the Company's

website: www.shipfinance.bm

Cautionary Statement Regarding Forward

Looking Statements

This press release may contain forward looking

statements. These statements are based upon various assumptions,

many of which are based, in turn, upon further assumptions,

including Ship Finance management's examination of historical

operating trends. Although Ship Finance believes that these

assumptions were reasonable when made, because assumptions are

inherently subject to significant uncertainties and contingencies

which are difficult or impossible to predict and are beyond its

control, Ship Finance cannot give assurance that it will achieve or

accomplish these expectations, beliefs or intentions. Important

factors that, in the Company's view, could cause actual results to

differ materially from those discussed in this presentation include

the strength of world economies and currencies, general market

conditions including fluctuations in charter hire rates and vessel

values, changes in demand in the tanker market as a result of

changes in OPEC's petroleum production levels and worldwide oil

consumption and storage, changes in the Company's operating

expenses including bunker prices, dry-docking and insurance costs,

changes in governmental rules and regulations or actions taken by

regulatory authorities, potential liability from pending or future

litigation, general domestic and international political

conditions, potential disruption of shipping routes due to

accidents or political events, and other important factors

described from time to time in the reports filed by the Company

with the United States Securities and Exchange Commission.

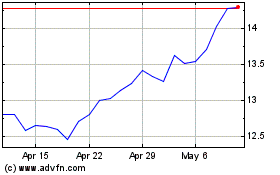

SFL (NYSE:SFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

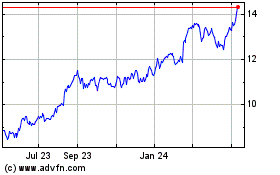

SFL (NYSE:SFL)

Historical Stock Chart

From Apr 2023 to Apr 2024