By Annie Gasparro and Jacob Bunge

America's food giants are shedding a generation of CEOs at a

remarkable rate, the culmination of years of bleak sales in an

industry that until recently, had gone unshaken for half a

century.

Over the past two years, at least 16 major packaged-food and

beverage chief executives have stepped down, according to a Wall

Street Journal analysis. The departure of Campbell Soup Co. chief

Denise Morrison earlier this month followed CEO changes at General

Mills Inc., Mondelez International Inc., Kellogg Co., Nestle USA,

Hershey Co., J.M. Smucker Co. and Twinkie-maker Hostess.

"I don't think we've ever seen something like this," said Greg

Wank, partner at Anchin, an advisory firm that works with food

companies.

The outgoing executives have contended with a new era of

American eating and grocery shopping habits, shepherded in by

millennials and the internet. Stalwart food brands no longer can

consistently command higher prices from retailers, forcing

management to focus on cost cuts. And as executives try to invest

on change, investors want stronger profit margins. The S&P 500

Packaged Food & Meat subindex has dropped 15% in the past two

years, while the S&P 500 has climbed 30%.

The top 25 food and beverage companies in the U.S. have

continued to lose market share, averaging annual sales growth of 2%

from 2012 through 2016, compared with 6% for the rest of the

industry, according to consultancy A.T. Kearney.

"You've got a lot of CEOs that are at their wit's end trying to

figure out growth," said a now-retired big-food-company chief.

"It was certainly much easier in my early decades than today's

CEOs have it," said former Conagra Foods Chief Gary Rodkin, who

retired in 2015.

While each company's situation is a little different, companies

say they now have the right leaders in place to navigate next

steps. Mondelez said its prior CEO improved its profit margin over

the past few years while sales growth was slower than it hoped.

Most of the other companies mentioned in this article declined to

comment further.

Hershey's Chief Digital Commerce Officer, Doug Straton, said the

industry for decades trained people on how things were -- including

focusing on physical stores and not e-commerce. "It's really hard

to burst out of that mindset, including for the CEOs," he said,

adding that sometimes a new face at the top can do that.

Sean Connolly, who joined Conagra Brands Inc. as chief in 2015,

quickly shook things up at the maker of Hunt's ketchup, Peter Pan

peanut butter, and Chef Boyardee. He relocated its headquarters to

downtown Chicago from Omaha, Neb., and sold off two big chunks of

the business.

With Conagra shares up 26% since he took over, Mr. Connolly has

called out rival food companies for neglecting brands and letting

bureaucracy impede innovation. Walking down the frozen-food aisle,

"you'll still find plenty of products that look like they're left

over from the 1980s and 1990s," he said at a conference this month.

"They're going to have trouble hanging on to that real estate

unless they modernize themselves."

Until recently, big brands were synonymous with the foods they

made -- Kraft and cheese; Heinz and ketchup; Kellogg and cereal;

Coke and soda. They won prime shelf space with retailers and had

big marketing budgets that furthered their favor with consumers.

And they could always charge a little bit more for their products

to keep profits rolling in when costs rose or sales slowed. The

strategy for success was straightforward and often attainable.

Now, shifts toward simpler ingredients and shopping for food

online, combined with a rise in niche, small brands and

grocery-store brands, have made the old playbook irrelevant.

Campbell tried to break into the fresh-food sector by acquiring

Bolthouse Farms in 2012. But the move backfired in many ways,

weakening profit margins and revealing the difficulties of managing

the supply chain for perishables. Meanwhile, Campbell's core soup

sales continued to struggle. Ms. Morrison's departure came as the

company faced its fifth consecutive year of lower U.S. soup

sales.

Investors said the CEO shuffle is a positive step for the

industry, particularly when a new executive is brought in from

outside. "There's always a bit more intrigue when you have an

external hire come into a company that's been around for 100

years," said Jacob Gamerman, senior research analyst at Neuberger

Berman Group, which manages $299 billion of investor funds.

Many of the food companies that have changed CEOs over the past

two years, however, have promoted internal candidates instead.

Campbell's interim chief and board member Keith McLoughlin said the

company is open to internal and external candidates for its

CEO.

A few factors unite some of the newly named leaders. Many, like

General Mills' Jeff Harmening and TreeHouse Foods' Steve Oakland,

have worked across different divisions of companies and bring

experience integrating acquisitions or restructuring

operations.

Others, including Kellogg's Steve Cahillane and Mondelez's Dirk

Van de Put, have worked on developing international markets, where

packaged-food sales have been growing faster than in the U.S.

Meanwhile, since 2016, activists have publicly demanded changes

such as a CEO replacement or sale at more than 40 food and drink

manufacturers around the world, according to data from Activist

Insight, making food processing one of the consumer-goods

industries most vulnerable to activists.

Some expect more changes. PepsiCo Inc. CEO Indra Nooyi has been

leading the beverage and salty-snack giant since 2006. Unilever

PLC's Chief Paul Polman has been at the helm since 2009, and people

familiar with the matter told The Wall Street Journal last November

that the board was looking for his successor. Pepsi and Unilever

declined to comment.

"The industry kind of reminds you of an NFL off-season with all

the coaching changes," said Brett Hundley, food analyst at the

Vertical Group LLC. "When a team changes its head coach, that

doesn't do anything in and of itself unless that person brings a

new strategy and gets a different outcome."

-- Cara Lombardo contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com and Jacob

Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

May 29, 2018 09:50 ET (13:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

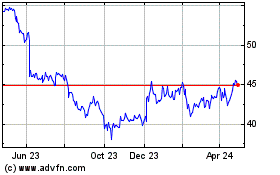

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

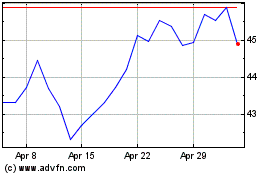

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Apr 2023 to Apr 2024