By Laura Saunders

Investors seeking both high income and low taxes poured billions

of dollars into publicly traded energy master limited partnerships.

Now many have tax headaches -- surprisingly big bills from Uncle

Sam and return preparers.

Two new MLP deals, from Williams Companies Inc.. and Enbridge

Inc., are the latest to trigger these headaches. In these deals,

known as roll-ups, the corporation sponsoring an MLP pulls it back

into the corporate fold, and MLP investors exchange their units for

corporate stock.

These consolidations will provide tax and other benefits to the

parent corporations and their shareholders. Williams said that as a

result of the deal, it expects not to owe cash taxes through

2024.

But for these MLPs' investors, the deals are taxable and neither

one includes a cash payment to help with their own tax bills.

"In each case, the corporation and its investors will reap tax

benefits at the expense of one segment of stakeholders," says

Robert Willens, an independent tax analyst.

A spokesman for Williams disagreed with this assessment, citing

a premium to be received by MLP investors, among other things. A

spokesman for Enbridge referred investors to the deal's

announcement.

These consolidations once again show the downside of the

innovative MLP format. They were originally conceived as a way to

attract investment to income-producing energy assets like

pipelines. As partnerships, MLPs bypassed a layer of corporate

taxes, and high depreciation plus special breaks helped defer taxes

on hefty income payouts.

These features drew investors craving income, many of whom

ignored MLPs' tax complexities. Some planned to hold their units

until death, when messy issues often disappear because of favorable

tax provisions.

However, many MLP investors haven't been able to hold that long.

Some corporate sponsors cooled to MLPs when the structure became

burdensome to growth. In 2014, Kinder Morgan Inc. consolidated two

affiliated MLPs that were widely held by investors in a

reorganization that was taxable to the investors.

The latest two hiccups for MLP investors both occurred on May

17. Tulsa-based Williams said it would acquire the remaining 256

million units of its affiliated MLP, Williams Partners. Investors

will receive nearly 1.5 shares in the parent for each unit they

own. Calgary-based Enbridge announced it would exchange company

stock, in different ratios, for units of two affiliated MLPs.

The two companies both cited a March 15 ruling by the Federal

Energy Regulatory Commission that denies a tax benefit previously

allowed to MLPs. This reduces profits and further tilts the scales

against the MLP format for some pipelines.

To be fair, MLPs have performed well for many investors. But

when units must be sold, the act of selling often brings a complex

and costly reckoning with the Internal Revenue Service.

"In the end, many MLP investors don't do as well as they

expected to," says Mark Cook, a CPA with SingerLewak in Irvine,

Calif.

For those facing an MLP roll-up, here are tips for the road

ahead.

Determine the cost. The starting point for measuring an

investment's taxable gain or loss is its purchase price plus

adjustments, known as "cost basis." With a stock this is often the

purchase price. But figuring the correct basis for partnerships

such as MLPs is usually complex because they pass income and

deductions directly through to their investors.

This means that MLP units often have many adjustments to their

purchase price. For example, income raises a unit's cost basis,

while depreciation and losses lower it. The partnership reports

annual adjustments to investors on a Schedule K-1 -- be sure to

keep these records.

Tracking adjustments is often tedious. A spokesman for Williams

said that a calculator on its website can help determine results

through 2017, but it doesn't yet include results for 2018.

Figure the gains or loss from the sale. The investor's net

results can include both profits and losses.

Net profits are typically taxable as capital gains, which can

qualify for lower rates, or as ordinary income, which is usually

taxed at higher rates. Losses are generally capital losses.

After an MLP sale, say Mr. Willens and Mr. Cook, some investors

wind up with an unwelcome tax result: large gains taxed at higher

ordinary income rates, and capital losses that can't be used to

offset them.

Don't donate. Some investors dealing with MLP complexity look to

donate units to charity, as they would a long-held stock. This

strategy seldom makes sense. Unlike with stock shares, the donor

usually can't deduct the full market value of the MLP units.

Cope with IRA issues. Tax specialists warn against putting MLP

units in individual retirement accounts or Roth IRAs, because

certain income could be taxable even though the account is

tax-exempt. Many investors don't owe this levy annually because the

taxable income falls below the limit of $1,000 per IRA.

However, a sale of all MLP units held by an IRA could trigger

substantial taxable income for IRA owners, says Mr. Cook.

Settle up. In addition to tax due, the IRS requires a special

statement from MLP investors in the year of a sale, breaking out

capital gains and ordinary income earned. Janet Hagy, a CPA in

Austin, Texas, warns that tax-prep software often lacks the proper

form.

She adds that preparing taxes for MLP units is so time consuming

that investors should expect tax-prep bills to rise by 200% to

300%.

Write to Laura Saunders at laura.saunders@wsj.com

(END) Dow Jones Newswires

May 25, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

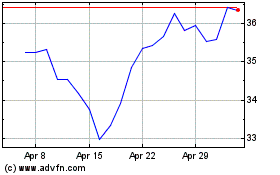

Enbridge (NYSE:ENB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enbridge (NYSE:ENB)

Historical Stock Chart

From Apr 2023 to Apr 2024