With Clothes Piling Up, Gap Leans on Heavy Discounts to Clear Stores

May 24 2018 - 7:45PM

Dow Jones News

By Maria Armental

Gap Inc. executives said they had to resort to heavy discounting

to move unsold clothes that had piled up at stores, moves that

weighed on profit in the first quarter and could carry over into

the current period.

"If you have too much inventory or the wrong inventory, holding

on to it does not make it better," Chief Executive Art Peck said on

a conference call Thursday. "And so we were very decisive on that

and took those actions. It wasn't without pain, but we believe it

was absolutely the right thing to do to continue to clean up the

business and position it for better performance."

Executives blamed operational issues that delayed the timing of

new items and disrupting the assortment of products, but said the

weak demand wasn't the result of customers disliking the company's

styles or fashions.

"We felt good across the whole portfolio that we actually had

strong product that was on trend and properly assorted," Mr. Peck

said.

The company reported Thursday that overall sales at established

stores rose 1% in the quarter ended May 5, as a 4% decline at its

namesake Gap brand offset gains at its Old Navy and Banana Republic

chains.

Shares of Gap fell 8% to $30.30 in after hours trading, after

ending the day at $32.95.

The Gap brand has been pressured by shift to online shopping and

struggled to recapture the magic of its 1990s glory days. Wardrobe

basics have evolved since its heyday, with many customers swapping

out denim for yoga pants. In recent years, Gap has lost market

share to fast-fashion rivals such as H&M and Zara. Old Navy,

the company's budget brand and biggest division by sales, has been

a bright spot.

The San Francisco-based company has been shifting its footprint

accordingly. Last year, it set plans to close about 200 Banana

Republic and Gap stores over the next three years, while opening

new Old Navy and Athleta locations. In February, the company

replaced the head of its Gap brand.

It ended the quarter with more than 3,600 stores, a net increase

of 23 stores.

Chief Financial Officer Teri List-Stoll said Thursday that the

operational overhaul of the Gap brand, while expected to be

positive in the long run, led to some operational missteps for the

spring and summer season.

"While we are heavier on inventory at Gap Brand than we would

have liked, over all, we feel good about where we ended the quarter

for the company, " Ms. List-Stoll said in the call.

Executives reiterated their financial targets for the full

fiscal year.

Over all, the company reported quarterly profit rose 15% to $164

million, or 42 cents a share, while revenue rose 10% to $3.78

billion.

Gross profit margin was 37.7% down from 37.9% a year earlier.

Excluding the impact from the adoption of a revenue accounting

standard that went into effect this year, gross margin narrowed to

36.7%, largely due to the Gap brand, the company said.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 24, 2018 19:30 ET (23:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

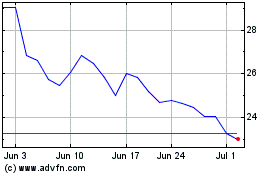

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024