Best Buy Benefits From Strong Consumer Confidence -- Update

May 24 2018 - 12:13PM

Dow Jones News

By Imani Moise

Best Buy Co.'s sales jumped in the latest quarter as the

electronics retailer continued to benefit from shoppers spending

more freely, but shares fell Thursday as some investors feared

there might not be much more room to run.

Same-store sales increased 7.1%, which Chief Executive Hubert

Joly attributed to higher consumer confidence and new products.

Consumer confidence, as measured in one index, reached a 14-year

high earlier this year and remained strong in May, signaling more

spending for the months ahead.

"This strong performance was broad-based, with positive

comparable sales across all channels, geographies and most of our

product categories," Mr. Joly said.

Best Buy's shares have climbed 47% over the past year compared

with the S&P 500's 14% gain, but tumbled 6.7% to $70.85 during

morning trading after the company decided not to raise its annual

guidance despite reporting first-quarter earnings that blew past

expectations.

The company continues to expect comparable sales to be flat to

up 2% for the year, which given the first quarter's strong results

could mean negative comparisons in the back half of the year,

according to a Wells Fargo research note.

Additionally, Chief Financial Officer Corie Barry said on a call

with analysts that higher investments in the company's supply chain

and higher transportation costs will squeeze margins for the rest

of the year.

Growth in consumer spending has given a much-needed boost to

traditional retailers who are trying to fend off growing

competition from online merchants. Walmart Inc., Target Corp. and

Macy's Inc. all reported rising same-store sales for the latest

quarter.

Best Buy has been fortifying its e-commerce program and

expanding services like tech support and in-home advisory to boost

sales. During the quarter the company unveiled a partnership with

Amazon.com Inc. to sell televisions equipped with Amazon's Fire TV

operating systems both in store and online on Amazon's

marketplace.

U.S. online sales grew 12% to $1.14 billion, but Mr. Joly said

the lines between online and in-store sales are becoming

increasingly blurred as customers opt to shop online and pick up

items in store or use a new mobile feature that allows shoppers to

scan and instantly compare prices while shopping in store.

In the future, he says "reporting online sales separately may or

may not make sense."

Overall for the first quarter, the Minneapolis-based company

reported a profit of $208 million, or 72 cents a share, up from

$188 million, or 60 cents a share, a year earlier. On an adjusted

basis, earnings rose 37% to 82 cents a share. Revenue rose 6.8% to

$9.12 billion. Analysts polled by Thomson Reuters had forecast

earnings of 74 cents on $8.74 billion in sales.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

May 24, 2018 11:58 ET (15:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

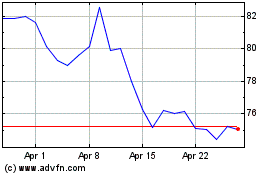

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

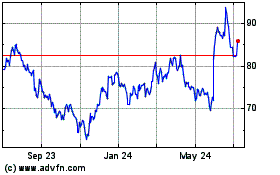

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024