Ackman Takes Roughly $1 Billion Stake in Lowe's -- WSJ

May 24 2018 - 3:02AM

Dow Jones News

By Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 24, 2018).

William Ackman's Pershing Square Capital Management LP is

joining another activist investor in Lowe's Cos., hoping to profit

as the retailer tries to make improvements under a new chief

executive.

Pershing Square has built a stake in the home-improvement chain

valued at roughly $1 billion as of Tuesday's close in what is

expected to be a friendly investment, according to people familiar

with the matter. Lowe's had a market value of roughly $78.3 billion

at Wednesday's close.

Mr. Ackman revealed the position at a conference in New York on

Wednesday, said the people, who were in attendance. He built it

over the past 45 days, they said.

The people said Mr. Ackman supports Lowe's incoming Chief

Executive Marvin Ellison, who during 12 years at Home Depot Inc.

was credited with improving customer service and e-commerce and

expanding its professional business. On Tuesday, it was announced

that Mr. Ellison would leave his position as CEO at struggling

retailer J.C. Penney Co. to take the top job at Lowe's, where he is

expected to draw from the same playbook he used at Home Depot.

Lowe's CEO Robert Niblock said in March he would retire, a week

after three new directors joined the board as part of an agreement

with activist investor D.E. Shaw & Co., which owns about a 1%

stake.

Home Depot's same-store sales growth has outpaced that of Lowe's

over the past several years. Lowe's stock had also sharply lagged

behind that of Home Depot over the past year, before closing up

10.4% Wednesday following upbeat guidance and news of Pershing

Square's involvement.

A Lowe's spokesman said the company is aware of reports of

Pershing Square's stake and it is committed to creating value for

all shareholders.

Mr. Ackman agrees with D.E. Shaw's view that Lowe's is lagging

Home Depot and could do more to capitalize on an improving

real-estate market, the people said. The stake would put two

activists in the top 16 holders in the company, according to the

people.

Mr. Ackman has pledged to remain out of the headlines after a

rough stretch of performance shrunk his fund. He has recently taken

several new positions where he has said he supported management and

avoided detailed complaints, including a quick trade in Nike Inc.

and an investment in United Technologies Corp., though he has

called for a breakup of the industrial conglomerate.

Pershing Square's publicly traded fund is up 2% this year,

according to disclosures, as some of his investments have started

gaining again.

Pershing Square previously held Lowe's shares in 2011, when

filings showed about a 1.7% stake soon after Mr. Ackman outlined a

bullish investment thesis on the retailer. He sold the shares by

the end of the year after the stock price rose.

Mr. Ackman's new stake in Lowe's makes for an unusual union with

Mr. Ellison, who helped stanch the bleeding at J.C. Penney in 2014

after Ron Johnson, a CEO Mr. Ackman had recruited, upended Penney's

pricing strategy and offerings to disastrous results.

Around the time Pershing Square exited J.C. Penney at a steep

loss, Mr. Ackman expressed contrition to his investors following a

few mistakes in the retail world, which also included a loss in

Target Corp.

"Clearly, retail has not been our strong suit, and this is duly

noted," he wrote in 2013.

Corrections & Amplifications William Ackman revealed his

stake in Lowe's at a conference in New York on Wednesday. An

earlier version of this article incorrectly said the conference

took place on Tuesday. (May 23, 2018)

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

May 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

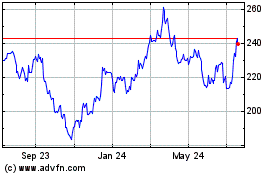

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

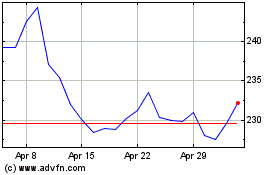

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024