Brazil Minerals, Inc. Expands Drilling for Gold From 6 to 25 Holes in the Paracatu Project

May 23 2018 - 8:27AM

Via OTC PR Wire -- Brazil Minerals, Inc. (OTC:BMIX) (the "Company"

or "Brazil Minerals") announced today that, given strong initial

results, its subsidiary Jupiter Gold Corporation (“Jupiter Gold”)

expanded the drilling campaign of its Paracatu Project from 6 holes

in an exploratory campaign to 25 holes in a detailed campaign.

Eleven of the twelve holes already drilled have shown visual

evidence of gold.

The target is an alluvial plain along the Rico Creek, which

drains the giant Paracatu gold deposit known as “Morro do Ouro”

(Gold Hill), an ore body of 16 million ounces owned by Kinross Gold

Corporation (NYSE:KGC). Geochemical analysis of the higher

quantity of samples collected in the detailed drilling will allow

for stronger statistical significance of results. In turn, this

will permit more accurate quantification for reporting and for the

preparation of a permit to mine the area. Marc Fogassa, CEO

of the Company, commented, “The initial results in the Paracatu

Project have been highly encouraging and thus it made sense to

expand the campaign. Note that this is our first effort at drilling

an area which is far away from our main Brazilian operations and

yet the logistics have worked out very well. We plan to replicate

this method for many of our other high potential mineral rights –

including claims for gold, diamonds, lithium, and cobalt, among

others.” The senior geologist on the Paracatu Project is Rodrigo

Mello, who has extensive experience in Brazilian gold geology. Mr.

Mello has worked in Brazil for some of the largest gold companies

in the world such as Goldcorp, AngloGold, and AngloAmerican, and

has written 19 geological reports, mostly on gold formations.

Photographs from the Paracatu Project drilling campaign and sample

material retrieved

follow: http://www.globenewswire.com/NewsRoom/AttachmentNg/c3c31a85-6e3a-43d8-b66c-b2e8ef2b7f62

BMIX Mineral Bank: Gold: 119,989 acres Diamond

(kimberlites): 92,961 acres Diamond (alluvial): 27,612 acres

Cobalt/Copper/Nickel: 5,011 acres Iron/Titanium/Vanadium: 4,938

acres Lithium: 288 acres Manganese: 4,970 acres

Aquamarine/Beryl/Tourmaline: 288 acres Sand (construction

industry): 4,995 acres About Brazil Minerals, Inc.

Brazil Minerals, Inc. along with its subsidiaries has a

business model focused on: 1) mining specific areas for gold and

diamonds, and 2) generating projects from its portfolio of high

quality mineral rights for transactions leading to royalties and/or

equity positions. Our first equity holdings from such strategy is a

55.4% ownership in Jupiter Gold Corporation. More information on

Brazil Minerals is at www.brazil-minerals.com. Follow us on

Twitter: @BMIXstock. Safe Harbor Statement This

press release contains forward-looking statements made under the

"safe harbor" provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward looking statements are based upon the

current plans, estimates and projections of Brazil Minerals, Inc.'s

management and are subject to risks and uncertainties, which could

cause actual results to differ from the forward- looking

statements. Such statements include, among others, those concerning

market and industry segment growth and demand and acceptance of new

and existing products; any projections of production, reserves,

sales, earnings, revenue, margins or other financial items; any

statements of the plans, strategies and objectives of management

for future operations; any statements regarding future economic

conditions or performance; uncertainties related to conducting

business in Brazil, as well as all assumptions, expectations,

predictions, intentions or beliefs about future events. Therefore,

you should not place undue reliance on these forward-looking

statements. The following factors, among others, could cause actual

results to differ from those set forth in the forward-looking

statements: business conditions in Brazil, general economic

conditions, geopolitical events and regulatory changes,

availability of capital, Brazil Minerals, Inc.’s ability to

maintain its competitive position and dependence on key management.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any security and shall not

constitute an offer, solicitation or sale of any securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction. We advise U.S. investors that

the claims listed in the BMIX Mineral Bank are exploratory in

nature, and as of now do not have “reserves” as such term is

defined in the Securities and Exchange Commission’s Industry Guide

7. Contact: Marc Fogassa CEO, Brazil Minerals,

Inc. (213) 590-2500 info@brazil-minerals.com

www.brazil-minerals.com @BMIXstock

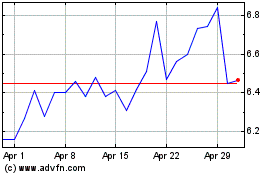

Kinross Gold (NYSE:KGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

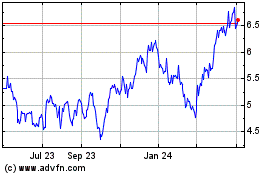

Kinross Gold (NYSE:KGC)

Historical Stock Chart

From Apr 2023 to Apr 2024