J.C. Penney CEO Quits to Join Lowe's -- Update

May 22 2018 - 10:23AM

Dow Jones News

By Imani Moise and Suzanne Kapner

Marvin Ellison is quitting his job as chief executive of

struggling J.C. Penney Co. to take over leadership of Lowe's Cos.,

another retailer in need of a revamp.

The retail veteran joined Penney in 2014 and shifted the

department-store chain away from apparel toward appliances. Last

year, he closed hundreds of stores and slashed jobs. But the

company's sales continue to lag behind rivals.

Lowe's, meanwhile, has been searching for a new CEO that can

improve results at the home-improvement chain, which faces pressure

from an activist investor and has trailed behind sales gains at

Home Depot Inc.

"This is the most challenging and competitive retail market that

we've seen in over 50 years," Mr. Ellison told analysts last week

on a conference call. Before Penney, he previously worked at Home

Depot and Target Corp.

On Tuesday, Lowe's said it had hired Mr. Ellison and he would

join the company on July 2. Penney shares slid 3.6%, while Lowe's

edged up 0.4%.

Penney said Tuesday it was launching a search for a new CEO. It

created an office of the chairman consisting of the chief financial

officer, the chief information officer and other executives who

will manage the day-to-day responsibilities until a successor is

found.

Mr. Ellison joined Penney when it was in crisis after former CEO

Ron Johnson's failed experiment to revamp the 116-year-old chain.

While Mr. Ellison stabilized sales, the company remains challenged,

which could make it more difficult for it to find a new CEO. It is

carrying a hefty debt load and it is unprofitable. It lost $78

million in the most recent quarter, compared with $187 million a

year ago.

"The turnaround program that Ellison put in place at JCP has

partly delivered but is still far from complete," said Neil

Saunders, managing director of GlobalData Retail, a consulting

firm. The "exit will also raise speculation that he is not

particularly optimistic about the future prospects of JCP."

Penney's same-store sales for the three months to May 5 rose a

scant 0.2%, below the company's own expectations and less than

rivals such as Macy's Inc. and Kohl's Corp., which both reported

strong results for the period.

Write to Imani Moise at imani.moise@wsj.com and Suzanne Kapner

at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

May 22, 2018 10:08 ET (14:08 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

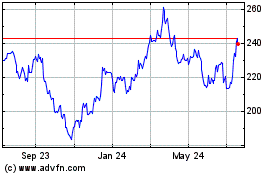

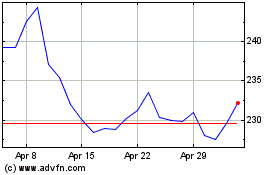

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024