Amended Report of Foreign Issuer (6-k/a)

May 21 2018 - 6:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K/A

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of May 2018

Commission File

No. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3

(NO. 333-209455) OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED

WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: May 21, 2018

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Managing Director, Head of

Documentation

& Corporate

Secretary Department,

Corporate

Administration Division

|

Mitsubishi UFJ Financial Group, Inc. (MUFG)

(TSE Code: 8306)

Corrections to

“Consolidated Summary Report <under Japanese GAAP>

for the fiscal year ended March 31, 2018”

Tokyo, May 21, 2018

— MUFG today announced partial corrections to “Consolidated Summary Report <under Japanese GAAP> for the fiscal

year ended March 31, 2018” disclosed on May 15, 2018, as shown in the Appendix.

— End —

(Translation)

Appendix

Corrections:

Consolidated Summary Report <under Japanese GAAP> for the fiscal year ended March 31, 2018 (Summary information)

1. Consolidated Financial Data for the Fiscal Year ended March 31, 2018

(3) Cash Flows

* The corrected

figures are underlined.

(Before Correction)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from

Operating Activities

|

|

|

Cash Flows from

Investing Activities

|

|

|

Cash Flows from

Financing Activities

|

|

|

Cash and Cash Equivalents

at the end of the period

|

|

|

|

|

million yen

|

|

|

million yen

|

|

|

million yen

|

|

|

million yen

|

|

|

Fiscal year ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2018

|

|

|

7,004,197

|

|

|

|

(656,875

|

)

|

|

|

(290,538

|

)

|

|

|

39,944,713

|

|

|

March 31, 2017

|

|

|

7,013,064

|

|

|

|

8,907,549

|

|

|

|

(670,592

|

)

|

|

|

33,968,391

|

|

(After Correction)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from

Operating Activities

|

|

|

Cash Flows from

Investing Activities

|

|

|

Cash Flows from

Financing Activities

|

|

|

Cash and Cash Equivalents

at the end of the period

|

|

|

|

|

million yen

|

|

|

million yen

|

|

|

million yen

|

|

|

million yen

|

|

|

Fiscal year ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2018

|

|

|

6,913,197

|

|

|

|

(565,875

|

)

|

|

|

(290,538

|

)

|

|

|

39,944,713

|

|

|

March 31, 2017

|

|

|

7,013,064

|

|

|

|

8,907,549

|

|

|

|

(670,592

|

)

|

|

|

33,968,391

|

|

Consolidated Summary Report <under Japanese GAAP> for the fiscal year ended March 31, 2018 (page

11-12)

3. Consolidated Financial Statements and Notes

(4) Consolidated Statements of Cash Flows

* The corrected figures are underlined.

(Before

Correction)

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Profits before income taxes

|

|

|

1,303,228

|

|

|

|

1,409,377

|

|

|

Depreciation and amortization

|

|

|

316,411

|

|

|

|

321,207

|

|

|

Impairment losses

|

|

|

10,162

|

|

|

|

76,122

|

|

|

Amortization of goodwill

|

|

|

16,737

|

|

|

|

17,603

|

|

|

Equity in losses (gains) of equity method investees

|

|

|

(244,453

|

)

|

|

|

(242,885

|

)

|

|

Increase (decrease) in allowance for credit losses

|

|

|

(92,783

|

)

|

|

|

(155,657

|

)

|

|

Increase (decrease) in reserve for bonuses

|

|

|

(285

|

)

|

|

|

4,759

|

|

|

Increase (decrease) in reserve for bonuses to directors

|

|

|

202

|

|

|

|

21

|

|

|

Increase (decrease) in reserve for stocks payment

|

|

|

10,400

|

|

|

|

1,206

|

|

|

Decrease (increase) in net defined benefit assets

|

|

|

(92,720

|

)

|

|

|

(123,708

|

)

|

|

Increase (decrease) in net defined benefit liabilities

|

|

|

1,652

|

|

|

|

(260

|

)

|

|

Increase (decrease) in reserve for retirement benefits to directors

|

|

|

14

|

|

|

|

(40

|

)

|

|

Increase (decrease) in reserve for loyalty award credits

|

|

|

959

|

|

|

|

600

|

|

|

Increase (decrease) in reserve for contingent losses

|

|

|

175,716

|

|

|

|

(66,513

|

)

|

|

Interest income recognized on statement of income

|

|

|

(2,888,134

|

)

|

|

|

(3,094,990

|

)

|

|

Interest expenses recognized on statement of income

|

|

|

863,677

|

|

|

|

1,188,223

|

|

|

Losses (gains) on securities

|

|

|

(181,811

|

)

|

|

|

(188,581

|

)

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Losses (gains) on money held in trust

|

|

|

8,771

|

|

|

|

450

|

|

|

Foreign exchange losses (gains)

|

|

|

459,763

|

|

|

|

417,825

|

|

|

Losses (gains) on sales of fixed assets

|

|

|

(8,200

|

)

|

|

|

5,800

|

|

|

Net decrease (increase) in trading assets

|

|

|

(1,737,675

|

)

|

|

|

6,172,302

|

|

|

Net increase (decrease) in trading liabilities

|

|

|

1,448,201

|

|

|

|

(7,200,920

|

)

|

|

Net decrease (increase) in unsettled trading accounts

|

|

|

(50,814

|

)

|

|

|

(60,914

|

)

|

|

Net decrease (increase) in loans and bills discounted

|

|

|

4,065,265

|

|

|

|

962,022

|

|

|

Net increase (decrease) in deposits

|

|

|

10,427,476

|

|

|

|

6,551,091

|

|

|

Net increase (decrease) in negotiable certificates of deposit

|

|

|

(242,013

|

)

|

|

|

(1,483,766

|

)

|

|

Net increase (decrease) in borrowed money (excluding subordinated borrowings)

|

|

|

4,551,643

|

|

|

|

(429,679

|

)

|

|

Net decrease (increase) in due from banks (excluding cash equivalents)

|

|

|

802,579

|

|

|

|

(5,220,840

|

)

|

|

Net decrease (increase) in call loans and bills bought and others

|

|

|

(1,413,158

|

)

|

|

|

2,362,074

|

|

|

Net decrease (increase) in receivables under securities borrowing transactions

|

|

|

(5,203,785

|

)

|

|

|

1,786,118

|

|

|

Net increase (decrease) in call money and bills sold and others

|

|

|

(3,999,428

|

)

|

|

|

631,521

|

|

|

Net increase (decrease) in commercial papers

|

|

|

33,847

|

|

|

|

(128,226

|

)

|

|

Net increase (decrease) in payables under securities lending transactions

|

|

|

850,842

|

|

|

|

2,612,538

|

|

|

Net decrease (increase) in foreign exchanges (assets)

|

|

|

(302,389

|

)

|

|

|

(844,857

|

)

|

|

Net increase (decrease) in foreign exchanges (liabilities)

|

|

|

(81,641

|

)

|

|

|

64,974

|

|

|

Net increase (decrease) in short-term bonds payable

|

|

|

95,507

|

|

|

|

(699

|

)

|

|

Net increase (decrease) in issuance and redemption of unsubordinated bonds payable

|

|

|

422,720

|

|

|

|

188,578

|

|

|

Net increase (decrease) in due to trust accounts

|

|

|

(3,402,151

|

)

|

|

|

488,598

|

|

|

Interest income (cash basis)

|

|

|

3,023,722

|

|

|

|

3,181,494

|

|

|

Interest expenses (cash basis)

|

|

|

(847,418

|

)

|

|

|

(1,170,125

|

)

|

|

Others

|

|

|

(684,097

|

)

|

|

|

(809,354

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Sub-total

|

|

|

7,416,541

|

|

|

|

7,222,489

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

(427,841

|

)

|

|

|

(250,661

|

)

|

|

Refund of income taxes

|

|

|

24,364

|

|

|

|

32,370

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

7,013,064

|

|

|

|

7,004,197

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of securities

|

|

|

(56,618,395

|

)

|

|

|

(72,969,164

|

)

|

|

Proceeds from sales of securities

|

|

|

39,602,665

|

|

|

|

33,353,855

|

|

|

Proceeds from redemption of securities

|

|

|

26,428,256

|

|

|

|

39,501,328

|

|

|

Payments for increase in money held in trust

|

|

|

(763,127

|

)

|

|

|

(540,772

|

)

|

|

Proceeds from decrease in money held in trust

|

|

|

615,931

|

|

|

|

401,831

|

|

|

Purchases of tangible fixed assets

|

|

|

(121,733

|

)

|

|

|

(159,814

|

)

|

|

Purchases of intangible fixed assets

|

|

|

(249,744

|

)

|

|

|

(247,378

|

)

|

|

Proceeds from sales of tangible fixed assets

|

|

|

31,815

|

|

|

|

11,790

|

|

|

Proceeds from sales of intangible fixed assets

|

|

|

2,890

|

|

|

|

700

|

|

|

Payments for transfer of business

|

|

|

—

|

|

|

|

(7,060

|

)

|

|

Payments for acquisition of subsidiaries’ equity affecting the scope of

consolidation

|

|

|

(21,954

|

)

|

|

|

(20

|

)

|

|

Proceeds from sales of subsidiaries’ equity affecting the scope of consolidation

|

|

|

2,761

|

|

|

|

—

|

|

|

Others

|

|

|

(1,815

|

)

|

|

|

(2,172

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

8,907,549

|

|

|

|

(656,875

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from subordinated borrowings

|

|

|

31,000

|

|

|

|

39,500

|

|

|

Repayments of subordinated borrowings redemption

|

|

|

(50,592

|

)

|

|

|

(245,328

|

)

|

|

Proceeds from issuance of subordinated bonds payable and bonds with warrants

|

|

|

837,401

|

|

|

|

863,460

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Payments for redemption of subordinated bonds payable and bonds with warrants

|

|

|

(476,943

|

)

|

|

|

(256,196

|

)

|

|

Proceeds from issuance of common stock to

non-controlling

shareholders

|

|

|

1,195

|

|

|

|

2,196

|

|

|

Repayments to

non-controlling

shareholders

|

|

|

(854

|

)

|

|

|

(16

|

)

|

|

Payments for redemption of preferred securities

|

|

|

(468,956

|

)

|

|

|

(150,000

|

)

|

|

Dividends paid by MUFG

|

|

|

(246,563

|

)

|

|

|

(241,067

|

)

|

|

Dividends paid by subsidiaries to

non-controlling

shareholders

|

|

|

(77,008

|

)

|

|

|

(53,896

|

)

|

|

Purchases of treasury stock

|

|

|

(217,666

|

)

|

|

|

(201,050

|

)

|

|

Proceeds from sales of treasury stock

|

|

|

3

|

|

|

|

2,225

|

|

|

Payments for purchases of subsidiaries’ equity not affecting the scope of

consolidation

|

|

|

(1,612

|

)

|

|

|

(50,364

|

)

|

|

Proceeds from sales of subsidiaries’ equity not affecting the scope of consolidation

|

|

|

0

|

|

|

|

0

|

|

|

Others

|

|

|

4

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(670,592

|

)

|

|

|

(290,538

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash and cash equivalents

|

|

|

(45,486

|

)

|

|

|

(80,462

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

15,204,534

|

|

|

|

5,976,322

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

18,763,856

|

|

|

|

33,968,391

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period

|

|

|

33,968,391

|

|

|

|

39,944,713

|

|

|

|

|

|

|

|

|

|

|

|

(After Correction)

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Profits before income taxes

|

|

|

1,303,228

|

|

|

|

1,409,377

|

|

|

Depreciation and amortization

|

|

|

316,411

|

|

|

|

321,207

|

|

|

Impairment losses

|

|

|

10,162

|

|

|

|

76,122

|

|

|

Amortization of goodwill

|

|

|

16,737

|

|

|

|

17,603

|

|

|

Equity in losses (gains) of equity method investees

|

|

|

(244,453

|

)

|

|

|

(242,885

|

)

|

|

Increase (decrease) in allowance for credit losses

|

|

|

(92,783

|

)

|

|

|

(155,657

|

)

|

|

Increase (decrease) in reserve for bonuses

|

|

|

(285

|

)

|

|

|

4,759

|

|

|

Increase (decrease) in reserve for bonuses to directors

|

|

|

202

|

|

|

|

21

|

|

|

Increase (decrease) in reserve for stocks payment

|

|

|

10,400

|

|

|

|

1,206

|

|

|

Decrease (increase) in net defined benefit assets

|

|

|

(92,720

|

)

|

|

|

(123,708

|

)

|

|

Increase (decrease) in net defined benefit liabilities

|

|

|

1,652

|

|

|

|

(260

|

)

|

|

Increase (decrease) in reserve for retirement benefits to directors

|

|

|

14

|

|

|

|

(40

|

)

|

|

Increase (decrease) in reserve for loyalty award credits

|

|

|

959

|

|

|

|

600

|

|

|

Increase (decrease) in reserve for contingent losses

|

|

|

175,716

|

|

|

|

(66,513

|

)

|

|

Interest income recognized on statement of income

|

|

|

(2,888,134

|

)

|

|

|

(3,094,990

|

)

|

|

Interest expenses recognized on statement of income

|

|

|

863,677

|

|

|

|

1,188,223

|

|

|

Losses (gains) on securities

|

|

|

(181,811

|

)

|

|

|

(188,581

|

)

|

|

Losses (gains) on money held in trust

|

|

|

8,771

|

|

|

|

450

|

|

|

Foreign exchange losses (gains)

|

|

|

459,763

|

|

|

|

326,825

|

|

|

Losses (gains) on sales of fixed assets

|

|

|

(8,200

|

)

|

|

|

5,800

|

|

|

Net decrease (increase) in trading assets

|

|

|

(1,737,675

|

)

|

|

|

6,172,302

|

|

|

Net increase (decrease) in trading liabilities

|

|

|

1,448,201

|

|

|

|

(7,200,920

|

)

|

|

Net decrease (increase) in unsettled trading accounts

|

|

|

(50,814

|

)

|

|

|

(60,914

|

)

|

|

Net decrease (increase) in loans and bills discounted

|

|

|

4,065,265

|

|

|

|

962,022

|

|

|

Net increase (decrease) in deposits

|

|

|

10,427,476

|

|

|

|

6,551,091

|

|

|

Net increase (decrease) in negotiable certificates of deposit

|

|

|

(242,013

|

)

|

|

|

(1,483,766

|

)

|

|

Net increase (decrease) in borrowed money (excluding subordinated borrowings)

|

|

|

4,551,643

|

|

|

|

(429,679

|

)

|

|

Net decrease (increase) in due from banks (excluding cash equivalents)

|

|

|

802,579

|

|

|

|

(5,220,840

|

)

|

|

Net decrease (increase) in call loans and bills bought and others

|

|

|

(1,413,158

|

)

|

|

|

2,362,074

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Net decrease (increase) in receivables under securities borrowing transactions

|

|

|

(5,203,785

|

)

|

|

|

1,786,118

|

|

|

Net increase (decrease) in call money and bills sold and others

|

|

|

(3,999,428

|

)

|

|

|

631,521

|

|

|

Net increase (decrease) in commercial papers

|

|

|

33,847

|

|

|

|

(128,226

|

)

|

|

Net increase (decrease) in payables under securities lending transactions

|

|

|

850,842

|

|

|

|

2,612,538

|

|

|

Net decrease (increase) in foreign exchanges (assets)

|

|

|

(302,389

|

)

|

|

|

(844,857

|

)

|

|

Net increase (decrease) in foreign exchanges (liabilities)

|

|

|

(81,641

|

)

|

|

|

64,974

|

|

|

Net increase (decrease) in short-term bonds payable

|

|

|

95,507

|

|

|

|

(699

|

)

|

|

Net increase (decrease) in issuance and redemption of unsubordinated bonds payable

|

|

|

422,720

|

|

|

|

188,578

|

|

|

Net increase (decrease) in due to trust accounts

|

|

|

(3,402,151

|

)

|

|

|

488,598

|

|

|

Interest income (cash basis)

|

|

|

3,023,722

|

|

|

|

3,181,494

|

|

|

Interest expenses (cash basis)

|

|

|

(847,418

|

)

|

|

|

(1,170,125

|

)

|

|

Others

|

|

|

(684,097

|

)

|

|

|

(809,354

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Sub-total

|

|

|

7,416,541

|

|

|

|

7,131,489

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

(427,841

|

)

|

|

|

(250,661

|

)

|

|

Refund of income taxes

|

|

|

24,364

|

|

|

|

32,370

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

7,013,064

|

|

|

|

6,913,197

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of securities

|

|

|

(56,618,395

|

)

|

|

|

(73,029,164

|

)

|

|

Proceeds from sales of securities

|

|

|

39,602,665

|

|

|

|

33,503,855

|

|

|

Proceeds from redemption of securities

|

|

|

26,428,256

|

|

|

|

39,502,328

|

|

|

Payments for increase in money held in trust

|

|

|

(763,127

|

)

|

|

|

(540,772

|

)

|

|

Proceeds from decrease in money held in trust

|

|

|

615,931

|

|

|

|

401,831

|

|

|

Purchases of tangible fixed assets

|

|

|

(121,733

|

)

|

|

|

(159,814

|

)

|

|

Purchases of intangible fixed assets

|

|

|

(249,744

|

)

|

|

|

(247,378

|

)

|

|

Proceeds from sales of tangible fixed assets

|

|

|

31,815

|

|

|

|

11,790

|

|

|

Proceeds from sales of intangible fixed assets

|

|

|

2,890

|

|

|

|

700

|

|

|

Payments for transfer of business

|

|

|

—

|

|

|

|

(7,060

|

)

|

|

Payments for acquisition of subsidiaries’ equity affecting the scope of

consolidation

|

|

|

(21,954

|

)

|

|

|

(20

|

)

|

|

Proceeds from sales of subsidiaries’ equity affecting the scope of consolidation

|

|

|

2,761

|

|

|

|

—

|

|

|

Others

|

|

|

(1,815

|

)

|

|

|

(2,172

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

8,907,549

|

|

|

|

(565,875

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from subordinated borrowings

|

|

|

31,000

|

|

|

|

39,500

|

|

|

Repayments of subordinated borrowings redemption

|

|

|

(50,592

|

)

|

|

|

(245,328

|

)

|

|

Proceeds from issuance of subordinated bonds payable and bonds with warrants

|

|

|

837,401

|

|

|

|

863,460

|

|

|

Payments for redemption of subordinated bonds payable and bonds with warrants

|

|

|

(476,943

|

)

|

|

|

(256,196

|

)

|

|

Proceeds from issuance of common stock to

non-controlling

shareholders

|

|

|

1,195

|

|

|

|

2,196

|

|

|

Repayments to

non-controlling

shareholders

|

|

|

(854

|

)

|

|

|

(16

|

)

|

|

Payments for redemption of preferred securities

|

|

|

(468,956

|

)

|

|

|

(150,000

|

)

|

|

Dividends paid by MUFG

|

|

|

(246,563

|

)

|

|

|

(241,067

|

)

|

|

Dividends paid by subsidiaries to

non-controlling

shareholders

|

|

|

(77,008

|

)

|

|

|

(53,896

|

)

|

|

Purchases of treasury stock

|

|

|

(217,666

|

)

|

|

|

(201,050

|

)

|

|

Proceeds from sales of treasury stock

|

|

|

3

|

|

|

|

2,225

|

|

|

Payments for purchases of subsidiaries’ equity not affecting the scope of

consolidation

|

|

|

(1,612

|

)

|

|

|

(50,364

|

)

|

|

Proceeds from sales of subsidiaries’ equity not affecting the scope of consolidation

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen)

|

|

For the fiscal year

ended

March 31, 2017

|

|

|

For the fiscal year

ended

March 31, 2018

|

|

|

Others

|

|

|

4

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(670,592

|

)

|

|

|

(290,538

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash and cash equivalents

|

|

|

(45,486

|

)

|

|

|

(80,462

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

15,204,534

|

|

|

|

5,976,322

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

18,763,856

|

|

|

|

33,968,391

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period

|

|

|

33,968,391

|

|

|

|

39,944,713

|

|

|

|

|

|

|

|

|

|

|

|

Selected Financial Information under Japanese GAAP For the Fiscal Year Ended March 31, 2018 (page 8)

3. Notional Principal by the Remaining Life of the Interest Rate Swaps for Hedge-Accounting

* The corrected figures are underlined.

(Before

Correction)

MUFG Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

691.6

|

|

|

|

5,114.1

|

|

|

|

13,597.4

|

|

|

|

19,403.2

|

|

|

Receive-floater/pay-fix

|

|

|

474.5

|

|

|

|

5,664.6

|

|

|

|

2,500.5

|

|

|

|

8,639.7

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,166.2

|

|

|

|

10,778.7

|

|

|

|

16,097.9

|

|

|

|

28,043.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BK Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

632.1

|

|

|

|

4,712.8

|

|

|

|

13,509.7

|

|

|

|

18,854.8

|

|

|

Receive-floater/pay-fix

|

|

|

15.2

|

|

|

|

3,906.2

|

|

|

|

680.7

|

|

|

|

4,602.3

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

647.4

|

|

|

|

8,619.1

|

|

|

|

14,190.5

|

|

|

|

23,457.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TB Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

59.5

|

|

|

|

401.2

|

|

|

|

87.7

|

|

|

|

548.4

|

|

|

Receive-floater/pay-fix

|

|

|

454.8

|

|

|

|

1,705.9

|

|

|

|

1,800.7

|

|

|

|

3,961.5

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

514.3

|

|

|

|

2,107.1

|

|

|

|

1,888.4

|

|

|

|

4,509.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(After Correction)

MUFG Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

712.9

|

|

|

|

5,388.4

|

|

|

|

13,597.4

|

|

|

|

19,698.8

|

|

|

Receive-floater/pay-fix

|

|

|

479.8

|

|

|

|

5,694.4

|

|

|

|

2,500.5

|

|

|

|

8,674.7

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,192.7

|

|

|

|

11,082.8

|

|

|

|

16,097.9

|

|

|

|

28,373.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BK Consolidated

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

632.1

|

|

|

|

4,712.8

|

|

|

|

13,509.7

|

|

|

|

18,854.8

|

|

|

Receive-floater/pay-fix

|

|

|

15.2

|

|

|

|

3,906.2

|

|

|

|

680.7

|

|

|

|

4,602.3

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

647.4

|

|

|

|

8,619.1

|

|

|

|

14,190.5

|

|

|

|

23,457.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TB Consolidated

|

|

|

|

|

|

|

|

|

(in billions of yen)

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

within 1 year

|

|

|

1 year to 5 years

|

|

|

over 5 years

|

|

|

Total

|

|

|

Receive-fix/pay-floater

|

|

|

80.7

|

|

|

|

675.5

|

|

|

|

87.7

|

|

|

|

843.9

|

|

|

Receive-floater/pay-fix

|

|

|

460.2

|

|

|

|

1,735.7

|

|

|

|

1,800.7

|

|

|

|

3,996.6

|

|

|

Receive-floater/pay-floater

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Receive-fix/pay-fix

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

540.9

|

|

|

|

2,411.2

|

|

|

|

1,888.4

|

|

|

|

4,840.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

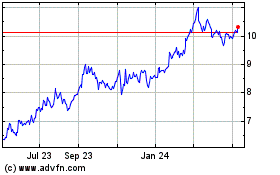

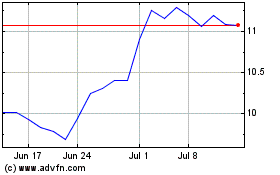

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024