By Khadeeja Safdar

Liz Carlson forked over $70 for a "heavyweight cotton" hoodie

after seeing an enticing ad on Facebook that claimed it had "the

softest interior we've ever created."

"I love hoodies, so when I saw that ad, it spoke right to my

heart," said Ms. Carlson, a 32-year-old in Oakland, Calif.

The ad was from an e-commerce site called Affinity Find, which

has more than 700,000 Facebook followers--about the same as

eyeglass seller Warby Parker. Affinity Find sells dozens of

products on its website, which says a store is coming soon to

downtown Seattle.

Ms. Carlson's hoodie, however, arrived three weeks after she

ordered it from an address in China. "It was reeking of a pungent

chemical smell like gasoline," she said. "The item was a rough

combination of synthetic fibers with no tags and plastic zips."

Affinity Find is run by Jonathan Smith, the owner of Clear Creek

Marketing & Sales LLC in Poulsbo, Wash. Mr. Smith declined to

comment and asked The Wall Street Journal not to publish his name,

citing "copycat entrepreneurs."

Welcome to a little-known corner of the e-commerce world, where

small entrepreneurs use social-media ads and hip virtual

storefronts to entice people into buying products listed on online

marketplaces such as Alibaba Group Holding Ltd.'s AliExpress.

The process often involves online storefronts transferring

customer details to an AliExpress seller, which ships the goods

directly to the customer; the storefront bills the customer. Called

dropshipping, it is a twist on a fulfillment technique that major

online retailers also use to send goods directly from their

manufacturers to the customer.

The entrepreneur profits by charging a high markup, betting

shoppers are unlikely to stumble upon the less-expensive goods on a

marketplace site. AliExpress is the most popular such marketplace,

but some entrepreneurs order from sellers on other marketplace

sites like Amazon.

The hoodie that Ms. Carlson purchased on Affinity Find for $70,

plus shipping and tax, is available on AliExpress for about $20

with free shipping to the U.S. Several other items for sale on

Affinity Find match listings at lower prices on the Chinese

marketplace.

Affinity Find has an F rating with the Better Business Bureau,

whose website says it found advertising issues and received

complaints about products, service and delivery.

The same hoodie was being pushed by other sites, including Sugar

Picks, which says it sells "carefully selected unique products,"

and Teelandia, which says it collaborates with local artists to

design clothes. Both sites posted Facebook ads in January with the

same language and images as Affinity Find's ad.

A representative for Sugar Picks, which lists an address in

Casper, Wyo., said in an email that the site has discontinued the

practice of dropshipping, noting "the bulk of our expenses comes

from advertisement cost which can be higher than the product cost

itself." Teelandia, which lists a Las Vegas address, didn't respond

to requests for comment.

Such sites often use Shopify Inc., a commerce platform where

sellers create their own e-commerce storefronts. In a blog post,

Shopify provides detailed instructions on how to sell using

AliExpress, calling it "retail arbitrage." It said it doesn't

comment on individual sellers that use its platform.

Craig Miller, Shopify's chief product officer, said the company

wants more people to start businesses. "If the quickest way for

someone to start being an entrepreneur and to try it out is to

resell someone else's products, I actually don't think there's

anything wrong with that, " he said. "But again I want to make sure

that whoever does sell online really stands behind their

products."

Facebook said it is taking steps to ensure people have good

experiences when they buy items from ads on the platform. "We're

developing a new way for people to flag businesses that deliver

products or services that are overwhelmingly unsatisfactory," said

Joe Osborne, a Facebook spokesman. "We think this can help hold

businesses more accountable."

A spokesman for Alibaba, which owns AliExpress, declined to

comment.

Flipping products from AliExpress has become so common that

self-proclaimed experts are selling online courses teaching

tactics, such as how to pick products that people are least likely

to research online and how to hide the original price of the

items.

From the balcony of a three-story mansion in San Diego, Kevin

David tells YouTube viewers how he left an unfulfilling office job

to make an e-commerce fortune. The 28-year-old, who sells a Shopify

course for about $1,000, says in the video that he generates

hundreds of thousands of dollars a month in sales from Shopify.

"Dropshipping is a beautiful business model," he says.

In an interview, Mr. David said he makes money from

Shopify-related businesses, including sales of his course, and

isn't sure how much he earns from dropshipping. He chalked up

complaints about dropshipping to problems with specific

storefronts.

"It's like any other business," he said. "Some people do it more

professionally, and some people do it less professionally."

Many online sellers run small operations out of their homes or

offices; they curate items from AliExpress and other marketplaces,

often using the same images, then generate enticing ads for

Facebook and Instagram.

When a customer orders from a Shopify-hosted storefront, the

seller transfers the shopper's shipping details to AliExpress. Many

sellers automate the transfer using an app called Oberlo, which

Shopify acquired last year. The app can pull products from

AliExpress into Shopify and send a default note to the suppliers

asking them to refrain from putting an invoice in the package.

Casey Ark, a 27-year-old in Bradenton, Fla., runs multiple

Shopify sites with more than three million total Facebook

followers. He said dropshipping is no longer lucrative since

Facebook's ad prices have risen and more people have launched

copycat storefronts. "The ad saturation is nuts," he said.

Jim Oberman contributed to this article.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

May 20, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

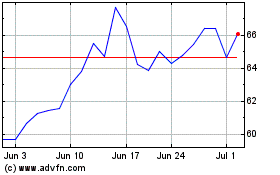

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024