Current Report Filing (8-k)

May 16 2018 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of report (Date of earliest event reported):

May 15, 2018

|

|

|

|

Horizon Bancorp, Inc.

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Indiana

|

000-10792

|

35-1562417

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

515 Franklin Street, Michigan City, Indiana

|

46360

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

(219) 879-0211

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

N/A

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On May 15, 2018, the Board of Directors of Horizon Bancorp, Inc. (the “Company”) amended the Company’s Amended and Restated Articles of Incorporation and declared a three-for-two stock split on the Company’s authorized common stock, no par value. The amendment to the Amended and Restated Articles of Incorporation increased the number of authorized common shares from 66 million to 99 million, to reflect and accommodate the declared three-for-two stock split. The Company’s 1 million authorized preferred shares remains the same, giving the Company total authorized common and preferred shares of 100 million, as increased from 67 million.

The amendment to the Amended and Restated Articles of Incorporation became effective upon filing Articles of Amendment with the Indiana Secretary of State on May 16, 2018. A complete copy of the Company’s Amended and Restated Articles of Incorporation, as amended by the Articles of Amendment effective May 16, 2018, is attached as Exhibit 3.1 to this Current Report on Form 8-K.

The effect of the three-for-two stock split on the outstanding common shares is that shareholders of record as of the close of business on May 31, 2018, the record date, will receive an additional half share for each share of common stock held. Shareholders will receive cash in lieu of any fractional share of common stock that they otherwise would have been entitled to receive in connection with the stock split, except that participants in the Company’s dividend reinvestment program and in the various stock purchase plans of the Company will have fractional shares credited to their accounts. The price paid for fractional shares will be based on the average closing price of a share of common stock as reported on the Nasdaq Global Select Market for the five trading days immediately prior to the record date. The additional shares issued in the stock split are expected to be payable and issued on June 15, 2018. The Company anticipates that the common shares will begin trading on a split-adjusted basis on or about June 18, 2018, or such other date established by Nasdaq.

Additional information about the stock split is included in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 8.01. Other Events

On May 15, 2018, the Board of Directors of Horizon declared a three-for-two stock split as described more fully above in Item 5.03 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

|

|

(d) Exhibits

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

Exhibit No.

|

|

Description

|

|

Location

|

|

|

3.1

|

|

|

|

Attached

|

|

|

99.1

|

|

|

|

Attached

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

Date: May 16, 2018

|

Horizon Bancorp, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Mark E. Secor

|

|

|

|

Mark E. Secor

|

|

|

|

Executive Vice President and Chief Financial Officer

|

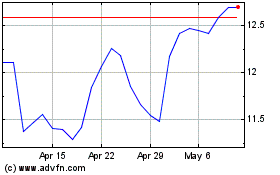

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

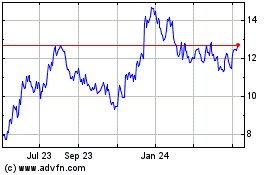

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024