Additional Proxy Soliciting Materials (definitive) (defa14a)

May 16 2018 - 9:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check

the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary

Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive

Proxy Statement

|

|

|

|

|

☒

|

|

Definitive

Additional Materials

|

|

|

|

|

☐

|

|

Soliciting

Material Pursuant to §240.14a-12

|

Navient Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the

Registrant)

Payment of filing fee (check the appropriate box):

|

☒

|

No fee

required.

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11

|

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date

of its filing.

|

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

AN IMPORTANT REMINDER TO SUBMIT YOUR PROXY TO VOTE AT OUR

ANNUAL

MEETING OF SHAREHOLDERS ON MAY 24, 2018

Navient’s Independent Directors Urge You to Vote

AGAINST Shareholder Proposal No. 4

May 16,

2018

Dear

Fellow Shareholders:

The

Board of Directors of Navient Corporation urges you to vote

AGAINST

Proposal No. 4, a

proposal sponsored by the AFL-CIO Reserve Fund and the

Employees’ Retirement System of Rhode Island requesting that

Navient prepare a report on the governance measures it has

implemented “to more effectively monitor and manage financial

and reputational risks related to the student loan crisis in the

United States.” One proponent has filed an open letter urging

Navient shareholders to vote for Proposal No. 4 (“Proponent

Letter”).

Our

statement in opposition to the proposal, which summarizes why we

believe the proposal is not helpful to shareholders or other

stakeholders, can be found in Navient’s proxy statement. We

believe that the proposal in general, and the Proponent Letter, in

particular, reflect a fundamental misunderstanding of the real

drivers of student loan concerns and the role of student loan

servicers in addressing these drivers.

BOTH THE PROPOSAL AND THE

PROPONENT LETTER MAKE FREQUENT REFERENCE TO A STUDENT LOAN CRISIS

AND GROWING LEVELS OF STUDENT LOAN DEBT. YET NAVIENT, LIKE MOST

STUDENT LOAN SERVICERS, DOES NOT SET TUITION LEVELS, MAKE THE LOANS

TO BORROWERS TO PAY THAT TUITION OR SET THE TERMS OF THOSE

LOANS

.

Student Loan Servicers Do Not Interact with Borrowers Until After

College Selection and Borrowing Decisions Have Already

Occurred

.

●

As illustrated in

the following chart,

1

Navient’s role as a servicer

begins after borrowers have made decisions about the cost of their

education. The role of the servicer is confined to following its

contractual requirements with the Federal government, and

applicable law.

The Federal Government, Not Navient, Sets Eligibility, Interest

Rates, and Other Terms of Virtually All Student

Loans

.

●

Both the proposal

and the Proponent Letter suggest that student loan servicers like

Navient are a contributing factor to the level of student loan debt

in the United States and a source of a student loan crisis.

In fact, 93% of

all student loans are owned or guaranteed by the Federal

government, which sets borrowing eligibility, loan amounts,

interest rates and repayment options.

●

Servicers of

federally-owned loans (78% of all loans) do not keep the interest

on the loans, are not paid based on how much debt students borrow,

and make substantially less for borrowers who delay their payments

through forbearance. The fees and performance measures for federal

student loan servicers create incentives to keep borrowers current;

the fees are based on number of borrowers—and not

debt—so servicers have no incentives to see students borrow

more or see them fall behind on their debts.

THE PROPOSAL REFERENCES “INCREASED DEFAULTS” AND THE

PROPONENT LETTER REFERENCES “GROWING STUDENT LOAN DELINQUENCY

TRENDS.”

In Fact, Delinquency and

Default Rates Have Been Declining

.

●

In the past three

years, nationally, the percent of federal borrowers who are

seriously past due on their payments has decreased 24%, while the

percent of federal dollars delinquent by 90 days or more has

decreased by 19%.

●

Each graduating

class serviced by Navient since 2010 has experienced better

delinquency rates as the economy has improved.

●

Since December

2015, the rate of federal borrowers entering default has decreased

by 20%, according to Department of Education data.

●

While delinquency

and default rates are declining, it is important to recognize that

the most significant challenges are among individuals who borrowed

relatively small amounts—generally a signal that they did not

complete college. A White House report published in 2016 by the

Obama administration showed that two-thirds of defaults came from

borrowers with less than $10,000 in balances. At these levels, it

is clear these are borrowers who went to college, borrowed, but did

not complete their degree. Those who did not complete are nearly

three times as likely to default as those who achieved their

degree.

2

CONTRARY TO THE ASSERTIONS

IN THE PROPONENT LETTER AND THE PROPOSAL, NAVIENT IS NOT A SOURCE

OF A “STUDENT LOAN CRISIS”. RATHER NAVIENT CONSISTENTLY

OUTPERFORMS OTHER STUDENT LOAN SERVICERS AND IS THE SOURCE OF

THOUGHTFUL, ACTIONABLE PROPOSALS THAT WOULD HELP ADDRESSS SOME OF

THE ROOT CAUSES OF STUDENT LOAN BORROWER

DISTRESS

.

Navient Has a Long Track

Record of Supporting Borrower Success and Producing Leading

Outcomes

.

●

In carrying out its

role as a loan servicer, Navient has earned an excellent track

record, as demonstrated by metrics such as delinquency rates and

default rates that are substantially better than those of loans

serviced by its competitors. In fact, according to the latest

Cohort Default Rate, borrowers serviced by Navient were 37% less

likely to default than others.

3

●

Navient educates

borrowers about repayment options and facilitates enrollment in

alternative payment plans such as income-driven repayment. In fact,

Navient leads comparable servicers in volume of loans enrolled in

plans based on income.

1

For more information please see

navient.com/facts

.

2

See

https://obamawhitehouse.archives.gov/sites/default/files/page/files/20160718_cea_student_debt.pdf

.

3

See

https://news.navient.com/news-releases/news-release-details/federal-student-loan-borrowers-serviced-navient-are-37-less

.

●

Navient’s

proactive, multi-channel communications approach leads other

servicers in helping at-risk borrowers avoid default. According to

data released in May 2018, borrowers who did not graduate and who

are new to repayment were most successful if their loans were

serviced by Navient.

Navient Continually Improves Its Programs and Has Proposed a Series

of Student Loan Reforms to Address the Real Drivers of Student Loan

Concerns.

●

Navient regularly

updates its servicing program to address the needs we see through

our customer feedback analysis and customer research. For example,

we have overhauled our customer website to make it easier to

navigate, created more visible reminders for payment plan

deadlines, established a specialized team to serve military

customers, sped up payment processing times, and added

functionality to more easily direct payments. Navient also

developed, piloted, and implemented a new process to help enroll

struggling FFELP borrowers in IDR plans, significantly reducing the

number of steps to complete IDR applications.

●

Navient has

developed a series of practical recommendations for reforms that

would make a meaningful difference to struggling student loan

borrowers, including simplifying repayment plans, streamlining

income-driven repayment enrollment processes, enabling courtesy

credit bureau retractions, bankruptcy reform, and financial

education. For example, see “

Truth in student

lending: What borrower complaints say about improving student

loans

,” and “

The student loan

crisis we should work together to solve

” at

https://news.navient.com/views-speeches

.

CITED ALLEGATIONS ARE UNPROVEN AND UNFOUNDED AND DO NOT SUPPORT THE

PROPOSAL

Lastly,

the Proponent Letter as support for the Proposal cites certain

pending actions by the Consumer Financial Protection Bureau (CFPB)

and by the Attorneys General of the States of Illinois, Washington,

and Pennsylvania, suggesting Navient’s business

practices—as characterized by the unproven allegations

contained in these lawsuits—are a source of a student loan

crisis.

In

fact, Navient has denied these allegations, and no court has

determined that it engaged in any of the practices being alleged.

Navient is vigorously defending itself against these actions and

has published its response at

navient.com/facts

.

For all

the reasons set forth in our proxy statement and this letter, we

urge our shareholders to vote

AGAINST

Proposal No. 4.

Sincerely,

|

John F.

Remondi

|

William M. Diefenderfer, III

|

|

President

and Chief Executive Officer

|

Chairman of the Board of Directors

|

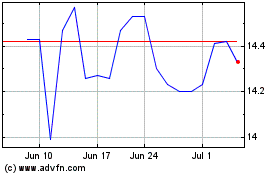

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

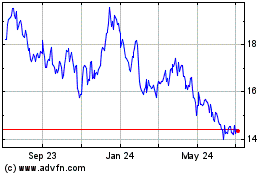

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024