Why the Credit-Card Boom May Have Just Peaked

May 16 2018 - 5:59AM

Dow Jones News

By AnnaMaria Andriotis

Following some of their strongest years ever, credit-card

issuers are grappling with an uneasy future.

Rising loan losses and increased rewards expenses are putting

pressure on card lenders' returns. The result is that one of the

most profitable consumer-lending categories in recent years may

become more of a middling player.

"The easy money has been made in card lending," said Don

Fandetti, consumer finance analyst at Wells Fargo & Co.

While cards remain highly lucrative for banks, the benefits of a

rising interest-rate environment have been muted lately. The added

revenue of cardholders paying more in interest payments each month

has also been offset by growing competition from lenders trying to

poach card customers by offering lower rates.

Credit cards became an appealing loan category for banks in the

wake of the last recession. Card balances grew at an accelerating

pace in recent years, reaching a 7% year-over-year growth rate

early last year. Total balances exceeded $1.03 trillion in January,

the highest on record, according to the Federal Reserve.

But that coincided with an increase in loan losses from

historically low levels, as banks set aside more money for future

write-offs. They also tightened their underwriting standards,

resulting in slowing growth. Card-balance growth in March was up

4.8% from a year earlier, compared with a 6.1% increase in March

2017 from the year-earlier period.

Five of the largest credit-card issuers -- American Express Co.,

Capital One Financial Corp., Citigroup Inc., Discover Financial

Services and Synchrony Financial -- generated a median return of

2.1% on their assets for common shareholders in the first quarter,

up from 2% a year earlier but down from 2.6% two years prior,

according to analysis by Autonomous Research. The recent peak was

3.7% in the second quarter of 2011, according to an industry

analysis by Autonomous at the time.

"The industry was at an unsustainable high...so coming down is

expected, " David Nelms, Discover's chief executive, said in an

interview.

The pickup in returns for most banks in the first quarter was

primarily the result of tighter underwriting, which helped slow the

rate of loan loss increases and the amount of money banks are

setting aside for future losses. U.S. tax-law changes that lowered

corporate tax rates also helped.

Still, returns remain largely unchanged -- and in some cases

down -- from about 2 1/2 years ago when the Fed began raising

rates. "Rising rates [are] a mixed blessing for the card issuers at

this point," said Brian Foran, analyst at Autonomous Research.

Companies aren't getting the full benefit of the higher rates

because while interest charges on cards are rising, so are the

interest rates card issuers are having to pay bank customers for

their online deposit accounts.

Some analysts predict that profitability will keep falling,

though it remains significantly higher than many other banking

products. Credit cards delivered a projected 3.8% return on assets

to 14 large banks highly concentrated in the card business last

year, compared with an overall 1.35% projected return for all

commercial banks, according to payments consulting firm Mercator

Advisory Group Inc. Mercator projects that card returns will fall

in 2018 to 3.5% due to losses and challenges cutting further

costs.

Stocks of card companies have reflected the concern, with

Discover shares down 0.8% so far this year, and Synchrony

Financial, the largest U.S. store credit-card issuer, down 11.4%,

compared with a 4% gain in the KBW Nasdaq Bank index.

Credit-card losses have been mostly rising over the past two

years after hovering around near-record lows. The average net

charge-off rate -- the share of outstanding debt that issuers wrote

off as a loss -- for eight of the largest credit-card issuers

reached a nearly five-year high of 3.46% in the first quarter,

according to Fitch Ratings. The increases have become worrisome

indicators for some shareholders of consumers' inability to pay

debts at a time when unemployment is low.

Another pain point for card issuers is the cost they incur from

so-called gamers, who search for the highest rewards on their

cards. These consumers sign up for credit cards with rich sign-up

bonus offerings and then stop using the card once they have tapped

out the early rewards.

U.S. credit-card attrition rates, a measure of how many cards

consumers and card issuers close, reached 15% in 2017, up from less

than 10% a year earlier, according to Mercator.

Meanwhile, banks and fintech lenders that originate personal

loans have been increasing solicitations in recent quarters. Many

of these offers are targeting consumers with credit-card debt and

pitching the opportunity to roll over that debt into a personal

loan at a lower interest rate. Their prime targets are the

customers who card issuers want to keep most: those with high

credit scores who carry a card balance each month.

A record 516 million personal loan solicitations were mailed out

in the first quarter, up 46% from a year ago, according to

estimates from market research firm Competiscan. This marked the

fifth-consecutive record-breaking quarter.

(END) Dow Jones Newswires

May 16, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

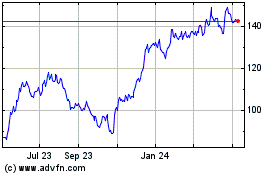

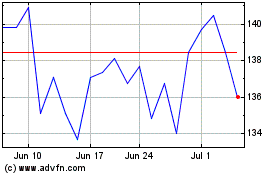

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024