Merck KGaA's Shares Fall After 1Q Results -- Update

May 15 2018 - 5:21AM

Dow Jones News

By Donato Paolo Mancini

Merck KGaA (MRK.XE) shares fell by as much as 4.8% in early

trade Tuesday after the company said that, despite organic growth,

its first-quarter sales declined, dragged by currency headwinds and

continuing market-share decline in performance materials in

China.

The company reported a 4.4% group sales decline to 3.69 billion

euros ($4.41 billion), affected by negative exchange rates. Its net

income decreased to EUR341 million, dropping 35% from EUR523

million a year earlier, it said.

Earnings before interest, taxes, depreciation and amortization,

or Ebitda, before one-time items was EUR1.01 billion, down from

EUR1.24 billion a year earlier. The company said favorable one-time

effects in its health-care sector buoyed numbers from the year

before.

Sales in its performance-materials division decreased 12% to

EUR564 million, with Chinese competition in liquid crystals

amplifying the decline, the company said.

According to consensus estimates compiled by FactSet, the

company was expected to post group sales of EUR3.70 billion, Ebitda

of EUR998 million and net income of EUR596 million.

Merck said it continues to expect a moderate organic net sales

increase of between 3% and 5% in 2018, with sales in the region of

EUR15 billion to EUR15.5 billion. The planned sale of its

consumer-health business to Procter & Gamble Co. (PG) is likely

to reduce group sales by between EUR900 million and EUR1 billion,

lowering sales estimates to between EUR14 billion and EUR14.5

billion, it said. Ebitda before exceptional items is expected to be

between EUR3.95 billion and EUR4.15 billion, it said.

The company's drug pipeline suffered some setbacks. Avelumab,

codeveloped with Pfizer Inc. (PFE), didn't deliver in a lung-cancer

study, whereas relapsing multiple sclerosis drug Evobrutinib met a

phase 2 trial endpoint.

Tepotinib, a cancer drug, received its first regulatory

designation in Japan, with analysts closely watching its potential

to treat a specific sub-population--at least 13,000 individuals in

the U.S.--of lung cancer patients affected by mutation METex14.

Wimal Kapadia, an analyst at Bernstein, sees Novartis AG's

(NOVN.EB) Capmatinib and Pfizer's Xalkori as likely competitors to

the drug.

Write to Donato Paolo Mancini at

donatopaolo.mancini@dowjones.com

(END) Dow Jones Newswires

May 15, 2018 05:06 ET (09:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

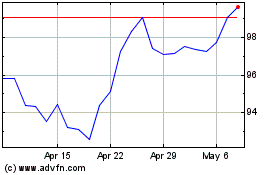

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

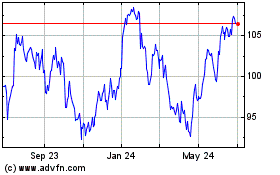

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024