Firms posting the best shareholder returns score in middle of

pack in terms of CEO pay

By Vanessa Fuhrmans

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 15, 2018).

The best-paid CEOs don't necessarily run the best-performing

companies.

Corporate boards have tried for years to tie chief executive

compensation to the results they deliver. The better the company

and its shareholders do, the more the top boss should be paid, or

so the pay-for-performance mantra goes. In reality, CEO pay and

performance often don't match up, and 2017 was no exception.

Among S&P 500 CEOs who got raises last year, the 10% who

received the biggest pay increases scored -- as a group -- in the

middle of the pack in terms of total shareholder return, according

to a Wall Street Journal analysis of data from MyLogIQ LLC and

Institutional Shareholder Services.

Similarly, the 10% of companies posting the best total returns

to shareholders scored in the middle of the pack in terms of CEO

pay, the data show.

"Stars are often underpaid, while average performers are often

overpaid, " said Herman Aguinis, a professor of management at

George Washington University School of Business.

One reason for the mismatch is that boards often set CEO pay by

benchmarking the average compensation for leaders at a peer group

of companies and setting performance targets accordingly, Mr.

Aguinis said. That works if CEO performance doesn't vary too

greatly from the average. But a study co-written by Mr. Aguinis and

published last week in the journal Management Research found that,

much like with professional athletes, there were vast differences

in the performance of CEOs.

The disparity between chief executive compensation and

performance appears to persist over longer periods, too, Mr.

Aguinis said. In the study, researchers analyzed the earnings of

more than 4,000 CEOs over the course of their tenures against

several performance metrics. They found virtually no overlap

between the top 1% of CEOs in terms of performance and the top 1%

of highest earners. Among the top 10% of performers, only a fifth

were in the top 10% in terms of pay.

In 2017, only two out of the 20 highest-paid CEOs who didn't

leave their jobs before the end of the year landed in the top 20

for shareholder return.

Robert Kotickof Activision Blizzard Inc., known for "Call of

Duty," "World of Warcraft" and other videogames, made $28.7 million

and posted a 76% return. Steve Wynn was paid $34.5 million, while

Wynn Resorts Ltd. posted a 98% total return. Mr. Wynn stepped down

as CEO in February amid sexual-assault allegations, which he has

denied.

Many firms condition a big share of pay on three-year

performance metrics that are only partially affected by a single

bad year, compensation consultants say.

CBS Corp. paid its chief, Leslie Moonves, $69.3 million last

year; total shareholder return was negative 6.2%. His pay was

virtually unchanged from $69.6 million in 2016 when the broadcaster

achieved a one-year return of 37%. Likewise, Comcast Corp. CEO

Brian Roberts's annual pay has hovered around $33 million the past

three years as annual shareholder returns ranged from 25% to

negative 1.1%.

In its proxy, CBS said Mr. Moonves received $12 million more in

2017 stock awards than the prior year, in part because of his

contract renewal. Comcast said in its filing that it prefers to

base executive pay on longer-term business-management metrics, not

total shareholder return.

Allergan PLC's Brent Saunders received a 700% raise in 2017 to

$32.8 million, despite total shareholder return of negative 21%.

The compensation package came during a year when Allergan ran into

patent setbacks for one of its best sellers, dry-eye drug Restasis,

which contributed to a 22% drop in the firm's share price for the

year.

Part of the $8.8 million Mr. Saunders got in incentive payments

stems from longer-term performance targets met since Allergan's

2014 acquisition of Forest Laboratories Inc., the company said in

its proxy statement. Another portion of his 2017 compensation,

$22.6 million in stock awards, won't vest until future years and is

contingent on meeting specific research and shareholder-return

goals. The drugmaker said in its proxy that because the award

covers two years, it will report less compensation for Mr. Saunders

for 2018 and 2019.

One of the biggest gaps between CEO pay and shareholder return

was at aerospace-parts company TransDigm Group Inc. For much of the

year, TransDigm's stock took a beating from short sellers who have

criticized the its acquisition-driven business model, but the

volatility had little effect on then-CEO Nicholas Howley's pay

package.

Shares, including reinvested dividends, returned just shy of 5%

for the fiscal year that ended Sept. 30, 2017, underperforming the

broader S&P 500 index for the first time in a decade. During

the same period, Mr. Howley earned $61 million, more than triple

the $18.9 million he made in 2016.

The bulk of his compensation -- $51.2 million -- came from

dividend-like payments on vested options, stemming from $46 in

special cash dividends the company awarded shareholders during the

fiscal year. TransDigm paid no dividends the previous fiscal year.

Mr. Howley also received $9.8 million in stock options. His base

salary was $7,000.

Mr. Howley stepped down in April after a 17-year run as CEO and

remains as TransDigm's executive chairman. The company declined to

comment on his pay package but pointed out that its proxy statement

shows the company's one-year return for the calendar, versus

fiscal, year was 20% and that its longer-term returns dramatically

outpace the broader market.

Write to Vanessa Fuhrmans at vanessa.fuhrmans@wsj.com

(END) Dow Jones Newswires

May 15, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

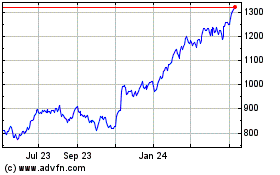

Transdigm (NYSE:TDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2023 to Apr 2024