Use these links to rapidly review the document

TABLE OF CONTENTS PROSPECTUS SUPPLEMENT

Table of Contents

Filed pursuant to General Instruction II.L of Form F-10

File No. 333-213985

PROSPECTUS SUPPLEMENT

To a Short Form Base Shelf Prospectus dated October 14, 2016

May 14, 2018

PLATINUM GROUP METALS LTD.

114,000,000 Common Shares

This prospectus supplement (this "

Prospectus Supplement

") of Platinum Group Metals Ltd.

(the "

Company

" or "

PTM

"), together with the short form base shelf prospectus dated October 14,

2016 (the "

Prospectus

"), relates to the issuance of (i) up to 114,000,000 common shares of the Company (the "

Common

Shares

") issuable from time to time on exercise of 114,000,000 Warrants (as defined below) expected by be issued by the Company pursuant to the Unit Offering (as defined

below); (ii) up to 17,100,000 Common Shares issuable from time to time on exercise of additional Warrants that may be issued by the Company on exercise of the Over-Allotment Option (as defined

herein); and (iii) such indeterminate number of additional Common Shares that may be issuable by reason of the anti-dilution provisions contained in the Warrant Indenture (as defined herein).

See "Description of the Warrants." The Common Shares issuable upon exercise of the Warrants are sometimes referred to herein as the "

Warrant Shares

."

The

Company filed a preliminary prospectus supplement dated May 3, 2018 and a final prospectus supplement dated May 11, 2018 to its short form base shelf prospectus dated

October 14, 2016 with the securities commission or similar regulatory authority in each of the provinces of Canada, except Québec, and in connection therewith a preliminary

prospectus supplement dated May 3, 2018 and a final prospectus supplement filed as of May 14, 2018 to its registration statement on Form F-10 with the United States Securities and

Exchange Commission (the "

SEC

") relating to the offering (the "

Unit Offering

") by the Company of units

(the "

Units

"). The Unit Offering is expected to be completed on or about May 15, 2018 (the "

Closing

Date

").

Each

Unit consists of one Common Share (an "

Offered Share

") and one common share purchase warrant (a

"

Warrant

"). Each Warrant will entitle the holder to acquire, subject to adjustment in certain circumstances, one Common Share at a price of US$0.17 per

Common Share (the "

Warrant Exercise Price

") until the date that is 18 months following the Closing Date (as defined herein) (the

"

Expiry Date

").

This

Prospectus Supplement registers the issuance of the Common Shares upon exercise of the Warrants under the United States Securities Act of 1933, as amended, in accordance with

the multi-jurisdictional disclosure system adopted by the SEC and the securities commission or similar regulatory authority in each of the provinces of Canada (except Quebec). This Prospectus

Supplement does not qualify in any of the provinces or territories of Canada the distribution of the securities to which it relates.

As

further described under "Recent Updates", the Company has entered into a subscription agreement for a private placement with Hosken Consolidated Investments Limited

("

HCI

"), whereby HCI or a subsidiary of HCI, upon closing of the private placement, will become a shareholder of the Company and hold approximately

9.09% of the outstanding Common Shares based on the current number of issued and outstanding Common Shares. Pursuant to the subscription agreement, HCI will hold a right to participate in future

equity financings of the Company to maintain its pro-rata shareholding. The closing of the Unit Offering is conditioned in part upon the private placement closing prior to or concurrently with the

closing of the Unit Offering. HCI has indicated its interest in participating in the Unit Offering. However, no assurance can be provided that HCI will participate in the Unit Offering.

This offering is made by a foreign issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare

this Prospectus Supplement and the accompanying Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of

the United States. Financial statements included or

incorporated by reference herein have been or will be prepared in accordance with International Financial Reporting Standards and are subject to Canadian auditing and auditor independence standards,

and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of Warrant Shares may have tax consequences both in the United States and in Canada. Such consequences

for investors who are resident in, or citizens of, the United States may not be fully described herein. Prospective investors should read the tax discussions contained in this Prospectus Supplement

and the accompanying Prospectus.

Table of Contents

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is

incorporated under the laws of British Columbia, Canada, that the majority of its officers and directors are residents of Canada, that some or all of the experts named in the registration statement

are not resident in the United States, and that a substantial portion of the assets of the persons are located outside the United States.

Neither the United States Securities and Exchange Commission nor any state or Canadian securities regulator has approved or disapproved of the securities offered

hereby, passed upon the accuracy or adequacy of this Prospectus Supplement and the Prospectus or determined if this Prospectus Supplement and the Prospectus are truthful or complete. Any

representation to the contrary is a criminal offence.

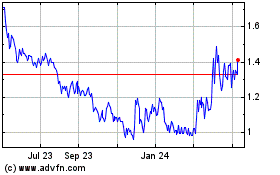

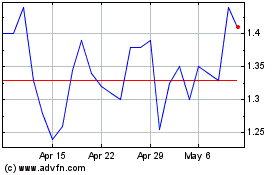

The

outstanding Common Shares are listed for trading on the Toronto Stock Exchange (the "

TSX

") under the symbol "PTM" and on the NYSE

American LLC (the "

NYSE American

") under the symbol "PLG". On May 2, 2018, the last trading day prior to the date of the public

announcement of the Unit Offering, the closing price of the Common Shares on the TSX was CAN$0.245 and the closing price of the Common Shares on the NYSE American was US$0.20. On May 11, 2018,

being the last day on which the Common Shares traded prior to filing of this Prospectus Supplement, the closing price of the Common Shares on the TSX was CAN$0.175 and the closing price of the Common

Shares on the NYSE American was US$0.14. The Company has applied to list the Warrant Shares issuable upon the exercise of the Warrants on the TSX and the NYSE American. Listing of these securities

will be subject to the Company fulfilling all of the listing requirements of the TSX and NYSE American, as applicable.

An investment in the Warrant Shares is highly speculative and involves a high degree of risk. See "Cautionary Note Regarding Forward Looking Statements" and "Risk

Factors".

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

i

Table of Contents

PROSPECTUS

ii

Table of Contents

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the terms of the Common Shares issuable

upon exercise of the Warrants and also adds to and updates information contained in the Prospectus and the documents incorporated by reference therein. The second part, the Prospectus, gives more

general information, some of which may not apply to the Common Shares issuable upon exercise of the Warrants. This Prospectus Supplement is deemed to be incorporated by reference into the Prospectus

solely for the purpose of the offering to which it relates. Other documents are also incorporated, or are deemed to be incorporated by reference, into the Prospectus and reference should be made to

the Prospectus for full particulars thereof.

Investors should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Prospectus and on the other

information included in the registration statement on

Form F-10 of which this Prospectus Supplement and the Prospectus form a part (the "Registration Statement"). The Company has not authorized anyone to provide investors with

different information. The Company is not making an offer of the Warrant Shares in any jurisdiction where such offer is not permitted. An investor should assume that the information appearing in this

Prospectus Supplement or the Prospectus is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference herein or therein is

accurate only as of the date of that document unless specified otherwise. The Company's business, financial condition, results of operations and prospects may have changed since

those dates.

Market

data and certain industry forecasts used in this Prospectus Supplement and the Prospectus and the documents incorporated by reference herein and therein were obtained from market

research, publicly available information and industry publications. The Company believes that these sources are generally reliable, but the accuracy and completeness of this information is not

guaranteed. The Company has not independently verified such information, and it does not make any representation as to the accuracy of such information.

The

Company's annual consolidated financial statements that are incorporated by reference into this Prospectus Supplement and the Prospectus have been prepared in accordance with

International Financial Reporting Standards, as issued by the International Accounting Standards Board ("

IFRS

").

Unless

otherwise indicated, all information in this Prospectus Supplement assumes no exercise of the Over-Allotment Option.

Unless

the context otherwise requires, references in this Prospectus Supplement to the "Company" include Platinum Group Metals Ltd. and each of its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein, contain "forward looking

statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward looking information" within the meaning of applicable Canadian securities

legislation (collectively, "

Forward Looking Statements

"). All statements, other than statements of historical fact, that address activities, events or

developments that the Company believes, expects or anticipates will, may, could or might occur in the future are Forward Looking Statements. The words "expect", "anticipate", "estimate", "may",

"could", "might", "will", "would", "should", "intend", "believe", "target", "budget", "plan", "strategy", "goals", "objectives", "projection" or the negative of any of these words and similar

expressions are intended to identify Forward Looking Statements, although these words may not be present in all Forward Looking Statements. Forward Looking Statements included or incorporated by

reference in this Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein include, without limitation, statements with

respect to:

-

•

-

the receipt and realization of proceeds from the Share Transaction (as defined below) component of the Maseve Sale

Transaction (as defined below);

-

•

-

the timing and completion of the Unit Offering;

-

•

-

the use of proceeds upon exercise of the Warrants;

S-1

Table of Contents

-

•

-

the timely completion of additional required financings and the potential terms thereof;

-

•

-

the Company's submission of a plan to the NYSE American to regain compliance with the continued listing criteria, the NYSE

American's acceptance thereof, the Company regaining compliance with the continued listed criteria, and the potential of the NYSE American initiating delisting procedures;

-

•

-

the repayment and compliance with the terms of indebtedness;

-

•

-

any potential exercise by Impala Platinum Holdings Ltd. ("

Implats

")

of the Purchase and Development Option (as defined below);

-

•

-

the successful closing of the HCI Private Placement (defined below), the use of proceeds therefrom and any board

appointments or participation in the Unit Offering or future financings of the Company involving the issuance of equity or securities convertible into equity by HCI;

-

•

-

the completion of the Definitive Feasibility Study ("

DFS

") and filing of a

mining right application for, and other developments related to, the Waterberg Project (as defined below);

-

•

-

the adequacy of capital, financing needs and the availability of and potential for obtaining further capital;

-

•

-

revenue, cash flow and cost estimates and assumptions;

-

•

-

future events or future performance;

-

•

-

governmental and securities exchange laws, rules, regulations, orders, consents, decrees, provisions, charters,

frameworks, schemes and regimes, including interpretations of and compliance with the same;

-

•

-

developments in South African politics and laws relating to the mining industry;

-

•

-

anticipated exploration, development, construction, production, permitting and other activities on the Company's

properties;

-

•

-

project economics;

-

•

-

future metal prices and exchange rates;

-

•

-

mineral reserve and mineral resource estimates; and

-

•

-

potential changes in the ownership structures of the Company's projects.

Forward

Looking Statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward Looking Statements in respect of

capital costs, operating costs, production rate, grade per tonne and concentrator and smelter recovery are based upon the estimates in the technical report referred to in this Prospectus Supplement,

the Prospectus and in the documents incorporated by reference herein and therein and ongoing cost estimation work, and the Forward Looking Statements in respect of metal prices and exchange rates are

based upon the three year trailing average prices and the assumptions contained in such technical report and ongoing estimates.

Forward

Looking Statements are subject to a number of risks and uncertainties that may cause the actual events or results to differ materially from those discussed in the Forward Looking

Statements, and even if events or results discussed in the Forward Looking Statements are realized or substantially realized, there can be no assurance that they will have the expected consequences

to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among

other things:

-

•

-

the Company's additional financing requirements;

-

•

-

risks relating to delays in or the Company's inability to receive or realize the proceeds of, or possible litigation

resulting from, the Share Transaction component of the sale of the Maseve platinum and palladium mine ("

Maseve Mine

"), also known as Project 1

("

Project 1

") and Project 3 ("

Project 3

") of what was formerly the Western Bushveld Joint Venture

(the "

WBJV

");

-

•

-

the inability of the Company to generate sufficient cash flow or raise sufficient additional capital to make payment on

its indebtedness, and to comply with the terms of such indebtedness, and the restrictions imposed by such indebtedness;

S-2

Table of Contents

-

•

-

the LMM Facility (as defined below) is, and any new indebtedness may be, secured and the Company has pledged its

shares of Platinum Group Metals (RSA) Proprietary Limited ("

PTM RSA

") and PTM RSA has pledged its shares of Waterberg JV Resources (Pty) Limited

("

Waterberg JV Co.

") to Liberty Metals & Mining Holdings, LLC, a subsidiary of Liberty Mutual Insurance

("

LMM

") under the LMM Facility, which potentially could result in the loss of the Company's interest in PTM RSA and the Waterberg Project in the event

of a default under the LMM Facility or any new secured indebtedness;

-

•

-

risks relating to the Company's ability to continue as a going concern;

-

•

-

the Company's history of losses;

-

•

-

the Company's negative cash flow;

-

•

-

uncertainty of estimated production, development plans and cost estimates for the Waterberg Project;

-

•

-

discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated

development and operating costs, between actual and estimated metallurgical recoveries and between estimated and actual production;

-

•

-

fluctuations in the relative values of the U.S. Dollar, the South African Rand and the Canadian Dollar;

-

•

-

volatility in metals prices;

-

•

-

the failure of the Company or the other shareholders to fund their pro rata share of funding obligations for the

Waterberg Project;

-

•

-

any disputes or disagreements with the other shareholders of Waterberg JV Co. or Mnombo Wethu Consultants

(Pty) Ltd. ("

Mnombo

") or the former shareholders of Maseve Investments 11 Proprietary Limited

("

Maseve

");

-

•

-

completion of the DFS for the Waterberg Project, which is subject to resource upgrade and economic analysis requirements;

-

•

-

the ability of the Company to retain its key management employees and skilled and experienced personnel;

-

•

-

contractor performance and delivery of services, changes in contractors or their scope of work or any disputes with

contractors;

-

•

-

conflicts of interest among the Company's officers and directors;

-

•

-

litigation or other legal or administrative proceedings brought against the Company;

-

•

-

actual or alleged breaches of governance processes or instances of fraud, bribery or corruption;

-

•

-

the possibility that the Company may become subject to the Investment Company Act of 1940, as amended

(the "

Investment Company Act

");

-

•

-

exploration, development and mining risks and the inherently dangerous nature of the mining industry, including

environmental hazards, industrial accidents, unusual or unexpected formations, safety stoppages (whether voluntary or regulatory), pressures, mine collapses, cave ins or flooding and the risk of

inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties;

-

•

-

property and mineral title risks including defective title to mineral claims or property;

-

•

-

changes in national and local government legislation, taxation, controls, regulations and political or economic

developments in Canada, South Africa or other countries in which the Company does or may carry out business in the future;

-

•

-

equipment shortages and the ability of the Company to acquire the necessary access rights and infrastructure for its

mineral properties;

S-3

Table of Contents

-

•

-

environmental regulations and the ability to obtain and maintain necessary permits, including environmental authorizations

and water use licences;

-

•

-

extreme competition in the mineral exploration industry;

-

•

-

delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with

the terms of such permits;

-

•

-

any adverse decision in respect of the Company's mineral rights and projects in South Africa under the Mineral and

Petroleum Resources Development Act (the "

MPRDA

");

-

•

-

risks of doing business in South Africa, including but not limited to, labour, economic and political instability,

potential changes to and failures to comply with legislation and interruptions or shortages in the supply of electricity or water;

-

•

-

the failure to maintain or increase equity participation by historically disadvantaged South Africans in the Company's

prospecting and mining operations and to otherwise comply with the Amended Broad Based Socio Economic Empowerment Charter for the South African Mining Industry

(the "

Mining Charter

") or any subsequent mining charter;

-

•

-

certain potential adverse Canadian tax consequences for foreign-controlled Canadian companies that acquire the

Common Shares;

-

•

-

the risk that the Company's Common Shares may be delisted, or that the Company may be required to effect a reverse stock

split in order to maintain the listing of the Common Shares on the NYSE American;

-

•

-

volatility in the price of the Common Shares;

-

•

-

the lack of a public market for the Warrants, and the potential inability of prospective investors to resell the Warrant

Shares at or above the Warrant Exercise Price, if at all;

-

•

-

possible dilution to holders of Common Shares upon the exercise or conversion of outstanding stock options, warrants or

convertible notes, as applicable;

-

•

-

any designation of the Company as a "passive foreign investment company" and potential adverse U.S. federal income

tax consequences for U.S. shareholders; and

-

•

-

the other risks disclosed under the heading "Risk Factors" in the Prospectus, in this Prospectus Supplement and in the

Form 20-F (as defined herein) and AIF (as defined herein), as well as in the documents incorporated by reference herein and therein.

These

factors should be considered carefully, and investors should not place undue reliance on the Forward Looking Statements. In addition, although the Company has attempted to identify

important factors that could cause actual actions or results to differ materially from those described in the Forward Looking Statements, there may be other factors that cause actions or results not

to be as anticipated, estimated or intended.

The

mineral resource and mineral reserve figures referred to in this Prospectus Supplement, the Prospectus and the documents incorporated herein and therein by reference are estimates

and no assurances can be given that the indicated levels of platinum, palladium, rhodium and gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience,

analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and mineral

reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Any inaccuracy or future reduction in such estimates could have a

material adverse impact on the Company.

Any

Forward Looking Statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation

to update any Forward Looking Statement, whether as a result of new information, future events or results or otherwise.

S-4

Table of Contents

CAUTIONARY NOTE TO UNITED STATES INVESTORS

The Company is permitted under the multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and

the United States (the "

MJDS

") to prepare this Prospectus Supplement, the Prospectus and the documents incorporated by reference herein

and therein in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. All mineral resource and mineral reserve

estimates included in this Prospectus

Supplement, the Prospectus and the documents incorporated by reference herein and therein, have been or will be prepared in accordance with National

Instrument 43-101 —

Standards of Disclosure for Mineral Projects

("

NI 43-101

"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public

disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the SEC set out

in Industry Guide 7. Consequently, mineral reserve and mineral resource information included and incorporated by reference in this Prospectus Supplement and the Prospectus is not comparable to similar

information that would generally be disclosed by U.S. companies in accordance with the rules of the SEC.

In

particular, Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable mineral reserves

used in NI 43-101 differ from the definitions in Industry Guide 7. Under SEC standards, mineralization may not be classified as a "reserve" unless the determination has been made that the

mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or

issued imminently in order to classify mineralized material as reserves under the SEC standards. Accordingly, mineral reserve estimates included and incorporated by reference in this Prospectus

Supplement and the Prospectus may not qualify as "reserves" under SEC standards.

In

addition, the information included and incorporated by reference in this Prospectus Supplement and the Prospectus may use the terms "mineral resources", "measured mineral resources",

"indicated mineral resources" and "inferred mineral resources" to comply with the reporting standards in Canada. Industry Guide 7 does not currently recognize mineral resources and

U.S. companies are generally not permitted to disclose mineral resources in documents they file with the SEC. Investors are specifically cautioned not to assume that any part or all of the

mineral deposits in these categories will ever be converted into mineral reserves under Industry Guide 7. Further, "inferred mineral resources" have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an inferred mineral resource exists. In accordance

with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or, except in limited circumstances, other economic studies. It cannot be assumed that all or any

part of "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" will ever be upgraded to a higher category of mineral resources or that mineral resources will be

classified as mineral reserves. Investors are cautioned not to assume that any part of the reported "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" included

and incorporated by reference in this Prospectus Supplement and the Prospectus is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted under NI 43-101;

however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. In

addition, the documents included and incorporated by reference in this Prospectus Supplement and the Prospectus may include information regarding adjacent or nearby properties on which the Company has

no right to mine. The SEC does not normally allow U.S. companies to include such information in their filings with the SEC. For the above reasons, information included and incorporated by

reference in this Prospectus Supplement and the Prospectus that describes our mineral reserve and resource estimates or that describes the results of pre-feasibility or other studies is not comparable

to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

S-5

Table of Contents

MINERAL RESERVE AND MINERAL RESOURCE DISCLOSURE

Due to the uncertainty that may be attached to inferred mineral resource estimates, it cannot be assumed that all or any part of an

inferred mineral resource estimate will be upgraded to an indicated or measured mineral resource estimate as a result of continued exploration. Confidence in an inferred mineral resource estimate is

insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited

circumstances set out in NI 43-101. Inferred mineral resource estimates are excluded from estimates forming the basis of a feasibility study.

Mineral

resources that are not mineral reserves do not have demonstrated economic viability.

DESCRIPTION OF EXISTING INDEBTEDNESS

The Company is party to a secured credit facility (the "

LMM Facility

") in favor

of LMM, as agent and a lender, and the other lenders from time to time party thereto (collectively, the "

LMM Lenders

") dated as of November 2,

2015, as most recently amended and restated as of February 12, 2018 and as further amended (the "

LMM Facility Agreement

"). The LMM

Facility is a US$40.0 million facility and was drawn down in full in a single advance in November 2015. The LMM Facility matures on October 31, 2019

(the "

LMM Maturity Date

"), provided that the Company (i) completes the Required Financing (defined below) before May 31, 2018,

(ii) uses the first US$12.0 million of gross proceeds from the Required Financing to reduce outstanding indebtedness under the LMM Facility and (iii) is not otherwise in default

under the LMM Facility Agreement (collectively, the "

Required Financing Conditions

"). Otherwise, the LMM Maturity Date is September 30, 2018 and

the Company must complete the Required Financing before May 31, 2018 and the Additional Required Financing (defined below) between May 31, 2018 and July 31, 2018, as further

discussed below. The Company intends that the Unit Offering, together with the HCI Private Placement (as defined below), will fulfill its obligation to complete the Required Financing.

Interest

at LIBOR plus 9.5% is accrued under the LMM Facility monthly and capitalized. If the Required Financing Conditions are not satisfied, then after June 30, 2018 interest is

accrued and paid to LMM quarterly. Payment and performance of the Company's obligations under the LMM Facility are guaranteed by PTM RSA and secured by a security interest in favor of LMM, on behalf

of the LMM Lenders, in all of the Company's present and after-acquired real and personal property, together with the proceeds thereof,

and a pledge over all of the issued shares in the capital of PTM RSA and the shares that PTM RSA holds in Waterberg JV Co. The LMM Facility contains various representations, warranties and

affirmative and negative covenants of the Company, and provisions regarding default and events of default, in each case relating to the Company and related entities, including Waterberg JV Co.

and Mnombo.

The

Company was a party to a first secured credit facility (the "

Sprott Facility

") in favor of Sprott Resource Lending Partnership,

as agent (in such capacity, the "

Sprott Agent

") and a lender, and the other lenders from time to time party thereto, (collectively, the

"

Sprott Lenders

") dated as of February 13, 2015 and as later amended and restated. On March 20, 2018, the Company made a payment of

US$107,755 to reduce the indebtedness under the Sprott Facility. Later, on April 10, 2018 the Company used US$46.98 million from the proceeds of the Plant Sale Transaction

(as defined below) to immediately repay all remaining indebtedness under the Sprott Facility, consisting of the outstanding principal amount of US$40.0 million, a bridge loan of

US$5.0 million, all accrued and unpaid interest of approximately US$1.78 million and, pursuant to the third amendment to the Sprott Facility, a fee of US$200,000 due upon the repayment

of the Sprott Facility.

For

more information regarding the Sprott Facility, see the Interim MD&A (as defined below), the Form 20-F, the AIF and the Annual MD&A (as defined below).

From

the remaining proceeds of the Plant Sale Transaction, pursuant to the fifth amendment to the original LMM Facility Agreement, the Company then paid an amount of

US$6.32 million to LMM on April 10, 2018. A further payment of Rand 3.26 million (US$271,667) was received from Royal Bafokeng Platinum Limited

("

RBPlat

") on April 9, 2018, for the exchange rate variance through the closing process of the Plant Sale Transaction from April 4, 2018

to April 5, 2018, and the amount in U.S. dollars was paid to LMM on April 13,

S-6

Table of Contents

2018.

These payments totaling US$6.59 million have been applied to reduce outstanding indebtedness under the LMM Facility, consisting of a US$400,000 fee due to LMM upon the repayment of the

Sprott Facility and US$6.19 million to reduce the PPA Termination Payment (as defined below).

The

LMM Facility was originally in second secured position relative to the Sprott Facility. Once the Sprott Facility was fully repaid, the LMM Facility assumed the first secured

position.

With

respect to the RBPlat (as defined below) shares received by the Company in the Share Transaction, the Company has agreed to pledge such shares under the LMM Facility,

complete the sale of such shares in a commercially reasonable and prompt manner and in any event within 120 days of receipt, with the proceeds of such sale to be used to reduce the outstanding

indebtedness under the LMM Facility.

The

Company has agreed to raise US$15.0 million in subordinated debt (in form and substance satisfactory to LMM), equity or securities convertible into equity before

May 31, 2018 (the "

Required Financing

"). The first US$12.0 million of gross proceeds of the Required Financing must be used to

reduce the outstanding indebtedness under the LMM Facility. Assuming the Required Financing Conditions are met, the Company has also agreed to use 50% of the proceeds from the exercise of any warrants

or other convertible securities issued by the Company for repayment of outstanding indebtedness under the LMM Facility. However, if the Required Financing Conditions are not met, then in addition to

completing the Required Financing prior to May 31, 2018 and using the first US$12.0 million of gross proceeds to reduce outstanding indebtedness under the LMM Facility, the Company will

be required to raise, from and after May 31, 2018 and prior to July 31, 2018, an additional US$20.0 million in Common Shares or subordinated debt (in form and substance

satisfactory to LMM) (the "

Additional Required Financing

"), from which the first US$20.0 million of net proceeds must be used to reduce

outstanding indebtedness under the LMM Facility. Further, in any event, the Company has also agreed to use 50% of the net proceeds from any equity or debt financings in excess of US$500,000 in the

aggregate (excluding intercompany financings, the Required Financing and the Additional Required Financing, as applicable) for repayment of outstanding indebtedness under the LMM Facility. See the

risk factor entitled "The Company will require additional financing, which may not be available on acceptable terms, if at all." The Company has also agreed under the LMM Facility to limit its use of

cashless exercise features in warrants and convertible securities that it may issue, excluding securities already outstanding and the cashless exercise of Warrants to be issued in the Unit Offering in

accordance with their terms.

In

connection with the second amendment and restatement of the LMM Facility Agreement, certain events of default were added to the LMM Facility Agreement, including, without limitation,

the occurrence of any of the following: the Company fails to remain listed on the TSX; RBPlat fails to remain listed on the JSE Limited; the RBPlat shares are cease traded (or equivalent) for a

period of 30 days or more; the Company fails to apply the proceeds from the sale of RBPlat shares received upon completion of the Share Transaction to reduce indebtedness under the LMM Facility

within three days of receipt; RBPlat makes an indemnity claim or seeks to reduce the amounts payable to the Company; Africa Wide Mineral Prospecting and Exploration Proprietary Limited

("

Africa Wide

") is paid in connection with the Maseve Sale Transaction an amount greater than 347,056 shares of RBPlat or the South African Rand

equivalent of US$854,935.01; the Company fails to apply the Maseve rehabilitation deposit (the "

Environmental Deposit Amount

") to reduce its

indebtedness under the LMM Facility within three business days of receipt; or the Environmental Deposit Amount received by the Company is less than Rand 58,000,000 (approximately US$4.7 million

as of May 10, 2018). The Company has agreed to maintain consolidated, unrestricted cash and cash equivalents of at least US$2.0 million and working capital in excess of

US$1.0 million beginning May 31, 2018.

In

connection with the LMM Facility, in November 2015 the Company and LMM entered into a production payment agreement pursuant to which the Company agreed to pay LMM a production

payment of 1.5% of net proceeds received on concentrate sales or other minerals from the Maseve Mine (the "

PPA

"). The Company, PTM RSA and LMM

entered into a Production Payment Agreement Termination Agreement, dated as of October 30, 2017 and amended as of February 12, 2018, May 1, 2018, and May 10, 2018, pursuant

to which the Company must pay LMM either US$15.0 million before May 31, 2018 or US$25.0 million from May 31, 2018 to the LMM Maturity Date (the applicable payment,

the "

PPA Termination Payment

"). The PPA Termination Payment is considered to be indebtedness under the LMM Facility and is secured by the same

collateral as the LMM Facility.

S-7

Table of Contents

As

of May 10, 2018, after applying approximately US$6.19 million toward the PPA Termination Payment, as described above, the Company's outstanding obligations under the LMM

Facility consist of approximately US$8.81 million required to satisfy the PPA Termination Payment if paid before May 31, 2018, or if later, approximately US$18.81 million, plus

approximately US$53.07 million in principal, accrued interest, fees and accrued production payments. Pursuant to the terms of the LMM Facility, all payments to LMM are first applied to the PPA

Termination Payment.

For

more information regarding the LMM Facility and the PPA Termination Payment, see the Interim MD&A, the Form 20-F, the AIF and the Annual MD&A.

On June 30, 2017, the Company issued and sold to certain institutional investors US$20.0 million in aggregate principal

amount of 6 7/8% convertible senior subordinated notes due July 1, 2022 (the "

Notes

"). The Notes are governed by an indenture

between the Company and The Bank of New York Mellon dated June 30, 2017, as supplemented on January 31, 2018 (together, the "

Note

Indenture

"). The Notes bear interest at a rate of 6 7/8% per annum, payable semi-annually on January 1 and July 1 of each year, beginning on

January 1, 2018, in cash or at the election of the Company, in Common Shares or a combination of cash and Common Shares, and will mature on July 1, 2022, unless, subject to certain

exceptions, such notes are earlier repurchased, redeemed or converted.

Subject

to certain exceptions, the Notes will be convertible at any time at the option of the holder, and may be settled, at the Company's election, in cash, Common Shares, or a

combination of cash and Common Shares. If any Notes are converted on or prior to the three and one-half year anniversary of the issuance date, the holder of the Notes will also be entitled to receive

an amount equal to the remaining interest payments on the converted Notes to the three and one-half year anniversary of the issuance date, discounted by 2%, payable in Common Shares. The initial

conversion rate of the Notes is 1,001.1112 Common Shares per US$1,000 principal amount of Notes, which is equivalent to an initial conversion price of approximately US$0.9989 per Common Share,

representing a conversion premium of approximately 15% above the NYSE American closing sale price for the Company's Common Shares of US$0.8686 per share on June 27, 2017. The conversion rate

will be subject to adjustment upon the occurrence of certain events. If the Company pays interest in Common Shares, such shares will be issued at a price equal to 92.5% of the simple average of the

daily volume-weighted average price of the Common Shares for the 10 consecutive trading days ending on the second trading day immediately preceding the payment date, on the NYSE American

exchange or, if the Common Shares are not then listed on the NYSE American exchange, on the principal U.S. national or other securities exchange or market on which the Common Shares are then

listed or admitted for trading.

Notwithstanding

the foregoing, no holder will be entitled to receive Common Shares upon conversion of Notes to the extent that such receipt would cause the converting holder or persons

acting as a "group" to become, directly or indirectly, a "beneficial owner" (as defined in the Note Indenture) of more than 19.9% of the Common Shares outstanding at such time or, in the case

of Citadel Equity Fund Ltd. (one of the note holders), if it or its affiliates would become a "beneficial owner" of more than 4.9% of the Common Shares outstanding at such time. In

addition, the Company will not issue an aggregate number of Common Shares

pursuant to the Notes that exceeds 19.9% of the total number of Common Shares outstanding on June 30, 2017.

Prior

to July 1, 2018, the Company may not redeem the Notes, except upon the occurrence of certain changes to the laws governing Canadian withholding taxes. On or after

July 1, 2018 and before July 1, 2019, the Company shall have the right to redeem all or part of the Notes at a price, payable in cash, of 110.3125% of the principal amount of the Notes

to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date; on or after July 1, 2019 and before July 1, 2020, the Company shall have the right to

redeem all or part of the outstanding Notes at a price, payable in cash, of 105.15625% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest, if any, to but excluding,

the redemption date; and on or after July 1, 2020, until the maturity date, the Company shall have the right to redeem all or part of the outstanding Notes at a price, payable in cash, of 100%

of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date.

S-8

Table of Contents

Upon

the occurrence of a fundamental change as defined in the Note Indenture, the Company must offer to purchase the outstanding Notes at a price, payable in cash, equal to 100% of the

principal amount of the Notes, plus accrued and unpaid interest, if any.

The

Company agreed in the Note Indenture to cause a prospectus and a registration statement to be filed with Canadian securities regulatory authorities and with the

U.S. Securities and Exchange Commission, as applicable, and become usable and effective within six months after June 30, 2017, and to remain usable and effective for certain periods. The

Note Indenture provides that if the Company does not do so, it shall pay additional interest on the Notes at a rate of 0.25% per annum for the first 90 days and at a rate of 0.50% per annum

thereafter, until the Notes are freely tradable by holders other than affiliates and certain other events have occurred. The Company has not filed the prospectus and registration statement and,

accordingly, currently pays additional interest as provided for in the Note Indenture.

The

Notes are unsecured senior subordinated obligations and are subordinated in right of payment to the prior payment in full of all of the Company's existing and future senior

indebtedness pursuant to the Note Indenture. The Company may issue additional Notes in accordance with the terms and conditions set forth in the Note Indenture. The Note Indenture contains certain

additional covenants, including covenants restricting asset dispositions, issuances of capital stock by subsidiaries, incurrence of indebtedness, business combinations and share exchanges.

On

July 25, 2017, US$10,000 of Notes were converted into 13,190 Common Shares of the Company. On January 1, 2018, the Company made the first semi-annual interest

payment on the Notes, issuing 2,440,629 Common Shares of the Company in payment of US$691,110 of interest. As at May 10, 2018, US$19.99 million principal amount of the Notes

remain outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference in the Prospectus solely for the purpose of the offering of the

Common Shares issuable from time to time on exercise of the Warrants. Other documents are also incorporated or deemed to be incorporated by reference in the Prospectus and reference should be made to

the Prospectus for full particulars thereof.

Copies of the documents incorporated by reference in this Prospectus Supplement and the Prospectus and not delivered with this Prospectus Supplement may be

obtained on request without charge from Frank Hallam at Suite 788, 550 Burrard Street, Vancouver, British Columbia, Canada, V6C 2B5,

telephone (604) 899-5450 and are also available electronically at www.sedar.com and www.sec.gov.

The

following documents, filed by the Company with the securities commissions or similar regulatory authorities in certain provinces of Canada and filed with, or furnished to, the SEC,

are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement and the Prospectus:

-

(a)

-

the

annual information form of the Company dated November 29, 2017 for the financial year ended August 31, 2017

(the "

Annual Information Form

" or "

AIF

");

-

(b)

-

the

audited consolidated financial statements of the Company as at and for the financial years ended August 31, 2017 and 2016, together with the

notes thereto and the auditor's reports thereon (the "

Annual Financial Statements

");

-

(c)

-

the

management's discussion and analysis of the Company for the financial year ended August 31, 2017

(the "

Annual MD&A

");

-

(d)

-

the

unaudited condensed consolidated interim financial statements of the Company for the three and six months ended February 28, 2018, together with

the notes thereto (the "

February Financial Statements

");

-

(e)

-

the

unaudited condensed consolidated interim financial statements of the Company for the three months ended November 30, 2017, together with the

notes thereto (together with the Annual Financial Statements and the February Financial Statements, the "

Financial Statements

");

S-9

Table of Contents

-

(f)

-

the

management's discussion and analysis of the Company for the three and six months ended February 28, 2018

(the "

February MD&A

");

-

(g)

-

the

management's discussion and analysis of the Company for the three months ended November 30, 2017 (together with the February MD&A, the

"

Interim MD&A

");

-

(h)

-

the

management information circular of the Company dated January 2, 2018 prepared for the purposes of the annual general meeting of the Company held

on February 23, 2018;

-

(i)

-

the

NI 43-101 technical report entitled "Independent Technical Report on the Waterberg Project Including Mineral Resource Update and Pre-Feasibility

Study — Project Areas located on the Northern Limb of the Bushveld Igneous Complex, South Africa" dated October 19, 2016

(the "

Waterberg PFS

");

-

(j)

-

the

material change report of the Company filed September 6, 2017 announcing that the Company had entered into a term sheet with RBPlat to sell

Maseve in a transaction involving the Plant Sale Transaction and the Share Transaction (together, the "

Maseve Sale Transaction

") valued at approximately

US$74.0 million;

-

(k)

-

the

material change report of the Company filed October 16, 2017 announcing that Implats had entered into definitive agreements

(the "

Implats Transaction

") with the Company, Japan Oil, Gas and Metals National Corporation

("

JOGMEC

"), Mnombo and Waterberg JV Co.;

-

(l)

-

the

material change report of the Company filed November 6, 2017 announcing the closing of the first phase of the Implats Transaction;

-

(m)

-

the

material change report of the Company filed November 29, 2017 announcing the completion of due diligence and the execution of binding legal

agreements for the Maseve Sale Transaction;

-

(n)

-

the

material change report of the Company filed February 14, 2018 announcing that all remaining conditions precedent to the sale of the Maseve

concentrator plant and certain surface rights to RBPlat in connection with the Maseve Sale Transaction have been fulfilled;

-

(o)

-

the

material change report of the Company filed April 6, 2018 announcing the closing of the sale of the Maseve concentrator plant and certain surface

rights to RBPlat in connection with the Maseve Sale Transaction;

-

(p)

-

the

material change report of the Company filed May 1, 2018 announcing certain amendments to the LMM Facility;

-

(q)

-

the

material change report of the Company filed May 3, 2018 announcing the execution of a subscription agreement with HCI for a private placement

sale of units to HCI or a subsidiary of HCI;

-

(r)

-

the

material change report of the Company filed May 11, 2018 announcing certain amendments to the LMM Facility and HCI Private Placement

(defined below);

-

(s)

-

the

material change report of the Company filed May 11, 2018 regarding the Unit Offering; and

-

(t)

-

the

Form 20-F annual report of the Company for the financial year ended August 31, 2017

(the "

Form 20-F

").

Any

document of the type referred to in the preceding paragraphs (excluding press releases and confidential material change reports) or of any other type required to be incorporated by

reference into a short form prospectus pursuant to National Instrument 44-101 —

Short Form Prospectus

Distributions

that is filed by the Company with a securities commission after the date of this Prospectus Supplement and prior to the termination of the distribution of the

Common Shares under this Prospectus Supplement shall be deemed to be incorporated by reference in the accompanying Prospectus solely for purposes of the offering of the Common Shares issuable from

time to time on exercise of the Warrants. In addition, any document filed by the Company with the SEC or furnished to the SEC on Form 6-K or otherwise after this Prospectus Supplement

(and prior to the termination of the distribution) shall be deemed to be incorporated by reference into this Prospectus

S-10

Table of Contents

Supplement

and the Registration Statement (in the case of a Report on Form 6-K, if and to the extent expressly provided for therein).

Any statement contained in this Prospectus Supplement, the Prospectus or a document incorporated or deemed to be incorporated by reference herein or therein shall

be deemed to be modified or superseded for the purposes of this Prospectus Supplement to the extent that a statement contained herein or in the Prospectus or in any subsequently filed document which

also is or is deemed to be incorporated by reference herein or in the Prospectus modifies or supersedes that prior statement. The modifying or superseding statement need not state that it has modified

or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an

admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is

required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its

unmodified or superseded form to constitute a part of this Prospectus Supplement, except as so modified or superseded. Without limiting the foregoing, each document incorporated by reference into the

Prospectus prior to the date hereof shall be deemed to have been superseded in its entirety unless such document is also listed above as being incorporated by reference into this Prospectus

Supplement.

ADDITIONAL INFORMATION

The Company has filed with the SEC the Registration Statement. This Prospectus Supplement and the Prospectus, which together constitute

a part of the Registration Statement, do not contain all of the information contained in the Registration Statement, certain items of which are contained in the exhibits to the Registration Statement

as permitted by the rules and regulations of the SEC. Statements included or incorporated by reference in this Prospectus Supplement and the Prospectus about the contents of any contract, agreement or

other documents referred to are not necessarily complete, and in each instance an investor should refer to the exhibits to the Registration Statement for a more complete description of the matter

involved. Each such statement is qualified in its entirety by such reference.

The

Company is subject to the information requirements of the

United States Securities Exchange Act of 1934

, as amended

(the "

Exchange Act

"), and applicable Canadian securities legislation, and in accordance therewith files and furnishes reports and other

information with the SEC and with the securities regulators in Canada. As a foreign private issuer, certain documents and other information that the Company files and furnishes with the SEC may be

prepared in accordance with the disclosure requirements of Canada, which are different from those of the United States. In addition, as a foreign private issuer, the Company is exempt from the

rules under the Exchange Act prescribing the furnishing and content of proxy statements, and its officers, directors and principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. In addition, the Company is not required to publish financial statements as promptly as U.S. companies.

An

investor may read any document that the Company has filed with or furnished to the SEC at the SEC's public reference room in Washington, D.C. An investor may also obtain copies

of those documents from the public reference room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 by paying a fee. An investor should call the SEC at 1-800-SEC-0330 or

access its website at

www.sec.gov

for further information about the public reference rooms. An investor may read and download the documents the Company

has filed with the SEC under the Company's corporate profile at

www.sec.gov

. An investor may read and download any public document that the Company has

filed with the Canadian securities regulatory authorities under the Company's corporate profile on the SEDAR website at

www.sedar.com

.

S-11

Table of Contents

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the Registration Statement: (i) the documents

referred to herein and in the Prospectus under the heading "Documents Incorporated by Reference"; (ii) consents of PricewaterhouseCoopers LLP and certain experts; (iii) powers of

attorney from certain directors and officers of the Company; (iv) the form of Indenture (as defined in the Prospectus); (v) the Warrant Indenture (as defined herein); and

(vi) the underwriting agreement relating to the Unit Offering.

ENFORCEABILITY OF CIVIL LIABILITIES

The Company is a company organized and existing under the

Business Corporations Act

(British Columbia). A majority of the Company's directors and officers, and some or all of experts named in this Prospectus Supplement, the Prospectus and the documents incorporated by reference

herein and therein, are residents of Canada or otherwise reside outside the United States, and all or a substantial portion of their assets, and a substantial portion of the Company's assets,

are located outside the United States. The Company has appointed an agent for service of process in the United States, but it may be difficult for investors who reside in the

United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for

investors who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon the Company's civil liability and the civil

liability of the Company's directors, officers and experts under the United States federal securities laws. A final judgment for a liquidated sum in favour of a private litigant granted by a

United States court and predicated solely upon civil liability under United States federal securities laws would, subject to certain exceptions identified in the law of individual

provinces and territories of Canada, likely be enforceable in Canada if the United States court in which the judgment was obtained had a basis for jurisdiction in the matter that would be

recognized by the domestic Canadian court for the same purposes. There is a significant risk that a given Canadian court may not have jurisdiction or may decline jurisdiction over a claim based solely

upon United States federal securities law on application of the conflict of laws principles of the province or territory in Canada in which the claim is brought.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this Prospectus Supplement and the

Prospectus are references to Canadian dollars. All references to "CAN$" are to Canadian dollars, references to "US$" are to United States dollars and references to "R" or "Rand" are to South

African Rand.

The

following table sets forth the rate of exchange for the United States dollar expressed in Canadian dollars in effect at the end of each of the periods indicated, the average

of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case, prior to and

including April 28, 2017 based on the noon rate of exchange and, subsequent to April 28, 2017, based on the daily exchange rate, as reported by the Bank of Canada for the conversion of

United States dollars into Canadian dollars.

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended August 31,

|

|

|

|

2017

|

|

2016

|

|

|

Average rate for period

|

|

CAN$

|

1.3178

|

|

CAN$

|

1.3265

|

|

|

Rate at end of period

|

|

CAN$

|

1.2536

|

|

CAN$

|

1.3124

|

|

|

High for period

|

|

CAN$

|

1.3743

|

|

CAN$

|

1.4589

|

|

|

Low for period

|

|

CAN$

|

1.2447

|

|

CAN$

|

1.2544

|

|

S-12

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended February 28,

|

|

|

|

2018

|

|

2017

|

|

|

Average rate for period

|

|

CAN$

|

1.2651

|

|

CAN$

|

1.3275

|

|

|

Rate at end of period

|

|

CAN$

|

1.2809

|

|

CAN$

|

1.3248

|

|

|

High for period

|

|

CAN$

|

1.2893

|

|

CAN$

|

1.3582

|

|

|

Low for period

|

|

CAN$

|

1.2128

|

|

CAN$

|

1.2843

|

|

The

daily rate of exchange on May 11, 2018 as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$1.00 equals

CAN$1.2779.

The

following table sets forth the rate of exchange for the Rand expressed in Canadian dollars in effect at the end of each of the periods indicated, the average of the exchange rates in

effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case, prior to and including

April 28, 2017 based on the noon rate of exchange and, subsequent to April 28, 2017, based on the daily exchange rate, as reported by the Bank of Canada for the conversion of Rand into

Canadian dollars.

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended August 31,

|

|

|

|

2017

|

|

2016

|

|

|

Average rate for period

|

|

CAN$

|

0.0984

|

|

CAN$

|

0.0902

|

|

|

Rate at end of period

|

|

CAN$

|

0.0968

|

|

CAN$

|

0.0893

|

|

|

High for period

|

|

CAN$

|

0.1076

|

|

CAN$

|

0.0993

|

|

|

Low for period

|

|

CAN$

|

0.0892

|

|

CAN$

|

0.0821

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended February 28,

|

|

|

|

2018

|

|

2017

|

|

|

Average rate for period

|

|

CAN$

|

0.0986

|

|

CAN$

|

0.0976

|

|

|

Rate at end of period

|

|

CAN$

|

0.1088

|

|

CAN$

|

0.1011

|

|

|

High for period

|

|

CAN$

|

0.1096

|

|

CAN$

|

0.1016

|

|

|

Low for period

|

|

CAN$

|

0.0883

|

|

CAN$

|

0.0892

|

|

The

daily rate of exchange on May 11, 2018 as reported by the Bank of Canada for the conversion of Rand into Canadian dollars was one Rand equals CAN$0.1043.

NOTICE REGARDING NON-IFRS MEASURES

This Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein include certain terms or

performance measures that are not defined under IFRS, such as cash costs, all-in sustaining costs and total costs per payable ounce, realized price per ounce, adjusted net income (loss) before tax,

adjusted net income (loss) and adjusted basic earnings (loss) per share. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this

information to evaluate the Company's performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS measures should be read in conjunction with the Financial Statements.

S-13

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about the Company and selected information contained elsewhere in

or incorporated by reference in this Prospectus Supplement, the Prospectus or the documents incorporated by reference herein or therein. This summary is not complete and does not contain all of the

information that you should consider before deciding whether to invest in the Warrant Shares. For a more complete understanding of the Company, the Company encourages you to read and consider

carefully the more detailed information in this Prospectus Supplement and the Prospectus, including the information incorporated by reference herein and therein, and in particular, the information

under the heading "Risk Factors" in the Prospectus, in this Prospectus Supplement and in the Form 20-F and the AIF.

Certain

capitalized terms used in this summary refer to definitions contained elsewhere in this Prospectus Supplement.

Overview

The Company is a platinum and palladium focused exploration and development company conducting work primarily on mineral properties it

has staked or acquired by way of option agreements or applications in the Republic of South Africa. The Company's material mineral property is the Waterberg Joint Venture Project

(the "

Waterberg Project

"), which is comprised of two adjacent project areas formerly known as the Waterberg joint venture project and the

Waterberg extension project. The Waterberg Project is held by Waterberg JV Co., in which the Company is the largest owner, with a 50.02% beneficial interest, of which 37.05% is held directly by

the Company's wholly-owned direct subsidiary, PTM RSA, and 12.974% is held indirectly through PTM RSA's 49.9% interest in Mnombo, a Black Economic Empowerment

("

BEE

") company which holds 26.0% of Waterberg JV Co. PTM RSA is a participant in the Waterberg Project, together with JOGMEC, Implats and

Mnombo, and is the operator of the Waterberg Project. Implats has been granted a call option exercisable in certain circumstances to purchase and earn into a 50.01% interest in Waterberg JV Co.

(the "

Purchase and Development Option

").

The

Company has sold all of its rights and interests, indirectly held through PTM RSA, in Maseve, including the Maseve Mine and Project 3 of what was formerly the WBJV both located on

the Western Limb of the Bushveld Complex. Currently, the Company considers the Waterberg Project to be its sole material mineral property.

Recent Updates

On September 6, 2017 the Company entered into a term sheet to sell all of its rights and interests in Maseve to RBPlat in a

transaction valued at approximately US$74.0 million, payable in two steps, for a total value of approximately US$62.0 million in cash and US$12.0 million in RBPlat common shares.

A deposit in escrow was paid by RBPlat in the amount of Rand 41,367,300 (valued for conveyance at approximately US$3.5 million equivalent on April 5, 2018)

(the "

Deposit

") on October 9, 2017. On November 23, 2017, the Company and RBPlat executed definitive agreements in connection with

the Maseve Sale Transaction.

The

first step ("

Step 1

" or the "

Plant Sale Transaction

") involved RBPlat acquiring the

concentrator plant and certain surface assets of the Maseve Mine for payment of US$58.0 million in cash to Maseve, conditional on certain approvals and conditions precedent. On

January 16, 2018, the South African Competition Tribunal approved the Maseve Sale Transaction. All remaining conditions precedent for Step 1 were fulfilled as of February 14,

2018. The Deposit was subsequently released to Maseve on March 15, 2018 and was applied to settle the Redpath Dispute (as described below). Step 1 was then completed on

April 5, 2018 coincident with the registration of the applicable surface rights to a wholly-owned subsidiary of RBPlat at the South African deeds office. RBPlat made a payment into trust, in

advance of conveyance, of Rand 646.74 million (valued at approximately US$54.5 million on April 4, 2018), being the Rand equivalent of US$58.0 million on April 4,

2018, less the Rand amount of the Deposit.

S-14

Table of Contents

The

net Step 1 cash payment of Rand 646.74 million, as described above, was received by the Company in South Africa on April 5, 2018 coincident with the registration

of the applicable surface rights to a wholly owned subsidiary of RBPlat. Upon receipt of the Rand 646.74 million in Canada on April 9, 2018 the Rand amount was translated into

US$53.3 million at a weaker exchange rate of 12.1341 for the U.S. dollar to Rand. On April 5, 2018, the legal conveyance date, the quoted U.S. dollar to Rand

exchange rate had weakened from the April 4, 2018 preparation date to 11.92, resulting in a further payment of Rand 3.26 million being due as a result of the exchange rate variation.

This amount was received from RBPlat on April 9, 2018, was converted in Canada to US$271,667 and paid to LMM on April 13, 2018.

The

definitive agreements, which were amended on February 2, 2018, February 12, 2018, March 12, 2018 and April 26, 2018 provided for, among other things,

(i) an interim period agreement between the Company and RBPlat, in place of the previously contemplated sub-contractor arrangement, which regulated the allocation of responsibilities and costs,

including electricity and water, in relation to the Plant Sale Transaction until the closing date of the Share Transaction (defined below), in some cases allocating costs on a 50-50 basis and

in other cases based on usage or responsibility; (ii) the release of the Deposit; (iii) the establishment of the Company's responsibility to procure certain electrical certificates

required for title transfer at an estimated cost of Rand 3,225,288 (approximately US$270,500 equivalent as of April 5, 2018), to be paid to Maseve's electrical contractor in accordance with the

schedule of works agreed between Maseve and the contractor; (iv) an acknowledgement of the settlement of the Redpath Dispute; and (v) removing certain conditions regarding the release

and payment of the RBPlat Contribution to PTM RSA.

The

next step ("

Step 2

" or the "

Share Transaction

") involved RBPlat acquiring 100% of the

shares in Maseve and all shareholder loans owed by Maseve for an aggregate consideration equal to approximately US$16.0 million as valued in September 2017, at the time of the Maseve Sale

Transaction term sheet. As valued in September 2017, RBPlat was to pay PTM RSA US$7.0 million in common shares of RBPlat plus approximately US$4.0 million in cash to acquire PTM

RSA's remaining loans due from Maseve and is to pay PTM RSA (82.9%) and Africa Wide (17.1%), in proportion to their respective equity interests in Maseve, a further US$5.0 million by way of

issuance of common shares of RBPlat to acquire 100% of the equity in Maseve. The Share Transaction required, within three years of the South African Competition Commission granting approval to the

Share Transaction, the approval of the Minister of Mineral Resources and other conditions precedent. The conditions precedent were satisfied, and Step 2 closed on April 26, 2018. In

connection with the closing, RBPlat acquired ownership of 100% of the shares in Maseve and all shareholder loans owed by Maseve. PTM RSA received 4,524,279 RBPlat shares, having a value of

approximately US$8.09 million as of May 10, 2018. The cash component of Step 2 is to be received by PTM RSA following RBPlat's replacement of the Environmental Deposit Amount with

respect to Maseve. See "Risk Factors" in this Prospectus Supplement. Following the closing of Step 2, the Company is no longer responsible for care and maintenance costs or the ongoing commitments

of Maseve.

All

of the proceeds from the Plant Sale Transaction, other than the amounts paid to settle the Redpath Dispute (defined below), were applied to the Company's secured debt. As part of

re-structuring arrangements agreed with LMM, the Company agreed to complete the Required Financing (and the Additional Required Financing, if applicable).

On

January 29, 2018, underground miner Redpath Mining South Africa (Pty) Limited ("

Redpath

") issued a letter of demand in regard to

various goods and services rendered by Redpath to Maseve in the total amount of Rand 54,544,183.31 (the "

Redpath Dispute

"). Maseve declined to

pay on the demand and raised various counterclaims based on previously agreed deductions and malperformance by Redpath, but nonetheless provided security for the amount claimed by Redpath through an

escrow arrangement with the Company's attorneys. The escrow account was funded with the Deposit and additional funds contributed by the

Company and Maseve. In addition, a further Rand 12,500,000 (approximately US$1.04 million equivalent as of April 5, 2018) was deposited into a separate escrow account by RBPlat

(the "

RBPlat Contribution

") for release to the Company as RBPlat's agreed share of the Redpath settlement (as described below) against delivery

of all closing deliverables required for closing of Step 2 of the Maseve Sale Transaction (the "

2

nd

Step Closing

") and paid

to PTM RSA as soon as possible after the 2

nd

Step Closing. Furthermore, when released from escrow, the RBPlat

S-15

Table of Contents

Contribution

will be returned to working capital to fund the Company's share of ongoing Waterberg Project DFS costs.

On

March 8, 2018, Maseve and Redpath executed an Agreement of Settlement whereby Maseve and Redpath agreed to settle the Redpath Dispute for Rand 40,940,141 (approximately

US$3.48 million equivalent as of March 14, 2018) in full and final settlement of all relevant disputes, liabilities and claims between the parties, which amount was paid to Redpath on

March 14, 2018 and was funded by releasing a portion of the Deposit from the escrow account. The balance of the escrow account was released whereupon the rest of the Deposit of Rand 427,159