Lilly to Buy Oncology Drug-Development Company AurKa -- Deal Digest

May 14 2018 - 8:43AM

Dow Jones News

By Bowdeya Tweh

ACQUIRER: Eli Lilly & Co., $89.49 billion market cap.

TARGET: AurKa Pharma Inc., a company working to develop a

treatment being studied in early-stage clinical trials in multiple

types of solid tumors.

PRICE: $110 million upfront, up to $465 million, based on

regulatory and sales milestones.

STATUS: Under agreement.

RATIONALE: The acquisition helps Lilly expand its oncology drug

pipeline.

HISTORY: Lilly sold the AK-01 compound in 2016 to TVM Capital

Life Science, which then established AurKa as part of a venture

fund.

STOCK: Shares in Lilly, up 2.8% over the past 12 months, were

unchanged in premarket trading.

Write to Bowdeya Tweh at bowdeya.tweh@wsj.com

(END) Dow Jones Newswires

May 14, 2018 08:28 ET (12:28 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

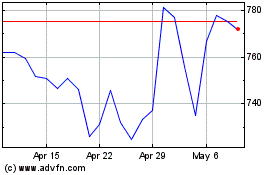

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024