Report of Foreign Issuer (6-k)

May 10 2018 - 5:20PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

May 10, 2018

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INDEX

|

|

1.

|

Translation of a submission from Banco Macro to the CNV dated

on May 10, 2018.

|

City of Buenos Aires,

May 10th, 2018

To:

Comisión

Nacional de Valores

(Argentine Securities Exchange Commission)

|

|

Re.:

|

Banco Macro S.A. Reports Relevant Event. Stock Repurchase

|

Dear Sirs,

In

my capacity as attorney-in-fact of Banco Macro S.A. (the “

Bank

”), I hereby inform the Comisión Nacional

de Valores (the “

CNV

”) that the Board of Directors of the Bank has decided to establish the terms and conditions

for the repurchase of shares issued by the Bank, in accordance with Article 64 of Law No. 26,831 and the Rules of the CNV.

This

decision has been adopted based on the current domestic and international macroeconomic context and the fluctuations in the capital

market in general, which has materially impacted the price of domestic shares, including the quotation of the shares of the Bank.

In addition, the Board of Directors has taken into consideration the financial strength of the Bank and its liquidity.

Therefore,

and in line with Board of Directors’ commitment to the Bank and its shareholders, to help reduce the quotation fluctuations,

minimizing any possible temporary imbalances between supply and demand within the market, and due to the excessive cost of capital

resulting from the current quotation prices, the Board of Directors has decided to establish the following terms and conditions

for the acquisition of shares issued by the Bank:

|

|

1.

|

Maximum amount of the investment

: Up to Ps$. 4,500,000,000.

|

|

|

2.

|

Maximum number of shares to be acquired

: Up to 4.5% of the Bank’s total capital stock, in compliance with applicable Argentine laws and regulations.

|

|

|

3.

|

Maximum payable price

: Up to Ps$. 158.00 per share.

|

|

|

4.

|

Term for the acquisition:

40 trading days in the Republic of Argentina, from the publication date of the relevant information in the Bulletin of the Buenos Aires Stock Exchange, subject to any further renewal or extension, which shall be duly informed to the public in such Bulletin.

|

Sincerely,

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 10, 2018

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Francisco Scarinci

|

|

|

|

Name: Jorge Francisco Scarinci

|

|

|

|

Title: Chief Financial Officer

|

|

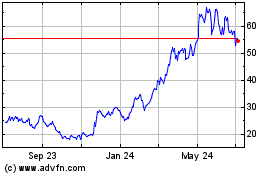

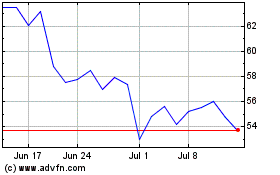

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024