Conference call begins today at 4:30 p.m.

Eastern time

NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY), a

biopharmaceutical company focusing on commercializing prescription

Avenova® for the domestic eye care market, reports financial

results for the three months ended March 31, 2018 and provides a

business update.

Unit volume through the retail pharmacy channel for the first

quarter of 2018 increased 12% versus the prior-year period. Net

sales for the first quarter of 2018 were $2.9 million, compared

with $3.7 million for the first quarter of 2017, with the decrease

due to a significant increase in rebates following health insurance

deductible resets at the beginning of the year. Gross margin on net

sales for the first quarter of 2018 was 91%, an increase from 84%

for the prior-year period. Cash used in operations for the first

quarter of 2018 was $0.5 million, a significant improvement from

cash usage of $2.0 million in the prior-year period.

“In combination with the salesforce reduction at the end of

2017, we paused our planned salesforce expansion in a seasonally

slow revenue quarter to focus on identifying the most profitable

territories,” said Mark M. Sieczkarek, NovaBay’s Chairman,

President and CEO. “Although we experienced growth in unit volume

for the quarter versus the prior-year period, our net revenue

declined due to the increased impact of rebates. Pharmaceutical

manufacturers are reporting that the outsized impact of rebates

negatively impacted sales across many products during the first

quarter, including Avenova.

“We flattened our sales organization to streamline

communications and improve training and strategic execution. We are

currently recruiting sales representatives in under-served

territories. We will continue to hire new representatives before

the end of 2018 in parallel with the progress we make on increasing

insurance coverage on Avenova sales by managed care

organizations.

“As an update on our initiative to obtain new or improved

reimbursement, introductions have been made with a target group of

top managed care prospects that we expect will lead to meaningful

discussions in the second half of 2018,” he added. “We believe we

have a powerful rationale with Avenova as the only prescription

product clinically proven to reduce bacteria on ocular surfaces,

which is the underlying cause of bacterial dry eye that represents

approximately 85% of the total dry eye market.”

First Quarter Financial Highlights

Sales and marketing expenses for the first quarter of 2018 were

$3.4 million, compared with $3.7 million for the first quarter of

2017, with the decrease due primarily to a reduction in the number

of sales representatives, partially offset by higher marketing

expenses. G&A expenses for the first quarter of 2018 were $1.6

million, compared with $3.1 million for the prior-year period, with

the decrease due primarily to lower stock-based compensation

expense and lower professional services and consulting fees.

R&D expenses for the first quarter of 2018 were $46,000,

compared with $62,000 for the first quarter of 2017.

The operating loss for the first quarter of 2018 was $2.4

million, an improvement from an operating loss of $3.8 million for

the first quarter of 2017.

Non-cash gain on the change of fair value of warrant liability

for the first quarter of 2018 was $0.2 million, compared with a

non-cash loss of $0.2 million for the first quarter of 2017.

The net loss for the first quarter of 2018 was $2.2 million, or

$0.13 per share, compared with a net loss for the first quarter of

2017 of $4.0 million, or $0.26 per share.

NovaBay reported cash and cash equivalents of $8.3 million as of

March 31, 2018, compared with $3.2 million as of December 31, 2017.

In February 2018, the company raised a net $5.6 million through a

private placement of common stock.

The Company used $0.5 million in cash to fund operations in the

first quarter of 2018, an improvement from $2.0 million used to

fund operations in the first quarter of 2017. The decrease was

primarily due to a lower net loss and favorable changes in working

capital.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and to answer questions. Shareholders and other interested parties

may participate in the conference call by dialing 800-608-8202 from

within the U.S. or 702-495-1913 from outside the U.S., with the

conference identification number 9649919.

A live webcast of the call will be available at

http://novabay.com/investors/events and will be archived for 90

days. A replay of the call will be available beginning two hours

after call completion through 11:59 p.m. Eastern time May 20 by

dialing 855-859-2056 from within the U.S. or 404-537-3406 from

outside the U.S., and entering the conference identification number

9649919.

About Avenova®

Avenova is an eye care product formulated with our proprietary,

stable and pure form of hypochlorous acid. It has proven in

laboratory testing to have broad antimicrobial properties as a

preservative in solution as it removes foreign material including

microorganisms and debris from the skin on the eyelids and lashes

without burning or stinging. Avenova is marketed to optometrists

and ophthalmologists throughout the U.S. by NovaBay’s direct

salesforce. It is accessible from more than 90% of retail

pharmacies in the U.S. through agreements with McKesson

Corporation, Cardinal Health and AmerisourceBergen.

About NovaBay Pharmaceuticals, Inc.: Going Beyond

Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company

focusing on commercializing and developing its non-antibiotic

anti-infective products to address the unmet therapeutic needs of

the global, topical anti-infective market with its two distinct

product categories: the NEUTROX® family of products and the

AGANOCIDE® compounds. The Neutrox family of products includes

AVENOVA® for the eye care market, NEUTROPHASE® for wound care

market, and CELLERX® for the aesthetic dermatology market. The

Aganocide compounds, still under development, have target

applications in the dermatology and urology markets.

Forward-Looking Statements

This release contains forward-looking statements that are based

upon management's current expectations, assumptions, estimates,

projections and beliefs. These statements include, but are not

limited to, statements regarding our business strategies and future

focus, our estimated future revenue, and generally the Company’s

expected future financial results. Forward-looking statements can

be identified with words like (and variations of): “believe,” and

“expect.” These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

achievements to be materially different and adverse from those

expressed in or implied by the forward-looking

statements. Factors that might cause or contribute to such

differences include, but are not limited to, risks and

uncertainties relating to difficulties or delays in manufacturing,

distributing, and selling the Company's products, obtaining

adequate insurance reimbursement for the Company’s products, the

uncertainty of patent protection for the Company's intellectual

property, and any potential regulatory problems. Other risks

relating to NovaBay’s business, including risks that could cause

results to differ materially from those projected in the

forward-looking statements in this press release, are detailed in

NovaBay's latest Form 10-K filings with the Securities and Exchange

Commission, especially under the heading "Risk Factors." The

forward-looking statements in this release speak only as of this

date, and NovaBay disclaims any intent or obligation to revise or

update publicly any forward-looking statement except as required by

law.

Socialize and Stay informed on

NovaBay’s progress:Like us

on FacebookFollow us on TwitterConnect with

NovaBay on LinkedInJoin us

on Google+Visit NovaBay’s Website

NovaBay ContactsFor NovaBay

Avenova purchasing information:Please call us toll free:

1-800-890-0329 or email sales@avenova.comwww.Avenova.com

NOVABAY PHARMACEUTICALS, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except par value

amounts)

March 31,

December 31, 2018 2017

ASSETS Current assets: Cash and cash equivalents $ 8,336 $

3,199 Accounts receivable, net of allowance for doubtful accounts

($10 and $13 at March 31, 2018 and December 31, 2017, respectively)

2,225 3,629 Inventory, net of allowance for excess and obsolete

inventory and lower of cost or estimated net realizable value

adjustments of $138 and $140 at March 31, 2018 and December 31,

2017, respectively) 479 504 Prepaid expenses and other current

assets 1,751 1,663 Total current assets

12,791 8,995 Property and equipment, net 435 471 Other assets

597 613 TOTAL ASSETS $ 13,823 $

10,079

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities: Current liabilities: Accounts payable $ 301 $ 466

Accrued liabilities 2,855 1,672 Deferred revenue 62

2,841 Total current liabilities 3,218 4,979 Deferred

revenues - non-current - 534 Deferred rent 261 286 Warrant

liability 1,275 1,489 Other liabilities 198

197 Total liabilities 4,952 7,485

Stockholders' equity : Preferred stock: 5,000 shares

authorized; none outstanding at March 31, 2018 and December 31,

2017 — — Common stock, $0.01 par value; 240,000, shares authorized

17,089 and 15,385 shares issued and outstanding at March 31, 2018

and December 31, 2017, respectively 171 154 Additional paid-in

capital 119,285 113,514 Accumulated deficit (110,585 )

(111,074 ) Total stockholders' equity 8,871

2,594 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $

13,823 $ 10,079

NOVABAY PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(in thousands except per share

data)

Three Months Ended March 31,

2018 2017 Sales: Product

revenue, net $ 2,934 $ 3,694 Other revenue 13 7 Total

sales, net 2,947 3,701 Product cost of goods sold 251

588 Gross profit 2,696 3,113 Research

and development 46 62 Sales and marketing 3,396 3,740 General and

administrative 1,622 3,088 Total operating expenses

5,064 6,890 Operating loss (2,368 ) (3,777 )

Non cash gain (loss) on changes in fair value of warrant liability

214 (235 ) Other income, net 4 2 Loss before

provision for income taxes (2,150 ) (4,010 ) Provision for income

tax - (1 ) Net loss and comprehensive loss $ (2,150 ) $

(4,011 ) Net loss per share attributable to common

stockholders, basic $ (0.13 ) $ (0.26 ) Net loss per share

attributable to common stockholders, diluted $ (0.14 ) $ (0.26 )

Weighted-average shares of common stock outstanding used in

computing net loss per share of common stock Basic 16,406 15,284

Diluted 16,670 15,284

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180510006164/en/

NovaBay Pharmaceuticals, Inc.Jack

McGovernChief Financial

Officer510-899-8800jmcgovern@novabay.comorInvestor ContactLHA Investor RelationsJody

Cain310-691-7100Jcain@lhai.com

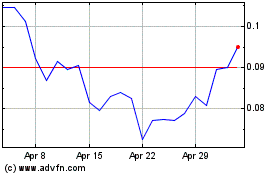

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024