Current Report Filing (8-k)

May 10 2018 - 7:06AM

Edgar (US Regulatory)

|

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

|

CURRENT

REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

Date

of Report (Date of earliest event reported)

|

May 7, 2018

|

|

VYSTAR

CORPORATION

|

|

(Exact

name of registrant as specified in its charter)

|

|

Georgia

|

000-53754

|

20-2027731

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

|

101 Aylesbury Rd.

Worcester, MA 01609

|

|

|

|

(Address

of principal executive offices)

|

|

|

|

|

|

|

|

(508)

791-9114

|

|

|

|

(Registrant’s

telephone number, including area code)

|

|

|

|

|

|

|

|

|

|

|

|

(Former

name or former address, if changed since last report.)

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a- 12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

1.01

|

Entry into a Material Definitive Agreement

|

Effective May 7, 2018,

nine (9) shareholders of Vystar Corporation, a Georgia corporation (the “Company”), consented to the Company’s

purchase of substantially all the assets of UV Flu Technologies, Inc., a Nevada corporation (“UV Flu”). The consents

were submitted pursuant to Rule 14(a)-2(b) (2) promulgated under the Securities and Exchange Act of 1934, as amended. Such Rule

provides that other than certain proxy solicitation rules which were either complied with or were otherwise not applicable to the

consents submitted to the Company, the proxy solicitation rules set forth in SEC Regulation 14A do not apply to “[any] solicitation

made otherwise than on behalf of the registrant where the total number of persons being solicited is not more than ten.”

The Company has been presented with written consents which include (a) an approved form of Asset Purchase Agreement between the

Company and UV Flu with respect to the purchase of substantially all the assets of UV Flu. The Common Stock held by the consenting

shareholders totaled 118,211,379 shares or approximately 52.8% of the total outstanding shares of Common Stock of the Company.

Pursuant to the Asset Purchase

Agreement, the purchase of substantially all assets of UV Flu was consummated on May 10, 2018. Vystar acquired all UV Flu intellectual

property & multiple patents, product lines, tooling, FDA clearances, research data, websites and other assets related to the

business for the purchase price of $975K or 27,918,000 shares of Vystar restricted common stock which may not be assigned or sold

by UV Flu for twelve months. With the exchange of Vystar shares for UV Flu shares, Vystar will welcome UV Flu’s approximately

1,000 shareholders to the Vystar family. Vystar will continue production of UV Flu product lines with BOI, a world-class manufacturer.

Vystar anticipates it will take 45 days to complete manufacture of the next orders of air purifier units and another 45 days to

relaunch sales with a new, more robust distribution model. Vystar plans to sell RxAir residential units via online and retail channels.

Vystar is assembling the

distribution network to relaunch sales of UV400 and Rx3000 units to the healthcare and medical markets, which UV Flu had ceased

due to sales force, distribution and cash flow constraints. Once production and sales are firmly re-established, Vystar expects

that the air purification products will produce margins of approximately 75%.

All shares of restricted

Common Stock issued to UV Flu at closing will be held for a minimum of one year before distribution of such shares to the UV Flu

shareholders and will be voted consistent with the vote of the Company’s other shareholders until such distribution.

|

Item

1.02

|

Termination of a Material Definitive Agreement

|

Effective May 8, 2018,

the Company paid all of its long term convertible indebtedness totaling $1,134,225 (including accrued interest) through the issuance

of a total of 27,918,000 million restricted shares of its common stock.

|

Item

2.01

|

Completion of Acquisition or Disposition of Assets

|

The disclosure above

under Item 1.01 is incorporated by reference into this Item 2.01.

|

Item

3.02

|

Unregistered Sales of Equity Securities

|

The disclosures in

Items 1.01 and 1.02 are incorporated by reference into this Item 3.02. The shares of Common Stock issued to (a) the holders of

the convertible indebtedness, and (2) UV Flu, were issued as exempt transactions under Section 4(2) of the Securities Act of 1933

and Regulation D promulgated thereunder.

|

Item

9.01

|

Financial Statement and Exhibits.

|

|

a.

|

Financial Statements of Businesses Acquired

|

|

|

To the extent required, the Company will file by amendment to this Current Report on Form 8-K the historical financial information provided by this Item 9.01(a) within 71 days of the date on which this Current Report on Form 8-K is required to be filed.

|

|

b.

|

Pro Forma Financial Information

|

|

|

To the extent required, the Company will file by amendment to this Current Report on Form 8-K the pro forma financial information provided by this Item 9.01(b) within 71 days of the date on which this Current Report on Form 8-K is required to be filed.

|

|

|

|

|

c.

|

Exhibits

|

|

|

|

|

|

10.1

|

Asset Purchase Agreement dated effective May 7, 2018 between UV Flu Technologies, Inc.

|

|

|

99.1

|

Press Releases dated May 8 and 10, 2018

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

VYSTAR

CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

Steven Rotman

|

|

|

|

Steven Rotman

President, Chief Executive Officer and

Chief

Financial Officer

|

|

|

|

|

|

Date:

May 10, 2018

|

|

|

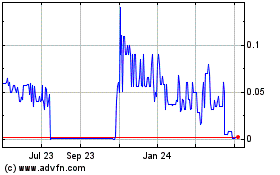

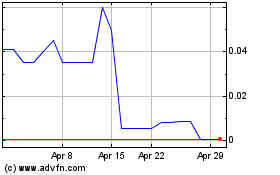

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Apr 2023 to Apr 2024