Vodafone Confirms Deal to Buy Some Liberty Global European Assets for Nearly $22 Billion

May 09 2018 - 3:59AM

Dow Jones News

By Stu Woo

LONDON -- Britain's Vodafone Group PLC agreed to a nearly $22

billion deal to buy operations in four European countries from John

Malone's Liberty Global PLC, a merger that would create one of the

continent's biggest telecommunications carriers.

Liberty Global, the world's biggest international cable company,

will sell its businesses in Germany, Hungary, Romania and the Czech

Republic to Vodafone, the world's second-largest wireless carrier

by subscribers behind China Mobile Ltd.

The deal, which is valued at EUR18.4 billion ($21.8 billion) and

would give Liberty Global EUR10.6 billion in cash, would face a

possibly lengthy European Union antitrust review. If completed, the

merger would create a continental giant selling the industry's holy

grail "quad-play" package: cable, internet, wireless and

landline-phone service on a single bill.

The deal would represent the latest in a global trend of

wireless carriers acquiring cable operations, or vice versa, to

offer quad-play packages. Wireless carriers need high-speed cable

networks to quickly transmit data to cellular towers for 5G, the

coming generation of mobile networks that promise to be fast enough

to enable near-instantaneous movie downloads and innovations such

as self-driving cars.

Both companies have said they have engaged in various forms of

merger talks with each other in recent years, but disagreed over

price. Vodafone in February said the two sides were again

discussing a potential merger. The difference this time, said

Liberty Global Chief Executive Mike Fries in an interview: "We

agreed on a price. It's that simple."

Chief Executive Vittorio Colao's strategy has been for Vodafone

to be the No. 1 or No. 2 carrier in each of the more than 20

countries where it operates. The company believes being first or

second allows Vodafone to differentiate itself through better

networks and services, and to justify higher prices.

Liberty Global, which is based in Denver and registered in

London, runs cable-focused operations in 12 European countries. Its

chairman is Mr. Malone, the billionaire media mogul, who leaves Mr.

Fries to run the company.

The deal wouldn't include Liberty Global's businesses in the

U.K. and Ireland, which compete with Vodafone's. Mr. Fries said

neither side was interested in merging those businesses.

The proposed transaction is likely to face close regulatory

scrutiny, as well as stiff opposition from Germany's Deutsche

Telekom AG over concerns it would give Vodafone too much power over

the country's TV market.

Mr. Fries said he expected European Union regulators to approve

the deal, which would close by the second half of 2019. He called

Germany a competitive market where Deutsche Telekom controls the

business, and that Vodafone's acquisition of Liberty Global's

assets there would boost innovation and investment.

A Deutsche Telekom spokesman said Tuesday that the deal would

lead to "considerable restrictions for consumers to fear. It will

be up to the antitrust authorities to examine the case carefully as

soon as it will be announced."

Asked about a potential Liberty Global-Vodafone deal during a

February conference call, Deutsche Telekom Chief Executive

Timotheus Höttges said he didn't think "this kind of concentration

in the cable market can be supported" by regulators. "I think there

will be no way that this deal is going to be approved and for us

it's completely unacceptable."

--Ben Dummett contributed to this article

Write to Stu Woo at Stu.Woo@wsj.com

(END) Dow Jones Newswires

May 09, 2018 03:44 ET (07:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

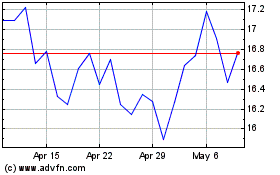

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

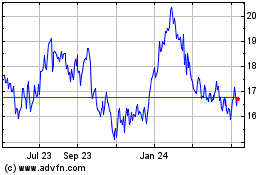

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024