The safety of junk debt issued by cable, telecom and satellite

giants is questioned

By Matt Wirz

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 9, 2018).

The consumer stampede to streaming media from traditional

broadcasters is claiming an unexpected victim: high-yield bond

investors.

Telecommunications, cable and satellite companies have borrowed

hundreds of billions of dollars in junk debt to build networks that

would allow them to dominate their markets for decades to come.

The proliferation of internet-based providers is upending that

expectation, forcing investors to question the safety of bonds they

bought from companies such as satellite broadcaster Dish Network

Corp., cable giant Charter Communications Inc. and landline

telecommunications company Frontier Communications Corp.

Dish, founded by satellite tycoon Charlie Ergen, may be the

canary in the coal mine of the new technological landscape.

Junk-bond investors have lent his companies more than $30 billion

over the past 25 years, according to data from Dealogic,

bankrolling Mr. Ergen's construction of a satellite constellation

and, more recently, his buying spree of wireless spectrum. Now they

are dumping Dish bonds and buying record amounts of derivatives

that insure against a default by the company, fearing that the

industry's rapid evolution is outpacing Mr. Ergen's business

strategy.

Although most cable and telecommunications bond prices have

declined moderately, Dish bonds have lost about one-quarter of

their value in the past year, pushing yields above 9% from about

6%. Higher yields for companies rated below investment grade

concern investors because such firms typically rely on new bond

sales to pay back debt.

Cord-cutting -- as the consumer shift from cable-TV

subscriptions toward streaming services is known -- is particularly

worrying for high-yield bond funds because technology, media and

telecommunications, or TMT, companies comprise about one-quarter of

the $1.25 trillion junk-bond market, according to the ICE BofAML

U.S. high-yield index.

That means one out of every four dollars invested by the average

high-yield bond investor goes to a company susceptible to changing

digital-media consumer behavior. The media component of the index

has lost about 1.33% this year, compared with a 0.38% loss for the

entire index.

"The level of cord-cutting is accelerating," said Jared Feeney a

cable and media bond analyst for Neuberger Berman Group, which

manages $41 billion of high-yield bond investments. Cable companies

such as Charter can offset defecting subscribers with broadband

internet sales, but the first quarter of the year brought

unexpectedly low revenue from video subscriptions and video

advertisement sales across the industry, he said.

High-yield bonds and media and telecommunications companies grew

up together in the 1990s in a largely symbiotic relationship.

Innovation and deregulation spurred the creation of dozens of new

satellite, cable and telecommunications companies whose founders

turned to the nascent junk-debt market for capital. Some grew

steadily and rewarded stock and bond investors, but many, such as

WorldCom Inc. and Global Crossing Inc., failed spectacularly in the

early 2000s, when they ran out of money before reaching

profitability and used fraudulent accounting to mask losses.

Defaults are low right now in telecommunications and media

bonds, and some companies that offer broadband and wireless access

actually benefit from the move toward streaming media.

Investors are also more eager to purchase high-yield bonds than

most forms of debt because they are less sensitive to expected

moves by the Federal Reserve to fight inflation by raising interest

rates, which pushes down prices of almost all bonds.

Signs of cord-cutting trouble emerged last year when wireline

companies, including CenturyLink Inc. and Frontier Communications,

that deliver telecommunications over land lines reported

faster-than-expected sales declines and their bond prices dropped.

The cost of credit- default swaps, or CDS, insuring $10 million

Frontier bonds has risen to $2.5 million from about $1.5 million a

year ago, according to data from IHS Markit. The company has about

$18 billion of bonds and loans outstanding in December, according

to its annual report.

The selling expanded to cable and satellite broadcasters such as

Charter and Dish this year as it grew apparent that their customers

are also abandoning them sooner than expected for internet-based

alternatives like Netflix Inc. and Amazon.com Inc. Rapid change

also spurred a wave of consolidation, from AT&T Inc.'s deal to

buy Time Warner Inc. to Sprint Corp. and T-Mobile US Inc.

attempting to combine for the third time in four years..

AT&T, which has an investment-grade credit rating, has been

hurt because it owns satellite-television operator DirecTV, which

like Dish is losing customers to streaming competitors. Satellite

broadcasters are especially sensitive to streaming-video

competitors because they can't sell broadband services to offset

subscriber defections.

Mr. Ergen, who still controls Dish, has outlasted numerous

satellite rivals such as cellular-phone magnate Craig McCaw and

former hedge-fund manager Philip Falcone. He foresaw the decay of

satellite video and began buying a large patchwork of wireless

network licenses more than a decade ago to help transition Dish to

the wireless broadband age.

A spokesman for Dish declined to comment. The company Tuesday

reported a 6% revenue drop for the first quarter caused by loss of

satellite-television customers.

Stock and debt investors backed Mr. Ergen through the decades in

part because he perennially explored selling the company, and its

wireless licenses, to larger companies like DirecTV, AT&T,

T-Mobile US and technology firm Amazon that could give Dish growth

and security. .But as mergers sweep the industry, Dish has been

left out and bondholders are worried Mr. Ergen will wait too long

and run out of cash before he can realize the long-awaited merger

that will transform his company.

"I think the chances of a deal are pretty low," said Neil

Bizily, a bond analyst for Thrivent Financial, an asset manager

with $6 billion of high-yield bonds and loans. Thrivent has sold

out of all Dish bonds, even though the company comprises about 1%

of the index most high-yield bond investors measure themselves

against, he said.

Some of Dish's $16 billion of bonds traded Tuesday at around 82

cents on the dollar, and Dish credit-default swaps were the most

heavily traded high-yield contract in the default derivatives

market over the past three months, a CDS trader said. The price of

insuring $10 million Dish bonds has about doubled this year to

$692,000, according to IHS Markit, and the value of contracts

outstanding has jumped to $5.2 billion from about $3.6 billion over

that period, according to DTCC Data Services.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

May 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

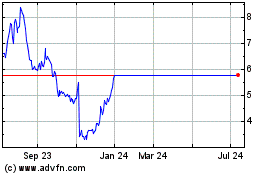

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024