First-Quarter Financial Highlights

- Strong net sales of $977 million;

year-over-year growth of 13%

- Net income of $109 million and net

income per diluted share of $2.01

- Non-GAAP diluted EPS increased 87%

year-over-year to $2.56

- Adjusted EBITDA increased 37%

year-over-year to $204 million; and adjusted EBITDA margin expanded

370 basis points year-over-year to 20.9%

- $116 million of cash from operations

and $98 million of free cash flow; $95 million reduction of total

debt

Zebra Technologies Corporation

(NASDAQ: ZBRA), the market leader in rugged mobile computers,

barcode scanners and barcode printers enhanced with software and

services to enable real-time enterprise visibility, today announced

results for the first quarter ended March 31, 2018.

“Our first quarter results were driven by strong broad-based

market demand for our solutions and excellent operational execution

by our team. We delivered net sales, EBITDA margin, and earnings

per share above the respective guidance ranges. We also continued

to aggressively retire debt, reducing our net leverage ratio to

2.8x,” said Anders Gustafsson, chief executive officer of Zebra

Technologies. “Given our sales and margin outperformance, we are

raising our full-year outlook for sales growth, EBITDA margin, and

free cash flow. We continue to be laser focused on providing

innovative solutions that give our customers a performance edge on

the front lines of their business operations.”

$ in millions,

except per share amounts

1Q18 1Q17

Change Select reported measures:

Net sales $ 977 $ 865 12.9 % Gross profit 465 401 16.0 % Net income

109 8 NM Net income per diluted share $ 2.01 $ 0.16 NM

Select Non-GAAP measures: Adjusted net sales $ 977 $ 866 12.8 %

Organic net sales growth 9.8 % Adjusted gross profit 466 402 15.9 %

Adjusted gross margin 47.7 % 46.4 % 130 bps Adjusted EBITDA 204 149

36.9 % Adjusted EBITDA margin 20.9 % 17.2 % 370 bps Non-GAAP net

income $ 138 $ 72 91.7 % Non-GAAP earnings per diluted share

$ 2.56 $ 1.37 86.9 %

Reported (GAAP) results

Net sales were $977 million in the first quarter of 2018

compared to $865 million in the first quarter of 2017. Net sales in

the Enterprise Visibility & Mobility ("EVM") segment were $625

million in the first quarter of 2018 compared with $544 million in

the first quarter of 2017. Asset Intelligence & Tracking

("AIT") segment net sales were $352 million in the first quarter of

2018 compared to $322 million in the prior year period.

First-quarter 2018 gross profit was $465 million compared to $401

million in the comparable prior year period. Net income for the

first quarter of 2018 was $109 million, or $2.01 per diluted share,

compared to net income of $8 million, or $0.16 per diluted share,

for the first quarter of 2017.

As of January 1, 2018, the company adopted revenue standard ASC

606. Revenue would have been $1 million higher for the three-month

period ended March 31, 2018 had the Company continued to follow our

accounting policies under the previous revenue recognition

guidance.

Adjusted (Non-GAAP) results

Consolidated adjusted net sales were $977 million in the first

quarter of 2018 compared to $866 million in the prior year period,

an increase of 12.8%. Consolidated organic net sales growth for the

first quarter was 9.8% reflecting growth across all regions, most

notably EMEA and North America. First-quarter year-over-year

organic net sales growth was 11.7% in the EVM segment and 6.4% in

the AIT segment.

Consolidated adjusted gross margin for the first quarter of 2018

was 47.7%, compared to 46.4% in the prior year period. This

increase was due to favorable business mix and the favorable impact

of currency changes, primarily in the EMEA region. Adjusted

operating expenses increased in the first quarter of 2018 to $282

million from $272 million in the prior year period primarily due to

growth in the business and increased incentive compensation expense

related to improved operating results.

Adjusted EBITDA for the first quarter of 2018 increased to $204

million, or 20.9% of adjusted net sales, compared to $149 million,

or 17.2% of adjusted net sales, for the first quarter of 2017

primarily due to higher sales and gross profit margin.

Non-GAAP net income for the first quarter of 2018 was $138

million, or $2.56 per diluted share, compared with $72 million, or

$1.37 per diluted share, for the first quarter of 2017. Lower

interest costs and a lower tax rate also drove year-over-year

improvement.

Balance Sheet and Cash Flow

As of March 31, 2018, the company had cash and cash

equivalents of $64 million and total debt of $2,133 million.

Free cash flow in the first quarter of 2018 was $98 million,

consisting of $116 million of cash flow from operations and capital

expenditures of $18 million. In the first quarter, the company made

$95 million in long-term debt payments and $26 million in scheduled

cash interest payments.

Outlook

Second Quarter 2018

The company entered the second quarter of 2018 with a strong

order backlog and expects second-quarter 2018 net sales to increase

approximately 9% to 12% from the second quarter of 2017. This

expectation includes an approximately 3 percentage point positive

impact from foreign currency translation.

Adjusted EBITDA margin is expected to be in the range of 18.5%

to 19.0% for the second quarter 2018, favorable to the prior year

period. Non-GAAP earnings per diluted share are expected to be in

the range of $2.10 to $2.30. This assumes an effective tax rate of

approximately 16% to 17%.

Full Year 2018

The company now expects full year 2018 net sales growth to

increase approximately 6% to 9%, which is favorable to our prior

outlook and includes an anticipated 2 percentage point positive

impact from foreign currency translation.

Adjusted EBITDA margin is now expected to be approximately 20%

for the full year 2018, which is favorable to our prior outlook and

an improvement compared to the full year 2017.

For the full year 2018, the company expects free cash flow to

exceed $500 million, which is favorable to our prior outlook, and

to reduce financial leverage.

Conference Call Notification

Investors are invited to listen to a live webcast of Zebra’s

conference call regarding the company’s financial results for the

first quarter of 2018. The conference call will be held today,

Tuesday, May 8, at 7:30 a.m. Central Time (8:30 a.m. Eastern Time).

To view the webcast, visit the investor relations section of the

company’s website at investors.zebra.com.

About Zebra

With the unparalleled operational visibility Zebra (NASDAQ:

ZBRA) provides, enterprises become as smart and connected as the

world we live in. Real-time information – gleaned from visionary

solutions including hardware, software and services – gives

organizations the competitive edge they need to simplify

operations, know more about their businesses and customers, and

empower their mobile workers to succeed in today’s data-centric

world. For more information, visit www.zebra.com or sign up for our news alerts. Follow us on LinkedIn, Twitter and

Facebook.

Forward-Looking Statements

This press release contains forward-looking statements, as

defined by the Private Securities Litigation Reform Act of 1995,

including, without limitation, the statements regarding the

company’s outlook. Actual results may differ from those expressed

or implied in the company’s forward-looking statements. These

statements represent estimates only as of the date they were made.

Zebra undertakes no obligation, other than as may be required by

law, to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, changed

circumstances or any other reason after the date of this

release.

These forward-looking statements are based on current

expectations, forecasts and assumptions and are subject to the

risks and uncertainties inherent in Zebra’s industry, market

conditions, general domestic and international economic conditions,

and other factors. These factors include customer acceptance of

Zebra’s hardware and software products and competitors’ product

offerings, and the potential effects of technological changes. The

continued uncertainty over future global economic conditions, the

availability of credit and capital markets volatility may have

adverse effects on Zebra, its suppliers and its customers. In

addition, a disruption in our ability to obtain products from

vendors as a result of supply chain constraints, natural disasters

or other circumstances could restrict sales and negatively affect

customer relationships. Profits and profitability will be affected

by Zebra’s ability to control manufacturing and operating costs.

Because of its debt, interest rates and financial market conditions

will also have an impact on results. Foreign exchange rates will

have an effect on financial results because of the large percentage

of our international sales. The outcome of litigation in which

Zebra may be involved is another factor. The success of integrating

acquisitions could also affect profitability, reported results and

the company’s competitive position in its industry. These and other

factors could have an adverse effect on Zebra’s sales, gross profit

margins and results of operations and increase the volatility of

our financial results. When used in this release and documents

referenced, the words “anticipate,” “believe,” “outlook,” and

“expect” and similar expressions, as they relate to the company or

its management, are intended to identify such forward-looking

statements, but are not the exclusive means of identifying these

statements. Descriptions of the risks, uncertainties and other

factors that could affect the company’s future operations and

results can be found in Zebra’s filings with the Securities and

Exchange Commission, including the company’s most recent Form

10-K.

Information regarding the impact of the TCJA consists of

preliminary estimates, based on current calculations,

interpretations, assumptions and expectations. These estimates may

change materially as we learn additional information about and

obtain additional guidance on the TCJA.

Use of Non-GAAP Financial Information

This press release contains certain Non-GAAP financial measures,

consisting of “adjusted net sales,” “adjusted gross profit,”

“EBITDA,” “Adjusted EBITDA,” “Non-GAAP net income,” “Non-GAAP

earnings per share,” “free cash flow,” “organic net sales growth,”

and “adjusted operating expenses.” Management presents these

measures to focus on the on-going operations and believes it is

useful to investors because they enable them to perform meaningful

comparisons of past and present operating results. The company

believes it is useful to present Non-GAAP financial measures, which

exclude certain significant items, as a means to understand the

performance of its ongoing operations and how management views the

business. Please see the “Reconciliation of GAAP to Non-GAAP

Financial Measures” tables and accompanying disclosures at the end

of this press release for more detailed information regarding

non-GAAP financial measures herein, including the items reflected

in adjusted net earnings calculations. These measures, however,

should not be construed as an alternative to any other measure of

performance determined in accordance with GAAP.

The company does not provide a reconciliation for non-GAAP

estimates on a forward-looking basis (including the information

under “Outlook” above) where it is unable to provide a meaningful

or accurate calculation or estimation of reconciling items and the

information is not available without unreasonable effort. This is

due to the inherent difficulty of forecasting the timing or amount

of various items that have not yet occurred, are out of the

company’s control and/or cannot be reasonably predicted, and that

would impact diluted net earnings per share, the most directly

comparable forward-looking GAAP financial measure. For the same

reasons, the company is unable to address the probable significance

of the unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

As a global company, Zebra's operating results reported in U.S.

dollars are affected by foreign currency exchange rate fluctuations

because the underlying foreign currencies in which the company

transacts change in value over time compared to the U.S. dollar;

accordingly, the company presents certain organic growth financial

information, which includes impacts of foreign currency

translation, to provide a framework to assess how the company’s

businesses performed excluding the impact of foreign currency

exchange rate fluctuations. Foreign currency impact represents the

difference in results that are attributable to fluctuations in the

currency exchange rates used to convert the results for businesses

where the functional currency is not the U.S. dollar. This impact

is calculated by translating, for certain currencies, current

period results at the currency exchange rates used in the

comparable period in the prior year, rather than the exchange rates

in effect during the current period. In addition, the company

excludes the impact of its foreign currency hedging program in both

the current year and prior year periods. The company believes these

measures should be considered a supplement to and not in lieu of

the company’s performance measures calculated in accordance with

GAAP.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

March 31, December 31, 2018

2017 (Unaudited) Assets Current assets: Cash and cash

equivalents $ 64 $ 62

Accounts receivable, net of allowances for

doubtful accounts of $2 million and $3 million as of March 31, 2018

and December 31, 2017, respectively

471 479 Inventories, net 448 458 Income tax receivable 31 40

Prepaid expenses and other current assets 39 24 Total

Current assets 1,053 1,063 Property, plant and equipment, net 262

264 Goodwill 2,463 2,465 Other intangibles, net 276 299 Long-term

deferred income taxes 115 119 Other long-term assets 80 65

Total Assets $ 4,249 $ 4,275 Liabilities and

Stockholders’ Equity Current liabilities: Current portion of

long-term debt $ 43 $ 51 Accounts payable 411 424 Accrued

liabilities 221 296 Deferred revenue 201 186 Income taxes payable

56 43 Total Current liabilities 932 1,000 Long-term

debt 2,090 2,176 Long-term deferred revenue 144 148 Other long-term

liabilities 102 117 Total Liabilities 3,268

3,441 Stockholders’ Equity: Preferred stock, $.01 par value;

authorized 10,000,000 shares; none issued — — Class A common stock,

$.01 par value; authorized 150,000,000 shares; issued 72,151,857

shares 1 1 Additional paid-in capital 266 257 Treasury stock at

cost, 18,755,228 and 18,915,762 shares at March 31, 2018 and

December 31, 2017, respectively (616 ) (620 ) Retained earnings

1,376 1,248 Accumulated other comprehensive loss (46 ) (52 ) Total

Stockholders’ Equity 981 834 Total Liabilities and

Stockholders’ Equity $ 4,249 $ 4,275

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share data)

(Unaudited)

Three Months Ended March 31, April

1, 2018 2017 Net sales Net sales of tangible

products $ 839 $ 735 Revenue from services and software 138

130 Total Net sales 977 865 Cost of sales:

Cost of sales of tangible products 423 379 Cost of services and

software 89

85

Total Cost of sales 512 464 Gross profit 465

401 Operating expenses: Selling and marketing 120 109

Research and development 101 96 General and administrative 71 75

Amortization of intangible assets 23 50 Acquisition and integration

costs 2 27 Exit and restructuring costs 4 4 Total

Operating expenses 321 361 Operating income 144

40 Other expenses: Foreign exchange loss — (1 )

Interest expense, net (11 ) (41 ) Total Other expenses (11 ) (42 )

Income (loss) before income taxes 133 (2 ) Income tax expense

(benefit) 24 (10 ) Net income $ 109 $ 8 Basic

earnings per share $ 2.04 $ 0.16 Diluted earnings per share $ 2.01

$ 0.16 Basic weighted average shares outstanding 53,286,249

51,842,025 Diluted weighted average and equivalent shares

outstanding 53,985,755 52,946,883

ZEBRA

TECHNOLOGIES CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended March 31, April

1, 2018 2017 Cash flows from operating

activities: Net income $ 109 $ 8 Adjustments to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 43 69 Amortization of debt issuance costs and

discounts 2 4 Share-based compensation 10 7 Deferred income taxes

(2 ) (9 ) Unrealized gain on forward interest rate swaps (12 ) —

Other, net (1 ) 1 Changes in operating assets and liabilities:

Accounts receivable, net 9 79 Inventories, net 6 (31 ) Other assets

(7 ) 17 Accounts payable (12 )

(52

) Accrued liabilities (74 )

—

Deferred revenue 19 30 Income taxes 22 (2 ) Other operating

activities 4 (4 ) Net cash provided by operating activities

116 117 Cash flows from investing activities:

Purchases of property, plant and equipment (18 ) (13 ) Purchases of

long-term investments (2 )

—

Net cash used in investing activities (20 ) (13 ) Cash flows

from financing activities: Payments of long-term debt (95 ) (80 )

Proceeds from exercise of stock options and stock purchase plan

purchases 3 4 Taxes paid related to net share settlement of equity

awards — (2 ) Net cash used in financing activities (92 )

(78 ) Effect of exchange rate changes on cash (2 ) (2 ) Net

increase in cash and cash equivalents 2 24 Cash and cash

equivalents at beginning of period 62 156 Cash and

cash equivalents at end of period $ 64 $ 180 Supplemental

disclosures of cash flow information: Income taxes paid $ 2 $ 5

Interest paid $ 26 $ 16

ZEBRA TECHNOLOGIES

CORPORATION AND SUBSIDIARIES RECONCILIATION OF ORGANIC NET

SALES GROWTH

(UNAUDITED)

Three Months Ended March 31,

2018 AIT EVM Consolidated

Reported GAAP Consolidated Net sales growth 9.3 % 14.9 % 12.9 %

Adjustments: Impact of foreign currency translation(1) (2.9 )%

(3.2 )% (3.1 )% Organic Net sales growth 6.4 %

11.7 % 9.8 % (1) Operating results reported in U.S.

dollars are affected by foreign currency exchange rate

fluctuations. Foreign currency translation impact represents the

difference in results that are attributable to fluctuations in the

currency exchange rates used to convert the results for businesses

where the functional currency is not the U.S. dollar. This impact

is calculated by translating, for certain currencies, the current

period results at the currency exchange rates used in the

comparable prior year period, rather than the exchange rates in

effect during the current period. In addition, we exclude the

impact of the company’s foreign currency hedging program in both

the current and prior year periods.

ZEBRA

TECHNOLOGIES CORPORATION AND SUBSIDIARIES RECONCILIATION OF

GAAP TO NON-GAAP GROSS MARGIN

(In millions)

(Unaudited)

Three Months Ended March 31, 2018

April 1, 2017 AIT EVM

Consolidated AIT EVM

Consolidated (1)

GAAP

Reported Net sales (1) $ 352 $ 625 $ 977 $ 322 $ 544 $ 865 Reported

Gross profit 183 282 465 162 240 401 Gross Margin 52.0 % 45.1 %

47.6 % 50.3 % 44.1 % 46.4 %

Non-GAAP

Adjusted Net sales $ 352 $ 625 $ 977 $ 322 $ 544 $ 866 Adjusted

Gross profit (2) 183 283 466 162 240 402 Adjusted Gross Margin 52.0

% 45.3 % 47.7 % 50.3 % 44.1 % 46.4 % (1)

Fiscal 2017 consolidated results include corporate

eliminations which are related to the Enterprise Acquisition in

October 2014 and are not reported in segment results. (2) Adjusted

Gross profit excludes purchase accounting adjustments and

share-based compensation expense.

ZEBRA

TECHNOLOGIES CORPORATION AND SUBSIDIARIES RECONCILIATION OF

GAAP TO NON-GAAP NET INCOME

(In millions, except share data)

(Unaudited)

Three Months Ended March 31, April

1, 2018 2017 Net income $ 109 $ 8

Adjustments to Net sales(1) Purchase accounting adjustments —

1 Total adjustment to Net sales — 1

Adjustments to Cost of sales(1) Share-based compensation 1 —

Total adjustments to Cost of sales 1 —

Adjustments to Operating expenses(1) Amortization of intangible

assets 23 50 Acquisition and integration costs 2 27 Share-based

compensation 10 8 Exit and restructuring costs 4 4

Total adjustments to Operating expenses 39 89

Adjustments to Other expenses, net(1) Amortization of debt issuance

costs and discounts 2 4 Foreign exchange loss — 1 Forward interest

rate swaps gain (12 ) — Total adjustments to Other expenses,

net (10 ) 5 Income tax effect of adjustments(2) Reported

income tax expense (benefit) 24 (10 ) Adjusted income tax expense

(25 ) (21 ) Total adjustments to income tax (1 ) (31 ) Total

adjustments 29 64 Non-GAAP Net income $ 138 $

72 GAAP earnings per share Basic $ 2.04 $ 0.16

Diluted $ 2.01 $ 0.16 Non-GAAP earnings per

share Basic $ 2.59 $ 1.40 Diluted $ 2.56 $

1.37 Non-GAAP weighted average shares outstanding (3)

Basic 53,286,249 51,842,025 Diluted 53,985,755 52,946,883

(1) Presented on a pre-tax basis. (2) Represents the adjustment to

the GAAP basis tax provision commensurate with non-GAAP

adjustments. (3) In periods of loss, Non-GAAP weighted-average

shares exclude restricted stock awards and performance stock awards

within basic and dilutive weighted-average share computations.

Share-based compensation awards that are dilutive in nature are

included within weighted-average dilutive share computations.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

GAAP to NON-GAAP RECONCILIATION

(In millions)

(Unaudited)

EBITDA

Three Months Ended March 31, April

1, 2018 2017 Net income $ 109 $ 8 Add back:

Depreciation 20 19 Amortization of intangible assets 23 50 Total

Other expenses, net 11 42 Income tax expense 24 (10 ) EBITDA

(Non-GAAP) 187 109 Adjustments to Net sales

Purchase accounting adjustments — 1 Total adjustments

to Net sales — 1 Adjustments to Cost of sales

Share-based compensation 1 — Total adjustments to

Cost of sales 1 — Adjustments to Operating expenses

Acquisition and integration costs 2 27 Share-based compensation 10

8 Exit and restructuring costs 4 4 Total adjustments

to Operating expenses 16 39 Total adjustments to

EBITDA 17 40 Adjusted EBITDA (Non-GAAP) $ 204

$ 149 Adjusted EBITDA % of Adjusted Net Sales 20.9 %

17.2 %

FREE CASH

FLOW

Three Months Ended March 31, April

1, 2018 2017 Net cash provided by operating

activities $ 116 $ 117 Less: Purchases of property, plant and

equipment (18 ) (13 ) Free cash flow (Non-GAAP)(1) $ 98 $

104 (1) Free cash flow is defined as Net cash

provided by operating activities in a period minus purchases of

property, plant and equipment (capital expenditures) made in that

period. This measure does not represent residual cash flows

available for discretionary expenditures as the measure does not

deduct the payments required for debt service and other contractual

obligations or payments for future business acquisitions.

Therefore, we believe it is important to view free cash flow as a

measure that provides supplemental information to our entire

statements of cash flows.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180508005442/en/

Zebra Technologies CorporationInvestorsMichael Steele, CFA, IRCVice President,

Investor RelationsPhone: + 1 847 793 6707msteele@zebra.comorMediaTherese Van RyneDirector, Global Public

RelationsPhone: + 1 847 370 2317therese.vanryne@zebra.com

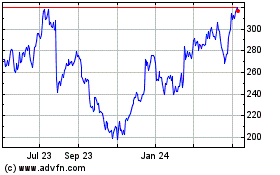

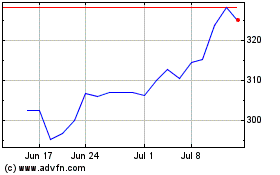

Zebra Technologies (NASDAQ:ZBRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zebra Technologies (NASDAQ:ZBRA)

Historical Stock Chart

From Apr 2023 to Apr 2024