Blackstone Buys Gramercy Property Trust for $4.42 Billion -- Update

May 07 2018 - 12:12PM

Dow Jones News

By Imani Moise

Commercial real-estate fund Gramercy Property Trust said Monday

that it reached a deal to sell itself to Blackstone Group LP for

about $4.42 billion in cash.

At $27.50 a share, the offer represents a 15% premium to

Gramercy's Friday closing price. Shares in Gramercy jumped to match

the offer price during morning trading.

Gramercy owns industrial, office and specialty real estate in

major markets across the U.S. including South Florida, Philadelphia

and Los Angeles.

"We are pleased to acquire Gramercy and its strong portfolio of

assets," said Tyler Henritze, head of U.S. real estate acquisitions

for Blackstone.

Blackstone is the world's largest real-estate investor with

roughly $120 billion in investor capital under management,

including both residential and commercial properties.

The deal marks the second major acquisition in the real-estate

investment trust industry in recent weeks. Prologis Inc. last week

agreed to buy DCT Industrial Trust Inc., which owns bulk

distribution and industrial properties, for $8.4 billion including

debt.

For months, many REITs have been trading at steep discounts to

the private market valuations of their properties. The higher

prices in the private market, combined with rising interest rates,

have cooled the sales volume of privately held commercial real

estate.

But the lower valuations of the public companies have made REITs

more attractive buyout targets. Some analysts have been predicting

that the disconnect between the public and private market

valuations would lead to more mergers and acquisitions activity in

the REIT world.

Peter Grant contributed to this article.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

May 07, 2018 11:57 ET (15:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

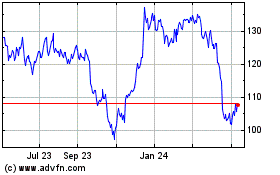

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

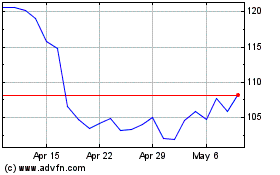

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024