By Nicole Friedman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 7, 2018).

OMAHA, Neb. -- Warren Buffett tried to reassure shareholders at

the Berkshire Hathaway Inc. annual meeting Saturday that the

company's success would continue once he is no longer at the

helm.

Berkshire promoted Mr. Buffett's two potential successors, Greg

Abel and Ajit Jain, to vice chairmen in January and gave them

bigger responsibilities overseeing the company's business units.

The managers of Berkshire's 60-plus business units now report to

either Mr. Abel or Mr. Jain, rather than to Mr. Buffett.

Their ascensions, and Mr. Buffett's eventual exit from the

company, have raised some concern about one of the hallmarks of

Berkshire's success: its reputation as buyer of choice for well-run

companies. Part of the appeal to those companies is Mr. Buffett's

seal of approval, and some shareholders question whether Berkshire

will have the same success acquiring businesses under Mr. Abel or

Mr. Jain.

"The reputation belongs to Berkshire now," Mr. Buffett said.

"For somebody that cares about a business. we absolutely are the

first call and will continue to be the first call."

Mr. Buffett said repeatedly at the meeting that Berkshire's

success in acquiring companies and finding attractive investments

is because of the company's balance sheet and track record, not his

personal fame. While Mr. Buffett's lieutenants are well-known to

followers of the company, Messrs. Jain and Abel rarely speak

publicly.

As for the day-to-day of running Berkshire, the new leadership

is so far status quo, Mr. Buffett said.

"Nothing's really changed that much," he said, joking that he

has been semiretired for decades. Berkshire allows its managers to

run their businesses relatively independently.

Mr. Buffett still oversees the firm's capital allocation. His

portfolio managers, Ted Weschler and Todd Combs, manage about $25

billion in stock investments, and Mr. Buffett manages the rest of

the company's stock and bondholdings, and its cash holdings.

Messrs. Combs and Weschler have arranged some deals for

Berkshire, Mr. Buffett said, and the heads of Berkshire

subsidiaries have long sought out "bolt-on acquisitions" on their

own.

The succession questions were a key component Saturday as Mr.

Buffett and his business partner, Berkshire Vice Chairman Charles

Munger, answered questions from shareholders, analysts and

journalists for hours.

The conglomerate runs a large insurance operation as well as a

railroad, utilities, industrial manufacturers and retailers. Its

holdings include Dairy Queen, Duracell, Fruit of the Loom, Geico

and See's Candies. This year, more than 40,000 people were expected

to travel to Omaha for the annual meeting.

In addition, Mr. Buffett again defended Wells Fargo & Co.,

one of Berkshire's largest equity holdings, despite a string of

scandals at the bank. Some of Berkshire's best investments have

experienced scandals in the past, including American Express Co.

and car insurer Geico, he said.

"All the big banks have had troubles of one sort or another," he

said. "And I see no reason why Wells Fargo as a company, from both

an investor standpoint and a moral standpoint going forward, is in

any way inferior to the other big banks with which it

competes."

Berkshire said Saturday that it swung to a rare loss in the

first quarter, hurt by the impact of an accounting rule change on

unrealized investment losses. It was the firm's first quarterly net

loss in nine years.

Berkshire reported a first-quarter net loss of $1.14 billion, or

$692 per Class A share equivalent, from $4.06 billion, or $2,469 a

share, profit in the year-earlier period. Operating earnings, which

exclude some investment results, rose to $5.29 billion from $3.56

billion in the year prior.

Mr. Buffett cautioned shareholders in his annual letter, which

was released in February, that Berkshire's earnings would appear

more volatile starting in 2018 because of the new accounting rule

that companies include unrealized investment gains or losses in

their net income. Berkshire reported a $6.2 billion drop in

investment income in the first quarter.

Berkshire also holds large investments, especially in the stock

market. Mr. Buffett told CNBC on Thursday that Berkshire increased

its large stake in Apple Inc. by 75 million shares in the first

quarter.

Berkshire's Class A shares closed Friday at $292,600, down 1.7%

for the year.

The 87-year-old Mr. Buffett, whose shrewd investments have

earned him the nickname "the Oracle of Omaha," still has plenty of

cash on hand for future acquisitions as a way to drive profit.

Berkshire held $108.6 billion in cash at the end of the first

quarter, down from $116 billion at the end of 2017.

Despite its burgeoning cash pile, Messrs. Buffett and Munger

continued to argue against paying a dividend to shareholders.

Berkshire hasn't paid a dividend in decades. Mr. Buffett said even

a one-time special dividend would be "very unlikely," but he noted

that if the firm decided it couldn't use its capital effectively,

it would figure out the best way to return it to shareholders.

Mr. Buffett also said that Berkshire's project with Amazon.com

Inc. and JPMorgan Chase & Co. to lower health-care costs for

their employees is making progress, and he hopes a chief executive

will be announced within months.

Corrections & Amplifications Greg Abel and Ajit Jain were

named as vice chairmen at Berkshire Hathaway Inc. in January. An

earlier online summary and subhead incorrectly stated the men were

named as vice chairmen at Saturday's annual meeting. (May 6,

2018)

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

May 07, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

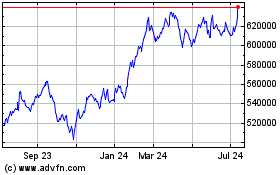

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

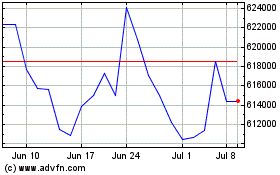

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024